Summary:

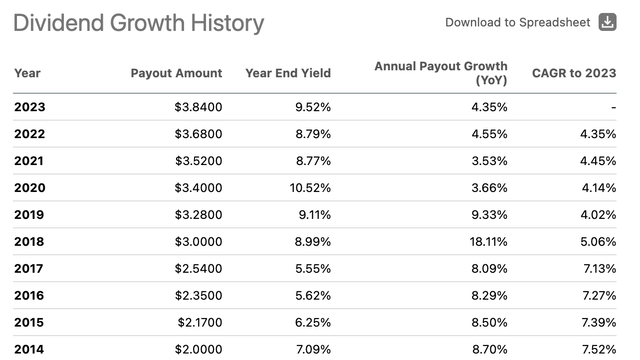

- After growing its dividends on average each year by 7.7% over the past 10 years, tobacco stock Altria’s dividend growth may stall now.

- The company’s stance towards dividends has been altered and given its history of EPS forecasts downgrades, there might be limited room for dividend growth next year anyway.

- But its high dividend yield, share buybacks, and competitive market multiples still suggest an upside for investors for now.

Mario Tama

When I last wrote about the tobacco stock Altria Group, Inc. (NYSE:MO) at the end of December, I was bullish on both its stock price and dividends. While my perspective on its price remains unchanged, after its latest results release, I’m more skeptical about its dividend growth.

In fact, I’m now of the view that they might show a minimal rise at all this year, which is a disappointment considering the 7.7% average growth in the annual dividend payout for the past ten years (see table below). These have played a substantial part in dividends becoming Altria’s unique selling point, with its trailing twelve months [TTM] yield of 9.5%, with the rest on account of its weak price trends.

With this as the context, here I focus on:

- Why do investors need to be prepared for Altria’s dividends to stall or see very limited growth in 2024 after robust growth over the past decade?

- Why despite this, there’s still a Buy case for the stock.

Why dividend growth can stall

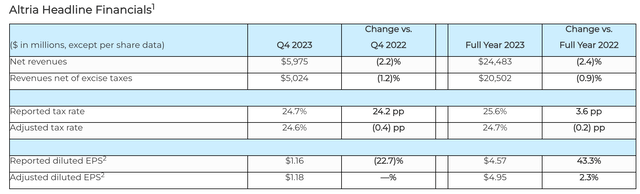

On the face of it, there appears to be no reason to think that the dividends can’t grow further. After all, Altria reported an increase in the adjusted diluted EPS in 2023 to USD 4.95 in 2023 (see table below). However, consider this.

Limited EPS growth can influence the payout

If the company’s dividend payout as a percentage of its adjusted diluted EPS remains static at the 2022 levels of 79.3% the dividend increases to USD 3.93 from USD 3.84 for the past year. This does its forward dividend yield for 2024 to 9.7%, however, the dividend growth itself is just 2.3%, in line with EPS growth, which is far below the average growth seen in the past decade.

Change in company stance towards dividends

In fact, there’s a possibility that it might be even lower based on the company’s forward stance about dividends. Dialing back to the 2023 results release, the company affirmed its goal of the dividend payout ratio at ~80% of adjusted diluted EPS.

But the statement is missing from its latest earnings release. Instead, Altria says “Future dividend payments remain subject to the discretion of our Board.”. In other words, it’s no longer saying it’s committed to the dividend payout ratio. Even if it were to maintain the ratio, dividend growth looks limited, and if maintaining the ratio is no longer in play, it can be safely assumed that dividend growth would be small.

Historical downward EPS revisions don’t bode well

So far, we are still talking about the potential payout in 2024 based on 2023’s earnings. I’m of the view that there’s a risk to dividend growth even for 2025. And this is based on Altria’s tendency to downwardly revise its EPS forecasts.

Let me elucidate. Altria started 2023 with a forecast of USD 4.98-5.13, representing a 3-6% increase in adjusted diluted EPS from 2022. Following another guidance reduction after it acquired NJOY Holdings, to expand its smoke-free product range, the company reduced it yet again with the release of its Q3 2023 results. By the final forecast, it had narrowed the EPS forecast range further to USD 4.91-4.98, an increase of 1.5-3%.

While two earnings downgrades were excessive last year, they weren’t far off from the trend. Altria has reduced earnings guidance in two years prior as well.

This can continue in 2024 as well as the following key metrics soften:

- Altria’s revenues continue to decline, with net revenues down by 2.4% in 2023 after a 2% fall in 2022 as the demand for tobacco continues to slide. Smokeable products, which contribute 89% of the company’s revenues, declined by 3.2%, and shipment volumes for cigarettes fell by 9.9% during the year.

- Further, operating expenses are up by 16.4% in the year after shrinking last year. Particularly with the company’s plans for expanding the distribution of NJOY products, there’s a possibility the expenses can continue to rise, which is bad news for operating income that’s down by 3.1% in the past year.

Limited EPS growth forecast for 2024 anyway

Further, as per Altria’s outlook, only a 2.5% increase is expected in adjusted diluted EPS in 2024, just slightly higher than that for 2023, at the midpoint of the guidance range of USD 5-5.15. Even if it sustains this forecast and maintains its payout ratio, the dividend per share will rise to USD 4 next year. This will be a 2.5% rise, in line with the EPS. While this raises the forward dividend yield for 2025 to 9.9%, considering the possibility of an EPS forecast reduction, there’s a risk to it, however.

Why the price can rise

Outside the dividend talk, however, just like the last time I checked, there’s still a likelihood of a price rise. First, the company’s share repurchase plan, worth USD 1 billion to be carried out during 2024 should also be a sweetener for investors. Considering that the amount is less than 1.4% of the stock’s market capitalisation, it’s unlikely to impact the price much, but there could be a marginal upside impact.

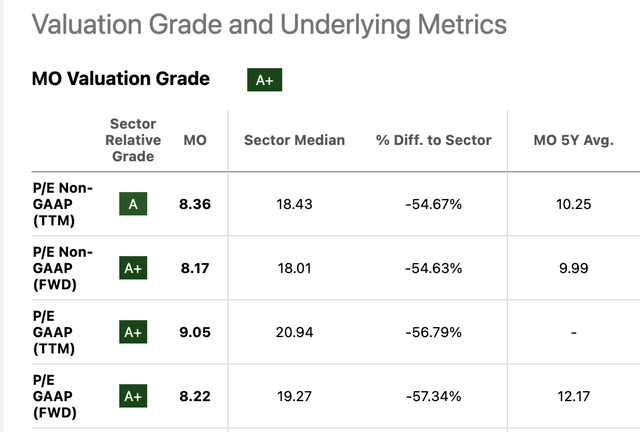

Next, with EPS seen growing going forward, the forward non-GAAP P/E ratio for 2024 is at 8x, which is lower than the 10x average level for the past five years. In fact, the market valuations are all trading lower than their five-year averages (see table below).

What next?

The key takeaway from the discussion is that investors need to be prepared for the possibility of a winding down in the dividend growth party. The stock has richly rewarded investors with passive income over the past decade. And while it’s true that its dividend yield stays strong for now, the dividend growth can slow down.

This is evident from a change in the company’s dividend stance, with no mention of it maintaining its payout of 80% as a percentage of the adjusted diluted EPS. A soft EPS growth itself indicates a smaller likelihood of dividend growth, especially as fundamentals like revenues and operating income weaken. It doesn’t help that Altria’s expectations for next year’s EPS growth aren’t particularly buoyant either, which is made worse by the risk of a downward revision in projections, as seen in past years.

Still, for now, the absolute level of dividends remains high, making Altria a buy purely for its dividend yield. Moreover, the outlook for its stock price is also positive. So this year could be rewarding for investors but over the longer term, a continuation of the high dividend trend can’t be guaranteed.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—