Summary:

- Amazon Prime Video will release season two of “The Lord of the Rings: The Rings of Power” series on August 29.

- Amazon’s investment seems exaggerated and inappropriate, hitting new records for a series.

- Despite the lack of important financial data, estimates suggest Amazon’s investment in the series could result in significant returns if we understand Amazon’s economics correctly.

Jerod Harris/Getty Images Entertainment

Amazon.com, Inc.’s (NASDAQ:AMZN) Prime Video will release season two of “The Lord of the Rings: The Rings of Power” series on August 29. As summer winds down in the Northern Hemisphere, let’s have some fun trying to solve a problem with very little confirmed financial data. That is, let’s see what the impact of this huge investment could be on Amazon’s financials. We have already done a similar exercise for the series’ first season (not to brag, but it was one of my most appreciated contributions to SA). Now, things have developed (and have become more expensive), so I found myself jotting down a few numbers to understand what is going on and why Amazon seems to splurge hundreds of millions (if not billions) on this series. After all, while fans of the saga may be eagerly waiting for new shows to come out (to then often being disappointed by the outcome), we, as investors, need to understand whether Amazon’s endeavor can turn into a profitable investment or not.

We are before a so-called Fermi problem, that is, an estimation problem because Amazon doesn’t disclose enough financials to help us make easy calculations. For example, we don’t know the exact number of Prime subscribers, and we also ignore how many new members the series added to the Prime ecosystem. Surely, Amazon knows. But it keeps these numbers private.

The premiere of the first season hit a record 25 million viewers in the first 24 hours and the whole show has been seen by at least 100 million people worldwide, with more than 24 billion minutes streamed. However, reports came out that the completion rate (people who watched the entire series of 8 episodes) was only 37% in the U.S., while overseas it reached 45%. Ideally, 50% is the threshold to consider a series successful. This is why in 2022, the series only ranked #15.

Amazon Prime had invited viewers to be patient, as the first season was a bit considered as a setup for the next four seasons, although the last three episodes already picked up a faster and more engaging pace, ramping up the spectacle. The last episode saw a 55.7x increase in viewership, boding well for the upcoming season. The second season seems to finally deal with the big events many fans are waiting for and the premiere of the first two episodes could spark new interest once again.

In any case, while we have to wait to see how the new season will be accepted by the public, we already know Amazon has started filming season three, meaning that the project will go forward. So, Amazon believes it will earn a decent return. Let’s then look at some numbers and see for ourselves what to make of this investment.

We already know Amazon spent $250 million to buy the rights to the appendices of the The Lord of the Rings. Season one saw its costs coming in at around $465 million. The studios were then moved from New Zealand to the U.K. and this may make film shootings a bit cheaper. But I am expecting the second season didn’t cost less than $400 million. This means that Amazon has probably already spent over $1 billion just for the rights and the first two seasons. By the end of the five seasons, we could well see an overall investment of $2-$2.5 billion.

Amazon’s Head of Global TV Vernon Sanders said the financial bet had more than paid off, after season one. While we should actually expect him to say something like this because of his role, chances are that what he states to support this is true saying in an interview with Deadline that the show

… broke records for most global viewers in its first day (25 million) and overall (more than 100 million), for minutes streamed (24 billion) and signups worldwide during its launch window, attracted younger viewers (record number of adults 18-34 for a Prime Video original) and affluent audiences (40% coming from households with income greater than $100,000) – and beyond, boosting Amazon’s sales of J.R.R. Tolkien books on which the series was based.

So, the returns on this bet come from two revenues: new Prime subscriptions and a boost in Tolkien book sales.

Unfortunately for us, Amazon doesn’t disclose its statistics about Prime members very often. We know that it hit 200 million subscribers worldwide in 2020. But since then, there has been no new officially confirmed number. Chances are Amazon is either waiting to hit the 250 million or the 300 million landmark before releasing a new update. So, we don’t even know how many new subscribers Amazon gained thanks to the first season of the show.

What we do know is that in Q3 2022, Amazon reported a jump in subscription services from $8.15 billion for the same quarter of the prior year to $8.9 billion. This is a 9% growth. In Q3 2021, the YoY growth of subscriptions was 24%. But this was Covid-time. However, in Q3 2023 Amazon reported 14.2% growth in subscription revenues. So, both of these comparisons don’t help us visualize whether or not the premiere of season one had a material impact on subscriptions. Actually, Q3 2022 seems to have been rather weak, subscription-wise.

Online stores went better. In Q3 2021 they increased by 3%. In Q3 2022, they were up 7%. But this was also a period of high inflation, and it is difficult to say that a boost in LOTR books was the reason for this result.

In the Q3 2022 earnings call, Brian Olsavsky (Amazon’s CFO) disclosed that:

In the first two months since its launch, Rings of Power has driven more Prime sign-ups globally than any other Amazon Original.

As we said, in Q3 2022, Amazon’s subscriptions increased 9% to $8.15 billion. Considering the then-average fee to be in the range between $90 and $100, and considering the negative FX impact, I concluded that in that quarter Amazon could have added around 2.5 million new subscribers, which was more than enough to repay the investment. In fact, I estimated that Amazon needed one million new subscribers to repay its investment.

Here many may be puzzled: one million new subscriptions don’t generate $1 billion in revenue, but just over $100 million per year. How can this repay Amazon? Amazon would need 5.1 million new U.S. subscriptions to repay just the first season and the rights. How is one million a satisfactory number?

This leads us to the key concept we have to understand: customer lifetime value (CLV). Since many watchers of the series belong to the younger cohorts, we can reasonably expect them to be alive for at least a decade.

All Amazon is doing is building an ecosystem that draws more and more groups of customers in to the allure and please them with all the benefits the membership offers. Once one signs up for Amazon Prime, the retention rate is around 93%, which is very high and positions Amazon Prime just above Costco’s incredibly resilient and growing retention rate.

In other words, Amazon doesn’t need to see its investment repaid in just one year thanks to its subscriptions. It is not a box-office business. Amazon wants to add members because of the stickiness of its ecosystem. As a result, Amazon knows each Prime member will stay around for a long time and will spend – on average – over twice as much as non-Prime members spend.

Some estimate the CLV of a Prime member to be close to $2,300 compared to $916 for non-Prime members. Two years ago, my calculations were a bit different and I considered the CLV of a new Prime member – net of the acquisition cost – to be around $930.

In any case, considering inflation and Amazon’s growth, we could consider the CLV to be estimated at around $1,500. It is probably higher, but it is better to be conservative when dealing with a situation where many assumptions need to be made. This means that by adding just 667k subscribers, Amazon gains a CLV of $1 billion. Since Amazon likely added more than this number of customers two years ago, thanks to the series, we can understand why the bet paid off. This season will then be much easier because Amazon doesn’t even need to amortize the rights cost (even though it could). In this light, $400 million spent for the series doesn’t look as much of a big deal, in terms of content spending. By the way, Amazon spent $19 billion on content (video and music) in 2023 while Netflix spent around $17 billion. The whole series of the three movies was produced with $281 million. This simply helps us understand we are before a different kind of scale when considering streaming services versus legacy entertainment companies.

Back to our estimates. True, this time it seems easy for Amazon to earn a decent return. But there is one objection: Amazon has already made a lot of LOTR fans subscribe thanks to season one, so this new season won’t be able to bring in many more subscribers.

Probably, it is true. But the two-year lag between one season and the other surely gives time for younger customers to grow and become possible new subscribers. However, the main thing to consider is that, between season one and season two, Amazon has launched its ad-supported tier – or, better, – it has offered the chance to upgrade to an ad-free tier by charging $2.99 a month.

Each hour of streaming has around three minutes of ads which makes us think those three minutes are worth at least $2.99 because Amazon is willing to give them up against that extra revenue. Just in Q2 2024, Amazon added $2 billion in advertising revenue YoY, with sponsored ads driving the majority of the advertising revenue. This means Amazon is just in its early innings of exploring the possibilities given by its video advertising business.

Unfortunately, once again we don’t know how many Prime members upgraded to the ad-free tier and how many are sticking with ads. But we know that season one of The Rings of Power captured around 1.25 billion minutes of viewing time in September 2022. This means 20.8 million hours. Considering that now Amazon earns at least $2.99 per streamed hour, we have over $60 million in extra revenue that could come in if season two performs as the first one. In other words, 15% of the content spend will be refunded in just one month of streaming.

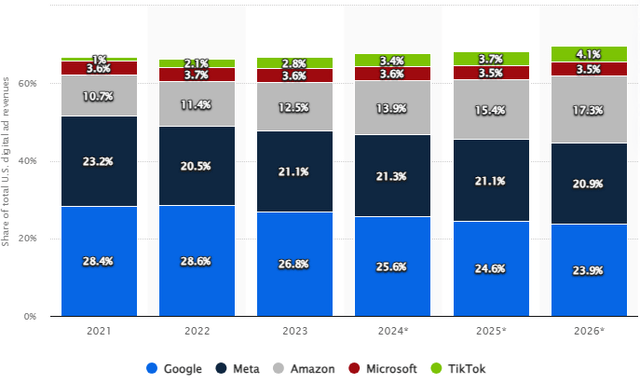

It is impossible to know the impact of extra sales of items related to the Middle-Earth fandom. Still, here, once again, we should expect not only an increase in sales but an increase in advertising revenue on Amazon.com as well. As per Statista, Amazon is the fastest-growing ad-selling company and is on track to increase its market share from 2021 through 2026 by almost 70%, adding 7 percentage points while Google and Meta are expected to lose 4.5 and 2.3 pps respectively.

As we can understand, this is higher margin revenue because it leverages existing assets. Moreover, Amazon is probably the most appealing platform for ads because it is a marketplace, meaning that when we are on the website we are already looking for something to buy. This makes me think Amazon’s ad conversion rate is probably the highest in the industry. The consequence is that customers are willing to pay Amazon more to display their ads because of their effectiveness.

Conclusion

After I learned Amazon’s economics behind this endeavor, I bought my first shares of the company and have since added anywhere between $80 and $160. I didn’t buy it because of AWS, I didn’t buy it because of its ads, I didn’t buy it because of its marketplace. What made me buy it is understanding its whole and unique ecosystem. The second reason that makes me stay long and keep buying Amazon is its scale. This year Amazon has proven to investors that it can rapidly grow its TTM FCF 6.6x ($6.7 billion in Q2 2023; $51.5 billion in Q2 2024) by simply reducing its investments in properties and other assets a little. The company has also informed investors that capex this year will be higher than anticipated because of AI-related spending. So, I am expecting the company to report $55 billion in TTM FCF by the end of the year. But, if Amazon wants to make its FCF explode, it can do so in just a few quarters. Right now, it trades at a 2.8% FCF yield, which is decent for a growing company. But we should remember that before the Covid-related investment cycle, not lengthened by the need for AI infrastructure, Amazon was spending $12-$16 billion in capex per year. Considering it can end this year making well over $110 billion in operating cash, I believe we are before a $100 billion FCF company. This suddenly makes Amazon’s FCF yield 5%, which shows the company is not expensive. Of course, many ask when Amazon will turn into profit mode only. But I am not too concerned about it. Eventually, Amazon will become a cash cow, but we should not underestimate the size and the profitability it will have reached once it gets there.

As a result, I rate Amazon as one of my most convincing picks and still rate it as a buy and consider it one of the best stocks to buy, hold for the long term, and hand over to one’s heirs.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.