Summary:

- Amazon.com, Inc. stock has outperformed its peers despite slow AI growth and deceleration at AWS.

- The company’s core retail business is expected to stay resilient, supported by optimized utilization in e-commerce.

- AWS is expected to reaccelerate growth in the second half, driven by emerging opportunities in generative AI.

- Advertising remains a strong emerging revenue stream with favorable profitability prospects.

Brett_Hondow/iStock Editorial via Getty Images

Amazon.com, Inc. (NASDAQ:AMZN) stock has been a strong gainer among the megacaps this year, outperforming its hyperscaler peers despite a slow start to the generative AI frenzy and ongoing deceleration and margin deterioration at Amazon Web Services (“AWS”). And the stock has remained resilient post-earnings, supported by another consecutive quarter of double beat, primarily driven by improvements to core e-commerce segment growth and profitability, partially offset by continued deceleration in AWS.

Looking ahead, we expect Amazon to be turning a corner from the macro-driven drag, as its core retail business stays resilient, which is corroborated by restored growth across its online stores business and margin expansion enabled by a newly implemented “regionalization” strategy. This is also in line with the Federal Reserve’s recent optimism over the “resilience of the economy,” with the committee’s staff economists “no longer forecasting a recession” despite persistent caution over a tepid economic growth outlook for the remainder of the year, which has turned a page from contracting GDP observed in early 2022.

The company’s retail arm is also expected to benefit further from an idiosyncratic advantage in retail media advertising sales given its massive trove of first-party data generated on global consumer preferences, effectively addressing advertisers’ demand for optimized return on ad spending (“ROAS”) as well as engagement and conversion rates amid the inherently macro-sensitive industry. Taken together with management’s cautious optimism for AWS to have troughed in the second quarter, the incremental boost from upcoming seasonality tailwinds in the core e-commerce arm, alongside an easier prior year comp in the second half – all the while maintaining a modest capex guide – makes a strong set-up for Amazon amid a still volatile market climate. This is expected to drive continued durability to the stock’s gradual uptrend this year.

AWS

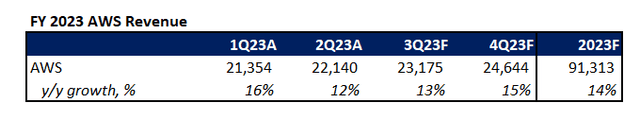

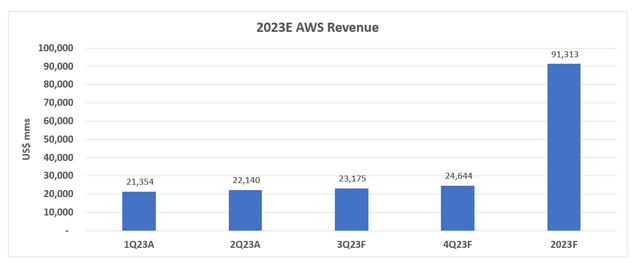

Amazon is well positioned to capitalize on a better second half, as investors’ top concern over AWS deceleration have likely found bottom during the second quarter. The profit-driving segment ended the second quarter with growth of 12% y/y, implying improvements towards the mid-teens range exiting June, compared with the low-10% range management had suggested in April:

And we are seeing these optimizations continue into the second quarter with April revenue growth rates about 500 basis points lower than what we saw [16%] in Q1.

Source: Amazon 1Q23 Earnings Call Transcript.

While optimization in the first half, alongside an uncertain enterprise IT spending environment amid ongoing macroeconomic challenges, have largely offset tailwinds stemming from incremental AI compute demand, AWS remains focused on driving reacceleration by capitalizing on three layers of emerging opportunities ensuing from the nascent technology trend. These include compute, large language models as a service, as well as relevant generative AI applications, which taken together addresses emerging demand across the AI supply chain spanning developers to end users.

As discussed in our previous coverage, Amazon’s comparatively lack of airtime for AI relative to its hyperscaler peers is far from a reflection of its reach in the emerging growth frontier. In fact, the company’s longer-term strategy for AWS has long imprinted AI into its core investment roadmap, reinforcing its role as the world’s leading public cloud provider and critical backbone to ongoing AI developments. The combination of Graviton, Trainium, Inferentia, Bedrock, Titan and CodeWhisperer effectively addresses the key layers of growth opportunities stemming from interest in generative AI. While we had previously expected AWS growth to moderate going forward due to optimization and multi-cloud adoption trends, the unit’s comprehensive generative AI strategy, which enables time and cost efficiencies alongside “democratized access” to the technology, without compromising on security and privacy, is expected to strengthen its moat.

…what we’re doing is democratizing access to generative AI, lowering the cost of training and running models, enabling access to large language model of choice instead of there only being one option, making it simpler for companies of all sizes and technical acumen to customize their own large language model and build generative AI applications in a secure and enterprise-grade fashion, these are all part of making generative AI accessible to everybody and very much what AWS has been doing for technology infrastructure over the last 17 years.

Source: Amazon 2Q23 Earnings Call Transcript.

Paired with AWS’ ongoing efforts in helping customers realize cloud spend optimization opportunities, the segment remains well positioned for reacceleration stemming from new workload deployment from customers, which will compensate for price pressures:

…there’s a lot of cost optimization dollars that came out and a lot of new workloads and new customers that went in…What we’re seeing in the quarter is that those cost optimizations, while still going on, are moderating and many maybe behind us in some of our large customers. And now we’re seeing more progression into new workloads, new business…So generally feel the business has stabilized, and we’re looking forward to the back end of the year in the future because, as Andy said, there’s a lot of new functionality coming out with – and there’s a lot of spend that will be in this area for all the great solutions that are out there for generative AI and large language models as well as machine learning solutions that we’ve always had for customers.

Source: Amazon 2Q23 Earnings Call Transcript

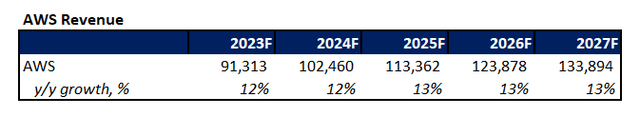

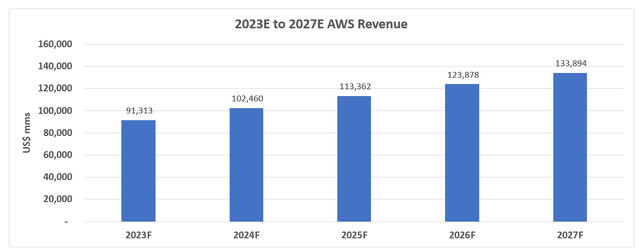

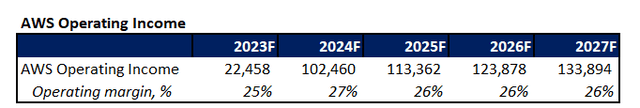

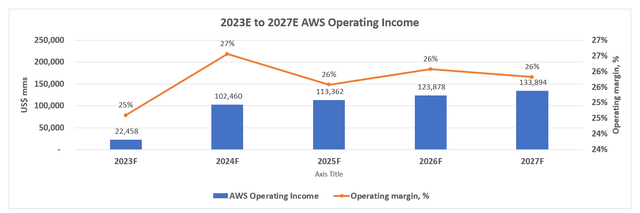

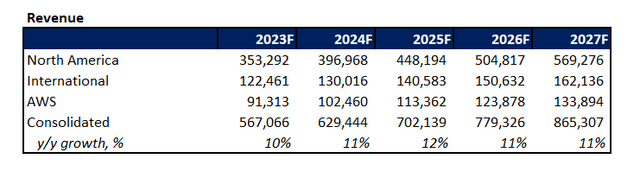

Looking ahead, we expect AWS growth to reaccelerate towards the mid-teens in the second half of the year, in line with observations exiting the second quarter as well as considerations for improved market share capture on total addressable market (“TAM”)-expanding generative AI opportunities.

However, over the longer term, general considerations for increased multi-cloud adoption trends and broader competition are expected to remain a market share dilutive headwind for AWS, driving expectations for growth to moderate in the high single-digit range.

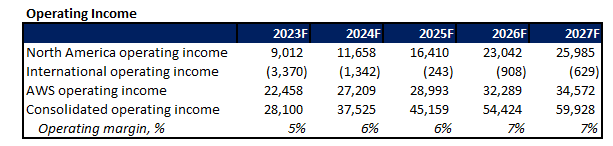

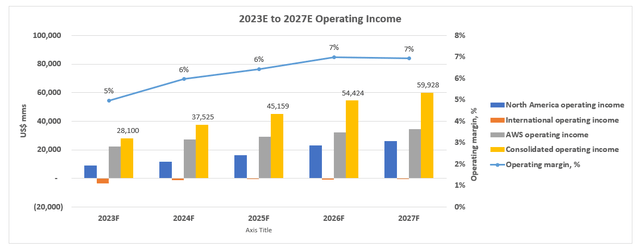

Meanwhile, the profit-driving segment’s operating margin is expected to improve further back towards the high 20% range, helped primarily by restored economies of scale via new workloads as the industry’s narrative moves beyond optimization.

What we’re seeing in the quarter is that those cost optimizations, while still going on, are moderating and many maybe behind us in some of our large customers. And now we’re seeing more progression into new workloads, new business.

Source: Amazon 2Q23 Earnings Call Transcript.

E-Commerce

Following several quarters of underutilization headwinds, coming off of an over expansion mishap during the pandemic, Amazon’s e-commerce operations during the second quarter demonstrated structural improvements to profitability. And related margin expansion efforts are expected to remain durable, considering the impressive sequential increase in North America operating income following the implementation of a regionalization fulfilment and delivery strategy in the U.S. Specifically, Amazon has exchanged its single U.S. national network “eight separate regions serving smaller geographic areas” earlier this year. The strategy has allowed the company to fulfil a higher volume of same-day / one-day deliveries for Prime members – a key purchase decision driver for shoppers – while maintaining lower costs.

Regionalization is working and has delivered a 20% reduction in number of touches for our delivered package, a 19% reduction in miles travelled to deliver packages to customers and more than 1,000 basis point increase in deliveries fulfilled within region, which is now at 76%.

Source: Amazon 2Q23 Earnings Call Transcript.

The effectiveness of Amazon’s newly implemented regionalization strategy for its North American retail business has made a tangible impact on the unit’s bottom-line, representing the primary driver of Amazon’s significantly EBIT outperformance of $7.7 billion during the second quarter, besting the average consensus estimate of $4.8 billion. The company’s North America operating income margin also jumped by three percentage points sequentially to 4% during the second quarter, which reinforces management’s optimism for incremental expansion to the bottom line in the months ahead as regionalization efforts ramp up.

In addition to significant optimization efforts implemented to drive down costs, Amazon also remains well positioned for seasonality tailwinds in the second half of the year. The upcoming back-to-school and holiday shopping season is expected to be stronger than the prior year as visibility on looming macroeconomic uncertainties improve. Despite ongoing monetary policy tightening to bring inflation back towards the 2% target range, price pressures have been moderating alongside a loosening labor market, while the broader economy has remained resilient, with Fed economists no longer expecting a recession. This is further corroborated by strong online spending, as observed through record-setting sales during Prime Day in July:

For instance, in Q2 of ’23, we offered customers 144% more deals and coupons than we did in Q2 of 2022. Prime Day was similar. Amazon offered more deals than any past Prime Day event with a wide selection across millions of products. Prime members purchased more than 375 million items worldwide and saved more than $2.5 billion across the Amazon store, helping make it the biggest Prime Day ever.

Source: Amazon 2Q23 Earnings Call Transcript.

While challenges to the consumer persist amid lingering macroeconomic uncertainties, which is consistent with price-sensitive shoppers’ continued demand for deals and discounts, the combination of seasonality tailwinds in the second half of the year, paired with the continued ramp up of Amazon’s regionalization strategy for North America retail is likely to further improve the segment’s bottom line. Although Amazon has offered more deals and discounts to Prime members to “maintain resilience and reach price-conscious consumers amid lingering inflation,” the recent implementation of a regionalization strategy is expected to drive meaningful cost savings, allowing the e-commerce segment to capture growth without compromising on profitability. In additional to regionalization, Amazon’s continued commitment to building new and better customer experiences through features such as “Buy with Prime” is also expected to help drive Prime subscription retention rates, as they address emerging online consumption trends such as increased demand for fast delivery times and free shipping.

Taken together, Amazon retail’s outperformance during the second quarter effectively assuages investors’ previous concerns that its fast and free fulfilment and delivery strategy will be “margin dilutive,” and reinforces its e-commerce moat. This is further corroborated by management’s expectations for third quarter operating income to fall between $5.5 billion and $8.5 billion, more than doubling from the prior year period and better than the consensus Wall Street estimate of about $5.5 billion.

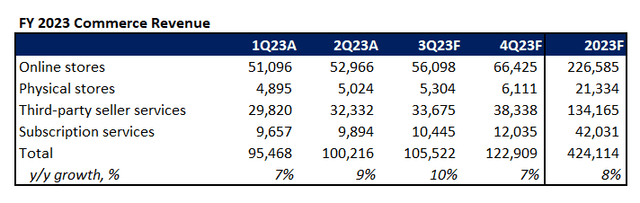

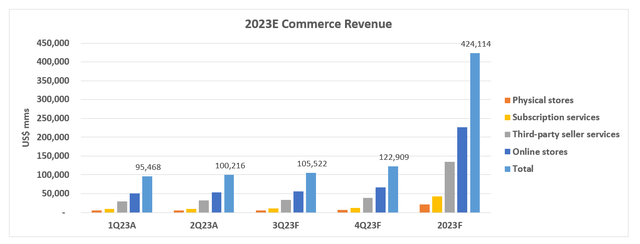

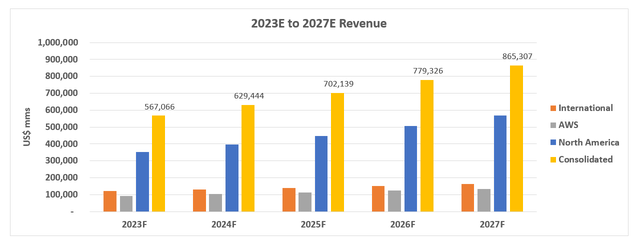

We expect reacceleration across Amazon’s online stores, physical stores, third-party seller services, and subscription services revenue in 2023, helped primarily by both seasonality and an industry-leading customer experience strategy that will strengthen growth in the second half.

Taken together, expect durability to North America net sales growth in the mid-teens range over the longer-term, while international net sales growth recovers toward the high single digit range as Amazon reinforces its e-commerce moat via broader implementation of new customer experiences such as regionalization and Buy with Prime, and drive better capture of secular opportunities ahead.

And North America profitability is expected to expand further in the longer-term as U.S. operations’ regionalization strategy continues to ramp. Meanwhile, losses in the international segment will likely remain an offsetting factor to retail margins, despite consistent improvements in recent quarters driven by moderating inflationary pressures. The base case consideration for the international segment’s profitability prospects over the forecast period is also consistent with bottom line improvements observed in existing markets being offset by losses incurred in newly launched markets – particularly emerging markets.

We’ve launched more than 10 countries in the past 6 years and are always evaluating our customer experience as well as our path to profitability, and we like the path we’re on. As a reminder, it took us 9 years to reach profitability in the United States.

Source: Amazon 2Q23 Earnings Call Transcript.

Advertising

Despite the unit’s emerging strength, as observed through two consecutive quarters a reacceleration back towards the 20% range, management continues to give little (but gradually improving) airtime to the high-margin segment’s outperformance which could potentially translate to upside potential in the segment being “underbaked” in the stock’s current valuation. The latest second quarter results continue to reinforce our view that Amazon is gradually becoming a dominant share gainer in the broader digital advertising market, with reach into retail media, search and AVOD advertising formats. And accelerating growth in Amazon’s advertising sales amid a slow-growing climate given the industry’s inherently macro-sensitive nature continues to underscore its competitive advantage in possessing one of the largest first-party data troves on consumer behavior and extensive reach.

As discussed in our previous coverage on the stock, AVOD and retail media ad formats have remained resilient against the macroeconomic drag experienced across the broader digital advertising market. And durable growth in the 20% range observed in Amazon’s advertising business in the first half of the year remains consistent with industry forecasts for double-digit growth for AVOD and retail media formats in 2023 despite ongoing macroeconomic challenges, and underscores the segment’s commitment to driving improved share capture of the opportunity.

This includes Amazon’s use of machine learning to improve the relevancy of ads delivered, driving improved ROAS for advertisers – a key performance metric for advertisers, especially amid a slow ad spending environment. And the strategy is in line with expectations that Amazon’s pinpointed focus on generative AI investments will continue to benefit adjacent segments as well, including the burgeoning advertising business. Ensuing improvements to relevant delivery of shopping and retail media ads is expected to drive further growth for the segment, while the ramp up of ad placements on Prime Video via Amazon Prime Original and external content partnerships such as the upcoming season for “Thursday Night Football” is also likely to reinforce ad dollar capture and retention going forward.

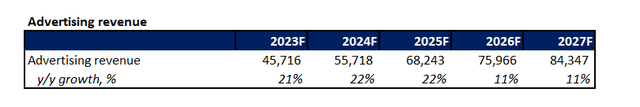

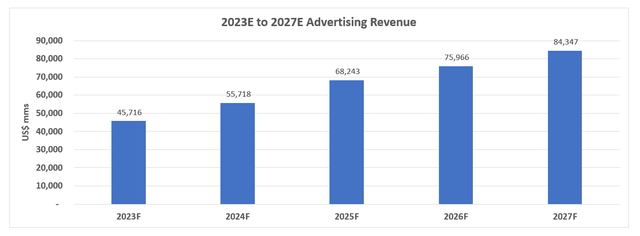

Taking into consideration the advertising segment’s performance in the second quarter, alongside broader industry trends and company-specific opportunities ahead in capturing incremental demand for retail media, search and AVOD ad formats, we expect the segment to maintain growth in the 20% range this year. And over the longer-term, advertising sales are forecast to expand at a five-year CAGR of 13%, in line with broader market considerations for forward growth prospects across key digital advertising formats – counting retail media, search and AVOD – plus an added premium for Amazon’s 1P data advantage.

Fundamental and Valuation Considerations

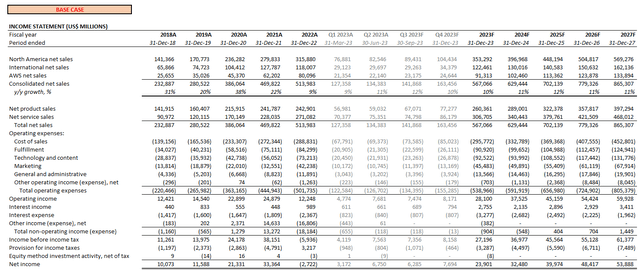

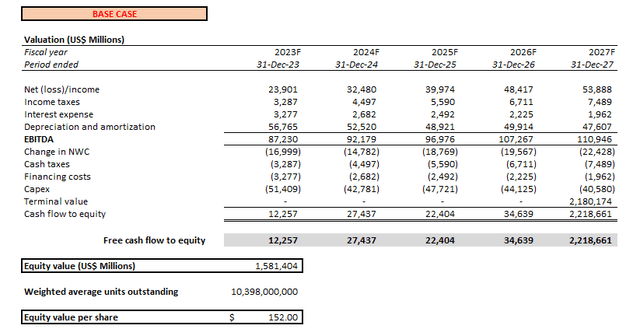

Taken together, the base case forecast expects Amazon’s third quarter revenues to expand by 12% y/y, in line with management’s guidance for growth in the 9% and 13% range. We expect core retail to re-emerge as an earnings staple for Amazon, while ad sales continue to ramp up as a core revenue driver and AWS profitability moderates on stabilizing growth.

Amazon_-_Forecasted_Financial_Information.pdf.

Meanwhile, management’s commitment to keeping full-year 2023 capex spend in the low $50 billion range is a plus to company valuations. The figure compares to almost $60 billion in the prior year, and moderating spend is not expected to compromise longer-term growth opportunities considering the company’s commitment to capitalizing on the emerging generative AI growth frontier.

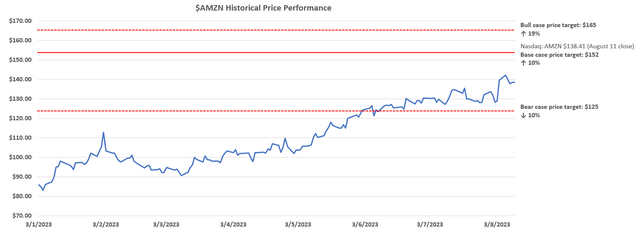

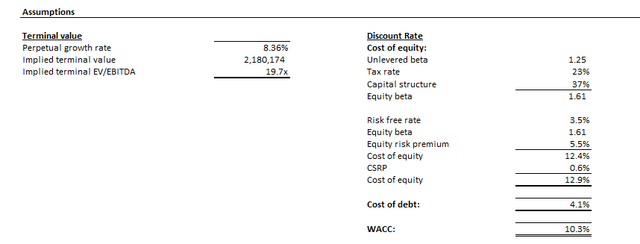

Applying a WACC of 10% in line with Amazon’s capital structure and risk profile, and estimated perpetual growth rate of about 8%, which implies a 17x 2024 EBITDA in line with the stock’s historical average and placement among its mega-cap internet peers, on projected cash flows taken in conjunction with the foregoing fundamental forecast, our base case price target is set at $152. This implies upside potential of 11% based on the stock’s last traded price in the $138 range (August 11 close).

Final Thoughts

Amazon has delivered impressive results for the second quarter. And its forward roadmap for all of core commerce, AWS and advertising reinforces a stronger growth story in the second half, alongside uncompromised earnings power helped by a newly implemented regionalization strategy and moderation of cloud spend optimization challenges ahead.

While broader macroeconomic headwinds are not yet completely behind us, the company demonstrates a strong set-up for the coming quarters, benefitting from expected seasonality strength and easier PY compares due to acute inflationary pressures in 2022, as well as structural improvements in both utilization and capitalizing on emerging secular tailwinds such as generative AI. Improvements to Amazon.com, Inc. profitability driven by both growth and cost optimization, alongside an unchanged capex roadmap remain value accretive factors that will likely unlock greater upside potential to the stock from current levels over the longer term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!