Summary:

- Tesla, Inc. faces challenges from slowing sales and declining EPS projections, a result of increased competition in the electric vehicle space and changing consumer buying patterns.

- TSLA stock’s valuation remains stretched compared to major auto companies, with downside risk looming due to deteriorating economic conditions and the mushrooming total of EV entrants.

- A major bearish reversal in the EMV trading indicator during July-August has marked previous price tops in the past.

Image Source/DigitalVision via Getty Images

Here is a puzzle for overly bullish investors in Tesla, Inc. (NASDAQ:TSLA) — sales per share are barely growing and EPS is projected to decline in 2024, before an industry-wide recession in car demand even appears. What if sharply mushrooming electric vehicle (“EV”) competition and flailing side hustles (AI, solar, autonomous robotaxis, power-charging tech, etc.) by management don’t produce much for operating numbers a year or two out? Heaven forbid, what if sales and earnings per share decline over the next 24 months? All told, that’s the sell logic starting to creep into Tesla trading since early July.

Should we still consider Tesla a “growth” company, assuming 2025 results are the same or weaker than 2023? If not, what should the share price and valuation be? I think Perma-bulls need to start getting serious about a far less optimistic future for the business than its high-growth past. With flat to lower numbers estimated for 2024, and no guarantees of substantial growth thereafter, why are we still putting super-high growth-based multiples on shares for a valuation?

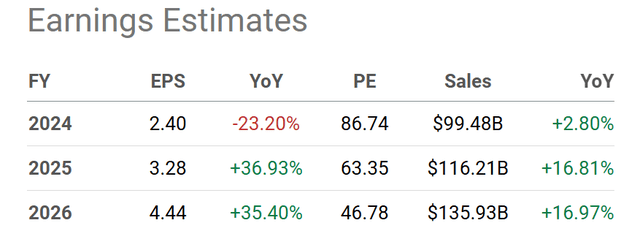

Seeking Alpha Table – Tesla, Analyst Consensus Estimates for 2024-26, Made August 13th, 2024

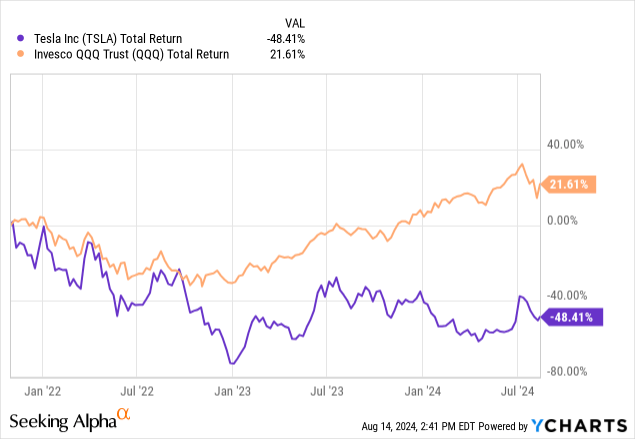

In my view, a severe recession shock to Tesla’s business is not at all discounted in shares. My forecast continues to look for a TSLA quote closer to $100 in a recession scenario, which would be far off (-75%) its $400+ all-time price peak in November 2021. Unfortunately for the hot money chasing this name, Tesla has been one of the worst performers in the Big Tech sector for investors over the last three years.

YCharts – Tesla vs. Big Tech QQQ ETF, Total Returns, Since November 2021

Don’t say a recession cannot happen or Tesla won’t decline appreciably in one. The company has never experienced a massive demand implosion in its history, as the 2008-09 recession in auto sales happened before the 2010 IPO of shares.

In January, my last Tesla article here warned about a slowing economy’s negative effect on Tesla’s quote. Long story short, the share price is down about -15% since then, with sales and EPS misses along the way.

So, consider this effort a friendly reminder that more downside risk is lurking. As I mentioned in my bearish article (with price around $300) in September 2022 here, tons of EV competition is going to hit the marketplace during 2025-26, putting all kinds of pressure on the operating business in 12–18 months (think fewer customers, falling EV selling prices, less overall growth, and declining profit margins).

The double-whammy of falling auto demand industry-wide from a recession, on top of the entry of serious competition for consumer price and auto options in EVs, means Tesla could continue to lead Big Tech on the downside over the next 12 months.

Tesla Homepage – August 14th, 2024

Stock Valuation Still Problematic

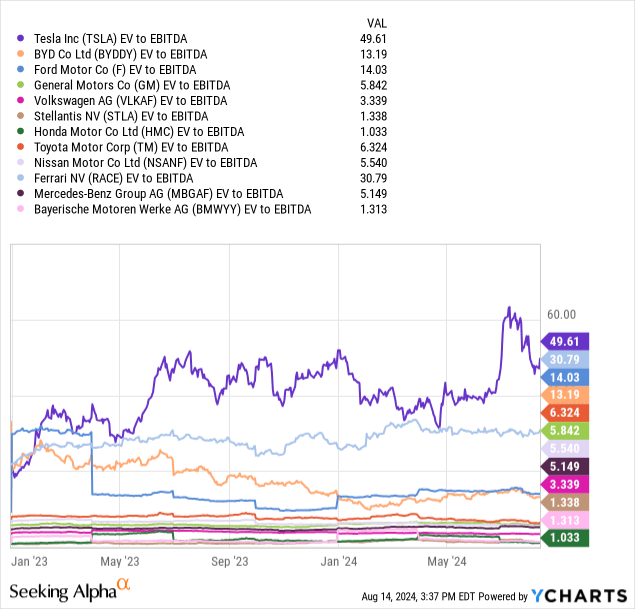

There are plenty of data points highlighting Tesla’s extended valuation. Of course, the valuation has improved on most financial metrics since 2021 (a function of the stock price dropping and financial results improving). But, the valuation remains very stretched vs. the other major auto names where you can invest your money. With 85% of 2023 revenue coming from new car sales, I am firmly placing this organization in the auto group (although many of you will disagree with my assessment).

In terms of apples-to-apples comparisons (autos to autos), using the enterprise value calculation of total equity and debt outstanding (minus cash) for Tesla and peers/competitors can give us the cleanest look at business valuations. On EV (enterprise value in this case) to core cash generation EBITDA, Tesla still stands out like a sore thumb as the overvalued pick of the group. Today’s trailing 49.6x ratio is quite a distance from the median average of 5.5x or mean average of 11.4x of the major global automakers.

YCharts – Tesla vs. Major International Automakers, EV to Trailing EBITDA, 18 Months

I know Tesla shareholders believed it “deserved” a high premium valuation because of rapid growth years ago. However, the outlier expansion story is fading rather quickly in 2024.

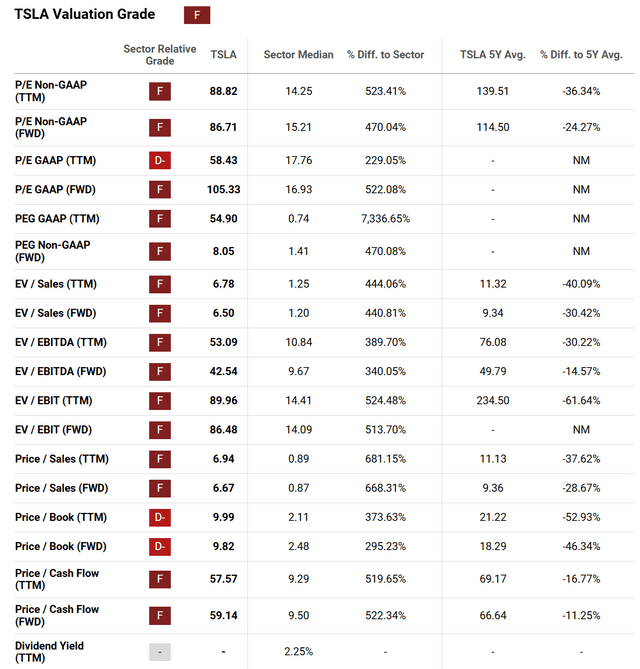

I won’t rehash tons of statistics for you. A number of Seeking Alpha analysts do that every month. Yet, on a host of valuation criteria and comparisons to the auto group, Seeking Alpha’s computer-sorting system puts an “F” Quant Valuation Grade on Tesla. You can review the below table, paying particular attention to the % Differences to Sector.

Seeking Alpha Table – Tesla, Quant Valuation Grade, August 13th, 2024

Where’s The Growth?

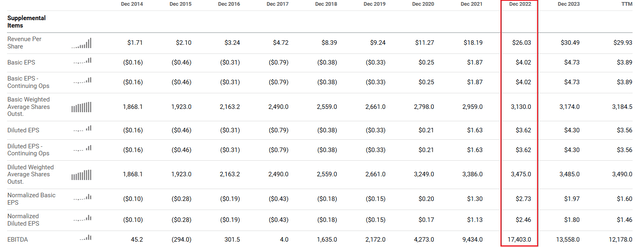

When we look at EBITDA and earnings stats, Tesla’s income output for shareholders is now lower than the full year of 2022 (boxed in red). It appears as though business profits peaked in the summer of 2023, with 12-month trailing results through June either flat lining or moving backwards.

Seeking Alpha – Tesla, Income Statement Table, 10 Years, Author Reference Point

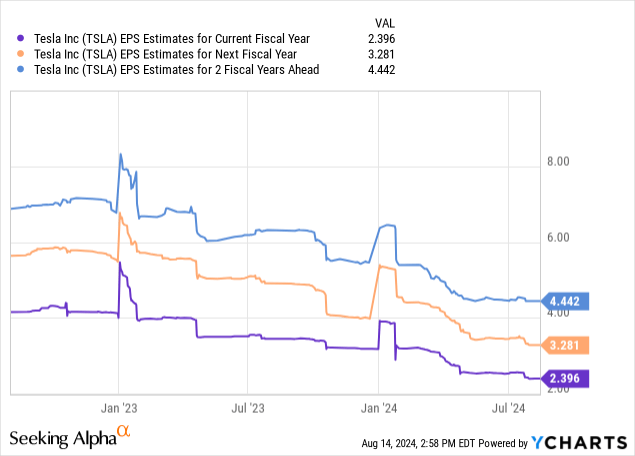

You can readily see trouble in the large downward revisions by analysts for earnings estimates this year through 2026. Remember, this is before competition for EV product exponentially heats up or a recession in overall industry demand becomes reality.

The downshift in analyst EPS estimates for FY 2026 has almost been halved (reduced by 50%) since January 2023. Is Tesla honestly worth almost 50x future earnings two years from now, when the S&P 500 (SP500) is under 20x for an equivalent estimate, and you can capture “risk-free” cash investment returns of 4% or 5% annually (equivalent to a stock P/E of 20x or 25x) for a 2-year hold?

YCharts – Tesla, Rolling Analyst EPS Estimates for 2024-26, Since October 2023

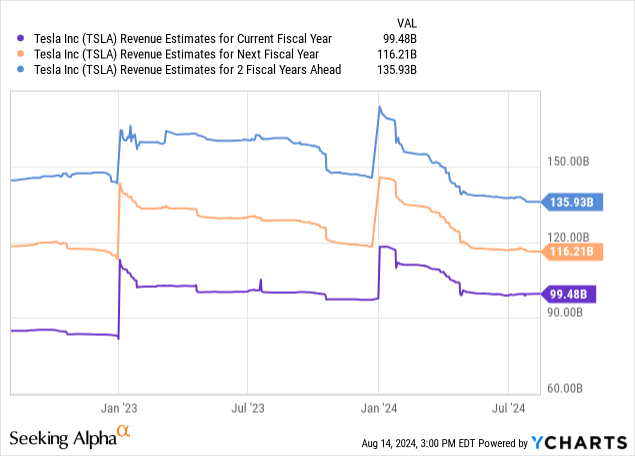

Revenue estimates have held up a little better, but have come down dramatically since January 2023. What if a recession slashes sales expectations another 10% to 20% by early 2025? Essentially, Tesla would morph into a no-growth stock like thousands of other choices for your capital.

YCharts – Tesla, Rolling Analyst Revenue Estimates for 2024-26, Since October 2023

The Dilutive Effect of CEO Pay-Package Saga

Financial per share metrics could also soon be slashed with a 10% dilution to existing shareholders, if all of CEO Elon Musk‘s stock options are exercised.

Mr. Musk already lost a ruling in Delaware court in January, explaining his pay package was out of bounds compared to other business managers, after shareholders filed a suit to stop the dilution. According to a Reuters article by Tom Hals,

A Delaware judge tossed out Elon Musk’s record-breaking $56 billion Tesla pay package on Tuesday, calling the compensation granted by the EV maker’s board “an unfathomable sum” that was unfair to shareholders…

The pay package granted stock option awards for approximately 304 million shares that Musk can buy at about $23.33 each… Musk earned all 12 tranches of stock option awards as Tesla hit escalating financial and operational goals.

In June at the annual shareholder meeting, Tesla owners approved Musk’s $56B pay package, plus voted yes to moving its state of incorporation from Delaware to Texas. So, it is up in the air, regarding the timing (if ever) of future management compensation packages diluting TSLA stakeholder interests. Judges and juries will have the final say.

My view is issuing new shares at the same time as sales and earnings run into a brick wall would be a very bearish development for shareholders, not remotely the positive catalyst being argued (to ensure Musk does not sell out his shares and leave the company).

Huge Technical Trading Reversal

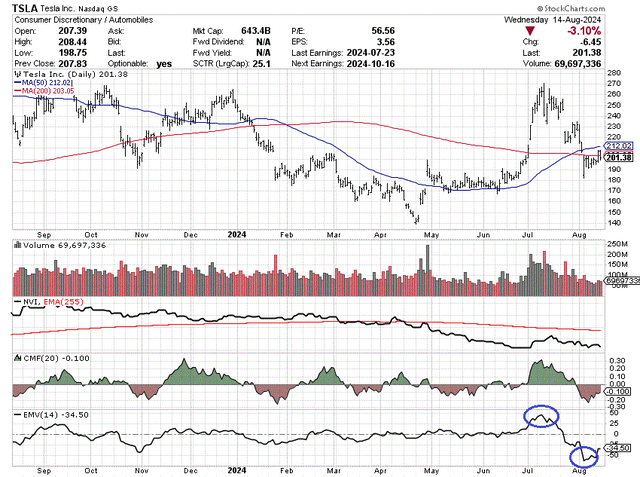

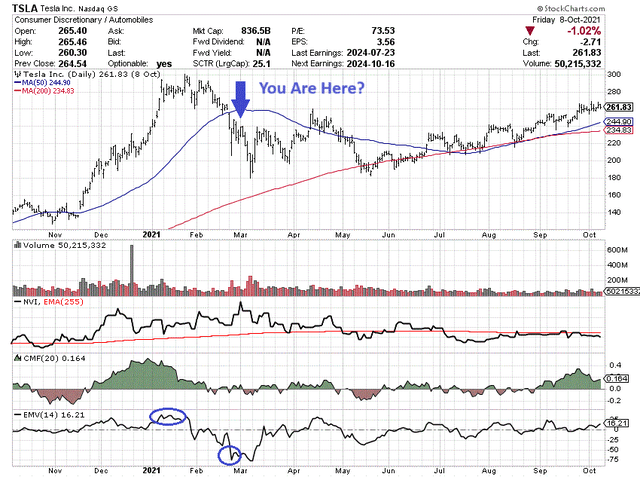

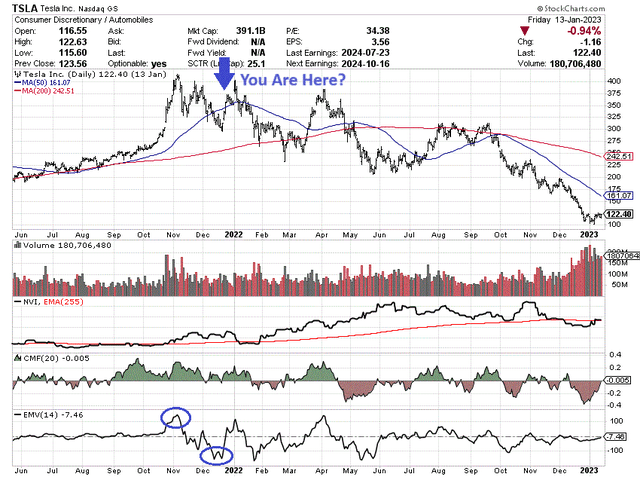

Another point of caution for Tesla bulls is the stock just experienced a monster trend reversal in the 14-day Ease of Movement indicator. It’s the kind of selling overwhelming buying volumes that has typically taken place right after major price tops or during serious corrections. I have charted the latest 12-month chart, plus the last twice EMV 52-week highs have reversed to 52-week low readings in rapid fashion (early 2021 and late 2021).

Current

StockCharts.com – Tesla, 12 Months of Daily Price & Volume Changes, Author Reference Points

January 2021 Peak

StockCharts.com – Tesla, Daily Price & Volume Changes, Oct 2020 to Oct 2021, Author Reference Points

November 2021 Peak

StockCharts.com – Tesla, Daily Price & Volume Changes, May 2021 to Jan 2023, Author Reference Points

However, more worrisome than the two previous EMV swings lower, the current situation includes a weak 20-day Chaikin Money Flow score and a Negative Volume Index zigzagging lower all year. So, I could argue an overhead supply problem is also part of the equation, alongside growing numbers of sellers wanting out, with buyers in retreat. At least that’s what the chart readout is telegraphing today.

Final Thoughts

What could push the price back above $200, perhaps even to $250 by the end of the year? I will note technical formations could change again unexpectedly to a bullish setting, especially if peace breaks out in the Middle East and the Fed eases aggressively into the election.

If you believe in the soft-landing or no-landing narratives regarding the economy, there’s an outside chance Tesla will hang around its current $201 price. To trade sustainably higher, I would posit a true “Goldilocks” scenario of lower inflation and interest rates, plus a stronger economy with rising consumer demand for autos will have to appear. Nevertheless, with such an elevated valuation, I do not foresee an outcome that keeps the price close to $250 over the next 12 months.

The disconnect for investors — Wall Street is still putting a massive overvaluation setup on Tesla shares, all based on the hope things won’t get worse for the company. My conclusion is Tesla’s price and valuation remain out of touch with events on the ground. The operating business is not going to grow by 50% or 100% yearly from today. Rosy analyst estimates are calling for 10% to 15% sales expansion annually, with a 20% to 25% rebound in EPS per annum over the next three years, when measured from 2023.

Any disappointment with expected results could torpedo the share price/valuation harshly, in my opinion, trading stocks over 37 years. The twin bogeymen of recessionary auto demand and intense EV competition may mean the easy-money period owning Tesla shares has already passed.

If sales decline in 2025, while EPS move into negative (red) territory, will retail investors and hedge funds run for the exits? Will Elon Musk sell more shares (like he did to buy Twitter, now X) if he sees a downturn materializing in operating results?

You have to reasonably ask yourself — versus 75 million automobiles sold globally in 2023, is Tesla’s 1.8 million units (2% of the total marketplace) worth nearly 50% of the entire industry’s equity capitalization? My answer is absolutely not if growth stalls, then moves into reverse.

I continue to rate Tesla shares a Sell for a 12-month outlook, with a possible range of $200 (today’s number) to $100 by next summer (approaching January 2023’s low quote), depending on economic conditions and EV competition.

Even lower quotes than $100 are plausible, given a prolonged and deep recession. TSLA’s 300% to 500% premium to the auto sector on most financial ratios will likely be slashed in a zero-growth environment for the company. Stock levitation usually happens for good reason. When the logic for a sky-high valuation disappears, so will the stock quote.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am short NASDAQ 100 and S&P 500 index derivatives, which have large Tesla holdings. This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.