Summary:

- Target Corporation and Shopify Inc. have formed a new e-commerce partnership, potentially driving growth for both companies.

- The deal could lead to increased sales for Target and more business opportunities for top Shopify sellers.

- While Shopify’s operational performance is stronger, both companies are not attractively priced for investment currently.

JHVEPhoto

Article Thesis

Target Corporation (NYSE:TGT) and Shopify Inc. (NYSE:SHOP) have formed a deal that could be positive for both involved companies. In this article, we will take a closer look at the deal and at both companies.

Past Coverage

I have covered both Target Corporation and Shopify Inc. in the past here on Seeking Alpha. My last article on Target is from 2022, where I noted the company’s issues with inflation and how this impacts profitability. Shares are down by a couple of percentage points since then.

I last covered Shopify in 2022, too, where I noted the lack of profits but the fact that Shopify wasn’t expensive on a sales multiple basis. Since then, SHOP has risen by a very strong 120%.

In today’s article, we will look at how the deal between Target and Shopify could impact both companies while also updating the investment thesis for both as many things have changed over the last two years.

Target And Shopify: Working Together

On Monday, Target and Shopify released news that the two companies would form a new e-commerce partnership. This partnership will see Target giving room to some of the most prominent and successful Shopify merchants on its Target Plus digital marketplace. This is the first deal between e-commerce giant Shopify and a huge brick-and-mortar-focused retailer such as Target, indicating that Target is eager to try out new things and that the company seemingly is an attractive partner for e-commerce-focused companies such as Shopify. Target has been working on new initiatives in many areas in the last couple of years, including customer experience, sustainability, and so on. This deal with Shopify shows that it keeps innovating to drive growth in new areas and to bring in new customers.

The new partnership could be positive for both involved companies, and for third-party sellers using Shopify, I believe. Target gets access to some of the most attractive sellers and products from Shopify, thereby making Target’s Target Plus digital marketplace more relevant and more attractive. It is likely that these new offerings do translate into new customers for Target Plus, who might stick around to purchase other (“non-Shopify”) goods on the platform. UBS analyst Michael Lasser also noted that Target Corporation might be able to use any learnings from this deal to drive its own (first-party) e-commerce sales in the future, which seems like a logical argument to me and which might have a long-lasting positive impact on Target’s sales growth going forward.

Shopify benefits from this deal as it increases the business opportunities for its top sellers, thereby becoming an even more attractive partner for these successful e-commerce merchants. The deal also gives marketing exposure to Shopify — when customers who have been using Target Plus in the past stumble upon some of the new products from Shopify sellers, they might be more inclined to check out the stores of these (and other) Shopify merchants.

Of course, the Shopify merchants who will have their products featured on Target Plus, which includes brands such as True Classic and Camden Lane, will also benefit from the new additional sales funnel.

We don’t know how large the impact of this new partnership will ultimately be, but it should be at least incrementally positive for all parties involved. Target has been working hard at expanding its e-commerce sales in the past, and this new deal could be a major step. If the deal does drive higher online sales, I wouldn’t be surprised if the two companies expand this partnership over time, and Target may even try to form similar partnerships with other online retailers. Likewise, Shopify could try to form similar deals with other retailers.

Target And Shopify: Good Investments?

Over the last year, Target is up 9%, while Shopify’s shares have risen by 3%. Neither performance is particularly strong, but stocks that have underperformed in the recent past might be more attractively priced today, relative to stocks that have outperformed over the last year. Looking among the laggards can thus be a valuable strategy.

When Target reported its most recent earnings results, the company showed a revenue decline of 3%, relative to the previous year’s quarter. This was below what the analyst community had forecasted, while Shopify’s performance was very different. Shopify beat expectations easily and showcased a compelling revenue increase of 23%, relative to the previous year’s quarter.

Target’s sales being down was primarily the result of lower comparable store sales, which dropped 3.7% year over year. When we account for inflation, sales in real dollars were down quite substantially. Weak consumer sentiment plays a role, but can’t be the only factor at play, as other retail-focused companies — including Shopify — have shown better results. Even Walmart (WMT) showed a 6% revenue increase during the most recent quarter.

Thus, it looks like Target’s offerings have become less relevant or less attractive over the last year, at least relative to what its competitors are offering. Target’s e-commerce sales growth wasn’t especially attractive, at just 1.4%, which indicates that it is a good idea for Target to try to expand its online offerings, including via the deal it has now formed with Shopify.

Shopify’s revenue growth, meanwhile, was driven by higher subscription revenues as well as by higher merchant solutions revenues. Gross merchandise volumes rose by a nice 23% compared to the previous year’s quarter, showing that the offerings of Shopify’s merchants are relevant and attractive to consumers. Shopify’s revenue growth would have been even stronger, at almost 30% year-over-year, if the company had not sold its logistics business. But even with the headwind stemming from this sale, Shopify’s business growth was highly appealing.

When it comes to margins, there is, again, a major difference between Target and Shopify. Shopify saw its gross margin expand substantially, by almost 400 base points, while Target’s gross margin was up by 140 base points. This still was an improvement for Target, but Shopify benefits more from fixed cost digression thanks to its stronger revenue growth. Shopify saw its operating profit swing to a positive number from a loss during the previous year’s period, while Target saw its operating profit decline by 2% compared to the previous year’s quarter — while margins expanded slightly, that wasn’t enough to fully offset the headwinds from lower revenues.

But while Target underperformed expectations with its first-quarter earnings results, the company has kept its guidance for the current year intact, expecting sales growth of around 1% and earnings per share of around $9.10. This indicates that the first quarter was the worst of the year and that results should be better in Q2 to Q4, which is a positive sign. An earnings per share guidance midpoint of $9.10 implies that Target is currently being valued at 16x net profits, which is not an especially high valuation, but which does not make the company a massive bargain, either.

Shopify has not released any guidance for the current year but is forecasted to earn around $1.00 per share this year, which means that the company is currently being valued at around 65x forward net profits. This is, of course, a much higher valuation relative to Target, but thanks to better margin growth, operating leverage, and way stronger business growth, the premium valuation could be justified.

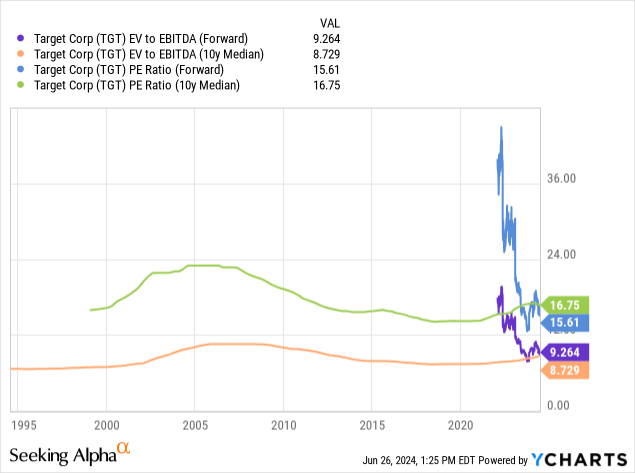

When we look at Target’s valuation relative to how the company was valued in the past, we see the following:

Target’s current enterprise value to EBITDA multiple is a little higher than the longer-term median, while its current earnings multiple is a little lower than the longer-term median. Overall, it thus looks like Target is relatively fairly valued right now, meaning the stock is neither particularly attractive nor particularly unattractive.

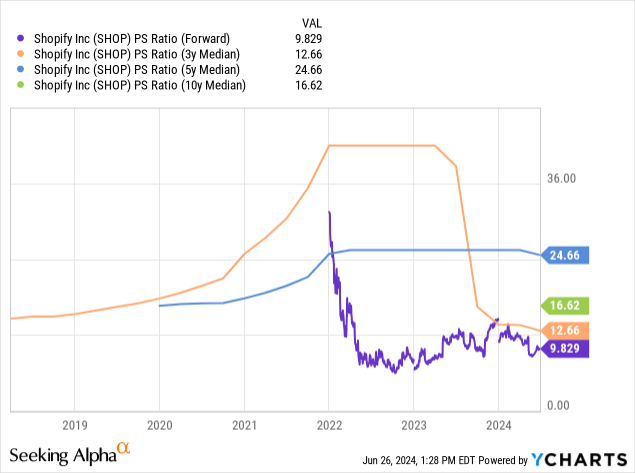

Shopify was not profitable for a long time, but we can look at its sales multiple instead:

We see that Shopify’s price to sales ratio, at 9.8, is lower than the longer-term median price to sales ratios (3-year, 5-year, 10-year). At least on a relative basis, Shopify is thus comparatively inexpensive right now, although it is worth noting that the company’s growth in the past was higher than the expected growth in the future: Over the last five years, Shopify saw its revenues expand by 470%, while the forecasted revenue increase over the next five years is considerably smaller, at 150%. A discount compared to the past valuation thus could be justified, making me believe that Shopify is relatively fairly valued right now.

Takeaway

The new partnership between Target Corporation and Shopify Inc. should be beneficial for both parties, although it remains to be seen how large the impact will ultimately be. Shopify looks a lot better than Target from an operational point of view, but neither stock is particularly attractively priced right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!