Summary:

- Real estate investment trusts offer steady dividend payments and are often considered “boring” compared to tech-focused companies.

- Cell tower REITs, data center REITs, and industrial/warehouse REITs offer more stock price growth potential than traditional landlords.

- American Tower and Crown Castle are two cell tower REITs that are currently underpriced and offer favorable risk/reward opportunities.

youngnova

Real estate investment trusts (REITs) are known for their steady, stable dividend payments.

Those payments tend to be higher than your average dividend company, mind you. But boiled down to their basics, REITs nonetheless offer dividend stocks.

Which puts them squarely in the “boring” category.

These companies weren’t ever meant to be market movers and shakers. And they largely haven’t been.

Go to just about any markets-focused news site, and you’re going to find stories about Amazon (AMZN), Alphabet (GOOG) (GOOGL), Apple (AAPL), Meta (META), and Netflix (NFLX). Perhaps a piece about the electric vehicle (EV) efforts by Ford (F) or Toyota (TM) or Tesla (TSLA). And, of course, artificial intelligence is the hot topic of the year.

In other words, technology-driven stories about technology-focused businesses dominate our financial conversations in 2023. We’re not living in a material world anymore, despite the best efforts of influencers everywhere.

(Sorry, Madonna.)

We’re living in a world driven mad by scientific discovery and the sometimes literal drive to see how far we can progress toward a Star Trek-esque future.

To be fair, our markets-focused news sites do sometimes feature remarks by JPMorgan Chase CEO Jamie Dimon. Meme stocks do get features when those are in vogue. Big oil profits during earnings season. Big-name retail bankruptcies too.

But it’s mostly tech stuff. And it has been a while.

In which case, most REITs just can’t cut it in the “exciting enough to say something about” category. Not in the mainstream financial media’s mind, anyway.

The Beauty of REITs Is in Their “Boring” Status

Actually, scratch that second-to-last sentence. It should have said “REITs in general just can’t cut it in the mainstream financial media’s ‘exciting enough to say something about’ category.”

Now, everyone who’s followed me for more than a minute knows I think that’s a real shame. REITs are wealth-building machines. If you have the patience to stick with them over time.

By reinvesting their dividends every time, you grow your shares in the company. And as you grow your shares in the company, you grow the amount of dividends you make every quarter or every month.

Which you then reinvest to get even more shares.

Which then yields even larger dividend payments.

Which you then reinvest to get even more shares.

Which then yields even larger dividend payments.

On and on it goes in a beautiful – though, yes, I’ll say it… boring – cycle that can and should end in a lovely or even luxurious retirement.

I get why that process doesn’t appeal to everyone, of course. It certainly doesn’t appeal to my young adult son, who would much rather focus on Tesla and cryptocurrencies.

In which case, I guess I’ve got nothing to offer him with regard to portfolio advice. He’s heard my spiels before: The same ones you hear from me all the time too. So I’m well past being offended by the eye rolls, sighs of impatience, and steady silences just waiting for me to let him get back to his screen time already.

I’m not going to be offended if that’s your stance either. Though I’m going to try to sway you first with something of a hybrid model: Something that takes REIT safety and security… then adds some technological spice to the mix.

Are Cell Tower REITs Underpriced?

There are actually three kinds of REITs that fit this tech-spice category.

Be warned: None of them offer the same level of excitement that AI does. They are still REITs, after all.

In fact, they’re much more REIT-ish than tech-ish when it comes to their stock performance. So don’t expect 20% moves to the upside in a single day.

Even so, the “tech trifecta,” as I call them – cell tower REITs, data center REITs, and industrial/warehouse REITs – do still offer much more stock price growth potential than your more traditional landlords. I’ve even called these three categories “growth REITs” in the past.

Industrials, moreover, are still going strong. CRE Daily, a commercial real estate-specific e-letter, just noted on Aug. 1 how:

“The industrial sector’s vacancy rate of 4% in March is at least 30 (basis points) lower than every other major CRE segment. That’s definitely a great sign for industrial owners and investors, and demonstrates the sector’s resilience and attractiveness.”

In addition:

“Dealmaking in the industrial sector has been robust, highlighting continued investor confidence despite macroeconomic headwinds. Unlike many CRE sectors, (the industrial category) has benefited from several post-pandemic trends, including the growing popularity of door-to-door e-commerce solutions.”

It’s worth noting that those e-commerce solutions require cell towers to happen too. People’s online orders have to be sent through the open air somehow to their proper destinations. Otherwise, there’s no recognized orders to fulfill.

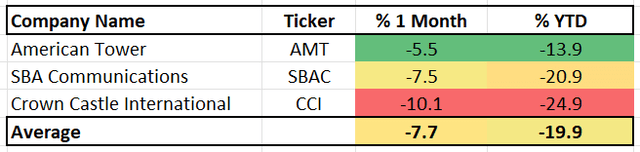

Yet for various reasons – which I’ll mention in the American Tower (NYSE:AMT) and Crown Castle (NYSE:CCI) segments below – the once high-flying (for REITs) sector has fallen out of favor.

Does this make a good time to buy in? Does one cell tower landlord stand out more than the other?

Those are worthwhile questions I’m more than happy to explore today.

Dividend Power for American Tower

American Tower, with a market capitalization of more than $86 billion, is one of the largest REITs in our coverage spectrum.

In fact, when you consider the fact that AMT’s 226,000 global tower sites and 25 data centers are expected to drive exponential growth thanks to growing cell tower usage. AMT is Vanguard Real Estate ETF’s (VNQ) second largest holding (at 5.98%).

AMT is one of the best ways to invest in the global thematic of wireless (Crown Castle our next pick is in the U.S. only) and with assets in 25 countries is also the largest owner in the U.S.

AMT’s international markets account for 45% of revenue, bringing an element of diversity that differentiates AMT from peers and are additive to overall growth at ~200 bps above the US long term.

AMT has a wide moat rating as we believe the model is attractive with a sticky customer base. AMT’s master lease agreements with larger U.S. carriers provide a high level of predictability (as well as $63 Billion in non-cancellable agreements).

In terms of the balance sheet, AMT is rated BBB- and continues to execute on financing initiatives, raising $2.7 billion in fixed rate debt in Q2 and extending the average maturity to six years.

AMT closed out Q2-23 with net leverage of 5.3x as it moves close to its target of 3 to 5x. Positively, floating rate debt declined from 20.6% to 14.6% in Q2.

Also, in Q2 AMT generated AFFO of $2.46 which beat consensus by $.04 per share. The company increased guidance from $9.645to $9.70 and lifted EBITDA by $75 million. In addition, AMT’s data center backlog of $54 million reached a new high up from $37 million at YE 2022.

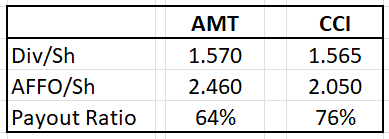

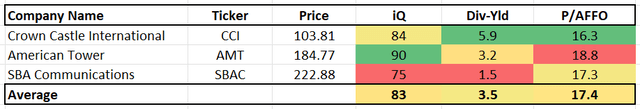

One of the key differences between AMT and CCI is the dividend payout ratio.

iREIT® Q2-23 Data

We believe AMT shares offer a favorable risk/reward.

AMT trades at 18.5x 2024E P/AFFO, below its one-, three-, and five-year averages of 21.4x/24.5x/24.2x.

The dividend yield is 3.3% and, as mentioned earlier, is well-covered with a payout ratio in Q2-23 of 64%.

Analysts forecast AMT to grow AFFO per share by 8% in 2024 and 8% in 2025 (another key differentiator with CCI as I will discuss below) versus +4.3%/-1.5% for SBA Communications/CCI.

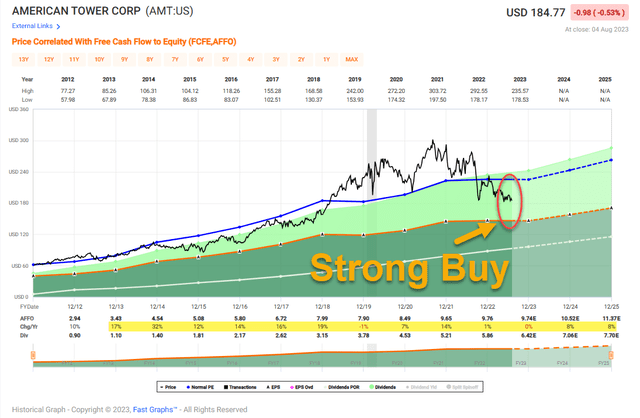

As illustrated below, AMT has an attractive growth history demonstrated by a highly predictable earnings and dividend stream.

FAST Graphs

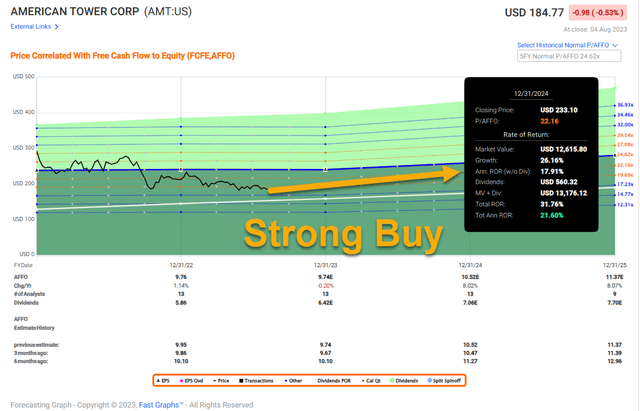

Our conservative forecast has AMT generating 20% annually and our optimistic forecast puts the annual return at 30%. Q2-23 results validate our upgraded Strong Buy recommendation (guidance was increased) and we like the data center positioning as it establishes AMT as a leader across multiple classes of communications real estate as 5G and wireless/wireline convergence accelerate globally.

Our Rec: Strong Buy

FAST Graphs

Crown Castle and Wide Moat

Crown Castle is a cell tower REIT that owns more than 40,000 cell towers, approximately 120,000 on-air or under-contract small cell nodes, and approximately 85,000 route miles of fiber. This gives CCI a presence in every major US market.

CCI is also included Vanguard Real Estate ETF (VNQ) as the fourth largest holding (at 3.3%).

As noted earlier, CCI does not own assets outside of the U.S. and it’s differentiated in terms of its small cell portfolio (120k) that enables additional network densification by offloading traffic and bolstering capacity in the areas of the network where data demand is the greatest.

Another key differentiator is CCIs route miles of fiber assets that increase returns by sharing the same fiber assets across thousands of fiber solutions customers. As CCI’s CEO pointed out on the latest earnings call,

“Across each U.S. wireless generation, the deployment of new spectrum, followed by cell site densification has increased network capacity and enabled exponential mobile data demand growth.

For us this has played out with an initial surge in tower activity to build out the latest generation network, followed by a consistent level of activity over a long period of time to support our customers.”

CCI’s balance sheet is a tad better than AMT (another differentiator).

CCI is rated BBB (AMT is BBB-) and in Q2-23 CCI’s leverage improved by .40x to 4.6x and variable rate debt decreased to 9.2% from 14.8% (AMT was 14.6% in Q2). Also, as referenced earlier, CCI’s payout ratio is 76% (compared with 64% for AMT).

As noted, small cell deployment is a differentiator for CCI and the company has avoided international expansion in favor of fiber and small cells, which accounts for ~30% of revenue.

Small cells represent a densification play with meaningful growth potential, but adoption has underwhelmed, they’re far more capital intensive than towers (~78% of 2023 capex), drag on margins/ROIC, and are not yet a key carrier priority.

Fiber also is price competitive with high churn and elevated macro sensitivity.

Personally, I view the tower model as attractive (with low churn) due to its higher margins, long-term contracts, escalators, and low capex.

In Q2-23 CCI generated AFFO per share of $2.05 (+13.9% Y/Y) and beat consensus of $2.02. Also, tower net organic billings growth and CCI estimates that 75% of its 5% annual growth expectations through 2027 are under contract, highlighting LT visibility within towers.

However, CCI lowered its 2023 AFFO outlook $0.09 to $7.54 as slower carrier activity weighs and implies 2H23 declines -3.5% y/y.

We also believe CCI shares offer a favorable risk/reward.

While valuation is more attractive (than AMT) at 15.4x 2024 AFFO/share and below its 3/5-year average of 22.8x/22.4x, Sprint churn will hit 2025, and we expect AFFO/share to decline in 2024/2025, and dividend growth will be minimal through 2025.

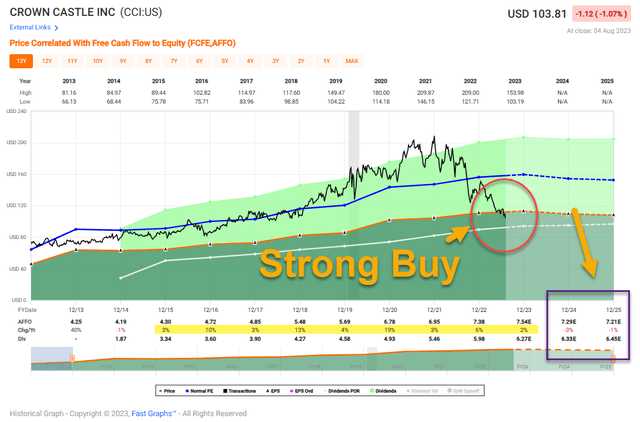

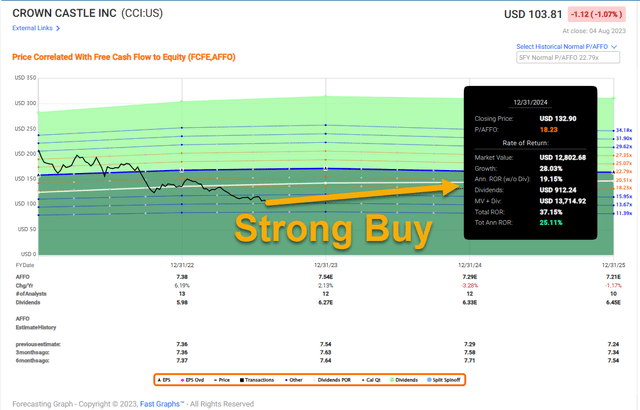

As viewed below, CCI has generated solid growth in years’ past, however, analysts are forecasting negative growth of -3% in 2024 and -1% in 2025.

FAST Graphs

CCI’s dividend yield is 6.0%, that’s a result of a higher payout ratio (than AMT) and discounted valuation. CCI trades at 13.9x vs AMT at 18.9x. Thus, we find CCI the much cheaper opportunity, but growth is less impressive (in the short term).

Our conservative model puts CCI at 25% annualized returns and the most likely forecast has the domestic “pure play” tower REIT at 30% annualized returns.

FAST Graphs

Our Rec: Strong Buy

In Closing…

AMT and CCI remain opportunistically priced and I’m taking full advantage of the selloff in the tower sector.

iREIT® on Alpha

I own shares in both REITs, and I will continue to increase exposure, as they move closer to an estimated 10% of my REIT portfolio.

I like AMT’s data center exposure and I like CCI’s small cell exposure. They have their own identities, however, I’m constructive on the long-term thesis of the REIT business model in which profit margins remain sustainable and highly predictable.

Even with the headwinds facing the sector (higher rates, lower carrier spending, etc..) the growth story is intact, and we view the tower model as one of the most desirable ways to sleep well at night (in the REIT sector).

As always, thank you for the opportunity to be of service.

iREIT® on Alpha

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMT, CCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For A FREE 2-Week Trial

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, Asset Managers, and we added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.