Summary:

- Nvidia Corporation’s exceptional performance is attributed to strategic actions taken several quarters ago.

- The company’s products provide the immense computing power required for artificial intelligence.

- Nvidia’s valuation puts investors in a tricky spot, with the stock valued at more than $1 trillion.

pixdeluxe

The sensational run of artificial intelligence (“AI”) leader Nvidia Corporation (NASDAQ:NVDA) is not the result of recent efforts, but actions taken many quarters ago.

I wrote over two years ago about Nvidia’s positioning as the pick-and-shovel investment for a new age of technologies requiring the immense computing power Nvidia’s products can provide.

Note: You can read that note here to familiarize yourself with the original investment thesis.

Nvidia’s performance has outrun every reasonable expectation, mine included. The company’s soared past a trillion-dollar valuation, which I figured would take until later this decade to achieve.

Now, it’s time to look ahead and gauge the investment landscape for Nvidia stock after its portfolio-changing run.

No shortage of demand

The company’s huge 2023 Q1 earnings sparked Nvidia’s remarkable run. Management guided for a tremendous growth acceleration, calling for $11 billion in revenue for the second quarter. The guidance-based $44 billion revenue run rate would be a massive leap from the $27 billion it posted in its fiscal year 2023.

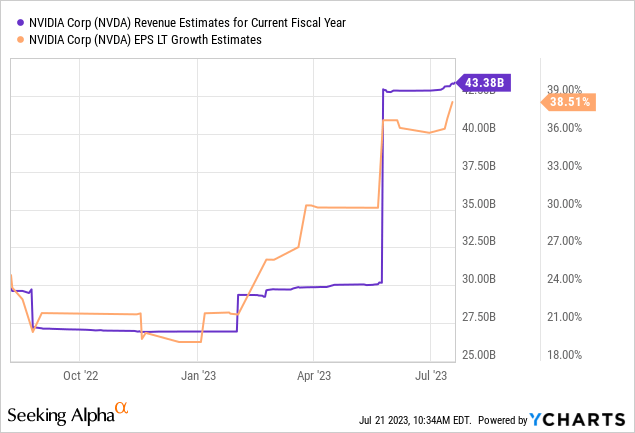

Analysts scrambled to adjust their estimates based on this uptick in business (see the chart below). Heightened expectations lift share prices, which has brought us to the present day.

Nvidia announces Q2 earnings at the end of next month (estimated August 23), so it’s too early to know whether Nvidia will meet these loftier expectations. However, it’s notable that Tesla, Inc. (TSLA) CEO Elon Musk noted during Tesla’s recent earnings call that it can’t get Nvidia’s chips fast enough. If a customer as big as Tesla can’t get enough chips, it’s reasonable to argue that most other companies can’t and that demand remains hot for Nvidia’s chips.

Analysts have steadily increased revenue estimates over the past several months, another indicator that Wall Street sees Nvidia’s business hitting a new gear over the coming quarters.

Is there juice left for squeezing?

The trillion-dollar question now becomes, how much success is priced into the stock at nearly $450 per share?

The answer may depend on your time horizon and willingness to endure volatility.

Nvidia estimated earnings-per-share (EPS) (Seeking Alpha)

For starters, the market has priced in Nvidia’s initial surge of growth, pricing shares at 57 times estimated earnings despite analysts building in a 136% increase in those earnings.

Assuming Nvidia delivers an estimated 25% to 35% annual growth onward, investors buying now are getting shares at 25 times earnings four years into the future. In other words, there’s a solid chance that the stock has pulled forward much of its near-term investment upside.

Of course, Nvidia could exceed expectations. The market may continue awarding a premium valuation to the stock based on continually high forward expectations. The tricky part is that nobody knows, and we will only know once Nvidia crosses those bridges.

The other side of the argument

Let’s turn to the other side. What could go wrong from here?

Investors should be careful extrapolating too far out into the future. Nvidia’s valuation will only be justified if the company successfully delivers on several years of high expectations.

Competition comes to mind as the most severe threat to Nvidia’s business. Some believe that Nvidia holds nearly 90% of the current market for AI computing chips. That paints a big target on Nvidia’s back.

Will competitors wrestle market share away from Nvidia? Again, it’s too early to tell. But investing is full of uncertainties, which is why many build a margin of safety into their strategy. Nvidia’s lofty valuation leaves little room for things to go less than exceptionally well over the next four to five years.

What should investors do?

It seems hard to believe that volatility won’t strike over the coming years. Markets routinely go through corrections and rallies within broader cycles. Investors should consider refraining from chasing Nvidia stock at absorbent heights and wait for a dip to buy shares.

When that time comes, consider buying slowly. You can’t know when a stock will dip, for how long, or how far it will fall. Building a position a little at a time can help you avoid jumping in with both feet at the wrong time. Nvidia Corporation shares seem poised to be a big winner over the next five years and beyond, but the short-term gains could be just about exhausted.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.