Summary:

- Investors often have a choice of where to invest in a company. One can invest in a company’s common stock, preferred stock(s) or bonds.

- Currently AT&T’s 2 preferred stocks look like a place to avoid with the worst current yield of any BB+ rated preferred stock in the market.

- We offer up Enstar Group preferred stock (ESGRP) as an alternative BB+ rated preferred with the best yield among fixed rate and LIBOR fixed-to-floaters in the market.

- ESGRP offers a current yield of 7.8% versus 5.7% for the two AT&T preferred stocks, T.PA and T.PB. ESGRP also offers up more call protection and some interest rate protection.

- Don’t overpay simply because one company is larger cap or a more familiar name than the other.

DestinoIkigai

AT&T

AT&T (NYSE:T) is a household name, at least for most Americans. It is a very old company that was once the telephone monopoly in the USA before anti-trust rules made them divest their local telephone companies (the Baby Bells as they were called).

Since then they have morphed into primarily a wireless company and a broadband company. They are one of the big 3 wireless companies along with Verizon and T-Mobile. They provide cell phone service to their customers and have a large number of their own stores around the country providing service to their customers as well as selling primarily wireless handsets. They also provide broadband services to businesses and homes.

AT&T’s Bonds, Preferred Stocks and Common Stock

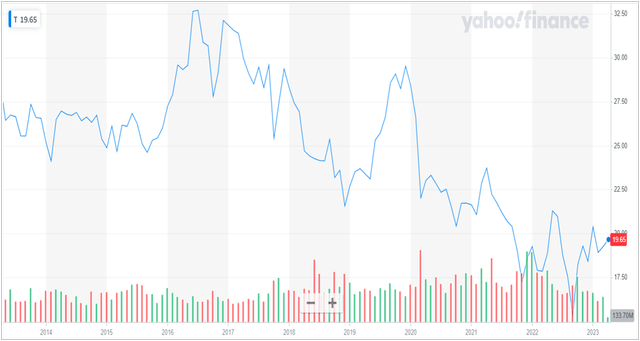

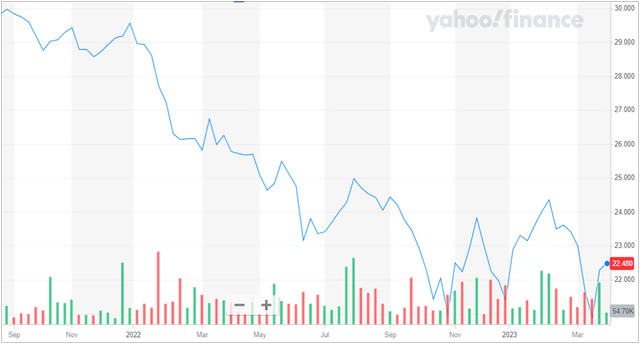

Investors in AT&T have 3 places where they can invest in the capital stack. They can buy the common stock which currently yields 5.66%. I am primarily a fixed-income analyst but I see nothing good about their common stock. It has been a miserable investment for a very long time now.

While the dividend alone is not bad, the total return of this company over the last decade has been quite poor. In my world, you don’t buy a common stock based on the dividend but rather you value a common stock based on the value of the business and what total return you can expect.

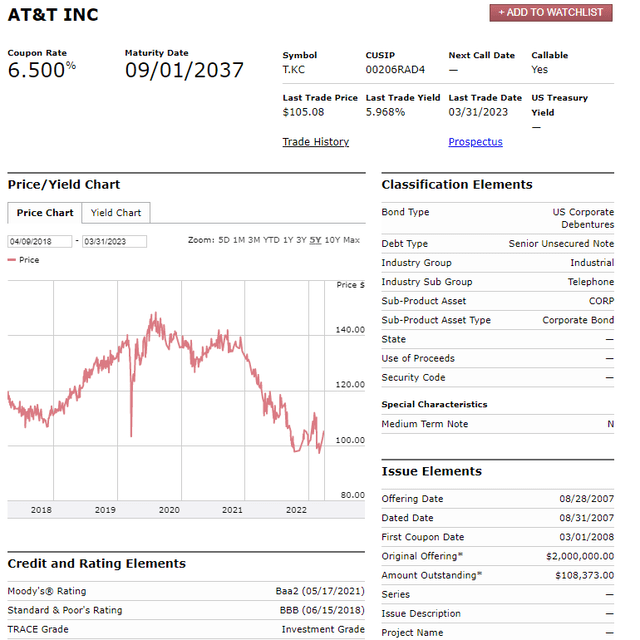

AT&T’s bonds offer yields of up to around 6%. This actually looks like the best bet in the capital stack of AT&T relative to the common stock’s total return and their preferred stocks which I will next cover. Here is one of the better bonds of AT&T.

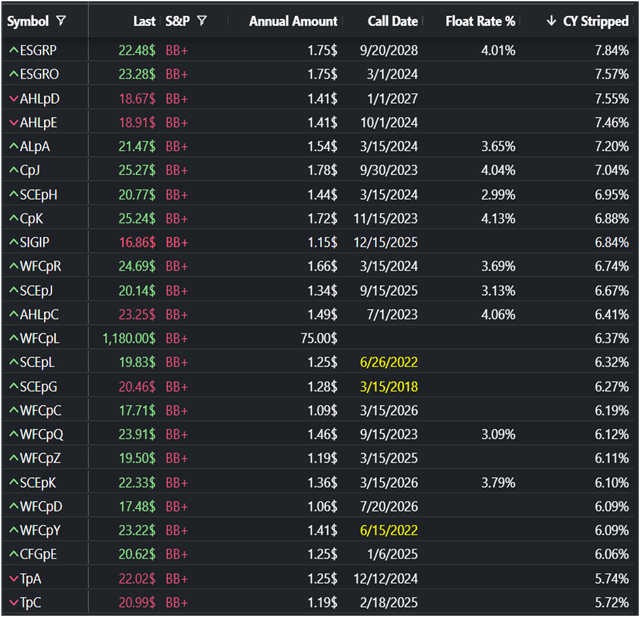

AT&T has 2 preferred stocks with the symbols T-A (T.PA) and T-C (T.PC). These preferred stocks are rated BB+ by S&P and Ba1 by Moody’s which is equivalent to a BB+ rating from S&P. What follows is a chart of BB+ rated “qualified” dividend paying preferred stocks that are either fixed-rate or LIBOR fixed-to-floating rate preferred stocks. So that I could fit the list on my screen, I removed a few of the regional banks which are likely to see downgrades, but doing so didn’t change anything and otherwise it is a complete list.

As you can see, T-A and T-C preferred stocks are at the absolute bottom of the list with far and away the worst yields of all BB+ preferred stocks. In fact, they offer a yield that is more than 2% below that of ESGRP. Given our current inflation rate, the after tax yield on T-A and T-C will be below 5% which means that these are not investments you want to make if you want to beat inflation and increase the real value of your portfolio.

Enstar Group

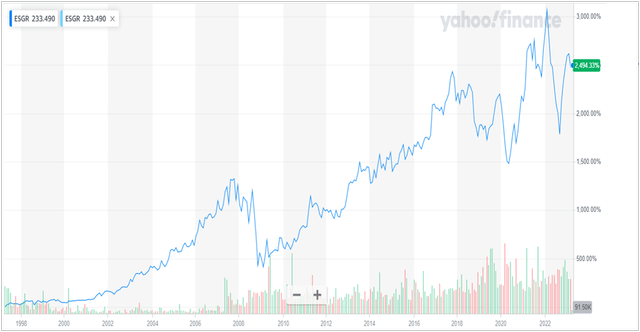

Enstar Group (NASDAQ:ESGR) is an insurance company that is expert in what is called “run off” insurance. For example, when an insurance company wants to liquidate they can only do so if they have no future liabilities. So what they do is pay ESGR to take their existing insurance policies off their hands so they can complete their liquidation. Also, some insurance companies simply want to exit one line of their insurance business and so they may also pay ESGR to take those policies off their hands. ESGR has been excellent in determining the risk of these policies and profiting from the purchase of policies from other insurance companies as the following chart shows.

As you can see, ESGR has been pretty much on a straight line higher since its inception achieving close to a 2500% gain. It dipped during the great financial crisis in 2008, again in the COVID crash, and recently due to massively higher interest rates and the bear market. But it is already experiencing a big rally as it has after every previous dip. In their most recent quarter, they reported a huge profit of over $13.00 per share. Although I generally to not make recommendations on common stocks, I would certainly buy ESGR before I would buy AT&T.

Undervalued ESGRP Preferred Stock

ESGRP (ESGRP) is a LIBOR fixed-to-floating rate preferred stock. As we saw in the chart above, the current yield of 7.84% is the highest among all BB+ rated fixed-rate and LIBOR fixed-to-floating rate preferred stocks. And the dividends are “qualified” for a reduced tax rate. Thus, after taxes ESGRP is clearly beating inflation unlike the AT&T preferred stocks.

Not only is ESGRP’s current yield more than 2% higher than T-A and T-C, but it also has better call protection with it not being callable until September of 2028 while T-A and T-C are callable in less than 2 years. Thus, if we move back into a lower rate environment, ESGR will not be able to call ESGRP for years.

Due to ESGRP’s high yield and far out call date, it traded up to $30.00 per share before the Fed started raising interest rates. Should we move back into a lower rate environment, ESGRP should be one of the best performers in terms of total return (yield plus capital gains).

ESGRP has some interest rate protection in that it floats at LIBOR plus 4.01% if not called. I have no idea where LIBOR might be then but at current LIBOR the yield on ESGRP will jump from its current 7.84% to 10.25%. And if LIBOR drops from 5.2% to 3.2%, you will still see a gain in yield. AT&T preferred stocks offer no interest rate protection.

ESGRP actually has the best floating rate of all BB+ preferred stocks. What may be misleading about the above chart is the “Float Rate %” column tells you what you would add to LIBOR if the stock traded at par. So although the C preferreds show a higher float rate, because they sell above par while ESGRP sells well below par, ESGRP actually has a better float rate yield than C at their current prices. The same with the AHL preferred stock.

So in every way, ESGRP tops the other BB+ preferred stocks and it is clearly a massively better value than the AT&T preferred stocks. It even is undervalued against its sister preferred stock, symbol ESGRO, which has a lower yield, less call protection and no protection against higher interest rates.

And ESGRP has fallen $1.00 per share this past month while the AT&T preferreds have risen $1.00 giving us a good entry point for ESGRP and exit point for T.PC and T.PA.

Bottom Line

At our Conservative Income Portfolio service I primarily focus on finding very undervalued and overvalued preferred stocks, bonds and baby bonds as I have done in this article. This focus lets one identify the best values in the market and avoid the worst. And sometimes this kind of analysis can point out great pair trades where you go long the undervalued security and short the overvalued security. Pair trade investing is one of the ways you can invest while eliminating interest rate risk and market risk since you don’t care whether the market goes up or down nor where interest rates go. For those interested, I recently posted an article that I believe is a very useful read on investing ideas that don’t have market risk or interest rate risk. These risks are generally the biggest risks you take when you invest in fixed-income.

In terms of today’s idea, it is quite simple. AT&T preferred stocks look very overpriced when compared to preferred stocks of the same credit quality. Don’t overpay simply because a company is well known or large. As an alternative to AT&T preferred stocks, we offer up one of the best preferred stocks in AT&T’s credit rating category of BB+. Preferred stock ESGRP has a 7.8% qualified dividend yield versus 5.7% for AT&T preferred stocks, it offers much longer call protection than the AT&T preferred stocks, and ESGRP offers some of the best interest rate protection in its category. ESGR has been a super performing company since its inception and we really like ESGRP. And if you like pair trading, you can consider purchasing ESGRP and shorting T.PC to eliminate market and interest rate risk.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ESGRP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to start building a Fixed Income Portfolio?

Conservative Income Portfolio targets the best Preferred Stocks and bonds with the highest margins of safety. We strongly believe that the next decade will belong to fixed income irrespective of whether you are conservative or aggressive in your approach! Get in on the ground floor of our recently started Bond and Preferred Stock Portfolios.

If undervalued fixed income securities, bond ladder, “pinned to par” investments and high yielding cash parking opportunities sound like music to your ears, check us out!