Summary:

- Abercrombie’s stock is down 30% since May as most investors are concerned about slower growth in the year’s second half, especially in Q4.

- Despite this concern, the fundamentals of the company are solid, with robust revenue growth, improved margins, minimal debt, and strong operating and free cash flows.

- Increased SG&A spending from promotional and marketing efforts could impact Q4 profitability, especially since the holiday season usually involves heavy discounting.

- Liquidity is strong, with significant cash reserves and zero long-term debt after debt repayments in Q2.

- I maintain a Hold rating for now. However, I could upgrade to a buy following Q3 earnings results and management’s updates on full-year guidance. My main concern prior to Q3 earnings is a sell-off similar to Q2.

anouchka

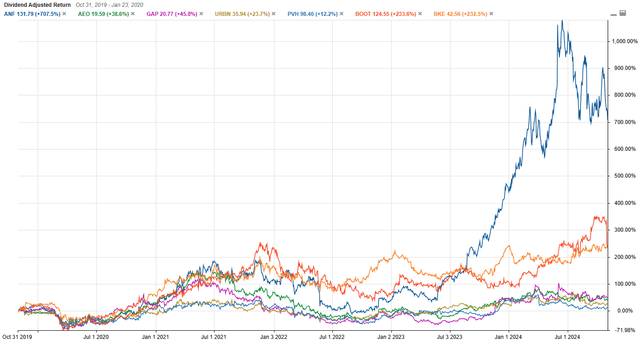

Abercrombie & Fitch Co. (NYSE:ANF) has been an outstanding performer in the apparel retail industry, outperforming the S&P 500 over the last five years by more than 600%.

Despite these impressive returns, the share price has seen a recent pullback, with the stock declining over 30% since reaching its peak in May.

Therefore, I decided to examine the reasons behind this pullback to determine if this is a normal correction or an early warning sign.

I will advance here that one of the main factors in this pullback is the cautious outlook management has provided for the second half of the year, particularly in Q4.

In my view, the company’s fundamentals and valuation ratios look quite decent when compared to its peers. However, at the moment, I maintain a Hold rating as there is a high risk for a selloff following Q3 2024 results, similar to what happened after the Q2 earnings release.

However, I will reconsider my rating after the Q3 results, particularly based on any updates from management regarding full-year guidance, and Q4 outlook.

Price Action

Over the last five years, the company has outperformed the S&P 500 by more than 600%.

When compared to some of its industry peers, the company is well ahead of its competitors by a wide margin.

However, since the peak in May this year, the share price has declined by over 30%. Let’s understand why.

Uncertainty In The Back Half Of The Year

During the Q1 earnings conference, management hinted at the possibility of slower growth in the second half of the year.

As we think about the back half, sitting here today, there’s still a lot of uncertainty out there, lots of learnings for us coming here in Q2 …

In the second quarter, management raised full-year net sales growth to 12%-13% YoY, up from the previously guided 10%.

However, they are taking a cautious approach for Q4, projecting sales growth of about 6.5-7.5%, which is lower than the low double-digit growth anticipated for Q3.

It seems that shareholders didn’t like the uncertainty surrounding the end of the year, with the share price dropping by 17% following the release of Q2 earnings.

To better understand if this (mini) sell-off was justified, let’s take a closer look at the fundamentals of the company.

Fundamentals

The income statement shows consistent double-digit revenue growth since Q2 2023.

More recently, this increase was driven by the Hollister brand recovery, which experienced a 17% increase in sales. Additionally, the company has expanded its reach to new customer demographics (mainly, millennials and Gen Z) through the NFL collections.

However, one of the challenges that the company is currently facing is the increased reliance on promotions and marketing, especially for the Abercrombie brand. Management has already indicated that Q4 is typically its most promotional quarter. Therefore, any increase in discounting could offset some of the gross profit improvements achieved in the first half of the year.

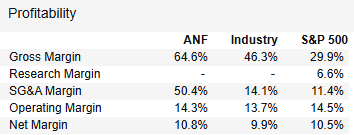

As a matter of fact, the company is using half of its revenue for SG&A expenses, which is significantly above the average of the industry.

stock rover

However, the main reason I am not overly concerned about their marketing and promotional spending is due to their operating and net margins, which are above the apparel retail industry.

Moving on to the balance sheet, the company has significantly reduced its net debt over the last year, from $538 million in Q2 2023 to $152 million in Q2 2024.

Tangible book value per share has increased to $23.6, and cash per share is up as well, to $14.5.

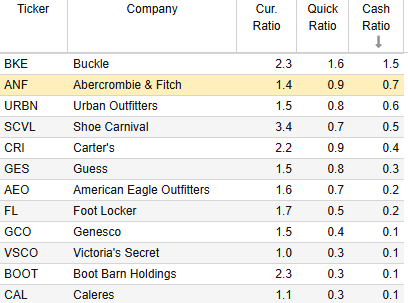

The liquidity ratios look quite decent, especially the cash ratio when compared to its industry peers.

stock rover

A quick look at the cash flow statement shows a significant cash outflow as the company reduced its debt by redeeming all outstanding 8.75% Senior Secured Notes due 2025, totaling $214 million.

As a result, the company has no long-term debt and no outstanding borrowings on its $500 million revolving credit line.

Over the last 12 months, cash from operations increased by 47%. Among the drivers was a decrease in inventory levels and revenue growth, already mentioned above.

Valuation

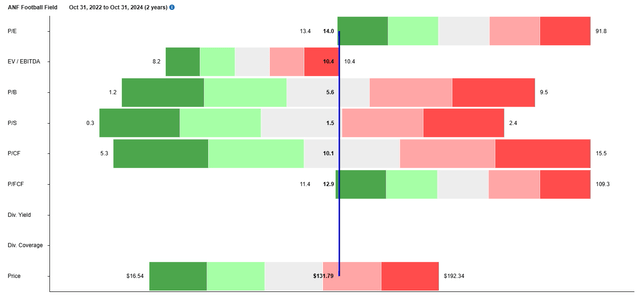

Despite the 632% return over the last 5 years, the valuation ratios don’t look bad at all.

I believe the pullback since May has helped bring some valuation ratios down to more reasonable levels.

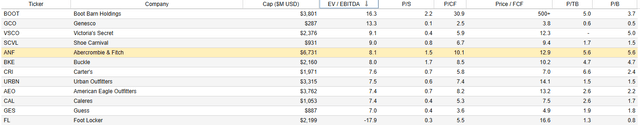

Additionally, despite outperforming the return of all its competitors, the company doesn’t look overvalued when using EV/EBITDA as the comparison metric.

Conclusion

To wrap up, despite the spectacular growth of the company, its decent margins, favorable recent price action, and reasonable valuation ratios, I maintain a Hold rating for this company.

I believe there’s a strong risk that the pullback could keep pushing the share price down after the Q3 earnings release on November 26.

Management already expressed their concerns for the last quarter of the year, with sales growth projected in the mid-single digits, compared to low double digits achieved in the past 5 consecutive quarters. Shareholders could see this slowdown as a negative sign, potentially leading to a selloff following the earnings release (similar to what happened in Q2 2024, where the share price declined by 17% due to these concerns).

If there is such a pullback following the Q3 earnings release, then I will reconsider my Hold rating. However, I need to see first an update on management’s outlook on the full-year results, before I can upgrade my rating to a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.