Summary:

- Eli Lilly will acquire Morphic Holding for $3.2 billion, and the deal brings a phase 2b asset MORF-057 for the treatment of inflammatory bowel disease, and a preclinical pipeline.

- Eli Lilly to acquire Morphic Holding for $3.2 billion, bringing lead asset MORF-057 for IBD treatment.

- The acquisition provides Eli Lilly a shot on goal in the IBD market, despite potential risks associated with MORF-057 and pipeline.

designer491

Eli Lilly (NYSE:LLY) announced that it will acquire Morphic Holding (NASDAQ:MORF) for $57 per share, or $3.2 billion. The deal brings a lead asset MORF-057, an oral candidate targeting the α4β7 receptor, for the treatment of inflammatory bowel diseases (‘IBD’) such as ulcerative colitis and Crohn’s disease. In my initiation article on Eli Lilly, I noted that the long-term upside does not depend solely on the company’s obesity pipeline and that I expect it to diversify its pipeline through business development, and this is what the Morphic deal represents.

What has drawn Eli Lilly to Morphic is the very attractive target that is validated by Takeda’s (TAK) Entyvio, which is an IV-administered and, more recently, subcutaneously administered antibody against α4β7. Entyvio has been on the market for 10 years now, it has generated more than $5 billion in global sales last year, and Takeda expects to generate peak sales in the $7.5 billion to $9 billion range. An orally available version that shows similar or even somewhat worse efficacy and clean safety could become an attractive option for patients suffering from IBD.

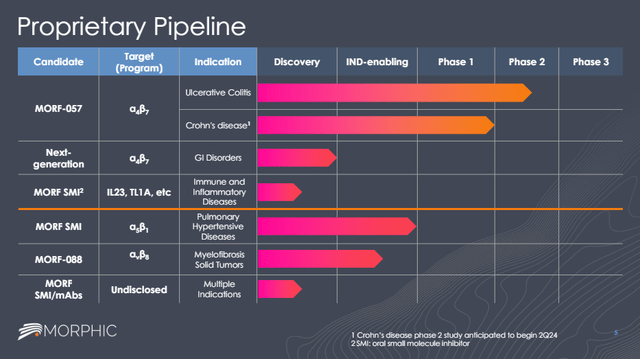

Eli Lilly is also getting the whole platform with preclinical oral candidates going after validated and attractive targets such as IL23 and TL1A, which are also dominated by subcutaneously administered antibodies. $3.2 billion could end up a small price for Eli Lilly to pay, and I believe it offers good risk-reward even if MORF-057 comes up short on efficacy compared to Entyvio as many patients would prefer an oral option even if it is somewhat less efficacious.

Deal terms

Eli Lilly will pay $57 per share or approximately $3.2 billion for Morphic, and it represents a 79% premium to the previous trading day’s closing price. The transaction is subject to customary closing conditions and is expected to close in the third quarter.

There should be no regulatory pushback as there is no risk of Eli Lilly having anywhere close to a monopolistic position since there are several other products on the market with big pharma participation.

MORF-057’s development timeline and outlook

Shares of Morphic had a wild ride since the summer 2019 IPO. The stock went public in July 2019 at $15 per share, and it reached an all-time high of $90 per share in March 2021. The surge was driven by the company reporting positive phase 1 results of MORF-057 that showed very high α4β7 receptor occupancy that was believed to predict strong efficacy in future studies. The stock was not at $90 for long, and it spent the rest of 2021 trading in the $50 to $70 per share range.

Near the end of 2021, the stock started to decline and hit the low 20s by the summer of 2022. However, news flow was light and all that happened during this period was AbbVie (ABBV) pulling the plug on the preclinical collaboration that covered Morphic’s integrin pipeline, and the share price actually started to recover after the end of this collaboration, and the stock continued to rise in early 2023 despite the end of another collaboration – Johnson & Johnson (JNJ) decided to terminate the research and option agreement with Morphic in January 2023.

The run-up in the share price was happening in anticipation of phase 2a results of MORF-057 in ulcerative colitis patients and in April 2023, Morphic reported positive results from this trial that sent the stock to the low 60s by June 2023. In this small phase 2a trial, MORF-057 met the primary endpoint of the trial by demonstrating a statistically significant reduction from baseline in the Robarts Histopathology Index (‘RHI’) which is a clinical measure to evaluate disease activity. The trial also showed a 2.3-point reduction in the modified Mayo Composite Score (‘mMCS’) from baseline and a 25.7% remission rate.

However, the stock was back to the low 20s by September 2023. The reason was the presentation of additional clinical data that painted a different picture of MORF-057. The poster ahead of the data presentation revealed that endoscopic improvement was achieved in only 25.7% of patients, and this compared unfavorably across trials to Entyvio which showed an improvement on the same endpoint in 41% of patients in the phase 3 trial, albeit at a later time point. Morphic defended the data by saying MORF-057 achieved these results in a population with more severe disease, but this statement offered little consolation at the time, and CEO Praveen Tipirneni’s sudden medical leave of absence contributed to the decline. Tipirneni returned to his role in early January.

There was no other news flow in the meantime and the stock recovered to above $30 per share before this week’s acquisition announcement.

Seeking Alpha, Trading View

The company pushed forward with clinical development and initiated a phase 2b trial of MORF-057, and the topline results are expected in the first half of 2025.

I listened to the company’s June presentation at the Jefferies Healthcare Conference to get a sense of the latest narrative around MORF-057, and it seems management was pushing the story of convenience of oral administration even with suboptimal efficacy compared to Entyvio, and that the very clean safety is what attracts patients to an α4β7 drug like Entyvio. They also said that MORF-057 should show similar safety to Entyvio and that this could be its additional advantage over other mechanisms such as JAK inhibitors or TNF drugs like Humira.

I cannot say I am impressed with this kind of an investment thesis on a product candidate, but I can certainly see a place in the market for a safe oral drug, even if its efficacy is worse than Entyvio’s. For $3.2 billion, MORF-057 does not have to come anywhere close to Entyvio’s $7.5 billion to $9 billion peak sales for the acquisition to pay off for Eli Lilly.

And longer-term, there is potential for Eli Lilly to use MORF-057 in combination trials with other mechanisms, including with its preclinical candidates targeting IL23 and TL1A which are also in development for the treatment of IBD.

Preclinical pipeline adds to long-term upside optionality

As mentioned, Morphic has preclinical oral candidates targeting IL23 and TL1A.

IL23 is a clinically validated target as AbbVie has generated positive phase 3 data with Skyrizi, which resulted in an FDA approval for the treatment of Crohn’s disease in 2022 and for the treatment of ulcerative colitis last month. Johnson & Johnson is close behind with Tremfya and has announced positive phase 3 results in ulcerative colitis patients and Crohn’s disease patients in May.

On the other hand, the TL1A class of drugs has seen increased M&A activity. Prometheus was acquired by Merck (MRK) for $10.8 billion last year, shortly after generating positive phase 2 data of its anti-TL1A antibody PRA023, Roche (OTCQX:RHHBY) acquired Telavant for $7.1 billion after RVT-3101 generated positive phase 2 data (Telavant only held U.S. and Japan rights for RVT-3101), and Sanofi (SNY) in-licensed Teva’s (TEVA) anti-TL1A antibody for $500 million upfront and the two companies will split the profits and losses on this candidate.

Morphic’s candidates are preclinical and unproven, but with significant long-term upside if they can come close to the efficacy of injectable drugs. And as I mentioned in the previous section, these candidates can potentially be developed in combination with MORF-057 and each other, and they could extract higher efficacy than each compound can as monotherapy.

Morphic also has a next-generation α4β7 candidate with an initial focus on gastrointestinal indications beyond IBD such as eosinophilic disorders, pouchitis and other potential indications.

And finally, Morphic has a preclinical pipeline with other focus areas, such as pulmonary hypertensive diseases, myelofibrosis and small molecules and monoclonal antibodies with undisclosed targets and indications. However, it remains to be seen whether Eli Lilly wants to push any of these programs forward.

Morphic Holding investor presentation

Risks

The main risk is that Eli Lilly paid $3.2 billion for a drug and platform that ends up producing uncompetitive data and uncompetitive additional candidates. MORF-057 could fail to show a difference to placebo in the phase 2b trial next year, or it could show a very modest treatment effect compared to placebo, and this could make this acquisition look bad.

Similarly, the rest of Morphic’s pipeline may generate poor clinical efficacy or safety, or end up not getting into the clinic at all.

Even so, $3.2 billion is not a lot for a company of Eli Lilly’s size and shareholders are unlikely to feel much pain, or no pain at all, if Morphic’s pipeline disappoints in the following years.

Conclusion

The $3.2 billion acquisition of Morphic Holdings adds a decent shot on goal for Eli Lilly in the very large IBD market with MORF-057 and potentially two additional oral drugs targeting clinically de-risked targets IL23 and TL1A.

As unexciting as the acquisition may look based on the clinical data MORF-057 delivered to date, I believe that even suboptimal efficacy compared to subcutaneously administered biologic competitors can produce decent long-term upside for Eli Lilly, especially for the price it paid. And this would be my baseline assumption, and it also seems to be the assumption of Morphic and Eli Lilly since anti-TL1A deals with biologics targeting the same diseases were worth a lot more (Merck paid $10.8 billion for Prometheus and Roche $7.1 billion for Telavant which only held commercial rights in the U.S. and Japan).

For Morphic shareholders, this provides a decent exit after the volatility in the last few years, and the binary risk of next year’s phase 2b readout of MORF-057 should now transfer to Eli Lilly. I expect no obstacles and believe the deal will close as guided in the third quarter.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.