Summary:

- Exxon Mobil Corporation’s Q1 2023 financial results show a deterioration from the previous quarter, with revenue down 12% and share price slightly dropping.

- The decline in oil prices and increased competition in the energy sector may lead to slower growth in dividend payouts or the need to borrow to pay them.

- The article initiates coverage of Exxon Mobil with a “hold” rating for the next 12 months, expecting the share price to drop to $96 per share in the next two months.

stefanamer/iStock via Getty Images

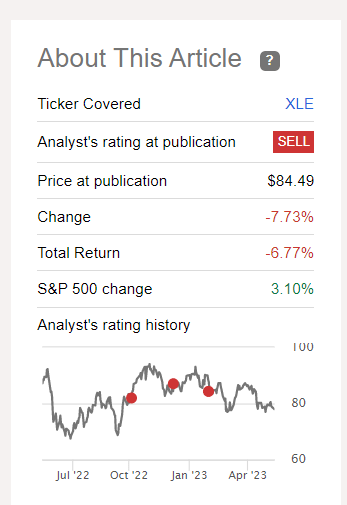

Since the publication of my bearish article “Is It Worth Investing In Oil And Gas Companies In 2023,” WTI crude and Brent futures have fallen by more than 15%. Moreover, the price of the Energy Select Sector SPDR® Fund ETF (XLE), one of the largest ETFs in the energy sector and which includes Exxon Mobil Corporation (NYSE:XOM), has fallen more than 7%, despite the positive performance during that time of the S&P 500 Index (SP500).

Nathan Aisenstadt – Seeking Alpha

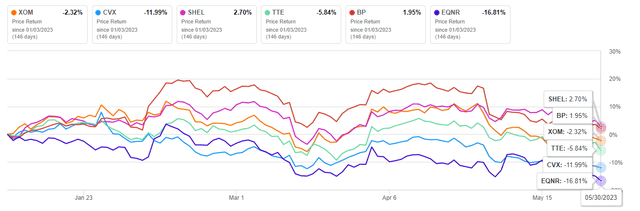

On April 28, 2023, Exxon Mobil, one of the world’s largest oil and gas companies, published financial results for the first three months of 2023, showing their deterioration from quarter to quarter. At the same time, since the beginning of 2023, Exxon Mobil’s share price has slightly dropped, which is a good result, given the decline in energy prices and increased competition from Shell plc (SHEL) and Chevron Corporation (CVX).

Author’s elaboration, based on Seeking Alpha

We initiate our coverage of Exxon Mobil with a “hold” rating for the next 12 months.

Exxon Mobil’s Financial Position

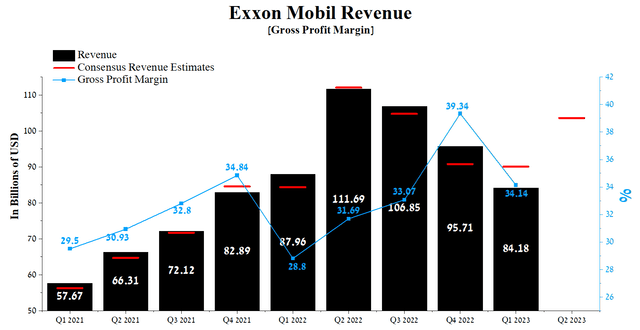

Exxon Mobil’s revenue for the first three months of 2023 was $84.18 billion, down 12% from the previous quarter and 4.3% from the first quarter of 2022. Despite substantially higher energy prices in recent years, the company’s actual revenue only beat consensus estimates six times out of nine, with a massive miss in Q1 2023, indicating Wall Street’s expectations of the dividend aristocrat’s prospects are too high.

Author’s elaboration, based on Seeking Alpha

The consensus estimate for Exxon Mobil’s revenue for the 2nd quarter of 2023 is $83.55-131.81 billion, up 15% from analysts’ expectations for the first three months of 2023. We estimate that this is too high an expectation, and according to our model, the company’s revenue will be $81.5 billion in the second quarter of 2023.

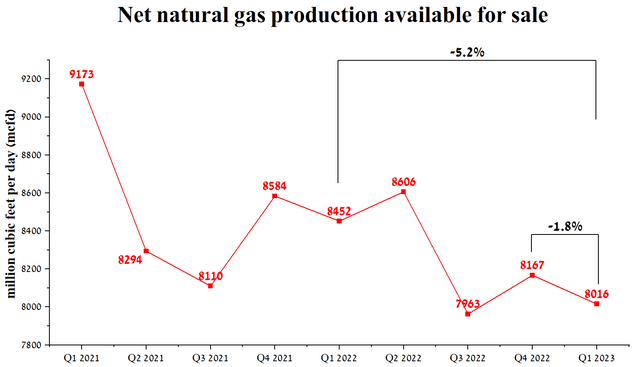

Natural gas is one of Exxon Mobil’s key revenue generators, and sales were 8,016 Mcfd in Q1 2023, down 5.2% year-over-year, one of the lowest since the introduction of COVID-19 vaccines into the market that a significant contribution to the recovery of economic activity in the U.S., Europe, and other developed countries.

Author’s elaboration, based on quarterly securities reports

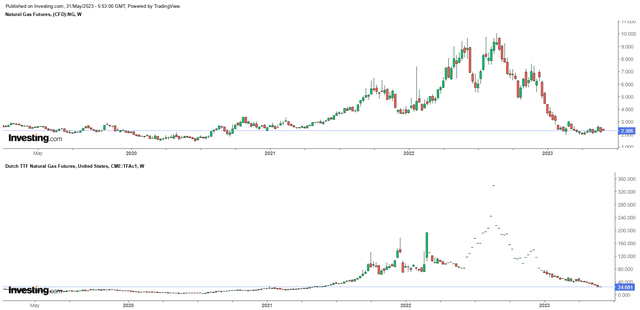

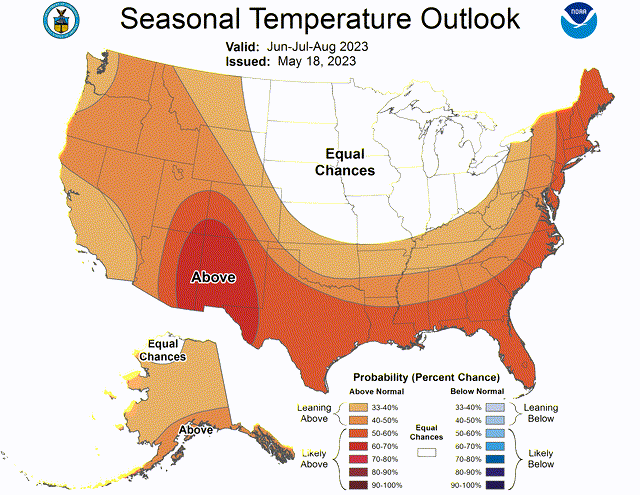

As of May 31, 2023, the price of natural gas in the U.S. is $2,304 per MMBTU, and at the same time, it continues to remain at extremely low-price levels due to its high reserves by the current time of the year and expected high temperatures in the summer. The National Oceanic and Atmospheric Administration (NOAA) forecast that much of the U.S. will experience unusually high temperatures in the coming summer, likely making it one of the hottest years.

National Oceanic and Atmospheric Administration

At the moment, natural gas prices are below levels when the panic around COVID-19 only grew, and the U.S. government was beginning to impose severe restrictive measures to curb the virus. At the same time, from August 2020 to December 2020, the price of Exxon Mobil shares was $32-$42, which is significantly lower than its current prices, indicating a discrepancy between Mr. Market’s assessments of the company’s prospects.

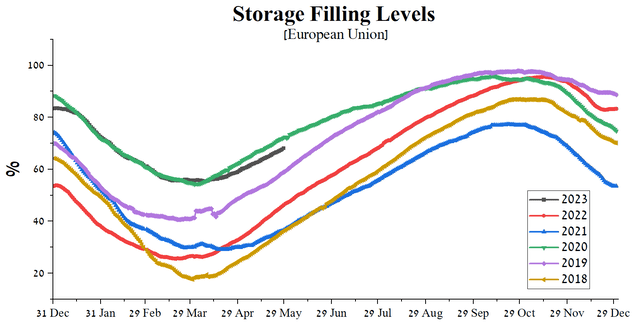

In the second half of May 2023, European natural gas prices fell below 25 euros per MWh, falling by more than 92% from their peak and thus reaching early 2021 levels.

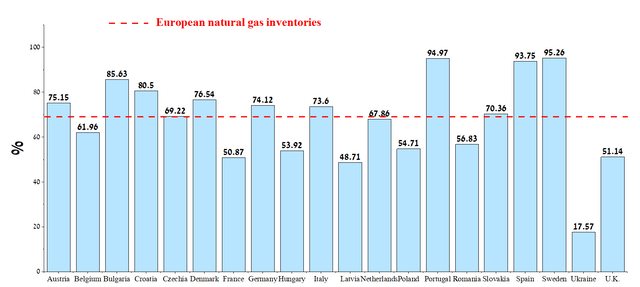

The main reasons for the decline in natural gas prices in Europe, which will ultimately continue to harm Exxon Mobil’s upstream revenue, are a hot winter and the preservation of natural gas reserves at a high level due to unprecedented supplies of liquefied natural gas. Moreover, we do not expect the Ukraine-Russia conflict and the blown-up Nord Stream 1 will lead to significant problems with the energy source for European countries in the coming winter. Since the start of the replenishment season, natural gas storage facilities in the European Union have been filled at 68.04%, according to the Gas Infrastructure Europe (GIE), a significant increase from previous years.

Author’s elaboration, based on Gas Infrastructure Europe (GIE)

At the same time, in most countries of the region, storage facilities are even more filled, which, taking into account the concluded long-term contracts with suppliers from the Middle East and the USA, will continue to put downward pressure on natural gas prices. We believe that the significant price cuts give European leaders confidence that their countries can easily do without Russian natural gas supplies, on which they were heavily dependent until February 24, 2022, and focus on switching to wind and solar energy.

Author’s elaboration, based on Gas Infrastructure Europe (GIE)

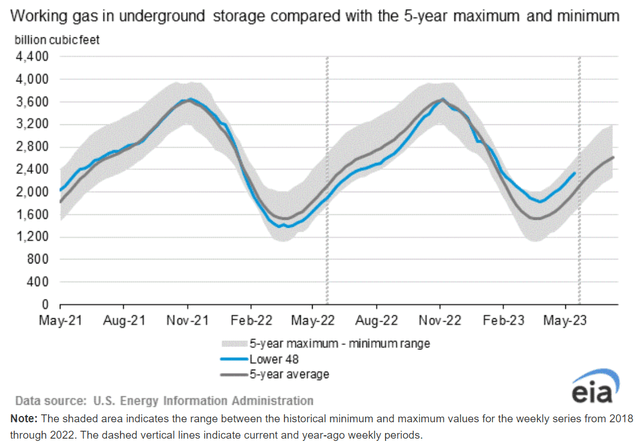

The EIA estimates that the total working natural gas in U.S. storage was 2,336 billion cubic feet, up 96 billion cubic feet from the previous week. At the same time, current reserves exceed the volumes shown relative to both 2022 and the five-year average.

U.S. Energy Information Administration (EIA)

Exxon Mobil’s gross margin was 34.14% in Q1 2023, reaching some of the highest levels in recent years but significantly down from the previous quarter. We predict that by 2023 Exxon Mobil’s gross margin will reach 32%, and by 2024 this value will decrease to 29.5% due to lower oil and gas realized prices and rising production and manufacturing expenses. This financial indicator is not only lower than that of the energy sector, but it also lags behind such main competitors as Chevron Corporation (CVX), Equinor ASA (EQNR), and TotalEnergies SE (TTE), which is another factor that discourages investors from choosing Exxon Mobil as a long-term investment during a period of declining inflation and rising investment in technology stocks.

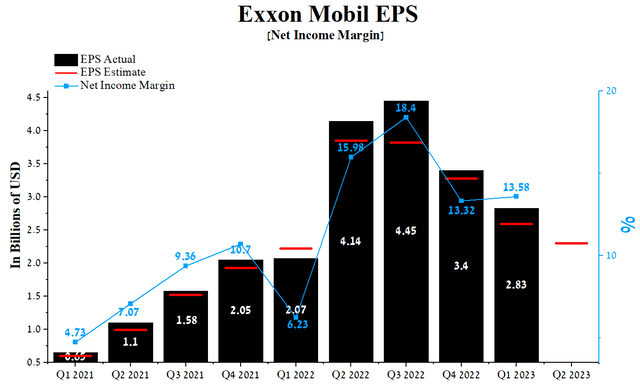

Exxon Mobil’s net income margin in Q1 2023 was 13.58%, up slightly QoQ but showing a more significant increase compared to the first quarter of 2022. The company’s earnings per share (EPS) for the first three months of 2023 was $2.83, down 16.8% from Q4 2022, but it has beaten analyst consensus estimates since 2021 in eight of the last nine quarters.

However, Exxon Mobil’s Q2 EPS is expected to be in the $1.88-$2.91 range, down 11.2% from the Q1 2023 consensus estimate. At the same time, the Non-GAAP P/E (TTM) is 7.08x, and the Non-GAAP P/E (FWD) is 10.5x, which is 16.26% and 22.96% respectively higher than the average for the energy sector, which is one of the factors indicating that the company is overvalued in the current period of China’s economic recovery after 2022 when the zero-COVID policy caused colossal damage to the country.

Author’s elaboration, based on Seeking Alpha

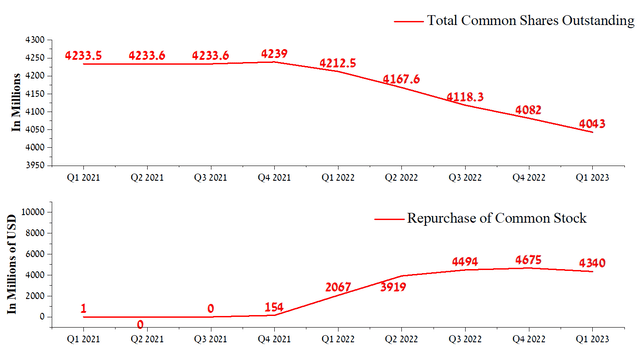

We believe that Exxon Mobil’s beating EPS is primarily due to the share repurchase program. In the first three months of 2023, Exxon Mobil bought back its shares for about $4.34 billion, while CEO Darren Woods still has the option to buy back the company’s shares for $30.7 billion until 2024.

Author’s elaboration, based on Seeking Alpha

Despite the impressive numbers, the continued decline in oil prices should negatively impact Exxon Mobil’s free cash flow, preventing the company’s management from actively resorting to the program. As a result, Darren Woods’s ability to support Exxon Mobil over $100 per share will be limited, which could make the company more vulnerable to short sellers.

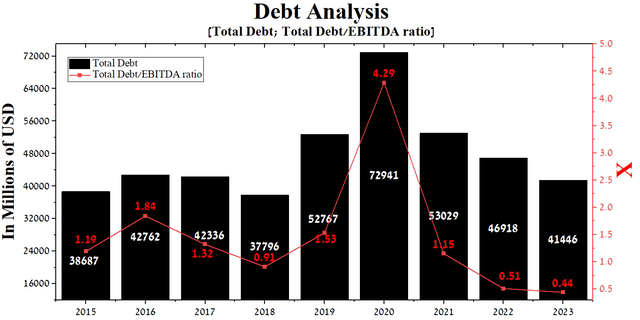

At the end of the first quarter of 2023, Exxon Mobil’s total debt was about $41.45 billion, down $11.58 billion from the end of 2021. However, despite the sharp drop in EBITDA in recent quarters, the total debt/EBITDA ratio has fallen from 1.15x to a record low for Exxon Mobil of 0.44x.

Author’s elaboration, based on Seeking Alpha

Given the bonds’ interest rates and maturity dates, we don’t expect Exxon Mobil to have any problems servicing or redeeming them. However, in 2020, we saw that the company’s management began to borrow money, including for the payment of dividends, to maintain the status of a dividend aristocrat.

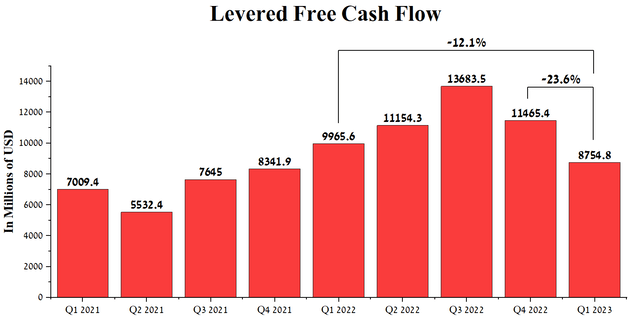

On October 27, 2022, Exxon Mobil’s management announced an increase in its quarterly dividend payout from $0.87 to $0.91 per share. Despite a high dividend yield of 3.47%, we believe that the ongoing collapse in hydrocarbon prices could either lead to slower growth in dividend payouts in future years or the need to borrow to pay them. Thus, levered free cash flow (LFCF) was about $8.75 billion in the 1st quarter of 2023, having decreased by 12.1% compared to the previous year and 23.6% compared with the last quarter.

Author’s elaboration, based on Seeking Alpha

At the same time, Exxon Mobil distributed $3.7 billion in dividends to shareholders in the first quarter of 2023, which is about 42.3% of LFCF, and this share will only grow in the coming quarters, including due to lower refining margins. Ultimately, this brings Exxon Mobil’s management closer to the red line, after which Darren Woods must adjust his dividend policy to reduce financial risks.

Conclusion

On April 28, 2023, Exxon Mobil Corporation, one of the world’s largest oil and gas companies, published financial results for the first three months of 2023, showing their deterioration from quarter to quarter. At the same time, since the beginning of 2023, Exxon Mobil’s share price has shown a slight drop, which is a good result, given the decline in energy prices and increased competition in the energy sector. This was mainly due to Darren Woods’s continued active use of the share repurchase program, helping to keep Exxon Mobil above $100 per share.

Due to the slower pace of Russia’s oil production cuts, weak economic data on China, a strengthening dollar during the current period of macroeconomic turmoil, growth in U.S. petroleum and other liquids production, and a high rate of people switching from internal combustion engines vehicles to electric vehicles, we expect the price of WTI crude and Brent futures to continue to decline in the next three quarters.

As a result, we expect Exxon Mobil Corporation’s share price to drop to $96 per share in the next two months before reaching a strong support zone. We initiate our coverage of Exxon Mobil Corporation stock with a “hold” rating for the next 12 months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.