Summary:

- Amazon needs to show outsized growth while increasing margins drastically in order to justify its current valuation; this is especially true for its core e-commerce business.

- We analyze several variables related to the e-commerce business and what must happen in the future for the current valuation to be seen as reasonable.

- Meeting these expectations may be challenging due to competition, challenges with third-party sellers, and the need to maintain low prices. Investors should closely monitor the e-commerce unit’s performance.

- Any miss in expectations in the near term can lead to share price deterioration which can allow long term focused investors to jump in and own a fundamentally solid business.

Daria Nipot

Introduction and Investment Thesis

Amazon (NASDAQ:AMZN) generated a staggering 80% return in 2023. While some may say ‘meh’ when comparing it to some of Amazon’s magnificent 7 peers, I certainly believe the rise this year from the 2022 year-end lows is tremendous. As a long term focused investor, I always like to assess whether these types of returns and the resulting valuations are still backed up by business and market fundamentals. As we all know, in the short run, stock markets often operate as voting machines, swayed by hype and sentiment. However, in the long run, they act as weighing machines, assessing the actual value of a company. There is no doubt that at least some short-term rise in Amazon’s value can be attributed to momentum and the general bullish sentiment in the market especially around large tech stocks.

Amazon’s e-commerce business which they disclose as Online stores/First party sales (1P) and Third Party Seller Services (3P) makes up ~65% of its total revenue today. While its other segments, primarily AWS, form a growing portion of Amazon’s revenue, the core e-commerce business will remain a key part of Amazon’s strategy and must show meaningful returns (both top-line and margin expansion) in order for the company to meet its growth expectations. In this article, I will deep dive into the e-commerce business and explore the following areas:

- A fundamental analysis of this business and what the current stock price implies in terms of future growth and margin expectations from this unit

- A discussion on whether these expectations are realistic and possible sources to attain the required growth and margin expansion

- Risks to attaining this forecast

Overall, our view on Amazon’s e-commerce unit is that it will continue to remain a leaders in the North American e-commerce space however will face continuing pressures from the likes of Walmart and others who are making moves to gain market share. While the growth expectations may be somewhat reasonable, I believe increasing operating margins may ultimately be the real challenge. I recommend long horizon investors to continue holding the stock and look for any dips in price to average down.

Fundamental Analysis of Amazon’s e-Commerce Unit

In order to forecast the required expectations from the e-Commerce unit, I performed a DCF analysis on the entire business using an underlying forecast which justifies the current stock price ($151 at the time of writing this article). Several authors on Seeking Alpha have performed a detailed DCF analysis of Amazon’s entire business so I won’t show all the details here, however I encourage you to read the previous articles which use a standard DCF methodology. The focus of this article is to dive deep into the e-Commerce forecast so I will stick with the math behind this unit. I will however describe our high level DCF assumptions below so readers can assess reasonability:

- Total Net sales in 2030: $1.27T (2023: $570B)

- Total Operating margin in 2030: 17% (2023: 6%)

- Tax rate: 12% (previous 3 year average)

- WACC: 10.5% (mid point from this source)

- Terminal Growth Rate: 3% (i.e. 50% higher than overall GDP growth of 2%)

e-Commerce unit projection

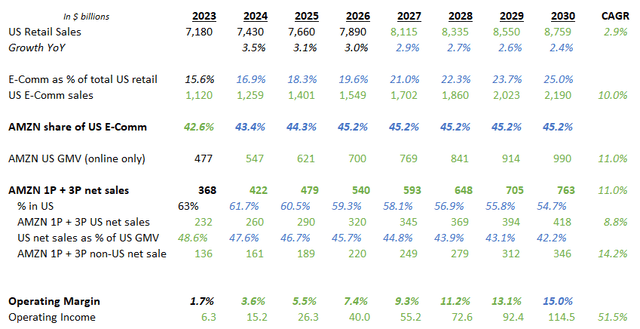

I have used the US e-commerce market as the underlying driver to project the figures below along with assumptions around international growth, e-commerce % of total retail sales and operating margins. I will endeavor to explain each variable in the commentary below

AMZN e-commerce projection (Various sources detailed below; authors assumptions)

AMZN e-commerce projection (Various sources detailed below; authors assumptions)

US retail sales

Current retail sales in the US stand at around $7.1T. Having seen a slowdown in 2022 and 2023, there is an expectation of higher growth in the near term with sales normalizing in the future closer to US GDP growth.

Reasonability Assessment: The size and growth assumptions here are backed by projections from several sources hence I consider this to be reasonable

E-Commerce share of US retail sales

While the current share of e-commerce is around 15.6%, there is an expectation of outsized growth here as more consumers go online to buy goods. This is expected to be driven by underpenetrated categories such as consumer packaged goods, Apparel, Furniture and Appliances (I now buy all my clothes online and have recently ordered major appliances online as well). I believe e-commerce sales will represent 25% of total US retail sales by 2030. This assumption is in-line with data from other sources I have researched.

Reasonability Assessment: The size and growth assumptions here are backed by various sources however I do find there to be variability with this variable. Overall I believe the share of e-commerce retail sales will grow and a 25% share by 2030 is realistic

Amazon share of US e-commerce sales

In order to calculate Amazon’s current share, I looked at the Gross Merchandise Value (GMV) for Amazon which stands at around $477b today. Note that GMV is higher than Amazon’s combined 1P and 3P sales as the 3P net sales disclosed on their financials are essentially their share of the total merchandise price. While Amazon doesn’t disclose their share of 3P sales (likely because they are taking an outsized portion and don’t want to show their 3P partners their profitability levels), I estimate that this share is around 30%. I expect Amazon’s share of US e-commerce will grow from 42% to 45% over the next few years after which it will plateau.

Reasonability Assessment: I believe this is a critical variable in our assessment and warrants careful consideration. Amazon is by far the largest online retailer in the US with Walmart (#2 online retailer) well behind at around ~6% share. Walmart has made aggressive moves recently in gaining additional market share while other retailers are also deploying their e-commerce strategies to gain share. There are also several foreign companies coming into the US market, with players such as Temu offering extremely low pricing in order to win market share. While Amazon is well ahead of others, it is reasonable to assume that it will have to ramp up spending to maintain its market share. This will likely be in the form of lower prices, faster shipping etc. All of these measures will weigh on Amazon’s margins which will require a major uplift in the coming years in order to meet investor’s growth expectations. Overall, I believe the assumption around Amazon’s market share in our projection is on the optimistic side.

US vs. International sales

North America sales make up ~73% of Amazon’s retail sales (non-AWS). I assumed that 63% is from the US while the rest is from Canada and Mexico. Our forecast assumes that the share of international sales will have to increase over time as these markets have higher growth within the e-commerce sector. Amazon has recently made a significant push into emerging market such as India and Africa.

Reasonability Assessment: While it is reasonable to assume that Amazon’s share of intentional revenue will grow over time, there are several considerations here which investors need to be mindful of. Growing in non-US markets will most certainly by accompanied with lower margins for longer. Amazon’s international segment as disclosed on their financials is still not profitable (while the North America segment did show a small profit in 2023) and there are already several established competitors in international markets with whom Amazon will have to play catch up (e.g. Flipkart in India and Jumia in Africa). Overall, I believe the growth assumptions in our projections within international markets is reasonable (I will comment on margin assumptions later which are correlated with this variable)

1P vs. 3P sales

In order to show the drastic margin expansion built in our projection, Amazon will need to increase its share of 3P sales as these are accompanied with a much higher margin. While not explicitly depicted in our model, there is an implicit assumption that 3P net sales (which are currently ~50% of 1P net sales) will need to increase drastically.

Reasonability Assessment: I believe this is another key variable which requires careful consideration. While Amazon has historically been the platform of choice of 3P sellers, there have been several challenges faced by these sellers which include accusations of Amazon copying their products and using the data from their sales to push their own brand. There have also been accusations by the FTC on the same issue. Essentially, third party sellers are increasingly coming to the realization that dependence on one platform may hurt their business in the long term. Hence I am seeing some aligning with Walmart and other emerging e-commerce platforms. This could mean that Amazon may have to ease up on their share of third party sales in order to retain/attract sellers. This will ultimately weigh on margins. Overall, I believe the projections in this area will be challenging to obtain while increasing margins as required.

Margin expansion

The is the area where there have always been questions, i.e. show me the money. At some stage, in order to justify its valuation, Amazon will need to become a lot more profitable in its e-commerce unit. While there has been some good progress in 2023 in the North America segment, the international segment is still unprofitable. As discussed in above, there are several challenges with regards to expanding margins ranging from keeping prices low for consumers, to offering a competitive share of sales to 3P sellers to investing in international markets where Amazon needs to show outsized growth. Our projection requires operating margins increasing to 15% (from sub 2% today) by end of 2030.

Reasonability Assessment: I believe this is the variable which is highly optimistic in our projection in light of the issues discussed above. Note that competitors such as Walmart (WMT) currently generate around 4% operating margins. While Amazon should be able to generate more than this, it is also pertinent to note that Walmart doesn’t face the same challenges Amazon will on the international expansion front.

Investor Takeaways

Despite the aforementioned challenges which I believe Amazon will face to meet expectations within its e-commerce unit, make no mistake, Amazon is a fascistic business backed by solid fundamentals. The e-commerce space has a long runway for growth and we could see other categories shift online which we may not expect today (e.g. there is already traction around buying cars online without ever visiting a dealership). My personal experience as an avid Amazon user has been that there have been an increase in general prices over the past year and there is other data to corroborate this with. This is also showing up in the higher profitability in Amazon’s North America retail segment. I find that where I used to go directly and search on Amazon before for everyday products, I now do a general Google search and look at other retailers as well. While no one quite has the free and fast shipping like Amazon Prime, many retailers are deploying a minimum basket strategy which leads to free shipping (i.e. offer free shipping if you buy more than a certain amount from their online store). Amazon is facing a dilemma, as all mature organizations do, between maintaining/growing market share and increasing profits and this will definitely have an impact on how Amazon meets its required growth trajectory to satisfy its valuation. I believe investors should keep a close eye on growth and profitability within the e-commerce unit for the next few years as even a slight miss in projections here can lead to share price deterioration which can lead to an opportune entry point for long term investors.

There are several other growth drivers for Amazon which could make up for any performance misses within its e-commerce unit. AWS is an obvious candidate here along with the growing advertising business. Recent developments within Generative AI along with the potential of additional ads revenue will provide growth avenues as well. I will aim to cover these parts of Amazon’s business in a future article.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.