Summary:

- Netflix’s profits without sufficient cash flow raise concerns about aggressive accounting choices and investment risk.

- GAAP allows for management decisions in accounting, making it difficult to determine what is conservative and reasonable for a pioneer like Netflix.

- Disney’s recovery from the pandemic and identifiable franchises make it a potential buy, but the company still faces challenges in the switch to streaming.

- Warner Bros. Discovery guides to the same cash flow guidance as Netflix, and it has the advantages of integration and franchises.

- Warner Bros. Discovery’s turnaround may lead to much faster cash flow growth than the market expects.

Mario Tama

Netflix (NASDAQ:NFLX) is often cited as an industry leader and “way ahead of the rest” with the talk about profits coming up next. But profits without cash flow (or with cash flow that is less than earnings), when growth slows, is a huge warning sign that the accounting choices were allowed but aggressive choices were made. If it persists, it can be a huge red flag for investors that the investment is riskier than the market would have you otherwise believe. Oftentimes, the cash flow statement with the GAAP numbers is a far better indicator of financial progress and acceptable investment goals with the accompanying risk.

GAAP in many cases allows for a lot of management decisions about accounting. In the case of an industry pioneer like Netflix, management will choose to promote the company and its advantages (as do many managements). But without any history, public accounts will likely be in a quandary as to what is conservative and what is reasonable until some history is established. That can lead to more earnings reported than GAAP cash flow. This rarely happens with established industries as conservative choices are backed by industry history.

Cash Flow – The Best Historical Year

Netflix has a very long history of less cash flow than earnings. Normally that would imply that the depreciation has to be adjusted to make the numbers comparable to others in the industry.

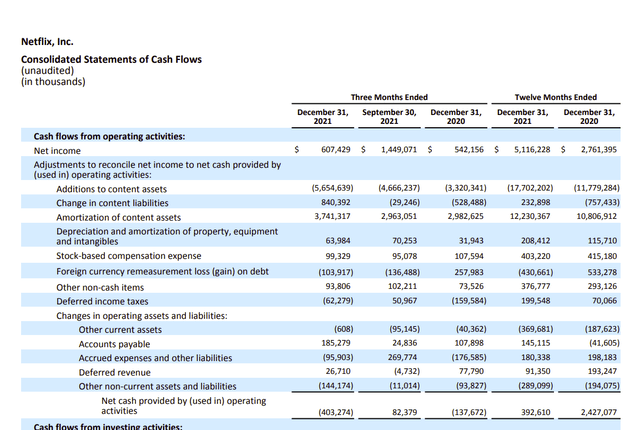

Netflix Cash Flow Statement For Fiscal Year 2021 and 2020 (Netflix Shareholder Letter For Fiscal Year 2021 Fourth Quarter)

Netflix reported the best annual cash flow (probably until the current fiscal year ends) back in fiscal year 2020 during the shutdown. This company, like many in the industry, could not make new material due to the pandemic. Therefore, cash flow was probably as good as it gets. Even so, with more than $30 billion in movie-related assets (probably including the equipment and buildings) on the balance sheet, that cash flow does not support the movie valuation.

Realistically, if no new content were made, cash flow would decline each year after the current one. Therefore, there is considerable investment always needed for earnings if what is shown above holds up.

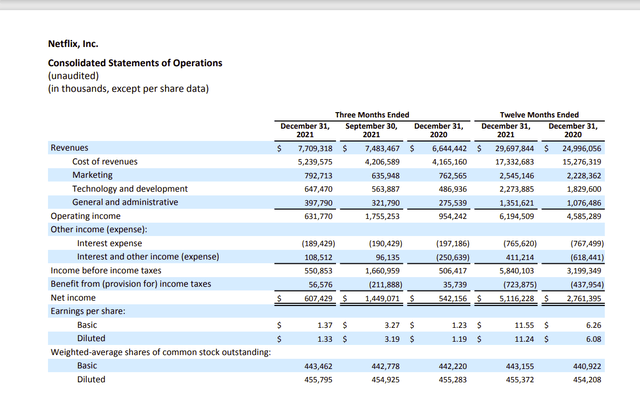

Netflix Income Statement Fiscal Years 2021 and 2020 (Netflix Fiscal Year 2021 Letter To Shareholders Fourth Quarter)

Meanwhile, for the fiscal year, far more earnings were reported than cash flow. When this happens, the first question an investor should ask is “how can you earn anything without the cash to go with it?”. Generally, a beginning accounting class would teach you that income plus depreciation should equal cash flow in a very simple model. Now a big company like this one will have a lot more adjustments, but such a simple calculation would be a place to start.

You also have content costs that are immediately expensed in the year in which they are made or created in this industry. Overall, it would appear that something making up Cost of Revenues should have been about $4 million higher for the fiscal year.

Back then, the growth slowed in fiscal year 2021 to considerably below 10%. A company with that growth rate should be generating more cash flow than earnings before the changes in accounts section of the cash flow statement because working capital accounts can and usually do soak up some cash as the company grows.

Current Situation

It really has not changed that much since those days.

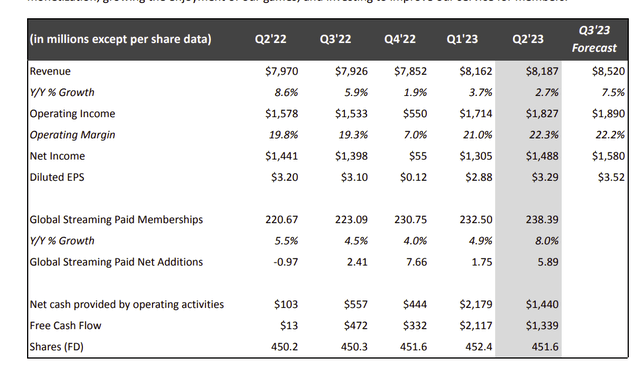

Netflix Business Summary (Netflix Shareholders Letter Second Quarter 2023)

Notice that there is only one quarter shown above where cash flow is larger than earnings. Management has mentioned a goal to spend on new content that is amortized. That will definitely help the situation.

As shown by the revenue growth, the heady days of big double-digit percentage growth are largely over. This company is heading towards the mature phase where growth in the teens will get to be an increasing challenge if it ever happens consistently again.

We should now be at the “pot of gold” phase where the company generates that promised cash flow. But management only forecast a free cash flow improvement to a $5 billion annual rate in the latest quarter.

In the meantime, the company has roughly $14 billion in debt and a market value of $168 billion to give an enterprise value of $172 billion. Those are approximations and the market value could certainly vary by the time you read this. However, short of a major enterprise value adjustment, most companies that grow in the single digits would expect a cash flow yield in the 20% range not to mention what a free cash flow yield should be for a company like this that was all set to generate a lot of cash “someday”.

The $5 billion cash flow is nothing close to a normal market expectation of roughly $30 billion for cash flow from operating activities (the GAAP number) followed by a decent amount of that going to free cash flow. This would imply a big downward adjustment in the current stock price when the market revalues this company to a regular fairly mature company with a decent growth rate that will probably never approach the “good old days” again.

Warner Bros. Discovery

Warner Bros. Discovery (WBD) was formed by the combination of assets sold by AT&T (T) to the old Discovery. It has only been around in its present form for less than two years. The general market take here is “ALL THE LOSSES” and deleveraging that has to happen on top of that. But deleveraging is focused on cash flow and increasing that cash flow. This company has the competitive advantage of integration and franchises. Therefore, earnings can be made in several ways unlike with Netflix. This is very different from Netflix which is focused on earnings and growth. Personally, I prefer the cash.

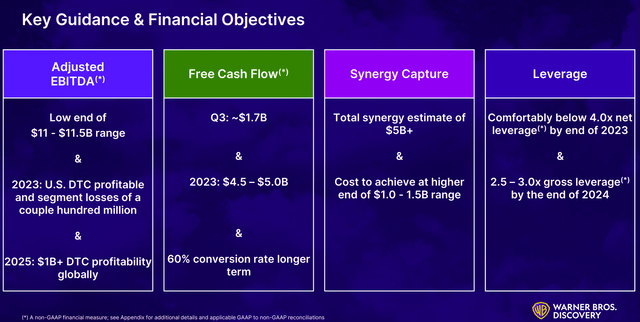

Warner Brothers Discovery Fiscal Year 2023 Guidance Summary (Warner Brothers Discovery Second Quarter 2023, Earnings Conference Call Presentation)

Warner Bros. Discovery is already up to $5 billion in free cash flow in its second year of existence for guidance and EBITDA is growing as well.

Furthermore, this management discovered more potential cash flow as shown below:

And we have talked about this in the past, cash was never an objective in 3/4 of this company. And so, when we went in and looked at the enormous amount of uncollected receivables, the enormous delays and even sending out invoices, the willingness to just pay our suppliers before even payments are due, it was just never a focus area. The discussion of a 10% margin business or a project, is that a good project? Could be but it could be a bad project if it takes 3 or 4 years to get the cash in after you deploy the capital.

This quote comes from Gunnar Wiedenfels (Chief Financial Officer) answering a question (during the second quarter conference call) as to where the cash is coming from.

More importantly depending upon the size of this issue, that extra cash flow can speed the deleveraging process, or it can be used to help divisions turn around. All they have to do is “whip the accounting into shape” to get that extra cash. Should the management turnaround plans succeed, that one-time cash bonanza will be replaced with operating cash in the future.

With this company, the market cap is about $27 billion, and the gross debt is listed in the latest presentation as roughly $48 billion. The enterprise value here is $75 billion. The turnaround story means that cash flow here is likely to grow far faster than is the case of Netflix as the turnaround proceeds. The risk, of course, is that management fails in the turnaround. For the same cash flow guidance there is roughly $100 billion less enterprise value. That lower enterprise value alone could decrease investment risk despite the leverage issue because the valuation difference is huge. Meanwhile, the prospects of an integrated company (or a conglomerate with franchises) like this one are probably better.

For investors, this $5 billion of guided free cash flow is way cheaper and the company is integrated as well. More importantly, the inherent operating leverage in a turnaround story would be a reason to expect fast cash flow and free cash flow growth the next few years.

Disney (DIS)

The last major competitor in the streaming industry would have to be Disney. Like Warner Bros. Discovery, there are franchises and integrations that provide multiple profit opportunities and a competitive advantage over Netflix.

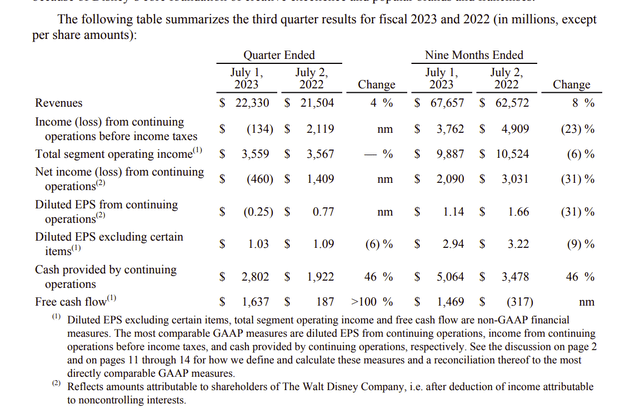

Disney summary of Operations (Disney Third Quarter 2023, Press Release)

Despite a challenging year for Disney, the cash flow GAAP number and the free cash flow are both running ahead of the previous fiscal year as Disney continues to recover from fiscal year 2020 (the pandemic shutdown).

The movie release schedule was better in the current fiscal year. But it still has ways to go before things are back to normal. Similarly, the parks are finally getting to the point where shutdowns are no longer a worry. There are still plenty of issues for Disney to tackle as there are for any ongoing company.

In the last fiscal year, Disney produced about $6 billion in cash flow and $1 billion in free cash flow. Fourth quarter is likely to provide a big jump for the fiscal year over that number. Further management has plans to continue the recovery and increase profitability (that could fail of course). The issue here is that these fiscal years were hardly “normal” as the business continues to recover from the pandemic.

Nonetheless, the switch to streaming from television and related issues are affecting this integrated company. Also, the company had an acquisition just before the pandemic that never got exploited as guided originally due to the pandemic shutdown. Therefore, this company is somewhat behind the others as it continues to recover. But that likewise means that cash flow will grow fast.

The company shows about $48 billion of short- and long-term borrowings with a current market cap of $148 billion. The total enterprise value of $196 billion explains why the previous CEO was brought back for a “second time around”. Clearly that enterprise value will not hold up as this is not a concept stock like Netflix. The company is too old and has a very long earnings history for that situation to exist. But it is also clear that the market is expecting an earnings return to the “good old days” and is getting impatient with the turnaround. What aids a turnaround is the brand reputation and the franchises the company has.

Key Ideas

Generally, cash flow is a much better indicator of company success than earnings. Management has far less ways to manipulate cash flow than earnings.

The cheapest company for the cash flow is clearly Warner Bros. Discovery. For those that are worried about the leverage, management has been growing EBITDA for some time and that growth looks to continue. The safety factor could well be the cash generated by billing and collecting accounts receivable correctly while handling accounts payable better than was the case in the past. That may lower the risk factor for potential investors while the turnaround proceeds. After that one-time bonanza, management will have to show enough improvement in operations to keep cash flow growing. That appears very likely to happen.

Next up would have to be Disney as Disney has a record of past success and easily identifiable franchises that make profits a bit easier to obtain. The current turnaround and other issues need to be appropriately addressed. But that would seem likely given the past history of Disney.

Netflix, on the other hand, appears to have matured and growth appears to have slowed. The company is the size where a reasonable expectation of future growth would be 10% or less. More importantly, compared to the first two, Netflix clearly has some aggressive accounting assumptions that likely have depreciation considerably understated compared with the first two. The evidence for this is back in 2020 when no new material could be made and cash flow was not close to supporting the asset number on the balance sheet.

Netflix has no franchises like Disney or Warner Bros. Discovery. Nor is the company a turnaround story like the other two where the turnaround would allow for a relatively fast cash flow growth until recovery is complete. Netflix is likely to have the lowest future cash flow growth of the three over the longer term (like five years). There is, relatively speaking, nothing close to the diversification of the other two that allows for multiple profits from a successful project. This company is dependent upon one hit after another, which is a relatively risky strategy compared to relying on franchises for future hits.

While the risk of all three is clearly high for a number of reasons, Warner Bros. Discovery is likely to be a speculative strong buy for investors who can handle the risk. Disney is likely to be a buy based on a successful recovery and turnaround as needed. Netflix is likely to be the one to watch from the sidelines until that company demonstrates an advantage over the other two. Right now, the cash flow would demonstrate that advantage is not there unless one would believe that Disney will fail in its comeback and turnaround as needed.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, WBD, DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

I own a NFLX put.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.