Summary:

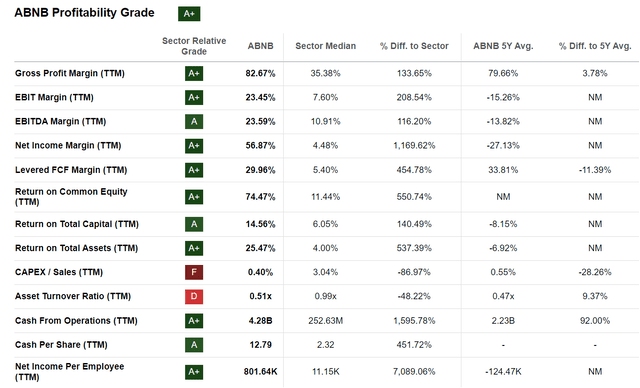

- Airbnb has significantly improved its profitability with a 23% EBIT margin and bookings trending over 20% above pre-COVID levels.

- The travel industry has performed better than expected, and leisure travel is expected to align with GDP growth.

- Looking into 2024, I expect booking growth for Airbnb to accelerate again, as consumer sentiment is poised for a strong year on falling inflation and interest rates.

- I am revisiting my thesis on Airbnb stock, and now calculate a fair implied target price of around $154/share. “Buy”.

Kenneth Cheung/iStock Unreleased via Getty Images

I have previously voiced negative sentiment on Airbnb (NASDAQ:ABNB) stock, as I have been concerned about the company’s valuation, as well as unsustainably high bookings post-COVID. However, six quarters following my initial assessment, I argue in favor of a major rating upgrade for the world’s largest travel company: I point out that Airbnb has managed to aggressively improve its profitability over the past few quarters, today operating at a 23% EBIT margin. Moreover, travel volume post-COVID has held up much better than previously projected and feared, as bookings today trend >20% above pre-COVID levels despite macro headwinds. Looking into 2024, I expect booking growth for Airbnb to accelerate again, as consumer sentiment is poised for a strong year on falling inflation and interest rates.

On the backdrop of supportive, and likely improving, commercial momentum I update my EPS estimates for Airbnb through 2028; and I now calculate a fair implied share price of $154.

For context, Airbnb stock has outperformed the broad U.S. equities market in 2023. For the trailing twelve months, ABNB shares are up about almost 48%, compared to a gain of approximately 20% for the S&P 500 (SP500).

Resilient Travel Demand Supports The Airbnb Buy Thesis

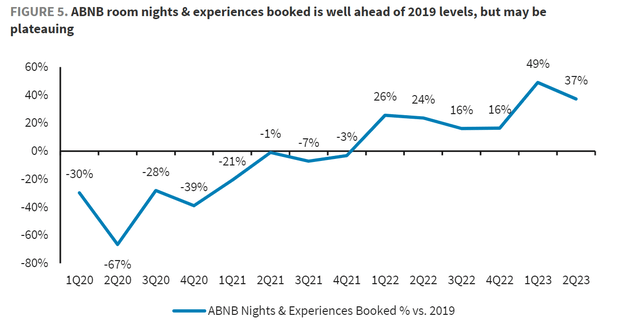

In 2023, the travel industry performed much better than expected, owing to the unexpected resilience of consumer spending despite notable macro headwinds. In that context, fears that leisure travel would bounce back to pre-2019 levels, following a period of pent-up demand, proved quite unnecessary. In fact, it is reasonable to expect that global leisure travel, Airbnb’s core audience, has comfortably stabilized at about 20% higher levels compared to 2019. In that context, Airbnb has captured much of the post-COVID demand, with Barclay’s mapping Airbnb’s booked experiences about for Q1 and Q2 at +49% and +37% compared to 2019 levels (Source: Barclays equity research note on Airbnb dated 12th December). Looking to next few years, I believe that the overall industry growth will align with GDP growth, which should provide a healthy backdrop for Airbnb’s growth, independent of additional market share gain.

Looking ahead into Q4, BoFA research leverages AirDNA’s estimates to project Airbnb’s fourth-quarter revenues at $2.25 billion, surpassing Wall Street’s expectation of $2.16 billion according to data collected by Refinitiv. If BofA is correct, then Airbnb would log an 18% YoY growth, well ahead of the 12-14% YoY growth projected by Airbnb management. In more detail, AirDNA’s calculations, using a quarterly indexing method, suggest that in Q4 Airbnb had approximately 99.8 million booked nights and a total booking value of $15.8 billion. These figures exceed Wall Street’s forecasts, which anticipated 98.1 million nights and $15.1 billion in bookings. (Source: BofA research note on Airbnb, dated 12th December: November data suggests solid rebound vs October for Airbnb).

Airbnb’s Business Model Is Poised For More Growth

Airbnb, since its inception in 2008, has revolutionized the hospitality industry with its unique business model. Over the years, it has not only transformed how people travel but also how they experience new destinations. Its success story is one marked by innovative approaches to internationalization, adapting to diverse markets, and leveraging technology to meet local needs. In that context, while Airbnb’s core offering as a two-sided marketplace for alternative accommodations may be reaching a mature stage in the U.S and Europe, Airbnb’s potential in emerging markets still presents significant opportunities for growth: Notably, countries in Africa, Southeast Asia, and Latin America, as well as Japan, with their rich cultural offerings and untapped tourism potential, could be key drivers of Airbnb’s future expansion. Moreover, Airbnb’s growth potential also suggests the expansion into more standardized offerings, such as hotels, and cruise ships. In that context, according to Phocuswright, the global hotel booking TAM is projected to reach $557 billion in 2024, a segment that Airbnb has only marginally tapped into.

On a separate note, Airbnb is well-positioned to leverage emerging technologies for structural, secular growth and market share gain. Specifically, recent product updates showcase Airbnb’s commitment to leveraging technology for enhanced service delivery. Specifically, the extensive integration of AI and machine learning for personalized recommendations transforms the user experience from a standard transaction to a tailored travel planning journey. Furthermore, the (likely) adoption of virtual and augmented reality technologies may support digital preview of accommodations and in-stay experiences.

Discussing Airbnb’s growth outlook, investors should consider that any incremental topline is highly value accretive for investors. Specifically, I point out that Airbnb’s business model operates on an 83% gross margin and a 23% EBIT margin, while only needing 0.4% of CAPEX as a percentage of sales!

The Airbnb Experience Is Not Simply Transactional

The Airbnb experience transcends the mere transactional exchange typical of traditional hospitality services. Unlike its competitors such as TUI, Booking.com, and Expedia, Airbnb has successfully differentiated itself by creating an ecosystem that fosters authentic experiences, distinguishing itself through a blend of personalization, community connection, and cultural immersion.

During Airbnb’s 3Q23 earnings call, CFO Dave Stephenson emphasized that Airbnb is increasingly focused on inspiring travelers rather than just facilitating transactions. By optimizing the search experience to prioritize inspiration and multi-session conversion, Airbnb demonstrates a clear strategy to engage users over a longer period. This reflects Airbnb’s commitment to being an inspirational platform that encourages exploration and discovery, rather than a mere transactional service for booking accommodations.

Airbnb’s inspirational, rather than transactional nature, supports cheaper and more engaging platform traffic. Unlike its peers who incur substantial costs in traffic acquisition, Airbnb’s strategy focuses on generating direct traffic. This approach not only reduces dependency on paid advertising but also enhances profit margins. Moreover, Airbnb’s strength in attracting direct traffic also affords the flexibility to undertake more daring initiatives and embrace higher levels of risk. This ability is crucial in an industry that is rapidly evolving and increasingly competitive.

Adjust Target Price to $154

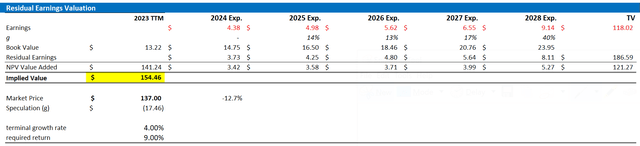

Reflecting a bullish backdrop, and in line with updated analyst consensus EPS estimates for ABNB through 2028, I structure a residual earnings model for the company’s stock. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

With regard to my ABNB stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal till 2028. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on ABNB’s cost of equity at 9%, which is approximately in line with the CAPM framework.

- For the terminal growth rate after 2025, I apply 4%, which is about 100-150 basis points above the estimated nominal global GDP growth. The growth premium should reflect structural growth of experience-centered consumption.

Given these assumptions, I calculate a base-case target price for ABNB stock of about $154/share.

Seeking Alpha; Company Financials; Author’s Calculations

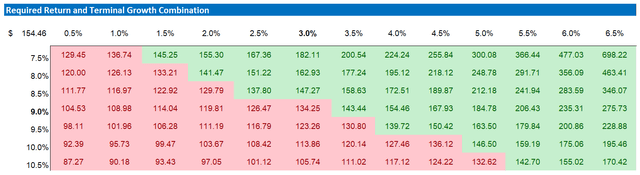

As I argued that my estimates for growth and equity charges may be conservative, I acknowledge that investors may hold varying assumptions regarding these rates. Therefore, I’ve included a sensitivity table to test different scenarios and assumptions. See below.

Seeking Alpha; Company Financials; Author’s Calculations

Investor Takeaway

Previously, I voiced concerns about Airbnb’s high valuation and perception of unsustainable post-COVID travel demand. However, the company’s performance in the trailing twelve months have prompted me to reconsider my thesis. Despite macroeconomic headwinds, Airbnb has maintained strong travel volumes (above 2019) and is poised for further growth in 2024, bolstered by improving consumer sentiment and economic factors like falling inflation and interest rates. Moreover, the company’s expansion into emerging markets, coupled with its potential in diversified offerings such as hotels and cruises, make me bullish on Airbnb’s structural growth potential. Based on these factors, I am revisiting my thesis on Airbnb stock, and now calculate a fair implied target price of around $154/share. “Buy”.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.