Summary:

- We found Airbnb’s Q3 results moderately positive.

- Airbnb’s key business metrics showed decent growth rates amid a challenging macro backdrop.

- For FY 2025, we anticipate revenue growth to decelerate to 6%-8%, and EPS from $3.32 to $3.67.

- We believe Airbnb is overvalued now, and anticipate headwinds in the short term.

stockcam

Shares of Airbnb (NASDAQ:ABNB) plummeted by 8.66% on 8 November as Q3 earnings released.

Its key business metrics still show decent growth rates amid a challenging macro backdrop. The key financial figures and business metrics for Q3 are listed below:

- Revenue: $3.73B (+10% YoY)

- Earnings per Share: $2.13 (-67.9% YoY)

- Free Cash Flow: $1.1B (FCF margin at 29%)

- Take Rate: 18.6% (flat YoY)

- Number of nights and experiences booked: 122.8M (+8% YoY)

- Gross booking value: $20.1B (+9.84% YoY)

- Gross booking value per night and experience booked: $163.64 (+1% YoY)

The slash in EPS resulted from the valuation allowance release of the U.S. deferred tax assets of $2.8 billion in 2023. Excluding this non-recurring factor, Airbnb’s net income of Q3 dropped from $1,605M in 2023 to $1,368M in 2024.

Discussion of Q3 Results

Q3 Results

First, Airbnb showed some good progress in improving the quality of stays.

Fluctuations in quality have long been one of the primary reasons that people may avoid Airbnbs. In view of this, the company removed over 300,000 listings as they failed to meet guest expectations over the past 12 months. Host cancellation rate was also down 30%.

They also introduced co-host feature to allow experienced hosts in the area to manage others’ Airbnb.

A series of improvement initiatives have improved customer experiences, which brought average rating of stays up while incident rates have gone down.

Second, Airbnb recorded decent growth in Q3.

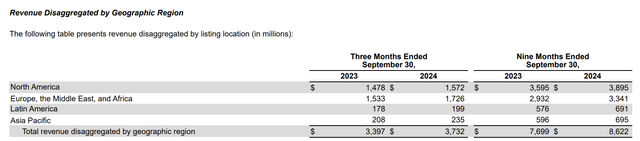

Benefiting from the Paris Olympics, the Europe, the Middle East and Africa (EMEA) market grew by 12.6% in the reporting quarter. Meanwhile, in Asia Pacific, the weakening of Japanese Yen and Korean Won propelled cross-border travel from nearby regions. Revenue from this area jumped by 13.0%.

Number of nights and experiences booked, and gross booking value also recorded ~8% and ~10% growth, respectively.

However, subsequent to strong rebound from the pandemic, there was a gradually moderating trend in most key metrics.

| 2023 FQ3 | 2024 FQ3 | |

| Revenue (YoY %) | +18% | +10% |

| Gross Booking Value (YoY %) | +17% | +10% |

| Nights and experiences booked (YoY %) | +14% | +8% |

| Gross booking value per night and experience booked (YoY %) | +3% | +1% |

| FCF Margin | 39% | 29% |

(Data abstracted from Airbnb 10-Q, compiled by Value Voyager)

Meanwhile, we observed a notable increase in expenses (25%+) for product development and sales and marketing.

As the management explained:

In marketing, we continue to invest in our global expansion markets in our comm strategy around icons and then also Performance Marketing where we’re seeing really great efficiencies.

Therefore, margins are compressed due to incremental expenses, which led to a 14.8% drop in net income (excluding tax benefits in 2023).

And finally, the company repurchased $1.1B of stocks in Q3 2024, reducing fully diluted share count to 665 million at the end of Q3 2024.

Discussion

We found Airbnb’s Q3 results moderately positive.

We’re positive to see the company striving to improve stay quality and enhance customer experiences.

Research done by Sánchez-Franco and Aramendia-Muneta revealed proximity to tourist attractions, staff recommendations and staff interactions and professionalism are the three most crucial features regarding customer satisfaction in an Airbnb.

Positive customer experiences can retain customers and drive key business metrics up. If people enjoy their stays in an Airbnb on prior trips, they have a high chance of staying in an Airbnb again.

We also see plenty of growth opportunities in Latin America and Asia Pacific, where the development of Airbnb is still in its early innings.

For instance, Japanese tourism exploded post-pandemic due to weakening of the Japanese Yen. Japan received 17.7 million tourists in the first half of 2024, up 65.9% from 2023, or up 6.9% from 2019.

This creates opportunities for Airbnb in an under-penetrating market.

But we believe both supply and demand for Airbnb in Japan are insufficient for the company to capture full advantage of the trend.

South Korea, China, Taiwan and the U.S. visitors took the top spots for most visitors visiting Japan. Asians, including Japanese, aren’t familiar with Airbnb, and cultural differences may halt them from hosting. Also, local regulations have pulled them back from using the platform, as the Japanese government has permitted Airbnb hosts to operate for a maximum of 180 days per year only.

On the contrary, budget hotels (e.g., APA hotel) are well established in Japan in convenient locations.

If we look back a few years earlier, Airbnb quitted the Chinese market because of intense competition.

Therefore, we doubt the efficiencies of spending in sales and marketing in newer markets. The increase in spending in sales and marketing outpaces growth in Latin America and Asia Pacific.

Projection on FY2025

Airbnb’s Q3 results reaffirmed the slowdown of growth. It’s merely possible that Airbnb would pick up a 30%+ increase in revenue, as if in the pre-pandemic era.

The following factors may hinder Airbnb’s growth rate next year:

1. Paris Olympics causes tough comps in Europe for Q2 and Q3 FY2025

2. Persistently cautious consumer sentiment

3. Weakening US dollar

4. Regulatory challenges in newer markets

We anticipate revenue growth to decelerate to 6%-8% in FY2025.

Under the regime of President Trump, corporate tax rates shall decrease from current 21% to 20%, which shall positively impact the company’s bottom-line.

However, expenses for product development and sales and marketing are likely to rise continually. And we barely see any plan from the company on expense control. The company has $4.2 billion available for share repurchases, which allows the retirement of around 31.3 million shares at the current price, or 4.7% of its share count. Assuming they will fully utilise the budget for share repurchases, we predict EPS for the next fiscal year will be from $3.32 to $3.67.

Airbnb’s Valuation

Below tabulated the 5-year average PE ratio for Airbnb’s competitors.

| Stock Ticker | 5-year Average PE Ratio |

| MAR | 37.20 |

| HLT | 32.74 |

| BKNG | 22.25 |

(Data abstracted from Seeking Alpha, compiled by Value Voyager)

Referenced from Airbnb’s peers and its growth projections, we believe it’s fair to give the company a 25x PE ratio, which is significantly lower than current forward PE ratio (36x – 40x).

Seeking Alpha Quant System also gave a “F Grade” regarding its valuation.

Is Airbnb a Buy?

Airbnb owns an extremely strong branding, which differentiates them from other alternative accommodations and allows them to have their market leading position unchallenged.

As Brian Chesky mentioned in the Q3 earnings call:

I hear them say Airbnb. I am going to book in Airbnb. I am going to get Airbnb. And I think we are really in a category of our own.

There is little doubt that Airbnb shall prevail in the long term. However, we expect short-term headwinds to slow down the growth of Airbnb.

With an unattractive valuation now, we see mostly downside from Airbnb. We expect the stock to underperform the broader market in the next 12 months due to the reasons stipulated in the article.

Therefore, we rate Airbnb as a “Sell”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We expect the stock to underperform the broader market in the next 12 months due to the reasons stipulated in the article. Readers should consider the risks of owning it. Value Voyager is not a professional investment advisor. No information in this publication is intended as investment advice to buy or sell any stock, bonds, derivatives, and any other financial instruments. Value Voyager may utilise past market performance to deduce future performance, but it is not guaranteed that the actual result will meet expectation. Readers should conduct their own research and due diligence before making any investment decision.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.