Summary:

- Last week, British American Tobacco p.l.c. shocked investors with a £25 billion impairment charge, mainly relating to its U.S. cigarette brands acquired in 2017.

- Given that Altria Group, Inc. only sells its cigarettes in the U.S., British American Tobacco’s news could be a sign of potentially serious issues.

- In this article, I explain why, contrary to expectations, Altria Group will not recognize an impairment charge on its cigarette business. However, this does not mean Altria is better-off than British American Tobacco.

- I will also assess the impact of the upcoming ban on menthol cigarettes and other flavored tobacco products and give an update on the dividend safety of Altria stock.

JohnnyPowell

Introduction

British American Tobacco p.l.c. (BTI, OTCPK:BTAFF) shocked investors on December 6, 2023, with the announcement of a £25 billion impairment charge, mainly relating to its U.S. brands acquired in 2017 (Reynolds American Inc.). The charge mainly resulted from a change in the economic life assessment from an infinite period to a period of 30 years. For those who are interested, I have covered this matter in a separate article on BTI.

Although an impairment charge was expected at some point, it conveys the message that the U.S. cigarette industry is in a worse state than previously thought. This is largely attributable to the post-pandemic accelerated volume decline and the growing importance of smoke-free alternatives. Hence, and due to the looming ban on menthol-flavored cigarettes and other flavored tobacco products (the decision was recently postponed), BTI’s management had to write down the value of its cigarette brands, which include the market leader in menthol – Newport.

However, as Altria Group, Inc. (NYSE:MO) is the only major tobacco company that only sells its products in the U.S., BTI’s impairment could be a sign of potentially serious trouble. I have discussed the ongoing need to offset declining cigarette volumes with price increases (against the backdrop of increasing price elasticity of demand), but also the increasingly limited headroom for margin expansion in other articles (here and here) and so will not address this topic in this update.

Instead, I will take a close look at Altria’s latest balance sheet and explain why Altria – unlike British American – will not be taking an impairment charge in relation to its cigarette business. In addition, I will quantify the expected impact of the ban on menthol cigarettes, as Altria is very exposed to this segment.

Why Altria Will Not Take An Impairment Charge On Its Cigarette Business

At the end of the third quarter of 2023, the carrying value of Altria’s goodwill and other intangible assets amounted to $20.5 billion, or about 56% of total assets. Total intangible assets consisted of the following:

Figure 1: Altria Group, Inc. (MO): Composition of the intangible assets balance at the end of Q3, 2023 (own work, based on company filings)

Over the course of the first nine months of 2023, the balance increased by approximately $3.0 billion, which is attributable to the acquisition of NJOY Holdings. The $2.9 billion transaction added a total of $1.3 billion of identifiable net assets to Altria’s balance sheet, of which $1.4 billion is attributable to amortizable intangible assets (technology, trademarks and supplier agreements). The difference is largely attributable to $167 million in deferred income taxes and $27 million in accrued expenses and accounts payable. The difference between the total consideration and the net asset value ($1.6 billion) was recognized as goodwill on Altria’s balance sheet.

This leaves a total of $17.5 billion in intangible assets (30% goodwill), which justify a closer look.

The lion’s share of Altria’s intangible assets excluding goodwill ($12.3 billion, excluding NJOY) is attributable to trademarks related to the acquisition of UST Inc. in 2009 ($8.8 billion, snuff and chewing tobacco). $2.6 billion is attributable to brands related to the John Middleton Inc. business (cigars), which Altria acquired in 2007. These are assets with indefinite useful lives that cannot be amortized. There remain $947 million of intangible assets, most (or all) of which have a definite useful life and are amortized over a weighted-average period of approximately 18 years. These assets include intellectual property and certain cigarette and e-vapor brands as well as customer relationships and supplier agreements.

Of the $5.2 billion goodwill attributable to acquisitions other than NJOY, $5.1 billion is attributable to the oral tobacco products segment (moist smokeless tobacco – MST – and snus products). Goodwill attributable to Altria’s smokeable products portfolio (<2% of total goodwill, excluding NJOY) has not changed since year-end 2022. The 2022 10-K contains a much more detailed presentation of goodwill and shows that of the $99 million, $22 million is attributable to the cigarette business and $77 million to the cigar business.

I acknowledge that this was probably a lot of accounting words and a lot of numbers, but the message can be summarized into a single conclusion:

Altria has no material intangible assets related to cigarette brands on its balance sheet – either in the form of goodwill (consideration paid on top of net assets) or other intangible assets (e.g., trademarks and supplier relationships). Therefore, and given that British American’s impairment mainly related to some of its acquired U.S. cigarette brands (e.g., Newport, Camel), it would be unreasonable to expect Altria to recognize an impairment on its (de facto non-existent) cigarette-related intangible assets.

At the same time, this means that Altria – unlike British American Tobacco – will not benefit from significant amortization charges. As I discussed in the update under my last article on BTI, the company will be able to take annual amortization as it has changed the economic life of its U.S. cigarette brands to 30 years. Considering that more than £60 billion of BTI’s intangible assets (excluding goodwill) are attributable to cigarette brands, this presents a very compelling opportunity to reduce the company’s tax burden. However, as I am not an expert on U.K. tax laws, please take this information with a grain of salt.

Turning back to Altria, while an impairment on cigarette brands (e.g., Marlboro) can be de facto ruled out, it is still possible that the company will take an impairment on its Middleton cigar business sooner or later, mainly due to the expected ban on flavored cigars (see FDA proposal and Middleton’s portfolio). However, should Altria follow the same path as British American and recognize the Middleton trademarks as a finite-lived intangible asset, it is quite possible that the company could benefit from recurring amortization over the expected remaining useful life of the asset. However, I would like to reiterate that I am not an expert on tax laws, but according to this article, it is very likely that Altria can benefit from related tax deductions provided the asset is amortized over 15 years.

Assessing The Potential Impact Of The Menthol Ban

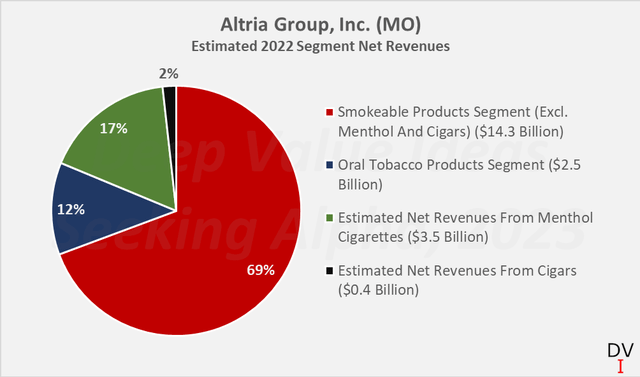

Altria does not report volumes or revenue from menthol cigarette sales in its quarterly updates. However, Altria reports its retail share of menthol cigarettes on a quarterly basis, which was 9.2% in the fourth quarter of 2022 and averaged 9.33% for the year 2022. Altria’s total retail share in the cigarette segment was 47.9% in 2022.

In my estimate, I have assumed that conventional cigarettes and menthol-flavored cigarettes are sold at the same prices. Of course, this does not take into account the contribution of the cheaper discount cigarettes. However, considering that Altria’s market share in discount cigarettes was only 3.1% in 2022, I think the error introduced by this approximation is negligible. I also had to approximate the contribution of cigar sales. Given the barely significant contribution to the total volume of smokeable products (1.7 billion sticks compared to a total of 84.7 billion sticks shipped in 2022, i.e., 2%), I think one can conclude that a 2% sales contribution to the smokeable products segment is a pretty reasonable approximation. Finally, I made the (fairly conservative) assumption that all of Altria’s cigar sales are flavored cigars and thus could potentially be banned.

It follows that in 2022, about 17% of net revenues likely came from menthol-flavored cigarette sales and 2% of net revenues came from (assumed flavored) cigar sales. Considering that Altria’s oral tobacco products segment is likely not profitable, most, if not all, of the company’s free cash flow (currently about $8.2 billion annually) comes from the sale of cigarettes and cigars. Consequently, should the ban go into effect, Altria could lose 21% of its free cash flow, which would bring its dividend payout ratio to just over 100% – Altria would likely have to cut its dividend.

Figure 2: Altria Group, Inc. (MO): Estimated 2022 segment net revenues (own work, based on company filings)

However, it is too conservative to assume that all former menthol smokers quit with the enforcement of the ban. A recently published study from Canada (menthol cigarettes were banned between 2015 and 2018) found that around 22% of former menthol smokers successfully quit their habit. This means that four out of five have either switched to regular cigarettes (here I see Marlboro positively positioned due to its current availability with and without menthol) or to other alternatives (here I see BTI and soon Philip Morris International (PM) at an advantage due to their smoke-free portfolios). The authors of the study also estimated the potential impact of a menthol ban on the U.S. market and concluded that more than 1.3 million smokers would likely quit (or less than 5%, based on the CDC’s 2021 data).

Taken together, a cessation rate of less than 5% (estimate for the U.S.) and 22% (data for Canada) would lead to a decrease in free cash flow of 2.3% to 5.2% (Figure 3). This assumes that all smokers who switch to an alternative cigarette brand remain loyal to Altria brands. However, even if this is not entirely the case, I believe the impact on free cash flow will most likely remain manageable. Hence, I think Altria can maintain its dividend and continue to grow it at a low single-digit rate. Of course, this scenario analysis does not take into account the proceeds from a potential sale of Altria’s stake in Anheuser-Busch InBev SA/NV (BUD), which would significantly reduce Altria’s leverage and improve its dividend payout ratio due to share buybacks (see this article).

Figure 3: Altria Group, Inc. (MO): Scenario analysis modeling the potential impact of a ban on flavored tobacco on free cash flow (own work, based on company filings, Fong et al. 2023 and own calculations)

Key Takeaways

An in-depth analysis of Altria’s latest balance sheet has shown that, unlike British American Tobacco p.l.c., the company will not recognize any impairment of goodwill or other intangible assets related to its cigarette brands for one simple reason: there are no material related assets on Altria’s books. At the same time, Altria will not be able to benefit from resulting amortization charges, which are also likely to be tax relevant under U.K. tax law.

Of course, this does not mean that Altria’s cigarette business is in a better position than that of British American. In addition to the industry headwinds, both companies’ sales (and therefore free cash flow) are likely to suffer if the ban on flavored smokeable tobacco products is implemented, as both are significantly exposed to menthol cigarettes (and Altria also to flavored cigars).

According to my own estimates, Altria generates about 17% and 2% of its net sales from menthol cigarettes and cigars, respectively. Assuming that Altria’s sales would decline by these percentages after the ban, the company’s dividend payout ratio would exceed 100% of free cash flow.

However, this expectation is too conservative, as it assumes a 100% cessation rate of former menthol smokers and that 100% of the cigars sold by Altria are flavored and, therefore, banned. Assuming a reasonable cessation rate range of 5% to 22% (as noted in a recent study), but still assuming a complete loss of cigar-related sales and cash flows, Altria’s consolidated free cash flow could decline by approximately 2.3% to 5.2%. Since the dividend payout ratio will not be affected too much under these assumptions, it can be assumed that Altria Group, Inc. will continue to pay out – and slowly increase – its generous dividend (current yield 9.5%). Of course, this does not yet take into account the positive effects of a possible sale of its stake in Anheuser-Busch.

Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your own due diligence.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, BTAFF, PM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.