Summary:

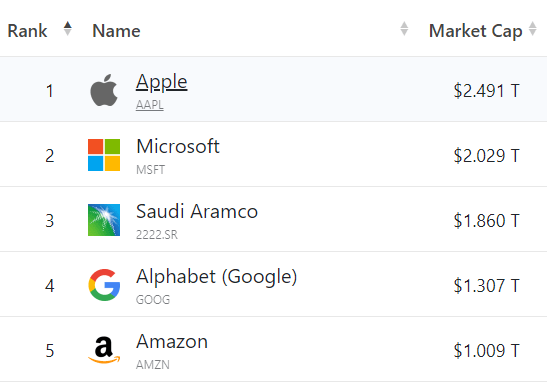

- Apple is the largest company in the world by market value.

- Apple has done extremely well over the last 3 years.

- However, Apple’s last 2 quarters have been very disappointing compared to last year.

- Unless Apple picks up its pace soon, future results are unlikely to match past results.

Justin Sullivan/Getty Images News

Apple Inc. (NASDAQ:AAPL) is the largest company in the world by MV (Market Value) with a valuation of $2.5 trillion.

CompaniesMarketCap.com

Its long-term stock market success may be the thing it’s best known for except perhaps for the iconic iPhone itself.

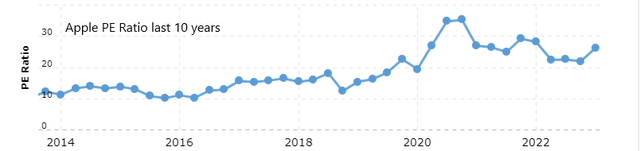

Looking at Apple over the last 10 years we see a huge increase in Apple’s share price over that time period of 750%.

When you are considering investing in the world’s largest company by MV and that company’s share price has grown by 750% over the last 10 years it is only natural to ask yourself can this continue? More specifically can it continue for the next 3 years?

In this article, I will compare recent results with the previous 3-year results to determine Apple stock’s likely performance over the next 3 years.

AAPL Stock Key Metrics

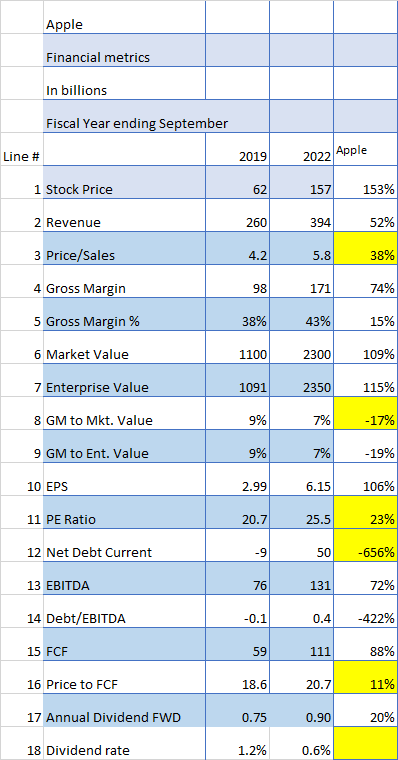

If we look at Apple’s financial metrics comparing the latest Fiscal Year ending September 30, 2022, with the values from 3 years ago, we can make a reasonable comparison of today’s value versus 2019’s value. Once we have made that comparison, we will make an attempt to see how the coming 3 years may play out.

Seeking Alpha and author

One quick look at the financial metrics table above comparing 2019 to 2022 shows that the share price (Line 1) went up 153% on a 52% revenue increase (Line 2).

I have highlighted in yellow the items I consider the most important in terms of magnitude compared to the other items.

As we have already noted, Apple’s price (Line 1) has increased by a substantial amount. But when we look at the Price/Sales ratio (Line 3), the Price/Sales ratio has increased an indicator that perhaps Apple is overvalued.

That is more obvious in the 10-year Price/Sales ratio which shows Apple riding high for the last 3 years or so.

We can also see that in the Price/ Earnings ratio (Line 11) which is higher now than 3 years ago.

If we look at Net Debt (Line 12) we see a huge difference. Debt in 2022 was $59 billion higher than in 2019. So obviously Apple increased its debt substantially in the last 3 years.

And despite a huge 88% increase in free cash flow (Line 15) the price to FCF is higher in 2022 than in 2019 possibly another indicator that Apple has become overpriced over the last 3-year period.

And lastly, the dividend rate (Line 18) has shrunk as the share price has gone up.

Of course, you could argue that Apple did so well since 2019 that it should be expected that its ratios would expand.

I would argue that Apple is unlikely to do as well over the coming 3 years as they have in the past 3 years and therefore is currently overvalued.

An investor, or potential investor, should keep his eye on FCF generation and debt going forward.

What Are Catalysts To Watch For?

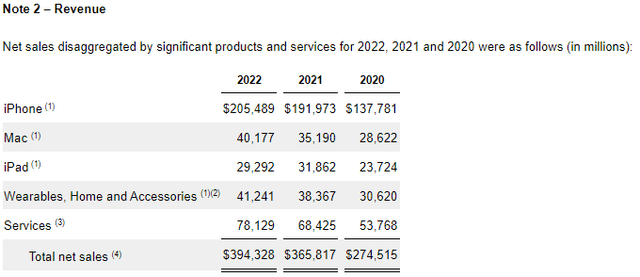

One of the keys to Apple’s future potential may be a rapid increase in Wearables and Services revenue. This is because wearables and services, such as AirPods and Apple Music, have much higher margins than hardware.

Here are the results from the most recent 10k:

Total revenue went up 44% over this period but Wearables only went up 35% and services by 47%. Those lines need to grow faster if a company with a huge $2.5 trillion market value is going to increase the share price substantially over the next 3 years.

Also, note it is not a good sign that iPad revenue actually decreased by 8% last year compared to 2021 and wearables were only up 8%.

With those warning signs, investors need to keep their eye on the quarter-over-quarter revenue to see if the big increase over the last 3 years can be duplicated in the next 3.

What Is The Short-Term Prediction?

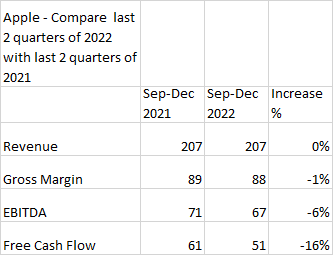

Continuing on my theme that Apple’s performance going forward is not likely to match up well with the most recent 3-year period, I show the following table comparing the last 2 quarters’ performance of 2021 to 2022.

Seeking Alpha and author

Revenue did not increase at all and arguably the 3 most important financial metrics were all down.

Those are some pretty ugly numbers if you think Apple will continue on its merry way over the next 3 years. My short-term prediction: Apple’s price will be coming down unless it has a hugely successful March 2023 quarter.

Where Will Apple Stock Be In 3 Years?

Based upon the above paragraphs, I would suggest that unless Apple has terrific March and June 2023 quarterly results, the 3-year results will be nothing like the last 3 years have been.

There appears to be a noticeable slowdown in Apple’s business prospects compared to the recent past and until that changes, Apple’s 3-year outlook is not robust.

Is AAPL Stock A Good Long-Term Investment?

Apple did not become the largest company in the world by market value by not being resilient and creative in its approach to business. It has proven naysayers wrong over and over again.

So the first thing to remember is never to count Apple out.

But having said that I have to go by what the numbers tell me:

Apple at the current time and price is at best a Hold.

And if results over the next 2 quarters are not robust, Apple will become a Sell.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.