Summary:

- Altria yields 9.4% and the company is committed to further dividend growth.

- Altria’s ability to pay dividends is determined by its financing cash flow and balance sheet.

- It appears that Altria’s dividend is sustainable for the foreseeable future, despite a substantial amount of debt and higher interest rates.

Mario Tama

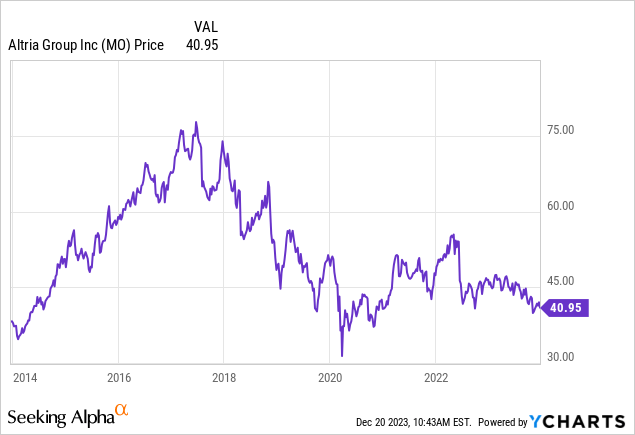

Altria (NYSE:MO) shares performed well for nearly a decade after the spin-off of Philip Morris International in March 2008. The stock appreciated, and the dividend continued to grow at a nearly double-digit rate. An attractive and growing yield has always been one of the primary reasons to buy tobacco stocks, distributions that are fueled by a business that is a little capital-intensive and generates substantial free cash flows. More and more, these dividends can be seen as compensation for shareholders who are willing to invest in an industry that has to deal with secular headwinds.

Obviously, investors have become more concerned about these headwinds in the past years. Since 2017, after outperforming the market for almost a decade and when Altria’s stock reached its all-time high, shares have declined nearly 50%. Continuous capital gains that investors were used to are a thing of the past, however the dividend growth story is still intact. Altria’s distribution is raised year after year, albeit at a slower pace (on average around 4% p.a. since 2020). Consequently, the yield climbs and is approaching the 10% threshold.

The market’s take is that the future is bleak for the tobacco industry. Cigarette consumption is continuously declining, at least in developed countries while regulatory pressure from authorities to ban smoking is increasing. Tobacco companies’ answer is to focus on non-combustible products, a market segment that is growing quickly. However, it remains to be seen if and when smoke-free alternatives will be able to compensate for the loss of the high-margin tobacco products.

Many investors buy Altria shares primarily because of the dividend. A steady income stream is what they count on and not the perspective of outstanding capital gains. Today’s yield based on the current quarterly payment of $0.98 exceeds 9%. Such a yield is comparable to the long-term average annual return of the S&P 500 which lies between nine and ten percent, depending on the period you look at, and the company is committed to further dividend growth. With the release of the Q3 results, Altria’s management confirmed to maintain a progressive dividend goal that targets mid-single digits dividend per share growth annually.

With a dividend yield of more than 9%, investors do not rely on share price appreciation in order to perform in line with the market. They can just sit and wait and collect the growing distribution, provided that the stock does not drop much further. The worst that could happen would be a dividend cut. Such a step would ultimately undermine the rationale to invest in Altria and possibly send shares over the edge.

Therefore, it is very important to question whether Altria’s distributions are sustainable, at least for the foreseeable future. To do so, I will analyze the company’s profitability, financing cash flow, and debt level.

Reliable Earnings Growth

History tells us that major tobacco companies were able to grow earnings steadily year after year although the number of cigarettes sold is continuously shrinking. This can be attributed to price increases so that fewer smokers pay more and more year after year. Can this development go on forever? Surely not, but the strategy has worked for several years now, and tobacco companies proved to be more resilient than many had thought.

Long-term, non-combustible products must replace the cash flows and high margins from declining cigarette sales. Sales in new product categories are indeed growing fast, but profitability must improve as well. Additionally, there is regulatory pressure and stringent monitoring by authorities on the smoke-free alternatives as well.

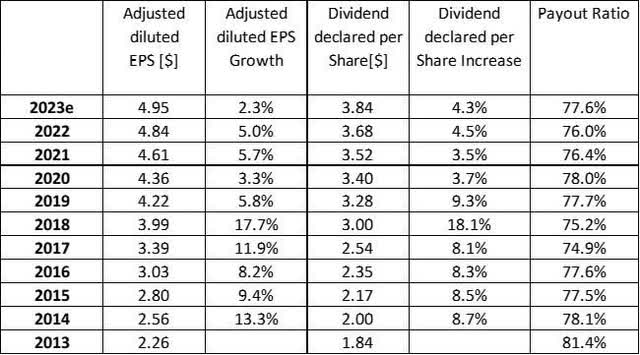

Looking at the actual figures of the last decade, Altria’s EPS has more than doubled from $2.26 in 2013 to $4.84 in 2022. The annual dividend payments have increased from $1.84 to $3.68. The dividend has been raised 58 times in the past 54 years; since the Philip Morris International spin-off in 2008, there have been 19 raises. Altria targets a payout of 80% of adjusted diluted EPS, and the payout ratio has been fairly constant at close to 80% for a decade.

2023 turns out to be a difficult year for Altria, and adjusted diluted EPS will only grow from $4.91 to $4.98 as outlined in the latest quarterly earnings release. This translates into a growth rate of 2.2% at the midpoint, the lowest in a decade and less than what would be required to compensate for the 4.3% dividend raise in 2023.

Altria EPS and Dividends 2013-2023

Source: Company reports, own calculations.

The years 2022 and 2023 have been challenging for Altria for several reasons. High inflation reduces disposable income and particularly consumer discretionary spending on tobacco products. This leads to an accelerated decline in cigarette volumes and more switching from branded to discount products. A hint is the market share of Altria’s Marlboro brand which fell from 42.9% in 2021 to 42.5% in 2022 and further to 42.1% during the first nine months of 2023. Possibly, this trend might reverse again in the coming year. Lower inflation could lead to lower-than-expected cigarette volume declines and also help Altria regain market share in 2024.

The figures above definitely prove that Altria has been able to grow EPS and the dividend per share steadily, even in a more challenging market and regulatory environment. My take is that further growth in the coming years is still possible, albeit at a lower rate. The solidity of the company’s balance sheet plays a crucial role here, and I will outline some key aspects.

Financing Cash Flow Analysis

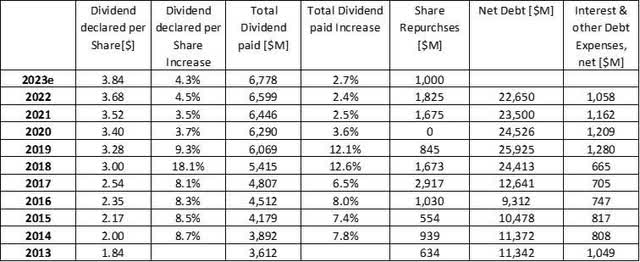

Since the Philip Morris Spin-Off, Altria has returned more than $86B to shareholders (which by the way exceeds the company’s current market cap of $73.2B). The majority of payments were dividends ($70.3B), but share repurchases have gained importance in the past decade as the retired shares help to increase EPS and reduce dividend payments.

Altria’s dividend increases have led to higher total distributions that were partly attenuated by buybacks. In absolute figures, dividend payments have grown from $3,612M in 2013 to $6,599M in 2022. Share purchases have slowed down the growth of the total amount paid, particularly in recent years when the declining share price allowed the company to buy back a greater number of stocks. Nevertheless, the percentage dividend growth has been higher than the percentage of shares repurchased, therefore the total amount paid has still increased.

In absolute terms, dividend payments have risen by $156M and $153M in 2021 and 2022 and will grow slightly faster in 2023 due to reduced buyback activity. Based on the number of shares outstanding after Q3, the current dividend of $0.98, and dividends of $5,040M already paid in the first three quarters, Altria’s dividend expenses will increase by about $170M in 2023. In my opinion, further total distribution growth at a similar level is manageable as long as EPS continues to grow at a low single-digit rate.

Altria Key Figures 2013-2023

Source: Company reports, own calculations.

Ideally, Altria would be able to buy back and retire enough shares so that the absolute dividend distribution would remain constant. This would increase Altria’s flexibility over time as long as the operational cash flow continues to grow. However, it would require a substantial increase in buyback activity.

Today’s low price is an advantage for Altria since it allows it to buy back more shares. Altria bought back shares for $1,675M in 2021 and $1,825M in 2022 under the $3.5B authorization. At the beginning of 2023, the company announced a new $1.0B repurchase program which will be completed by year-end. I would not be surprised if the next authorization comprised even a higher volume to give the company more flexibility. If this happens, it could also be a hint that Altria intends to monetize its Anheuser-Busch Inbev stake soon.

Debt Profile and Outlook

Another key aspect to assess whether Altria can achieve its dividend growth goal is the company’s debt level and the cost of debt. Unfortunately, Altria made some costly mistakes when it came to acquisitions in the past with the consequence that the company’s debt level is much higher than it had to be. The company’s net debt exploded from 2016 to 2018 after investing $12.8B in Juul and $1.8B in Cronos – investments that are almost worthless today.

In 2023, Altria made the next acquisition and bought NJOY Holdings for $2.75B. The takeover has essentially been funded through payments from Philip Morris (PM) to whom Altria sold exclusive U.S. commercialization rights to the IQOS system for $2.7B, so the transaction only had a negligible impact on the company’s debt. However, Altria cannot afford to write down another costly takeover, and it is crucial that NJOY becomes a profitable business that increases future cash flows.

Altria also benefitted from lower interest rates for nearly a decade, and the cost of debt became gradually cheaper. The steep rise in interest rates since 2022 means that Altria has to pay much more for new debt. For example, Altria USD five-year bonds issued in November 2023 carry a coupon of 6.2%. This compares to 2.35% for similar bonds issued in 2020.

Despite higher interest for new debt, the company’s overall position remains rather comfortable, having secured low interest rates by issuing long-term bonds when rates were historically low, and only a small portion of the debt is maturing in 2024 and 2025. Fortunately, it appears that interest rates have already peaked and if the Fed started cutting rates next year, it would allow Altria to tap the bond market at a more attractive level.

Fitch has reaffirmed Altria’s BBB rating in May 2023 with a stable outlook even after considering the long-term portfolio uncertainties, i.e. the secular cigarette volume declines and the risks associated with new category non-combustible products.

Altria’s net debt development acknowledges the positive trend. The level of $22,7B at the end of 2022 was $3.2B lower than three years earlier. In this context, interest and other debt expenses were reduced by $220M.

AB InBev – Altria’s Ace in the Hole

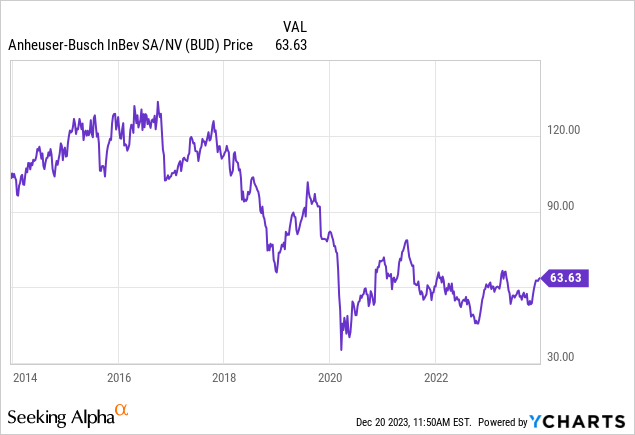

Altria owns 185 million restricted and 12 million ordinary shares of Anheuser-Busch InBev (BUD) which represents a 9.8% ownership interest in the company. The restricted shares can be converted into ordinary shares and sold since the lock-up period has ended in 2021. Based on BUD’s current share price, the stake is worth about $12.2B – more than half of Altria’s net debt.

Should Altria decide to sell AB InBev shares, the proceeds could be used to pay down debt or for additional buybacks to reduce interest or dividend payments. An additional repurchase program might be the preferred option, since it would save the company to pay more than 9% in dividend payments which is much more than the cost of debt.

Shares of AB InBev have performed as badly as Altria’s and have lost half of their value (in USD) since the closing of the SAB Miller takeover in 2016. However, the stock’s recent trend looks friendlier than Altria’s, and it also appears that the outlook for AB InBev’s business is improving. Further share price appreciation to more attractive levels might be a trigger for Altria to reduce its stake in AB InBev.

Altria receives dividends from AB InBev which have a positive impact of around $160M before taxes on the company’s cash flow. However, the current dividend of €0.75 per share (which has been raised from €0.50 the year earlier) is still only a fraction of what it used to be years ago after several dividend cuts and the yield of 1.3% is very meager compared to what Altria pays its own shareholders.

There have been new rumors that Altria might explore a divestment of its AB InBev stake earlier this year, and I think this could indeed be a valid option, probably after a further recovery of BUD’s share price. Altria would not necessarily have to sell the entire stake, but even a partial sale where the proceeds are used for an additional repurchase program would increase Altria’s financial flexibility and foster EPS and dividend growth. It would surely be a catalyst for the beaten-down share price as well.

Conclusion

The market takes a cautious position towards Altria and other tobacco stocks. Continued regulatory pressure, declining cigarette volumes and uncertainty about the future as well as the profitability of replacement products are putting pressure on the stocks.

On the other hand, Altria’s still growing profitability and the increasing dividend contradict the rationale of a dying business. Based on the company’s balance sheet, the financing cash flow, and having a valuable asset (the AB InBev stake) up its sleeve, I consider Altria a reliable dividend payer in the foreseeable future.

Disclaimer: Opinions expressed herein by the author are not an investment recommendation, any material in this article should be considered general information, and not relied on as a formal investment recommendation. Before making any investment decisions, investors should also use other sources of information, draw their own conclusions, and consider seeking advice from a broker or financial advisor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, BUD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.