Summary:

- Amazon’s future growth potential is often underestimated due to its size, but its unique position in leading growth industries sets it apart.

- Amazon’s online store, 3P sales, advertising, subscriptions, and AWS segments all contribute to its potential $4 trillion valuation by 2030.

- A sum-of-the-parts valuation approach projects steady growth and profitability across all segments, supporting a ‘Strong Buy’ rating for Amazon stock.

hapabapa

Introduction

I’m not revealing anything new when I say that Amazon.com, Inc. (NASDAQ:AMZN) is a giant in the business world and that its growth story has been impressive. However, in today’s article, I’m not here to talk about its past but its future. There is a widespread opinion in the market that when a company is already very large, its growth possibilities are limited. While this is true to some extent (obviously, it is impossible for Amazon to grow perpetually at 30% as in a few years it would surpass the global GDP), I think this limitation is often overestimated, and it is believed that companies the size of Amazon cannot generate value at an attractive enough rate.

Companies like Amazon or Microsoft Corporation (MSFT) are not only well-established giants, but are also the main drivers of the industries with the most significant projections for the coming years. This is something that has happened very few times in history; neither Cisco Systems, Inc. (CSCO) nor Exxon Mobil Corporation (XOM) nor many others that have been the world’s largest companies, have been able to lead new growth industries in addition to the mature markets they already control. The FAAMG companies are a unique case in history and should be valued as such. As Amazon’s own motto says, “It’s still Day 1.”

Despite having risen more than 100% from the lows, I believe Amazon has more than enough potential to grow another 100% in the coming years and reach a $4 trillion market capitalization. In this article, we will break down all of Amazon’s business lines to project each one into the future and ultimately make a sum-of-the-parts valuation, which, I believe, is the most accurate approach for this company.

Online Store

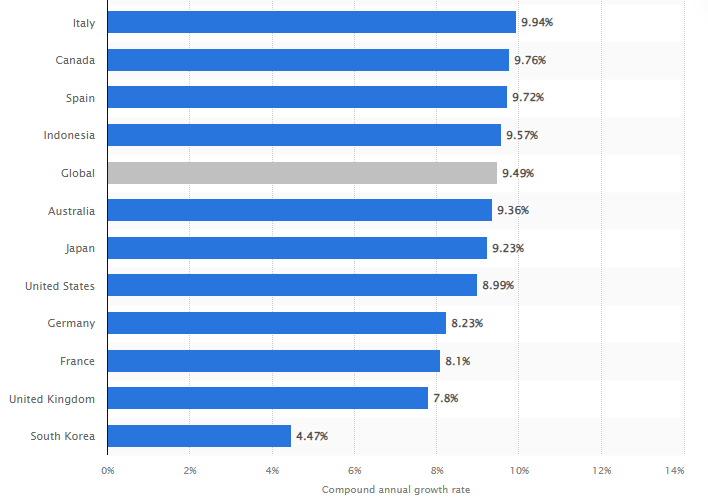

Products that Amazon sells directly on its website account for slightly less than half of the company’s revenue. However, over the years, this has been losing weight in the revenue mix, and although it may not seem like it, this is very good for the company. We will discuss this in more detail later. As for online commerce, even though it is already widespread, we cannot yet say that the market is mature. If we look at the following chart, we see that the compound annual growth rates for online commerce in most developed economies are expected to grow at rates above 8%.

It is especially notable that in the US and Canada, the markets where Amazon has the most presence, growth rates of almost 9% and 10% are still expected. Therefore, just considering that Amazon maintains its market share, which, I think, is very conservative since they offer by far the best service, it would be expected that e-commerce would grow at a similar rate for the company. I also find it noteworthy that in Europe, where Amazon is still consolidating its presence, growth rates of 7-9% are also expected. Therefore, as Amazon gains more market share, which I believe it will, we will see growth rates even in double digits.

Statista

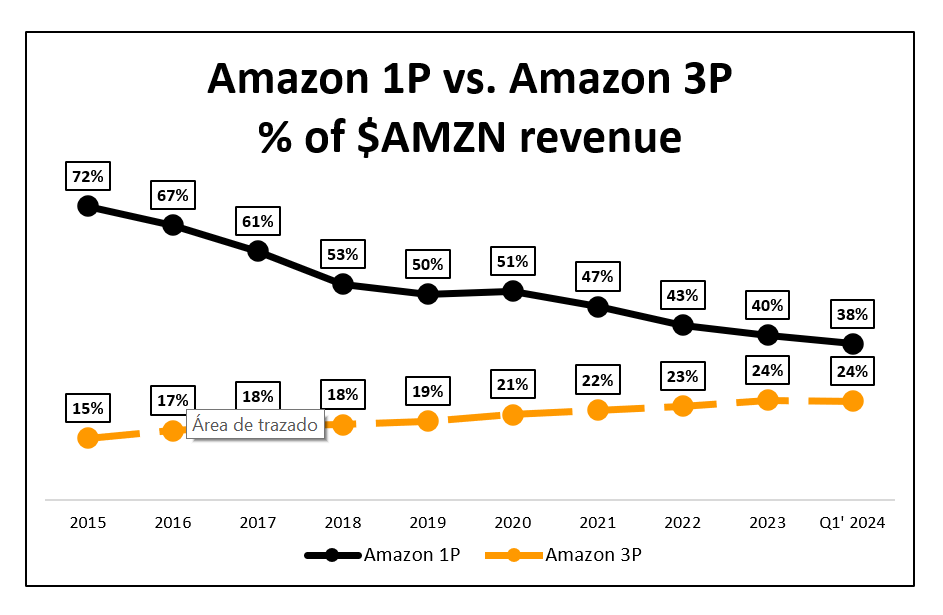

However, I believe that the direct sale of products is not the most important aspect of Amazon, and the growth rates we will see here will not be those we discussed earlier. Where I do think Amazon will grow at those rates and even higher is in 3P sales, which I will talk about next. The most important thing is that thanks to the 1P business, Amazon has built the two parts that I consider most important and difficult in online commerce: the platform and the logistics infrastructure.

First, the platform is key because no matter how good your products are or how beautiful your website is, if no one knows you, it is useless. In this regard, Amazon has managed to create consumer habits so that when people think about buying something, they always think first, ‘What if I buy it on Amazon?’ Through reasonably low prices on many products, the fastest deliveries in the market, and excellent customer service in addition to many other benefits and promotions, Amazon has managed to get into consumers’ minds on a very deep level. Just as when you think about searching for something on the internet, you go to Google without thinking; when you need to buy something online, you go to Amazon.

On the other hand, the logistics infrastructure that Amazon has built is simply unmatchable. The amount of capex that needs to be invested is simply beyond what anyone else can replicate. Amazon’s infrastructure is starting to be better in many cases than that of dedicated companies like UPS or FedEx, with the advantage of being more international. This is crucial because achieving faster shipping breaks the advantage of buying in physical stores, which is immediacy. In 2022, they made the mistake of oversizing their logistics capacity, but this has been corrected over time, and they are now returning to positive operating margins with a forecast of continued growth.

3P Business

Once we see how Amazon has already built the most difficult part of e-commerce, which is the distribution platform and logistics, the next move they took makes perfect sense: using this to offer it as a service to third-party companies. For an external company, the most challenging aspect of selling online is getting traffic to your store, so the showcase that Amazon offers is simply unrivaled. We have already seen how terribly expensive it is to achieve the platform and distribution, so as I see it, for 95% of companies, selling on Amazon has more advantages than disadvantages.

Considering that the commissions Amazon charges can reach up to 35% of the product value, and even higher if the product is shipped using their logistics, and that the cost for Amazon is highly optimized thanks to its scale, this business has substantially higher margins than direct product sales. Therefore, it is very positive to see how this segment has grown at much higher rates than direct sales. Amazon is becoming a service company more than a product company, and 3P is perhaps what has contributed the most to this.

CAESAR CAPITAL substack

Therefore, in 3P, Amazon has a business that grows far above GDP (e-commerce), with the largest platform in the market, the largest logistics network in the world, and very little competition due to the enormous costs it would take for rivals to match Amazon’s scale. In summary, we could say that Amazon is becoming a fee on global online commerce, which, as it continues to increase the efficiency of its logistics network, will become something really profitable, just like other similar businesses in other sectors such as Booking Holdings Inc. (BKNG) in hotels or Visa Inc. (V) in electronic payments.

Advertising

Once the distribution platform is created, which is the most complicated part as we mentioned, many ways to monetize it arise, and advertising is perhaps the most logical. Advertising on Amazon works very simply: the more you pay, the higher you appear in the searches for certain products, very similar to how it works on Google.

However, advertising on Amazon is much more effective than on Google or social media because when a user is searching on Google or scrolling through social media, they are not necessarily looking to buy anything, making it much harder to grab their attention. On the other hand, when users search for something on Amazon, they are in “shopping mode,” meaning they are actively looking to buy something. This makes appearing in the top search results on Amazon much more valuable than appearing in a social media feed.

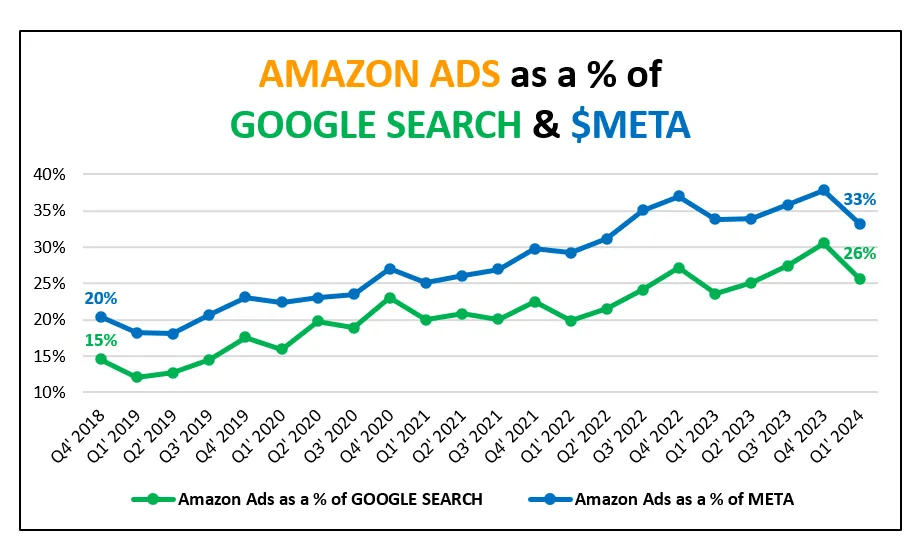

The biggest proof of this is analyzing how advertising on Amazon has grown compared to Alphabet or Meta, and as you can see, we are talking about much higher growth rates in recent years. In the following graph, you can see how advertising revenue now accounts for a third of Meta’s and a quarter of Google Search’s, when just six years ago it was 20% and 15%, respectively.

CAESAR CAPITAL substack

So, if we take into account the significant advantages that online advertising has over traditional advertising and that Amazon has an advantage within online advertising, it is very likely that we will see growth rates in the advertising segment far exceed double digits in the coming years.

Subscriptions

Another way to increase the monetization of your platform is through subscriptions. Amazon Prime is an almost mandatory subscription if you live in a large American or European city because the value you receive with it is far greater than its cost. This has always been Amazon’s idea with this subscription: to make the customer feel like they must pay for it because it feels as if they’re getting things for free. In reality, it’s ideal for Amazon because whether it’s through the series and movies on Prime Video, the music on Prime Music, the cloud storage, or the many other benefits it offers, every customer who subscribes to Amazon Prime becomes part of the ecosystem and is more likely to make their purchases on Amazon. You might sign up because you want to watch the new Fallout series, and you end up buying your child’s birthday gifts on Amazon since you have free shipping.

Even though it may seem like Amazon charges little for its subscription given the high costs of offering free shipping, producing series and movies, etc., in reality, every customer that Amazon manages to attract fuels its virtuous cycle. The more customers it gains, the more economies of scale it can achieve, and the more profitable its infrastructure becomes, allowing it to continue offering more value to users at the same price, which in turn attracts more users into its ecosystem, thus keeping the wheel turning.

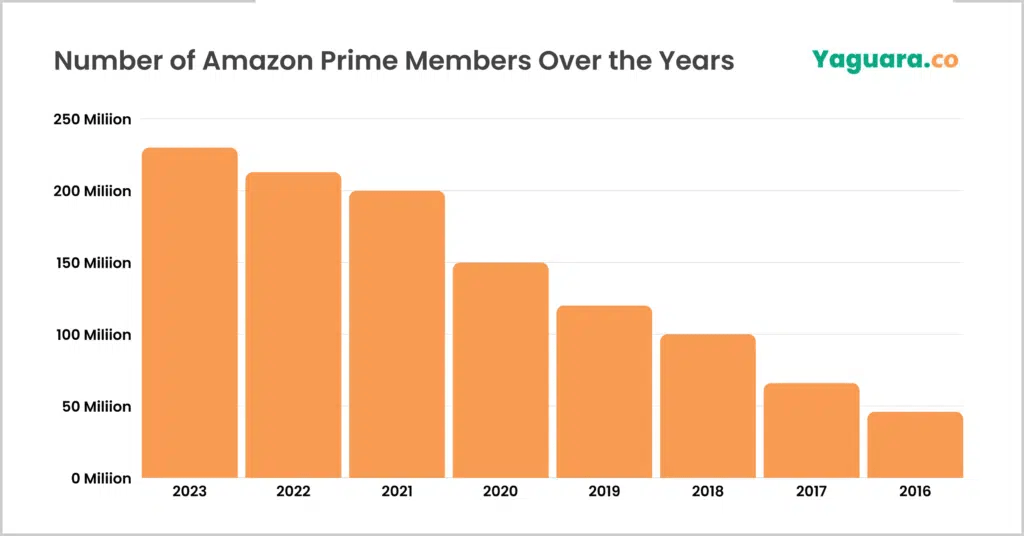

Yagura

Amazon also has other subscriptions like Audible or Twitch, but I believe they are not as relevant as Amazon Prime, which is the one that truly keeps the wheel turning. Prime currently has over 200 million subscribers with a very high retention rate, thanks to the high value it offers, as we just discussed. Although this may seem like a lot, there is still much untapped market potential, especially in Europe where Amazon is still in an early phase and where customers are just beginning to recognize its value.

AWS

I wanted to save for last what many consider to be the crown jewel: AWS. Many people believe that this business is far superior to the rest of Amazon and that it should even be listed separately. Personally, I disagree; I see Amazon as a whole, and AWS is just one part of it. It’s true that the cloud business, being divided among AWS, Azure, and GCP, is one of the best out there today-recurring and with spectacular margins once you reach AWS’s scale-but I don’t think AWS should be viewed as something independent from Amazon.

The cloud business is extraordinary, and although I don’t think AWS will be the long-term winner in this, I also don’t think it needs to be. In this article, I discuss more why I believe Azure will end up being the number one in cloud solutions, but that doesn’t mean I think Amazon won’t take a very significant share of the pie (25-30%). Amazon has the advantage of being the first to enter this space, so they are very well-established and work with some of the best clients, like Netflix. They probably offer the most comprehensive solutions at a very competitive price, making it very difficult for Azure or GCP to steal their customers; instead, they are competing for new ones.

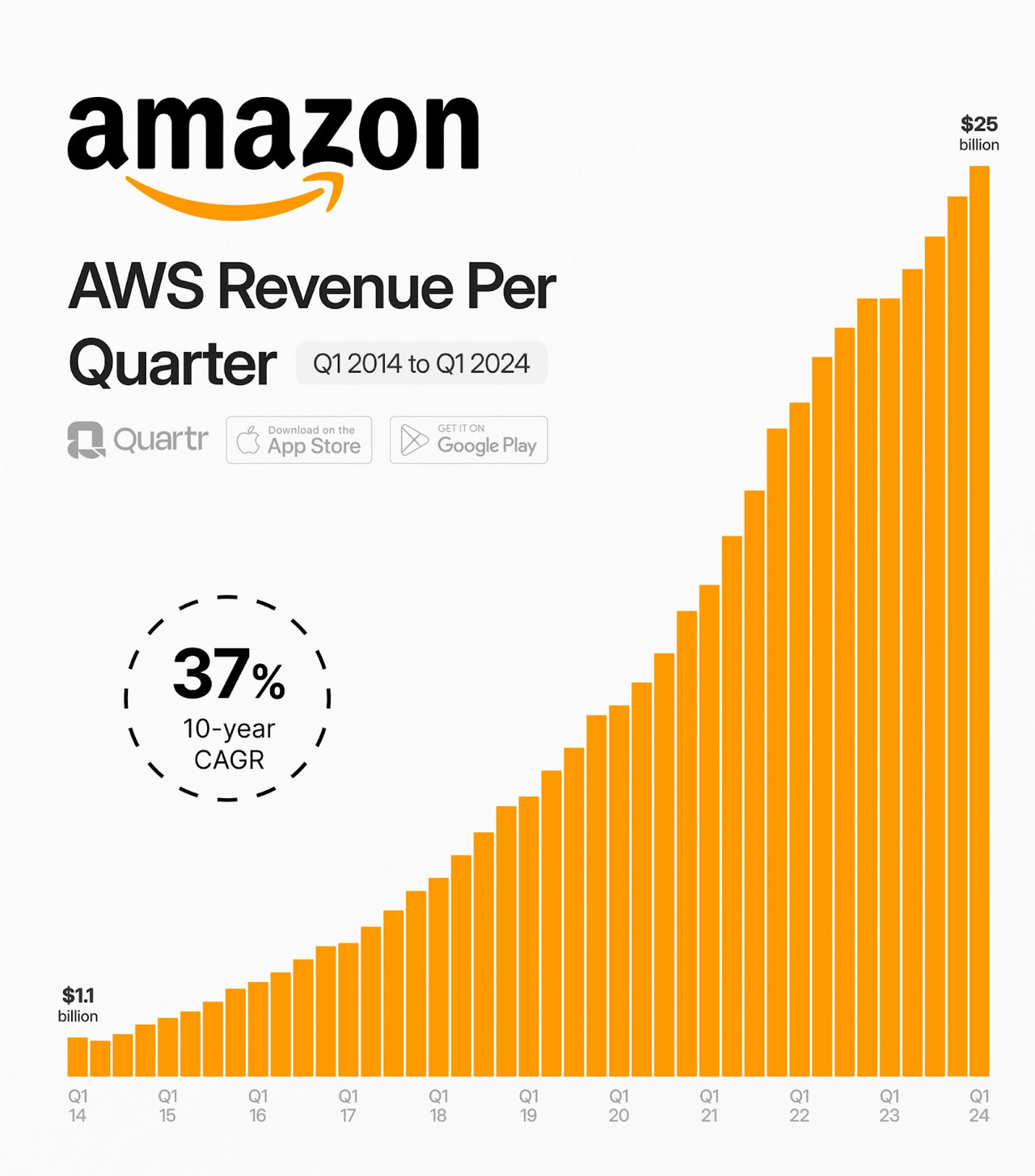

AWS, already a $100 billion business, continues to grow at 18%, which is incredible, and it will likely keep doing so for several more years. The transition to the cloud is still underway, and Amazon will remain a relevant player in the coming years. Moreover, thanks to being the first to start and having captured some of the best clients in the early stages, they have already optimized their infrastructure, achieving operating margins of 40% with AWS.

So, is AWS a key pillar of the Amazon thesis? Without a doubt, but that doesn’t mean the rest of the business doesn’t contribute its share, as we will see later in the valuation. It is just another segment of the company-one of the best and most profitable-but still just another segment in the end.

Risks

From my point of view, the thesis on Amazon carries much less risk today than it did a few years ago. There used to be concerns that their business would never become profitable, but that has now been thoroughly proven wrong. Therefore, as with all mega-caps, the greatest risk might come from regulators. There have often been talks of potential sanctions or even forcing Amazon to break up.

To me, this doesn’t make sense anymore because it’s no longer valid to say that they are operating at a loss and only keeping the company afloat with AWS to clear out competitors. They have managed to become profitable in all their businesses and across all geographies, so I find it increasingly unlikely that this would happen. However, it is definitely a risk to monitor closely because regulatory intervention in Amazon could be a severe blow to shareholders.

Valuation and conclusions

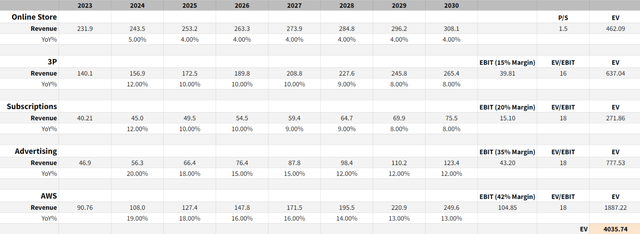

Let’s explain the title of this article: why I believe Amazon will be worth $4 trillion before the year 2030. Among the many possible valuation methods, I have decided to use a sum-of-the-parts approach, as Amazon has so many segments with such distinct characteristics that it would not be fair to apply a single multiple or perform a single discounted cash flow analysis. Let’s look at my personal projections for each Amazon segment and how much I believe each one could be worth.

-

Online Store: We have already seen that Amazon is interested in pivoting its business towards 3P, so I have projected a 4% growth in sales in this area, slightly above GDP growth but well below the 13% of recent years. To value it, I have decided to use a sales multiple of 1.5, giving a value of $462 billion by 2030.

-

3P: Regarding 3P, I expect much more growth in the coming years. Last quarter saw a 12% increase, and I estimate growth between 8-10% until 2030. Thanks to operational leverage and being conservative, I believe they can achieve a 15% operating margin. For this segment, I apply a 15x EBIT multiple, which is in line with Walmart Inc.’s (WMT) historical average, a company with a weaker business model and lower growth.

-

Subscriptions: The subscription business, especially Prime, I believe, has a lot of growth potential ahead, particularly in terms of pricing. I think it’s fair to apply 8-10% growth in the coming years with a 20% operating margin. Applying an 18x multiple, we reach a value of $267 billion by the end of the decade.

-

Advertising: This is one of the segments I expect the most from in the future, as we have already discussed. I project growth rates above 12% for several years. Additionally, I believe they can achieve operating margins of 35% or even higher, much less than those of comparable companies like Alphabet Inc. (GOOG) (GOOGL) or Meta Platforms, Inc. (META) in their advertising businesses. I also use these two companies as a reference to apply an 18x EBIT multiple, which is below the over 20x these two typically trade at.

-

AWS: Finally, I believe AWS will continue to grow at a mid-double-digit rate for several more years, somewhat less than its comparables Azure or GCP, but still at a good pace. To be conservative, I have applied a 42% EBIT margin, very similar to what Azure currently has, and an 18x multiple, which could be even higher. This segment alone could be worth almost $2 trillion on its own if these forecasts, which I find very feasible, are met.

As we have just seen, if we take into account all the assumptions I have just made, which, I believe, are not overly demanding-neither too conservative but still achievable under normal scenarios for Amazon-we reach the conclusion that the company should be worth $4 trillion by 2030. From current prices, this implies more than a 15% annual compound growth rate, which, for a company of Amazon’s size and with its strong history, is enough to warrant a ‘Strong Buy‘ rating for its stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.