Summary:

- Las Vegas is experiencing major changes, including the addition of a state-of-the-art stadium, the relocation of sports teams, and being selected as the host city for the 2024 Super Bowl.

- VICI Properties, a real estate investment trust (REIT), owns a significant portion of the Las Vegas strip and is rapidly expanding beyond Vegas.

- VICI’s concentrated tenant base, long lease terms, and non-commoditized real estate lower its risk and position it for growth and stability in the uncertain macro environment.

LPETTET

Introduction

The other day, I watched the Formula 1 Las Vegas race, which may very well have been the most anticipated race event of 2023. One of the most obvious reasons is the fact that Las Vegas is the place to be when it comes to entertainment.

Besides that, it has always been the gambling capital of the U.S. and has now evolved into a hotspot for all kinds of entertainment.

Just recently, it benefitted from a number of major changes. Below are a few that come to mind. Feel free to add to this in the comment section.

- Allegiant Stadium: This state-of-the-art stadium not only hosts Raiders games but also serves as a venue for various events, concerts, and other sports activities.

- Las Vegas Raiders & As: Not only did Oakland lose its NFL team, the Raiders, to Las Vegas, but it also lost its baseball team to Sin City. Starting in 2028, the As are expected to play in Vegas – in a new stadium that hasn’t been built yet.

- 2024 Super Bowl Host: Las Vegas being selected as the host city for the 2024 Super Bowl is a significant milestone, as it will put yet another spotlight on the city in early 2024.

- The Shere: this $2.3 billion LED orb is the world’s most advanced concert venue and a major upgrade to the Las Vegas skyline. It’s also the world’s largest billboard, as the picture below shows.

LA Magazine

What I’m getting to here is that real estate is all about location, location, and location.

I believe this applies to Vegas more than to other places.

This also comes with major benefits for the companies that own these buildings.

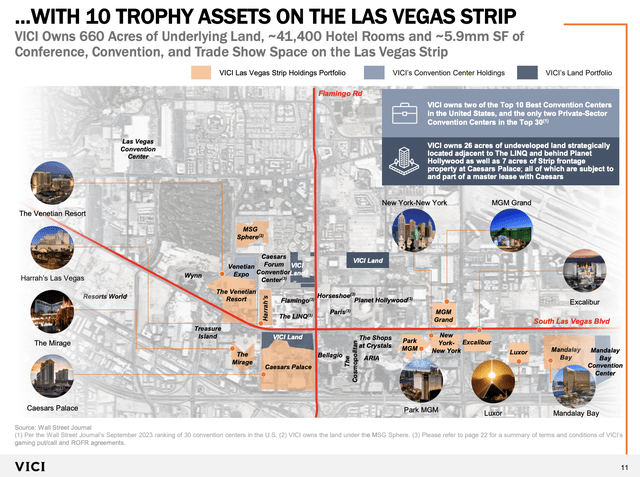

One of them is VICI Properties (VICI), a company that owns a big part of the strip.

This REIT, which comes with a 6% yield, is rapidly expanding beyond Vegas, adding other properties with growth opportunities while maintaining a healthy balance sheet and the potential to outperform its REIT peers on a prolonged basis.

In this article, we’ll discuss all of this and more.

Strategic Growth With Key Assets

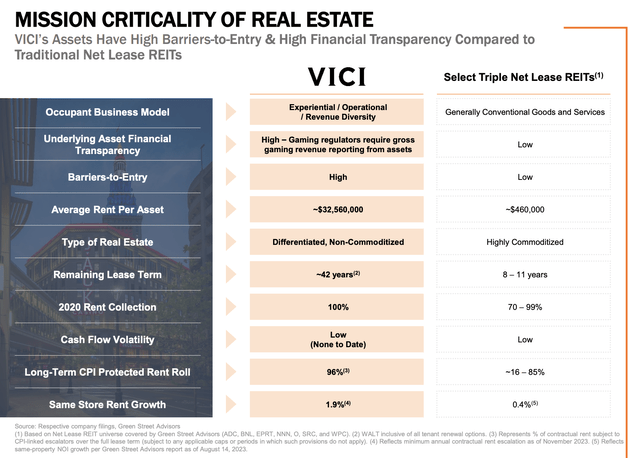

There are a few things that set VICI apart from companies like Realty Income (O) that have thousands of tenants.

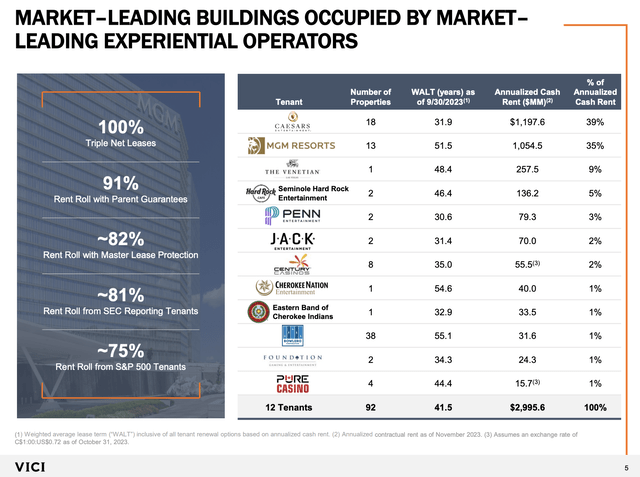

VICI is a highly concentrated company. It has 54 gaming properties, 38 family entertainment centers, and 12 tenants.

Normally, a concentrated tenant base is a huge red flag, as it means that the loss of a single tenant is a big deal.

In the case of VICI, these risks are very subdued.

As we can see below, the company generates roughly $3.0 billion in annual rent. 39% of this comes from Caesars Entertainment (CZR). MGM Resorts (MGM) accounts for 35% of total revenues. These two tenants cover 31 of the company’s 92 buildings.

Furthermore, the Venetian alone accounts for 9% of total annual rent.

What lowers the company’s risk is that there is no alternative. Neither MGM nor Caesars would give up Vegas properties, as the buildings they operate are often the reason why they are doing so well in the first place.

This includes MGM Grand, New York-New York, The Mirage, Caesars Palace, Park MGM, and many others.

As we can see in the overview below, the company’s real estate is non-commoditized, which is extremely unique.

Adding to that, 100% of the company’s contracts are triple net lease deals, meaning tenants pay for insurance, maintenance, and taxes. This lowers inflation risks on top of the fact that almost all contracts come with inflation escalators, although most are capped at 3%.

It also needs to be said that there are significant other benefits, including the fact that the average lease term is 42 years, which is one of the reasons why the company hasn’t experienced any cash flow volatility. In 2020, for example, it collected 100% of its rent.

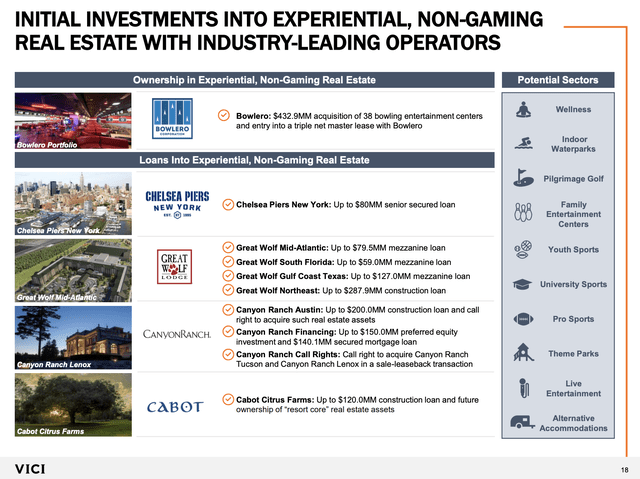

Furthermore, the company is expanding beyond Vegas. As of November 2023, the company generated 47% of its rent in Las Vegas. 53% of its rent came from regional and international properties, which includes its latest acquisition of 38 bowling entertainment centers from Bowlero (BOWL), a deal to develop leisure assets for luxury wellness company CanyonRanch, and other non-gaming assets.

Although I have zero interest in owning bowling real estate, I get the company’s move.

These deals diversify its business and are seen as immediately accretive investments with positive impacts on 2024 earnings.

These commitments extend beyond financial gains, representing strategic relationships that position VICI for growth when market conditions stabilize.

In other words, good tenants will allow VICI to work on future deals, helping tenants grow and expanding VICI’s assets.

Related to this, during its third-quarter earnings call, the company emphasized the strong operating results of its tenants, exemplified by significant investments from major operators such as Caesars, The Venetian, and MGM.

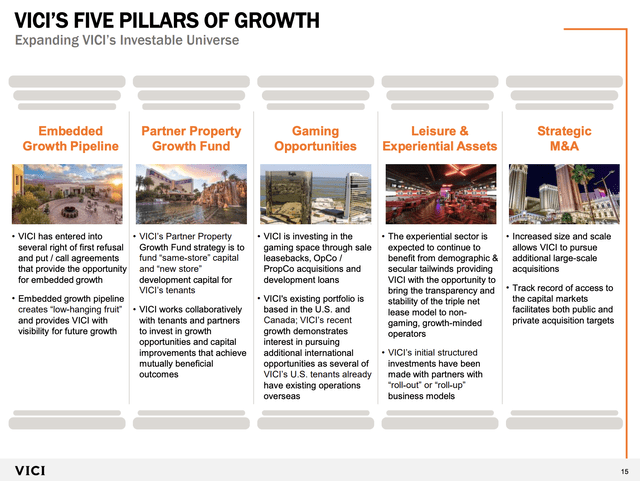

These investments, including hundreds of million-dollar deals, underscore the commitment of VICI’s tenants to enhance both the quality of assets and the productivity of their operating businesses, which is one of the company’s five growth pillars to grow same-store growth and create win-win opportunities for itself and its tenants.

This strategy and portfolio also help the company to withstand headwinds.

VICI Remains Steadfast Amids Uncertainty

As we all know, we’re dealing with a challenging macro environment. Rates are elevated, inflation is sticky, and economic growth is declining. Nonetheless, VICI noted that its tenants are doing well.

During its October earnings call, VICI mentioned that Caesars is reported to be on track for its best October ever, showcasing the resilience and vitality of the city’s entertainment sector.

The same goes for VICI.

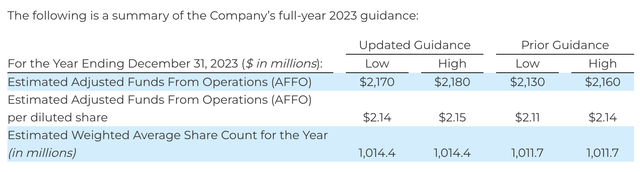

AFFO (adjusted funds from operations) per share for the quarter was $0.54, marking an 11% increase compared to the same period in 2022.

This performance helped the company to hike its guidance.

- The revised AFFO year-end estimate is between $2.17 billion and $2.18 billion or $2.14 to $2.15 per diluted common share.

- VICI anticipates an 11% year-over-year growth in AFFO per share, positioning it among the REITs with the highest expected growth rates.

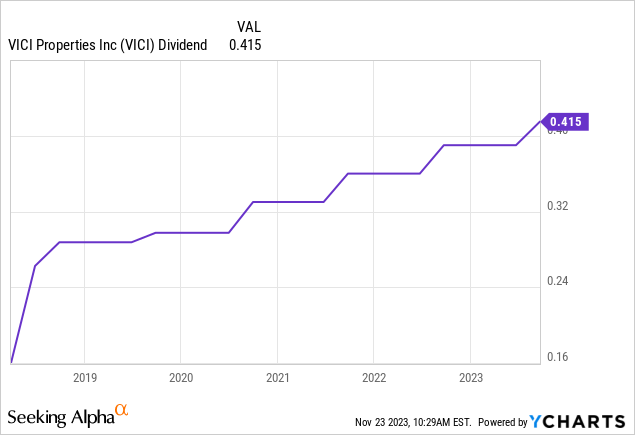

Thanks to these developments, VICI increased its quarterly cash dividend to $0.415 per share, a 6.4% year-over-year rise.

This translates to a 5.8% yield.

Over the past five years, this dividend has been hiked by 17.4% per year. It is protected by a 77% 2023E AFFO payout ratio (using the company’s guidance).

As the chart above shows, the five-year dividend CAGR was impacted by high initial hikes.

I expect moderate hikes of 4-6% to continue on a prolonged basis, which would be a terrific deal for a stock yielding 6%.

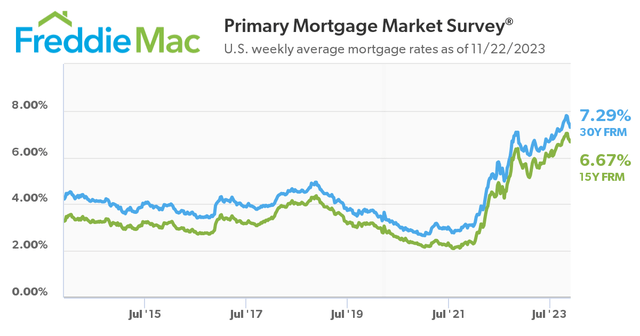

The dividend is also protected by a healthy balance sheet, which is very important in this economy, with mortgage rates close to 7%.

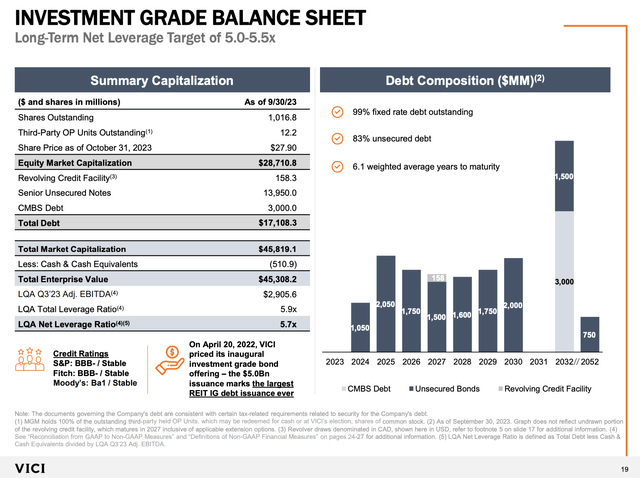

With $430 million in cash, $250 million in estimated net proceeds from forward sale agreements, and $2.3 billion available under the revolving credit facility, VICI believes it is well-prepared for this environment.

Net leverage, measured by net debt to annualized Q3 adjusted EBITDA, stands at approximately 5.7x.

The company’s weighted average interest rate is 4.35%, factoring in its hedge portfolio, with an average maturity of 6.1 years.

It has an investment-grade BBB- rating.

The valuation isn’t bad, either.

Valuation

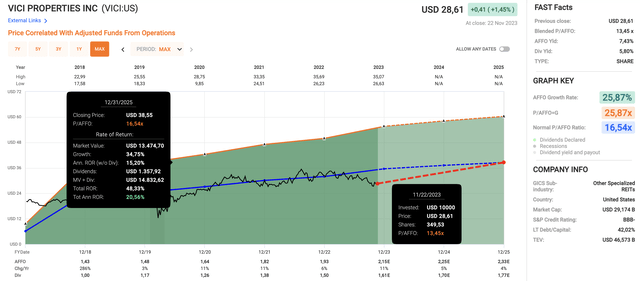

Since VICI became a public company, it has traded at a price/AFFO multiple of 16.5x. It currently trades at a blended P/AFFO multiple of 13.5x. Shares are down 18% from their all-time high.

- This year, AFFO is expected to rise by 11%, in line with company guidance.

- Next year, AFFO is expected to rise by 5%, followed by 4% growth in 2025.

When adding these growth expectations to a return to its normalized valuation, it would imply a $38.6 stock price target, which is 35% above the current price.

Incorporating dividends would imply a 20.6% annual return through 2025.

Having said that, this is a theoretical performance. Unless rates come down soon, it will take a while until VICI trades at 16.5x AFFO again.

Nonetheless, these numbers show a strong margin of safety.

While it may take a while for VICI to gain upside momentum, I believe accumulating VICI shares at current prices is the way to go. If the market provides more corrections, investors can average down, boosting their yield.

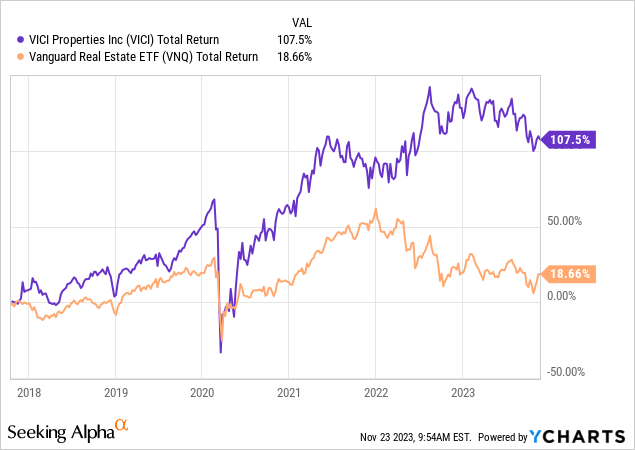

On a long-term basis, I expect VICI to keep outperforming its peers and deliver strong total returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.