Summary:

- Housing correction has just begun.

- The company remains well-financed and should be able to overcome the current environment.

- It will take at least 12 months for the finances to normalize.

Tony Anderson

In my previous piece about Opendoor (NASDAQ:OPEN) (written here), I had written that margins will continue to be under pressure at least until the market steadies out. Since then, Opendoor has been witnessing adverse conditions from markets, and it seems that the issues will continue throughout this year.

The real question is how long will it be until Opendoor finally turns the table? This is mostly dependent on the housing market, and when prices finally bottom out. The reality is housing prices increased significantly over the past few years, and now are headed toward a longer-term correction. Here are a few factors that will determine when the housing market finally bottoms out.

Housing still remains expensive

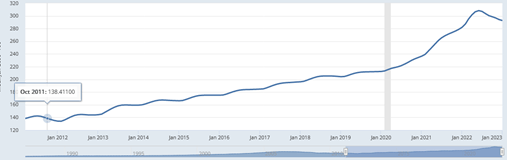

The Case-Shiller housing index is still significantly above 2020 levels, and at this point, mortgages are hitting levels not seen in decades. The index has only declined slightly through the last year but is still quite high, all things considered. Meanwhile, the home price-to-income ratio also remains at a record high. Therefore it is likely that Opendoor will have to continue to buy and trade property into a market where prices will be declining for at least 12-18 months in my opinion. Adding to the woes, it is unlikely that interest rates come down significantly in the near term, as inflation has been relatively stuck, at least core inflation, which means higher rates or longer.

While in the short term, existing home sales are rising, the trend is not likely to last. 30-year mortgages are still above 6%, and as the Fed continues to raise rates, in the short term they could go back above 7%. Meanwhile one of the biggest factors that were driving home prices was investor activity. Investor activity is already down 46% and is expected to fall further through the year, which should further affect home prices.

“Investors accounted for $31 billion in home sales last quarter, dropping 42.7% year over year from $54.1 billion at the same time the previous year, the figures showed.” -Mansion Global

Case-Shiller Housing (FRED)

Opendoor’s model is dependent on rising prices

As I mentioned in my previous article Opendoor’s model is dependent on prices increasing.

“We expect to have sold or be in contract on over 85% of the cohort by the end of 1Q23. Once the “old book” is behind us, we expect to return to positive unit margins by the second half of 2023. To sell these homes quickly while preserving as much margin as possible, we revisited and reset all our portfolio management processes to drive above-market clearance rates.”-CEO

Clearly, management is focused on clearing inventory as fast as possible and there is not much it can do in the short term. It remains to be seen what kind of volume comes up in the coming quarters, but it is unlikely that the volume will pick up significantly as home prices will continue to head downwards in the short term. This means that the company will have to go through a period where it is constantly losing cash.

Taking a looking at the company’s cash position

Despite significant cash burn during the year the company still has around $1.8 billion in cash, I expect that losses on the sale of homes, and a lack of profitability will lead to increased cash burn in 2023. That would mean around $300 million dollars due to loss from operations is likely in 2023, and that will be reflected in cash flow throughout the year. Luckily this is not large enough to have any permanent effect on the company’s operations.

Clearly, management is focused on the long-term, where it can become a legitimate buyer and seller of homes, and take advantage of a positive long-term trend in the housing market. Regardless, the model will be up against a number of key factors including what is likely to be higher interest rates and demographics that continue to be negative globally.

Luckily for Opendoor despite its issues, mainly poor profitability, which may remain an issue for the long-term, the combination of cash on books, and the low valuation i.e. a price-to-sales which is around 0.07, may make the company quite attractive to investors.

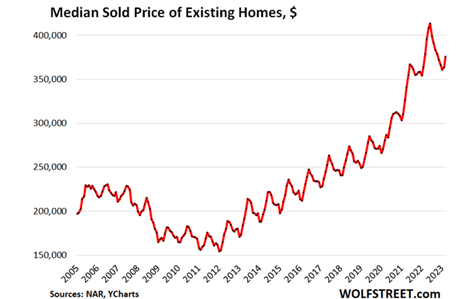

Opendoor will take a while possibly a year before things bottom out. The housing market will continue to correct until interest rates remain higher, which means that the Opendoor will too remain under pressure. As housing prices continue to drop, expect the trend to continue for a while, and prices could head 30-40% lower before settling down. If interest rates don’t come down significantly, we could potentially see a 50% correction in home prices. Median home selling prices also continue to drop, which means Opendoor is facing significant pressure from all sides. Meanwhile, a sales-to-all cash buyer, decreased by 24%, and the median days a property has spent on the market has nearly doubled from 17 to 29 days.

Median Home Prices (NAR)

This would mean that there would be significant mark-to-market losses for the company moving forward. The reality is investors will have at least to wait 12 months to reassess where the company is going.

Opendoor is likely to continue to transact throughout 2023, but will likely see a slowdown overall in the rate of transactions itself. This means that the company is likely to see revenue fall as well if prices continue to head downwards. The overall prospects aren’t great in the short term for the company, although any chance of a significant negative event is also unlikely. Revenue could come in around $7-8 billion on the lower end of the scale, as operations are scaled back.

In conclusion, investors would be best to hold their investment for Opendoor if they are looking to the long-term and could potentially average out their investments. The long-term prospects are better but it will take a while before Opendoor can steady out its earnings. Until then it’s a wait-and-watch scenario as high-interest rates environment continues to push down the real estate market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.