Summary:

- Adobe is reporting Q1 earnings next week.

- Although Adobe’s last couple of earnings were mixed, the company has a long track record of strong performance.

- I highlight three catalysts to watch for in Q1 and 2023.

hapabapa

Thesis

Adobe (NASDAQ:ADBE) stock remains a high quality tech stock due to its strong Rule of 40 score, wide moat, and other factors. Despite some recent struggles, Adobe stock is likely undervalued today and has multiple potential catalysts. Thus, I rate it as a strong buy.

When Does Adobe Report Earnings?

The next ADBE earnings report is for its Q1 FY2023 earnings. The company will report on Wednesday March 15th at 5 PM EST. This is exactly three months after Adobe’s last earnings report; its Q4 earnings were reported on December 15, 2022.

Is Adobe Expected To Beat Earnings?

The following table shows analyst expectations for Adobe’s Q1 earnings relative to the Q1 expectations that Adobe provided in their Q4 report.

| Metric | Adobe | Analyst Average |

| Revenue | $4.6B – $4.64B | $4.62B |

| EPS | $2.60 – $2.65 | $2.65 |

Based on this table, analysts are confident that Adobe will meet its guidance, but are more confident about the bottom line than the top line.

For it to be considered a true earnings beat, Adobe will also have to beat analyst expectations. This would mean GAAP EPS growth above 9% and revenue growth above 8%. Note that in the last 90 days, 15 analyst estimates were revised upward and 5 were revised downward. Thus, analyst sentiment remains mixed, and their average target for Adobe is constantly shifting.

To understand how likely it is that Adobe beats analyst expectations, let’s take a look at how Adobe did in past earnings.

How Was Adobe’s Previous Earnings?

Adobe’s Q4 results were mixed, with $3.60 EPS (+12.5%) beating analyst expectations but $4.53B revenue (+10.1%) missing estimates. That’s the same story as Q3, where Adobe also beat on EPS but missed on revenue.

It’s worth noting that prior to Q3, Adobe had a two year streak of top and bottom line beats and was widely regarded as an over-performer. However, it’s undeniable that the last couple reports haven’t been great.

Catalysts To Watch For ADBE Q1 Earnings

There are a few catalysts for Q1 and later in 2023 that could help push ADBE stock higher:

- Figma: It was reported two weeks ago that the DOJ and EU/UK regulatory bodies may move to block Adobe’s acquisition of Figma. ADBE stock promptly fell 8%, which is ironic considering that the original acquisition announcement also caused a selloff as investors believed that Adobe paid too much. Adobe still expects the acquisition to close in 2023. I believe that any resolution to the Figma saga will relieve investor uncertainty and eventually push ADBE stock higher.

- Macro Changes: Adobe has often factored macro issues into their guidance and has so far been very accurate in that process. If the U.S. Dollar starts to decline (either due to rate cuts, a recession, or other factors), that will be great for Adobe stock. As things stand today, Adobe expects to lose 4% of revenue in 2023 due to unfavorable exchange rates in their large international business.

- Artificial Intelligence: Since the start of the year, stocks that are associated with artificial intelligence and generative AI like Microsoft (MSFT), Nvidia (NVDA), and Baidu (BIDU) have outperformed the market. Although I am skeptical of whether this outperformance is justified by fundamentals, it’s undeniable that this is an investing trend today. So far, Adobe has not been strongly associated with AI and has underperformed the market year-to-date. However, if Adobe can convince investors of its association with AI as a leading tech company, it could see multiple expansion.

Is Adobe Stock Expected To Go Up?

Despite the recent struggles with slowing growth and missed expectations, ADBE stock is actually beating the market since I last covered it following Q3 earnings, when I gave it a Strong Buy rating with the following commentary:

Here’s a simple way of looking at the recent events. Adobe’s market cap was $186B on September 5th, shortly before earnings. Today’s market cap is $131B. That’s a difference of $55B, due to a selloff which is largely being attributed to a $20B acquisition.

Since that time, ADBE stock is up 17% compared to 5% for the S&P 500, and today Adobe’s market cap stands at $146B. While ADBE stock has had a nice rally, it’s still substantially lower than before the Figma acquisition was announced.

Of course, this is anchoring bias. But looking at Adobe stock on a forward P/E and P/FCF basis, it’s cheaper than fellow tech giants Microsoft, Apple (AAPL), and Salesforce (CRM).

| Stock | P/FCF | Forward P/E |

| ADBE | 20 | 19 |

| MSFT | 45 | 23 |

| CRM | 31 | 20 |

| AAPL | 27 | 23 |

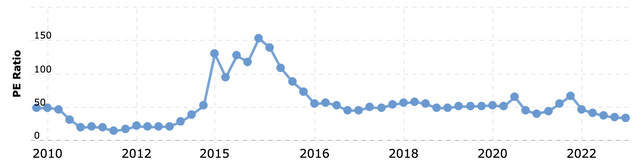

Adobe’s P/E ratio is also at multi-year lows, having fallen by over 50% since 2020:

ADBE P/E Ratio (via MacroTrends)

Considering this valuation and the aforementioned catalysts, I continue to rate ADBE stock as a strong buy. Perhaps not as strong as after the panic selling following Q3 earnings in light of the rally amid slowing growth since then. But it’s likely still a stronger buy than the overall market. Analysts seem to agree, giving Adobe an average target price of $391 (19% upside). My price target is slightly more bullish than average at $409.

Conclusion

Adobe’s recent earnings have been mixed, and investors can only hope that their Q1 earnings come in ahead of expectations, as most of Adobe’s earnings have done over the years. Although I don’t expect Q1 to blow investors out of the water, I do expect Adobe to continue to steadily outperform the market in the coming years. Adobe stock is still undervalued today and thus a strong buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ADBE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.