Summary:

- Eli Lilly’s eyewatering upsurge this year was upended by its double-slashed full-year 2024 guidance following the Q3 earnings update this morning.

- The slight Q3 revenue miss continues to highlight volatile supply chain dynamics facing its best-selling Zepbound/Mounjaro tirzepatide products.

- Investors were also caught off guard by the unprecedentedly material acquired IPR&D charge related to LLY’s acquisition of Morphic Holdings in Q3.

- However, a deeper dive into LLY’s monetization roadmap for its existing offerings and impending pipeline unveils a unique optimization strategy that remains an underappreciated competitive advantage.

jetcityimage

Eli Lilly’s stock (NYSE:LLY) has been duly adjusted this AM following a surprise slash to its full year 2024 guidance. This marks a stark pivot from two consecutive quarters of raised revenue guidance in the billions, driven by continued demand momentum for Zepbound and Mounjaro through 1H24.

Specifically, LLY’s earnings guidance saw a steep plunge from the previous range of $15.10 to $15.60 per share on a reported basis, to now $12.05 to $12.55 per share. The adjustment was primarily attributable to acquired IPR&D charges of $2.83 billion, or $3.08 per share, related to the Morphic Holding transaction that closed in Q3. Meanwhile, management also slashed the upper range of LLY’s previous revenue guidance to reflect “inventory decreases in the wholesaler channel” for its core growth-driving Mounjaro and Zepbound products in Q3. The tempered outlook continues to reflect the volatile supply chain facing unprecedented demand for Zepbound and Mounjaro.

However, we believe LLY remains well-positioned for unlocking incremental upsides from its incretin pipeline, complemented by resilient demand for its non-incretin medicines in recent quarters – particularly in its oncology offerings. Specifically, LLY has been diligent in optimizing its monetization roadmap for tirzepatide by expanding dosage and presentations of its existing Mounjaro and Zepbound products, as well as their geographic availability. This is further complemented by an expanding indication pipeline for tirzepatide in common chronic diseases to diversify monetization reliance beyond obesity management. The expanded breadth of monetization means for tirzepatide is also reinforced by a strategic go-to-market model that includes focus on penetrating commercial opportunities, improving access through insured indications, as well as ongoing promotional efforts.

In addition, LLY’s oncology developments have also been stepping up, which is especially evident in strong Verzenio uptake in both metastatic and adjuvant indications for breast cancer. This is expected to be further complemented by positive read-outs from end-stage trials on Imlunestrant – an oral therapy targeting metastatic breast cancer – administered in conjunction with Verzenio.

Taken together, LLY remains a positive long-term investment opportunity. The stock remains well-positioned for incremental valuation gains. This is primarily underpinned by LLY’s sustained long-term growth trajectory via its unique optimization business model, which remains an underappreciated competitive advantage, in our opinion.

Monetizing Tirzepatide with Breadth and Depth

LLY’s eyewatering valuation upsurge in recent years has been primarily driven by demand for tirzepatide in obesity management (Zepbound) and treating type 2 diabetes (Mounjaro). Growth from Zepbound and Mounjaro continues to be a function of supply availability, given robust uptake across the U.S. and overseas.

Despite the FDA’s recent removal of Mounjaro and Zepbound from the drug shortage list, LLY continues to caution a “choppy” end-market experience as pharmacies gradually restock various dose levels of the product. This is further exacerbated by the market’s limited availability of multi-use and single-use quick injection pens – the primary presentation format for Zepbound and Mounjaro today.

The unfavourable impact was evident in LLY’s slight Q3 revenue miss, which was attributed to inventory decreases in the wholesale channel. The observation was consistent with management’s previous anticipation for continued volatility in tirzepatide availability despite an improved supply demand balance in recent quarters. Management had cautioned that the complexity around the different presentations and dose levels for both Mounjaro and Zepbound will continue to impact end-market availability of the products over the near-term.

However, LLY exhibits a unique long-term optimization strategy that will elongate its tirzepatide success observed to date. Specifically, LLY’s newly launched products and ongoing pipeline associated with tirzepatide continues to focus on expanding the depth and breadth of its monetization roadmap – breadth through multiple indications, and depth through multiple monetization means for each indication.

This is effectively an optimized monetization strategy, in our opinion, which remains underappreciated. Not only does the strategy optimize LLY’s penetration of GLP-1 opportunities, but it can also potentially be replicated for future innovations in the pipeline. This accordingly reinforces confidence in a sustained long-term growth trajectory for LLY, which will also partially mitigate its inherently elevated exposure to cyclical and patent cliff risks facing pharmaceuticals.

Expanding Depth of Tirzepatide Monetization

In order to better address unprecedented demand for its tirzepatide products, LLY has been working on expanding presentations of both Zepbound and Mounjaro beyond the quick injection pens. We view this as a way of improving access and penetration for tirzepatide indications at LLY that have received regulatory approval to date.

The increasing depth of tirzepatide monetization at LLY is evident in the recent introduction of vial formats for Zepbound and Mounjaro. Specifically, LLY has introduced 2.5mg and 5mg single-dose Zepbound vials in the U.S. through its LillyDirect platform in August. The new presentation is aimed at better addressing end-market demand for the weight loss solution, while also alleviating pressure on the supply chain for injection pens. The company has also been working on an oral GLP-1 – Orforglipron – for weight loss indication, which is currently in late-stage Phase III trial.

In addition to expanding presentations, management has also been enhancing LLY’s go-to-market strategy for tirzepatide to optimize penetration and end-market access. For instance, the company has been prioritizing advocation for Zepbound inclusion in health plan coverages across the U.S. Close to 90% of insured corporate workers in the commercial segment have formulary coverage for Zepbound in the U.S. as of July; more than half of American employers are now providing anti-obesity drug coverage for workers. And over the longer-term horizon, LLY aims at expanding indication for tirzepatide to better address diseases, such as obstructive sleep apnea (“OSA”), eligible for Medicare coverage.

Expanding Breadth of Tirzepatide Monetization

More importantly, we believe LLY has been prudent in expanding the breath of tirzepatide’s monetization means through multiple indication. This is a key competitive advantage that remains underappreciated by LLY investors, in our opinion. LLY’s optimized monetization strategy is evident in its continued work on expanding the indication for tirzepatide beyond weight loss and type 2 diabetes management:

- Obstructive Sleep Apnea (“OSA”): LLY has reported positive results from its tirzepatide program for treating moderate to severe OSA in adults with obesity. Specifically, the program showed tirzepatide had up to 51.5% effectiveness in managing OSA for trial participants. The results have been submitted to the FDA and EMA for review, with management expecting a regulatory response in the U.S. as early as the end of the year.

- Heart failure associated with obesity: LLY has reported positive results from its SUMMIT Phase 3 trial in evaluating tirzepatide effectiveness in managing heart failure. Participating candidates on tirzepatide showed a 38% reduction in risk of worsening heart failure; the drug also showed significant effectiveness in improving symptoms and physical limitations stemming from heart failure. LLY is currently planning the submission of SUMMIT Phase 3 trial results to the FDA and other regulatory agencies later this year.

The approval of additional tirzepatide indications targeting common chronic illnesses will unlock substantial additive growth for LLY. The industry currently estimates more than 900 million adults are affected by OSA around the world, with more than 10% of the American population affected by the condition. Meanwhile, one in four American adults are predicted to develop heart failure in their lifetime, with increased risk for “individuals with obesity, hypertension, and clusters of comorbidities”.

The Rising Oncology Spotlight

In addition to LLY’s monetization momentum observed for its tirzepatide indications, management has also continued to highlight resilience in end-market uptake for the company’s non-incretin medicines. Demand is particularly evident for its oncology offerings.

The company’s Verzenio (abemaciclib) drug indicated as a primary and adjuvant treatment for metastatic breast cancer continues to demonstrate strong growth of 32% y/y in the third quarter. Much of the product’s strength has been driven by higher realized prices in the U.S., which offsets management’s previous acknowledgement of risks of stalled penetration during the Q2 earning update. Specifically, Verzenio boasts a 70% adoption rate as the standard course of treatment in metastatic and adjuvant breast cancer, nearing industry’s average 80% “maximum rate of new medical practice adoption”. While LLY’s efforts in better penetrating the remaining 30% continue, higher realized prices for Verzenio represent a key compensatory growth factor for the drug in the meantime.

Looking ahead, LLY is looking to better monetize Verzenio by combining it with the company’s Imlunestrant oral selective estrogen receptor degrader (“SERD”) in treating metastatic ER+ breast cancer. This, again, highlights LLY’s optimization strategy for monetizing its existing innovations and impending pipeline.

The combined treatment is currently being studied as part of the Phase III EMBER-3 trial, with the readout slated for later this year. A positive result would represent a groundbreaking development in both treating patients with ER+ metastatic breast cancer and improving their quality of life, underpinning long-term demand for LLY. Both Imlunestrant and Verzenio are oral tablets that would address inefficiencies in the current administration of their suboptimal Fulvestrant counterpart. Fulvestrant is administered through painful and frequent intravenous injection, which is not a feasible option in adjuvant settings that require a course of treatment that currently spans as much as 10 years.

Fundamental Considerations

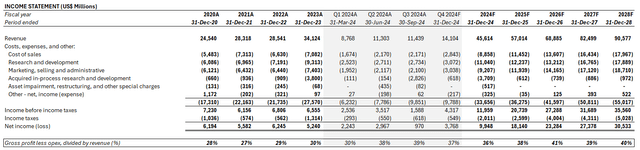

Adjusting our previous forecast for LLY’s actual Q3 performance and slashed forward outlook, we expect its full year 2024 revenue to expand 34% y/y to $45.6 billion. We expect unprecedented demand for Mounjaro and Zepbound to remain countered by evolving dynamics in the supply chain over the near-term. More evident alleviation is expected through 2025 instead, when expanded presentations and dose levels start to ramp, alongside improved capacity. LLY’s near-term growth outlook will be further complemented by anticipated indication approvals for tirzepatide in treating OSA and heart failure, which are currently in late-stage trials and in the process of a regulatory review. Other oncology developments will also be key in reinforcing ongoing resilience in LLY’s non-incretin medicine uptake.

Meanwhile, we expect LLY to maintain its long-term operating margin target in the high 30% range. The material acquired IPR&D associated with LLY’s Morphic transaction in Q3 represents a one-time, isolated impact, in our opinion, instead of a structural downward shift to its earnings trajectory. The $2.8 billion in acquired IPR&D from Morphic recorded in Q3 will likely be recovered through the long-term ROI underpinned by LLY’s acquired pipeline. Morphic currently leads in the development of oral treatments for inflammatory bowel diseases (“IBD”) such as Crohn’s and ulcerative colitis. Positive results from the ongoing pipeline will substantially improve patient outcomes, while also underpinning incremental long-term growth for LLY as IBD currently represents one of the most common chronic illnesses globally.

Author

Valuation Considerations

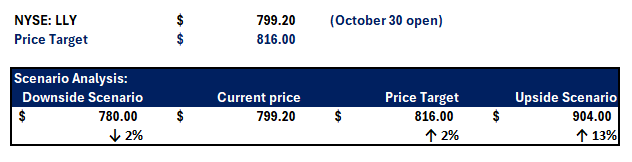

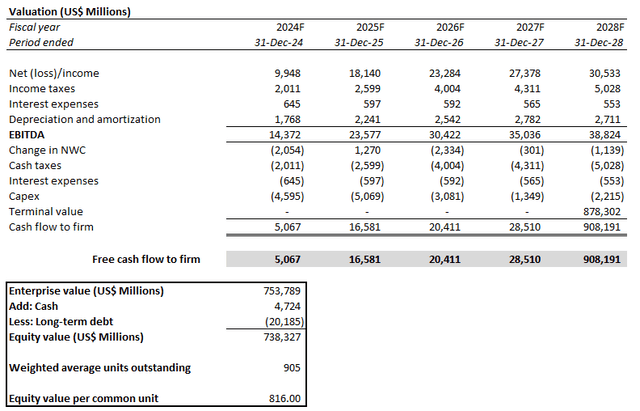

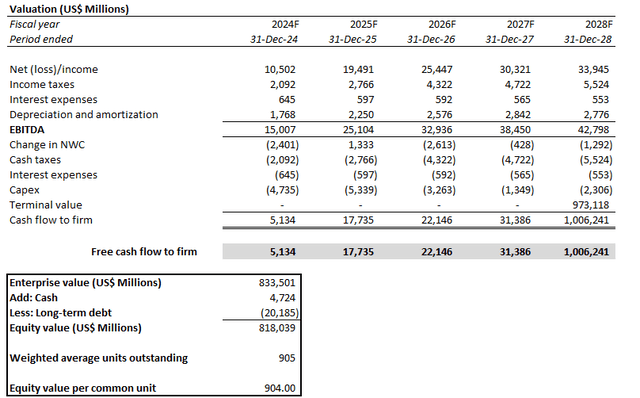

Admittedly, LLY’s tremendous to upsurge this year has been priced for perfection and then some. As a result, the stock’s post-earnings selloff fairly represents the downward adjustment attributable to the $2.8 billion of acquired IPR&D from LLY’s Morphic transaction in Q3, which markets had not previously considered. Our base case valuation analysis sets a price target for LLY at $816, which approximates its post-earnings price on October 30.

Author

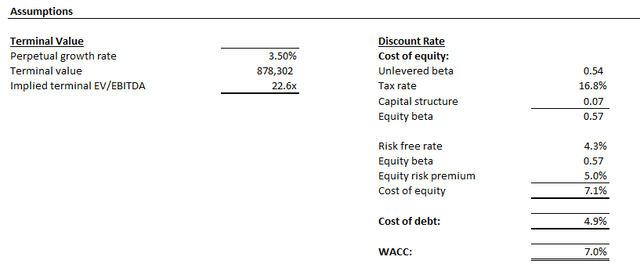

The price target is derived under the discounted cash flow approach, which considers projections in line with the fundamental analysis discussed in the earlier section. A WACC of 7.0% is applied to the analysis, which is consistent with LLY’s capital structure and risk profile. The analysis also considers an implied perpetual growth rate of 3.5% on 2028E EBITDA to project LLY’s terminal value. The valuation assumption is in line with the anticipated pace of long-term economic expansion across LLY’s core operating regions, which we believe to be a fair representation of the company’s steady-state growth outlook.

Author

Author

Upside Scenario

With consideration of LLY’s optimization strategy discussed in the foregoing analysis, we believe the stock remains well-positioned for recovering from its latest post-earnings selloff. In the upside scenario, we expect LLY to return to the $900 level. This will be unlocked by additive growth factors, such as successful approval for multiple tirzepatide indications beyond obesity and type 2 diabetes management, to further monetization of LLY’s pipeline.

Author

Conclusion

Admittedly, LLY’s slashed revenue and earnings guidance for 2024 were a surprise, especially given substantial raises to its outlook observed through 1H24. The adjustment has overshadowed an otherwise strong growth trajectory for Zepbound and Mounjaro, as well as LLY’s non-incretin medicines like Verzenio.

While the slight Q3 revenue miss continues to highlight volatility in supply conditions facing LLY’s core incretin product sales, its long-term growth prospect remains intact. The upcoming expansion of manufacturing capacity for tirzepatide, paired with LLY’s unique go-to-market strategy and optimized monetization model for the product, should better address pent-up demand and unlock incremental growth. More importantly, the substantial cut in 2024’s EPS outlook is unlikely to impact LLY’s long-term operating margin target. The downward adjustment represents an isolated one-time impact related to the Morphic acquisition, which we believe to be recoverable from the long-term ROI prospects of LLY’s acquired pipeline.

Taken together, we remain positive on LLY’s position as an opportunistic long-term investment, with its sustained long-term earnings growth trajectory underpinned by a uniquely optimized monetization roadmap that remains underappreciated.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.