Summary:

- PayPal is facing significant challenges as fintech rivals and increasingly tech-savvy banks expand into its territory.

- Recent strategic efforts by PayPal’s new management, including Fastlane and PPCP, haven’t adequately addressed the fundamental challenges facing the company.

- Shrinking market share overshadow PayPal’s strong brand name, relative discount to peers, and positive FCF.

JasonDoiy

Investment Thesis

PayPal (NASDAQ:PYPL) is losing ground to competitors. Fintech rivals and digital-savvy banks are stealing its customers and profits. The new leadership is scrambling to regain lost ground, but their efforts may be too little too late. The stock’s suppressed price levels reflect this warranted pessimism.

Our hold rating mirrors PayPal’s strong Free Cash Flow generation, solid brand recognition, and strong balance sheet, counterbalanced by eroding market share, increasing competition, and lack of a reliable plan to fight off these pressures.

Q1 24 Results

PayPal’s dominance in the digital payments industry is waning as competition intensifies. While Total Payment Volume ‘TPV’ grew by 14% in Q1, transaction revenue lagged, increasing by only 10%. This discrepancy, coupled with the fact that most ‘transaction revenue’ growth came from interest income, suggests PayPal is losing pricing power and/or experiencing a shift in product mix toward lower-margined offerings. This is further evidenced by a drop in gross margins to 44%, down from 48% in the same period of last year. Meanwhile, active accounts have been on a decline since Q3 2023, down 1.4% in Q1 2024 to 427 million accounts compared to 433 million accounts a year ago.

In the peer-to-peer ‘P2P’ market, one of many formidable competitors, Zelle, which powers the mobile banking apps of over 2000 US banks, grew at a staggering 28% YoY in 2023, dwarfing PayPal’s TPV growth of 12% in the same period and double its much-celebrated 14% growth in Q1 2024.

In the Small and Medium Enterprise ‘SME’ space, fintech startups like Stripe, Adyen (OTCPK:ADYEY), and Block (SQ) are making moves onto PayPal’s territory. All three are replicating PayPal’s core strengths of simplicity, transparent pricing, and auxiliary financing, but also going one step further in addressing PayPal’s shortcomings. Stripe appeals to tech-savvy businesses with its flexible, customizable solutions, while Square leverages its brick-and-mortar presence to expand into the digital realm. Ayden, which traditionally focused on large enterprises, has recently partnered with Bill.com to expand its offering in the SMB space.

Despite some positive strides, such as reducing SG&A, lowering credit and transaction losses, and streamlining customer support (which helped push Adjusted Operating Income to $1.4 billion, up from $1.2 billion in Q1’23), it is clear that PayPal’s once-dominant position is eroding as competitors expand their offerings in areas once dominated by PayPal, leaving it scrambling to adapt and stay relevant.

Management’s Initiatives

During the Q1’24 earnings call, PayPal’s new management team, headed by CEO Alex Chriss, laid out plans to revitalize the business. We feel that most of these initiatives are operational improvements (some of which are cost-cutting plans) that don’t rise to the occasion. Management’s remarks focused on three primary initiatives:

Fastlane by PayPal for Enterprise Customers

PayPal’s ‘Fastlane’ service, designed to streamline checkout for large enterprise customers, isn’t particularly a game-changer for the company. While the service offers a faster checkout experience with less password authentication, major tech players like Alphabet (GOOG)(GOOGL), Microsoft (MSFT), and Apple (AAPL) have already integrated similar features into their browsers. These browsers save payment data and autofill details, offering a seamless checkout experience that rivals Fastlane’s benefits.

While PayPal’s CEO claims a ‘low double-digit lift’ in guest take rates for businesses using Fastlane, one can’t help but feel that the company is playing catch-up, rather than setting a new standard with the new service.

PayPal Complete Payments Platform for SMBs

PayPal’s new Complete Payments Platforms ‘PPCP’ service, aimed at simplifying payment processing for SMEs, offers little innovation. Essentially, a repackaged version of existing capabilities, PPCP’s adoption by 7% of SMB customers since its new service launch in April 2023 is unlikely to drive significant revenue growth. It simply lacks a clear value proposition compared to existing services.

PayPal’s historical neglect of the SME sector, marked by high fees and poor customer service, has alienated this crucial market. With numerous alternatives available, SMEs are increasingly vocal about their dissatisfaction on social media, potentially hindering PayPal’s growth initiatives.

Rewards Program and Revamped App for Consumer Segment

PYPL’s revamped app and rewards program, while showing some initial promise (a 7% increase in weekly app logins and a 4% increase in transaction margins) may not deliver sustainable growth. The novelty of a new interface often fades, and the competition in the credit/debit card rewards is too severe. Since rewards are tied to users’ purchases, it’s a zero-sum game which is unlikely to move the needle in a saturated market where banks offer similar perks. For example, Andy from the ‘Be Clever With Your Cash’ YouTube channel explains his method to collect his American Express (AXP) card rewards, only using PayPal when a merchant doesn’t accept Amex payments.

The new package tracking service shows some promise. Integrating it with personalized ad recommendations could increase user engagement, but also raises privacy concerns that PayPal must address carefully. In his first media interview since taking the helm of PayPal, CEO Alex Chriss highlighted the wealth of consumer data that PayPal is sitting on, suggesting that this could fuel the development of more personalized and data-driven products and services.

Valuation

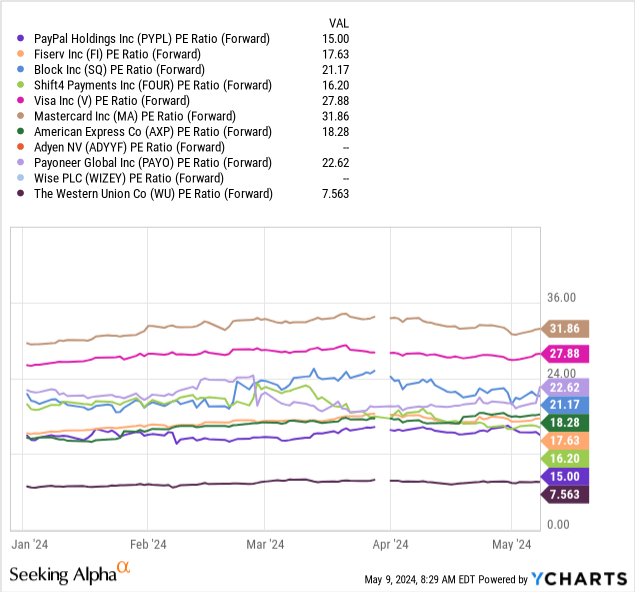

PayPal’s seemingly attractive 15x forward PE ratio, standing at the lower end of the industry range, might tempt value investors. However, this doesn’t tell the whole story. Compared to Visa (V) and Mastercard (MA), which boast expanding user bases (unlike PayPal), and virtually impenetrable market positions, PayPal’s investment proposition seems weak. These industry leaders justify their premium valuation with the consistent growth and stability that PayPal lacks.

Looking at high-growth peers like Adyen (ADYYF) and Block (SQ) further exposes PayPal’s shortcomings. With a mere 9% revenue growth in Q1, PayPal is dwarfed by Adyen’s 27% and Block’s 19% YoY revenue growth. While Adyen’s 54x PE might seem a bit excessive, together with Block’s 21x PE ratio, highlight the premium investors are willing to pay for the growth that PayPal lacks.

Even when compared to more niche players in the international remittance market like Wise (OTCPK:WIZEY) and Payoneer (PAYO), PayPal’s valuation doesn’t stand out. Wise and Payoneer’s low 20s PE ratio is justified by impressive 70% and 19% revenue growth rates, respectively.

How I Might Be Wrong

Our primary forecast is for PayPal to appreciate in line with the market, but underperform its peers in the digital payments sector. This assessment underpins our current ‘Hold’ rating. However, several factors could prove this outlook wrong, potentially making PayPal a ‘Buy’. Specifically, we might be underestimating the potential impact of PayPal’s new initiatives such as Fastlane and PPCP for SMEs or new AI-driven services, including Package Tracking. If these initiatives are executed well, they could significantly enhance user experience, leading to higher conversion rates and customer retention than we assume in his analysis. This is especially true given PayPal’s established brand and large user base, where small changes could have a material impact that we haven’t accounted for.

Summary

PayPal is clearly playing defensive in a market it once dominated. It still enjoys a strong balance sheet, reliable free cash flows, and a reputable brand, but these are increasingly overshadowed by intensifying competition and shrinking market share.

Management’s growth initiatives laid in recent quarters lack the edge needed to truly stand out in today’s market. They seem more like a desperate attempt to retain market share than true standard-setting innovations. In simple terms, management’s new initiatives are unlikely to shape its narrative, which is now dominated by shrinking market share figures, underpinning our ‘Hold’ rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.