Summary:

- AbbVie has shown strong growth, especially in immunology and oncology, with Skyrizi and Rinvoq driving impressive sales and long-term growth potential.

- Despite Humira’s patent loss, AbbVie has managed a “soft landing” and continues to innovate, particularly in neuroscience and oncology.

- The company offers a solid dividend with a 51% payout ratio and consistent growth, making it attractive for conservative investors seeking income and growth.

- Given its current valuation, I recommend a cautious investment approach, starting small and averaging down if the stock drops.

amphotora/E+ via Getty Images

Introduction

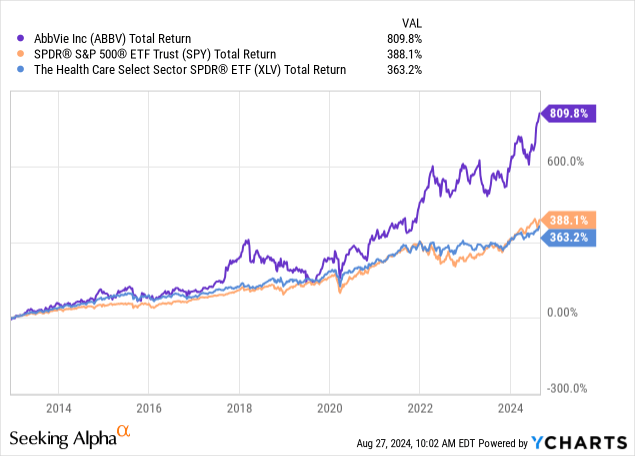

On May 29, I wrote an article titled “Looking For Both Income And Growth? 4%-Yielding AbbVie Has You Covered.” Since then, shares of the Abbott Laboratories (ABT) spin-off have returned roughly 30%, beating the S&P 500 by 23 points.

Since becoming independent in April 2012, AbbVie Inc. (NYSE:ABBV) has returned 810%, beating both the S&P 500 and the healthcare ETF (XLV).

Although I’m obviously happy, my thesis has turned out to be correct, it’s important to re-assess the risk/reward, as I am far from done buying shares of this giant.

Hence, in this article, I’ll update my thesis, using its latest earnings and other major developments that explain how I would deal with this dividend grower at current prices.

So, as we have a lot to discuss, let’s get to it!

AbbVie is Firing On All Cylinders

Every day, I check the S&P 500’s biggest losers. To me, this adds more value than watching the winners, as I am always looking for a bargain. As a long-term investor, I’m not always happy when my stocks take off, as it makes reinvesting capital much harder.

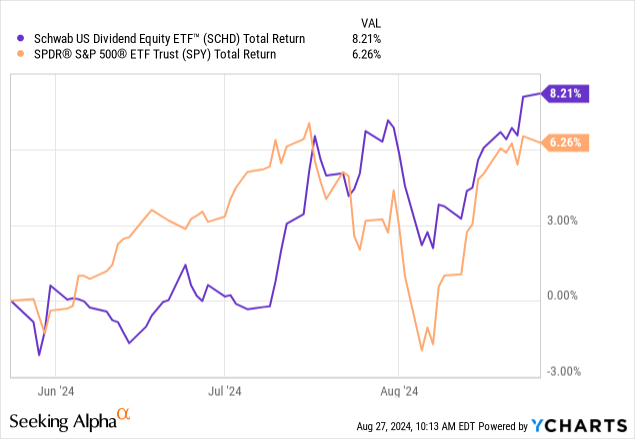

Right now, we’re in such a situation, as dividend stocks, in general, have done very well in recent weeks.

Over the past three months, the Schwab U.S. Dividend Equity ETF (SCHD) has returned more than 8%. This move has been supported by a wide range of stocks, including AbbVie.

Investors have been buying AbbVie with both hands, as the company has proven it can move beyond the Humira patent loss, which caused a lot of uncertainty last year.

In 2022, Humira generated close to $19 billion in sales, making it the biggest patent loss of 2023.

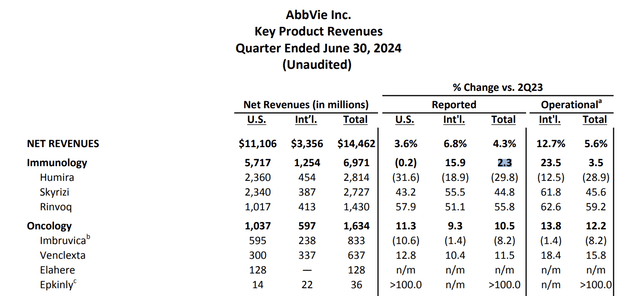

In the recently released second quarter, the company grew its operating revenue by roughly 4%, which is in line with its first-half performance. The biggest tailwind came from its ex-Humira growth portfolio, which accounts for more than 80% of total sales.

This growth platform exceeded the company’s initial sales guidance by more than $1 billion, fueled by success in key areas like immunology and oncology, two areas the company expects to achieve significant long-term growth.

In immunology, the company has two blockbuster drugs, Skyrizi and Rinvoq. If you’re new to AbbVie, this is what these two drugs are targeting:

Skyrizi is approved for forms of arthritis, psoriasis and Crohn’s disease in the U.S., while Rinvoq treats arthritis, eczema and ulcerative colitis. – Biopharma Dive

In the second quarter, these two drugs generated $4.1 billion in sales. Even better, they have shown growth of roughly 50% in their fifth full year on the market.

According to AbbVie, Skyrizi, in particular, has secured a dominant position in the American biologic market for psoriasis, where it captured 38% of the total prescription market. As one can imagine, that’s a big deal.

Furthermore, in gastroenterology, Skyrizi and Rinvoq are on track to double their sales in inflammatory bowel disease (“IBD”) this year.

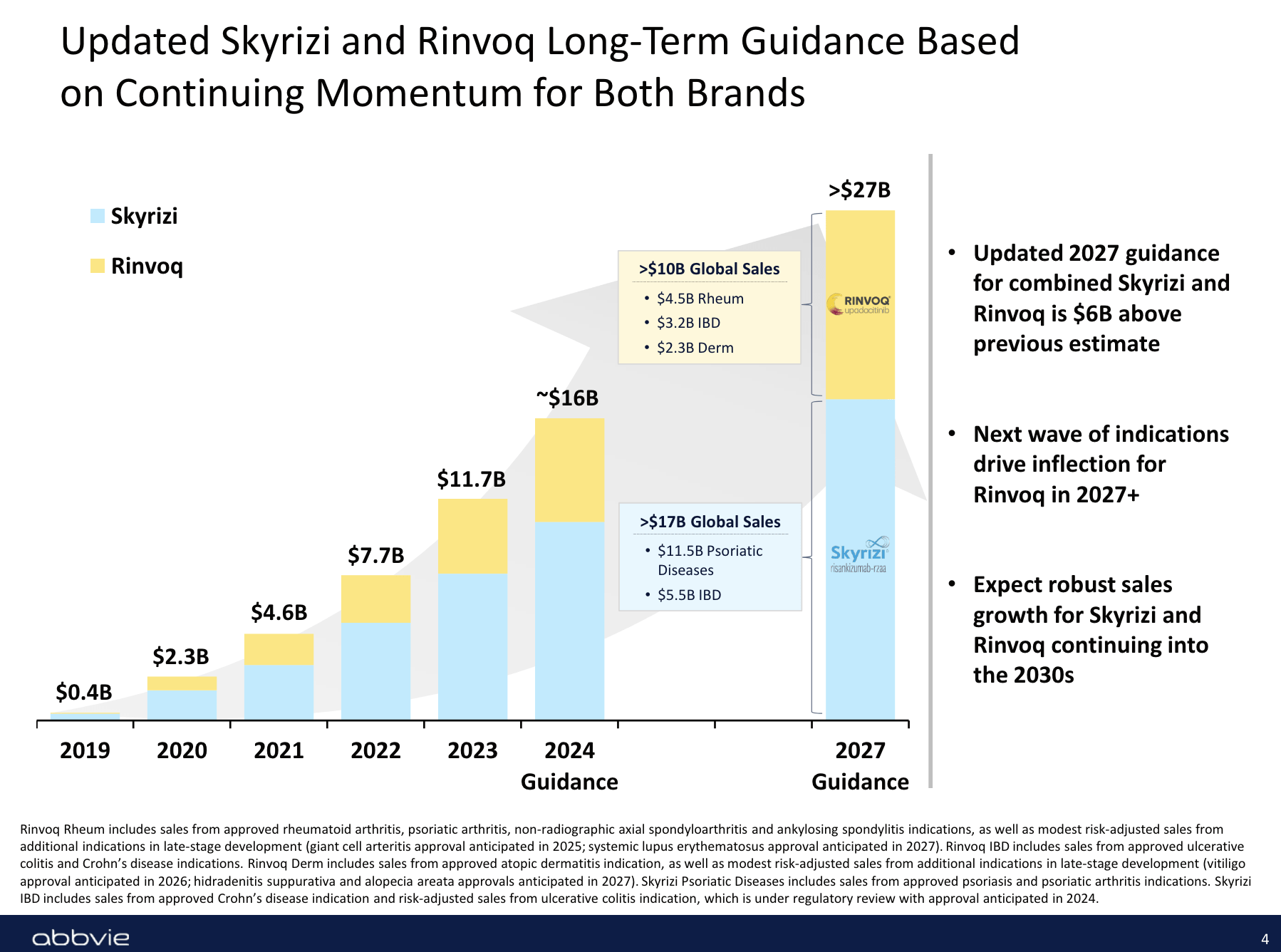

On a long-term basis, growth is expected to remain high. In my prior article, I used the chart below, which shows a combined sales guidance for these two drugs of more than $27 billion by 2027 – more than double its 2023 result.

AbbVie

Oncology was another bright spot.

Despite competitive pressure, this segment saw 10.5% total growth.

According to the company, Elahere stood out. This is a treatment for solid tumors that has shown a strong market uptake, generating $128 million in sales (see above).

“As the first treatment to show a statistically significant overall survival benefit in patients with platinum-resistant ovarian cancer, ELAHERE provides an effective new option for patients with folate receptor alpha-positive tumors. These patients previously had very limited options and ELAHERE changes that.” – AbbVie

In general, ongoing innovation in its oncology pipeline, including treatments like Teliso-V and AbbVie-400 for solid tumors and the BCMA CD3 bispecific for multiple myeloma, put AbbVie in a good spot to grow in an area that needs a lot of innovation.

Speaking of markets with elevated growth, by buying Cerevel, AbbVie aims to expand its footprint in neuroscience as well, which is a market with significant unmet needs.

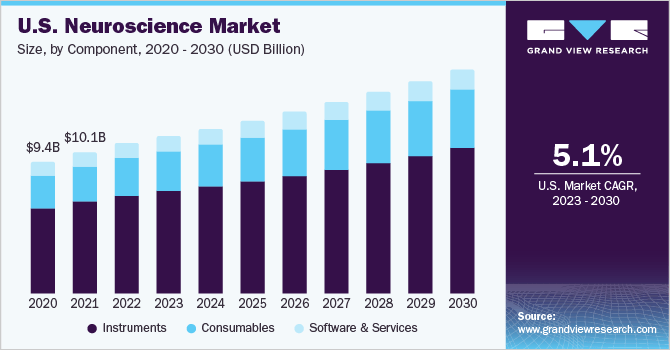

Including instruments, consumables, and software/services, Grand View Research estimates 5.1% market growth through 2030.

Grand View Research

Moreover, in its 2Q24 earnings call, AbbVie noted it has executed almost a dozen early-stage deals in the first half of the year, targeting innovative technologies in immunology, oncology, and neuroscience.

These are expected to provide elevated growth in the next decade.

It also helps that the decline in Humira is going as expected. The biggest risk is that biosimilar drugs gain market share too quickly. That has not been the case, proving that AbbVie’s outlook on the drug is still valid.

Humira, which delivered global sales of $2.8 billion, down 28.9% on an operational basis due to biosimilar competition. Erosion in the U.S. was in line with our expectations in the quarter, and our guidance contemplates the impact of additional formulary changes over the course of the year. Importantly, we continue to anticipate that Humira will maintain parity access to biosimilars for a significant majority of patient lives this year. – ABBV 2Q24 Earnings Call

Dividend Growth & Valuation

Thanks to strong revenue growth, the company reported $2.65 in earnings per share, beating the midpoint of its guidance by $0.10. Going forward, analysts expect growth to remain elevated.

However, please note that analysts expect full-year EPS to be down. This is due to the difference between adjusted and unadjusted EPS growth. In 2Q24, for example, unadjusted EPS was just $0.77. The difference includes an unfavorable impact related to acquired in-process research and development (“IPR&D“).

Using the FactSet data from the chart below, the company is expected to grow its EPS by 11% next year, potentially followed by 12% in 2026.

This bodes well for its dividend.

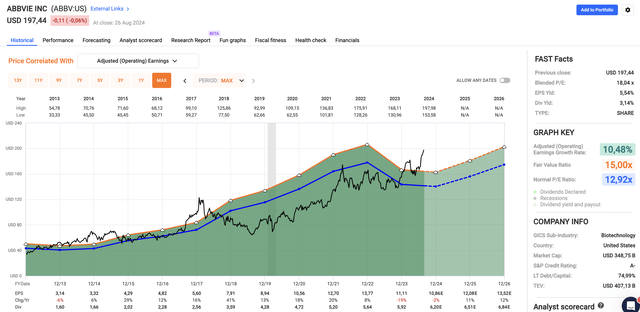

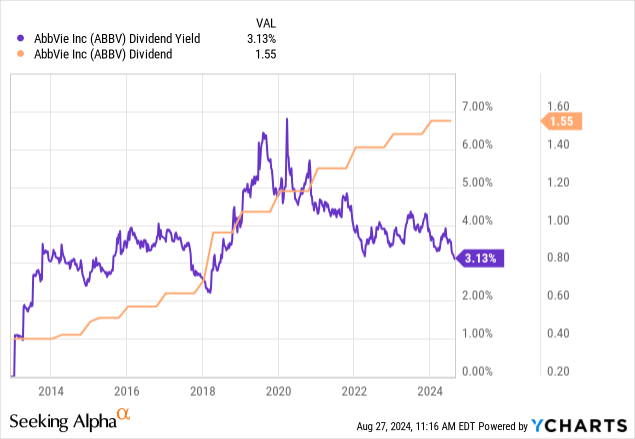

Due to the recent stock price surge, the yield has dropped to 3.1%. While this is a big decline from the >4% yield investors enjoyed most of the time before 2024, it is roughly in line with the long-term median, as we can see below.

This dividend is protected by a 51% payout ratio (using 2025 EPS expectations) and has a five-year CAGR of 8.0%, which is very decent for a yield this high.

As we can see in the chart above, ABBV has hiked its dividend every single year since becoming independent in 2012.

Now comes the bad news.

ABBV shares are trading at a blended P/E ratio of 18.0x, which is roughly five points above its long-term average of 13.0x. Using the FactSet data from the FAST Graphs chart above, the company has a fair price target of $176 based on 2026 EPS expectations.

However, because of elevated growth expectations, no major pending patent losses, and the “soft landing” from Humira, I believe a higher valuation multiple is appropriate. Using a 15.0x multiple, we get a fair price target of $203, 3% above the current price and $5 above the consensus price target.

Although I will maintain a Buy rating due to the company’s good outlook and tremendous secular growth potential, I would suggest new investors break up their initial investment.

Whenever I buy a new stock that is not “deep value,” I usually start small and add gradually over time. Given ABBV’s outlook and valuation, I believe that’s the best way to approach this investment. If it drops, investors can average down. If it takes off, investors have a foot in the door.

Personally, I’m likely reinvesting dividends on a >5% drop, as I have a substantial investment in ABBV (relatively speaking). If the company’s growth outlook was less impressive, I would have applied a Hold rating.

Takeaway

AbbVie has proven its strength, with impressive gains even after the Humira patent loss.

Even better, the company’s growth in immunology and oncology, in addition to strategic moves in neuroscience, indicates a very bright future.

Moreover, with improving revenue growth, a healthy dividend backed by solid and anti-cyclical earnings, and a focus on expanding its therapeutic portfolio, AbbVie remains a key player in the healthcare sector and a go-to place for conservative investors seeking growth and income.

Pros & Cons

Pros:

- Strong Growth Drivers: AbbVie’s immunology and oncology portfolios, led by Skyrizi and Rinvoq, are delivering impressive growth, with expectations for elevated long-term growth.

- Innovation and Pipeline: Ongoing developments in neuroscience and oncology, in addition to strategic M&A, position AbbVie for long-term growth in high-growth markets.

- Solid Dividend: With a 51% payout ratio and consistent dividend growth since 2012, AbbVie offers a reliable income stream backed by anti-cyclical earnings.

Cons:

- Humira’s Patent Loss: The recent expiration of Humira’s patent shows the vulnerabilities of biotech giants.

- Innovation Dependence: AbbVie’s growth heavily relies on the success of new drugs and M&A.

- Competition: The pharmaceutical sector is highly competitive.

- Regulatory Risks: Changes in healthcare regulations and drug approval processes can negatively impact AbbVie’s operations and profitability.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.