Summary:

- Today, we’re exploring what ‘Fair Value’ for GME shares could be.

- Given the declining sales figures, persistent headwinds, and patently absurd valuation, we’re staying far away from this stock.

- In an optimistic scenario, we’ve pegged Fair Value at around $6.5 per share, which is 72% beneath the current stock price.

- We rate GME a ‘Strong Sell’.

jetcityimage

Most of the time when we review a company, we start with the premise that the market is probably somewhat correct, if not entirely correct, about a stock’s value.

We often think that the market is wrong upon further inspection, but it typically pays to at least get a sense of what investors are thinking before starting your own analysis. Then, you can ferret out the degree to which you think you have an edge, which can then be expressed in a position.

In the case of GameStop (NYSE:GME), the reverse is probably true.

As a bona fide meme stock, the company doesn’t trade on fundamentals, and so there’s really no reason to take a look at ‘market expectations’ because they’re quite difficult to parse.

In May, Roaring Kitty, the meme stock ‘hero’ from 2021, showed that he had a massive amount of capital invested in the name, and the stock flew up more than 500% over a few days from trough to peak:

In situations like this, we think it’s a lot easier to work backwards from the ground up to get a sense of where the stock could be headed over the long term.

Today, we’ll be doing just that.

In this article, we’ll take a look at GME’s business, trends, and assets to determine what we think the company is worth on a fundamental basis.

Then, we’ll issue our rating.

In case you’re short on time, we think GME is a ‘Strong Sell’ – a speculative plaything for shorter term traders that has no position in a serious portfolio.

If you want to see how we came to that conclusion, then read on.

GME’s Financials

If you’re just coming into the picture now for the first time in the last few years, here are the high-level stats to be aware of.

GME’s market cap is around $9.5 billion.

Over the last twelve months, the company did $4.9 billion in revenue, $1.2 billion in gross profit, and $24 million ($0.024 billion) in net income.

This is a net margin of 0.51%, which puts the company slightly in the black.

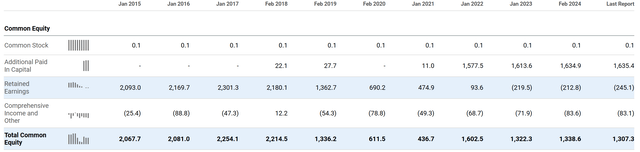

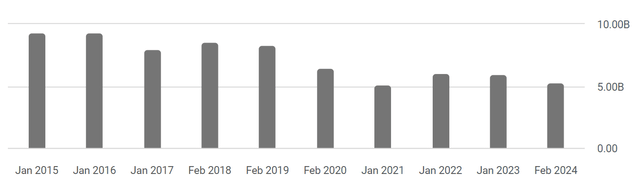

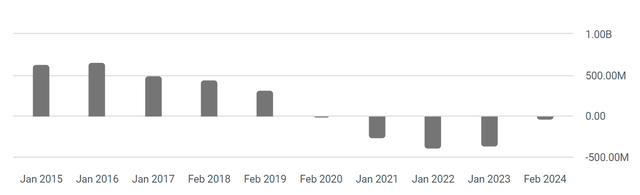

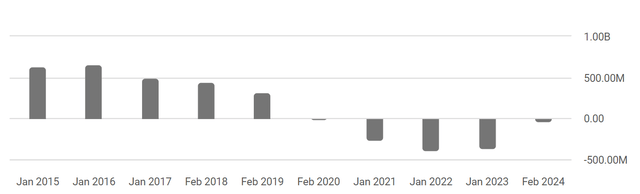

For context, these financial results come within the picture of generally falling revenue, worsening operating income, and plummeting EBIT:

Revenue (Seeking Alpha) Operating Income (Seeking Alpha) EBIT (Seeking Alpha)

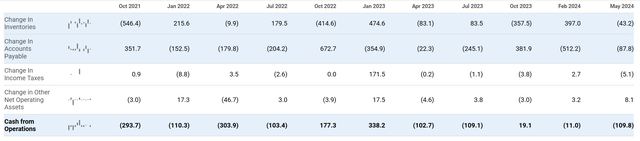

To some, the incremental improvements over the last year or so to GME’s bottom line have served as ‘proof’ of the company’s turnaround, but cash from operations remains firmly negative as net losses around payables and inventory keep cropping up:

To be clear, we do want to give management some credit for shoring up the balance sheet, cutting costs, and getting the company into fighting shape looking forward.

Since 2021, the company has been focused on a few key prongs, all of which have been focused on making the company investible:

• Establish Omnichannel Retail Excellence – We aim to be the leading destination for games and entertainment products through our stores and ecommerce platforms. To accomplish this, we are taking steps to ensure we are a fast and convenient solution for our customers. This includes increased product availability across all channels, faster fulfillment through ship from store offerings, and a further improved customer service experience.

• Achieve Profitability – During fiscal 2023, we continued to optimize our cost structure to align with our current and anticipated future needs. We will continue to focus on cost containment as we look to operate with increased efficiency.

• Leverage Brand Equity to Support Growth – GameStop has many strengths and assets, including strong household brand recognition and a significant store network.

Taken together, there have been some improvements made to GME from an asset allocation standpoint.

That said, there are still huge headwinds that shareholders should be ready to contend with.

The main cause of GME’s revenue decline has been an increase in digital game purchases directly on consoles and PCs, which is a trend that we don’t see reversing anytime soon.

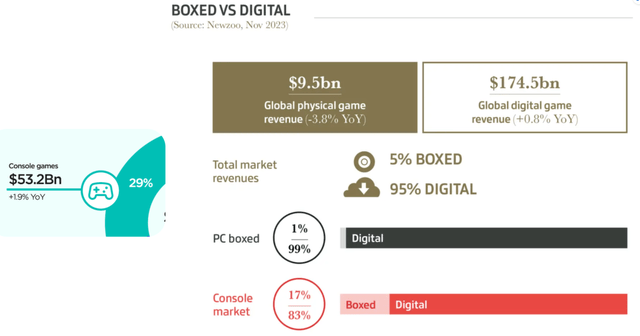

In 2023, only 17% of console gaming revenue was physical, as opposed to digital:

In 2022, just one year earlier, the number was 28%.

To us, these megatrends in gaming represent terminal velocity when it comes to physical sales. We will have an all-digital future in gaming – it’s hard to see things going any other direction.

To underscore this fact, console manufacturers are already producing consoles without disc slots:

Quora

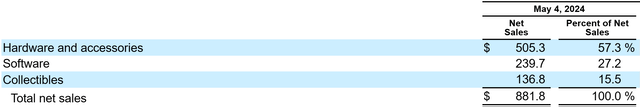

To be fair to GME, the company does sell adjacent products to games as well, including software keys and collectibles:

Plus, gamers need to go somewhere to buy consoles, controllers, and other equipment, which means that we don’t think all of GME’s revenue sources are going to zero.

However, GME’s cost structure is going to have a tough time coping with the decline in sales if and when games begin to make up a smaller and smaller portion of what people actually buy at GameStop.

It’s already happening:

[We had a] 29.1%, decline in the sale of new software, a $220.5 million, or 30.4%, decline in the sale of hardware and accessories, and a $36.2 million, or 20.9%, decline in the sale of collectibles.

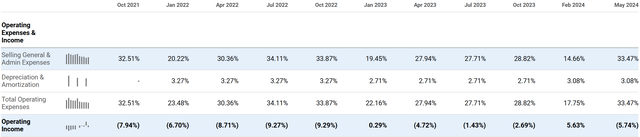

It’s very hard to cut your way to profitability when sales are dropping this fast:

Slashing SG&A simply can’t keep up with market forces that are beyond GME’s control.

On top of that, all of the aforementioned moves taken to improve the company’s position thus far have come at great expense to shareholders, as retained earnings continue to plunge into the red and common equity value declines:

Long story short, we think the company is in better shape than it was in 2021, but it’s very hard to imagine a scenario where GME can get revenue moving in the right direction and keep the cost structure profitable.

We think GME will stay in business for the foreseeable future and could even be profitable going forward given the improved balance sheet. However, doing so would likely mean that the company’s revenue would be a fraction of where it is today.

This brings us to the valuation.

GME’s Valuation

Right now, as we mentioned, GME’s market cap is roughly $9.5 billion.

But what is the company actually worth?

Well, if you assume that sales will continue declining until the company sells an even split of collectibles, consoles, and software keys at some point in the next 5 years, then we’re looking at a revenue base of roughly $1.2 – $1.5 billion per year.

On this, if management can continue making progress on the cost structure, then we could see 10% net margins over time (which is a tad generous given the headwinds), which would result in $120 – $150 million per annum in profit.

This would be an optimal outcome for shareholders, in our view, and assumes solid management execution to get to this point.

If you slap on a 12x P/E – which is a discount to the sector’s average 17x P/E due to GME’s lower growth profile – then you end up with a potential market cap somewhere in the $1.4 – $1.8 billion range.

Tack on the additional $1 billion in cash, and you end up with $2.4 – $2.8 billion market cap as a Fair Value for GME sometime over the next few years.

Remember, this assumption includes continued declines in sales to a ‘baseline’ (which might not exist) and assumes 10% net margins (which may be impossible to generate).

Taken together, we’d argue this is a rosy projection.

Right now, GME is trading at a $9.5 billion market cap, which is significantly higher than this value. If GME were to fall tomorrow to this estimate, investors would lose 72% overnight, and shares would settle around the $6.5 mark.

The key thing here is that GME’s sales are still substantial, which means that it’s easy for investors to look at the company and think the following:

‘Well, if sales can stay flat and profitability improves, then the multiple doesn’t look so crazy’.

However, as sales continue to drop (as they have been doing), then the $9.5 billion market cap makes absolutely no sense from a fundamental standpoint.

Long story short, given the discrepancy between our projection and the company’s current market cap, it’s hard to argue that GME is anything other than a ‘Strong Sell’.

Risks

That said, we don’t think you should be shorting the stock.

As we mentioned at the start of this article, GME doesn’t trade off of fundamental value in the short term, which means that the stock is prone to serious, prolonged, nasty spikes which are sure to wreck the average short seller.

As Manuel Paul Dipold’s recent article summarized in the title: “GameStop: Too Risky To Buy, Too Risky To Short“.

This seems about right, in our view.

We’ve outlined the many risks to staying long at this price, but going short simply doesn’t make a lot of sense either.

Summary

All in all, we think the best path for investors interested in GME is simply to stay away. It’s too volatile to consider as a short play, and the fundamentals simply don’t back a long position.

Thus, our ‘Strong Sell’ rating.

Stay safe out there!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.