Summary:

- Amazon.com, Inc.’s stock has surged over 30% since summer, with a strong recovery and a bullish outlook, targeting $250-300 by year-end 2025.

- Amazon’s Q3 2024 earnings exceeded expectations, driven by Amazon Web Services or AWS’ 19% YoY growth, with significant profitability and cash flow improvements.

- AWS’s AI capabilities and market leadership position Amazon for continued growth, potentially increasing its market share and driving future profitability.

- Despite risks like competition and regulatory issues, Amazon’s valuation remains attractive, with the potential for substantial EPS growth and a stock price of $500-600 by 2030.

tigerstrawberry

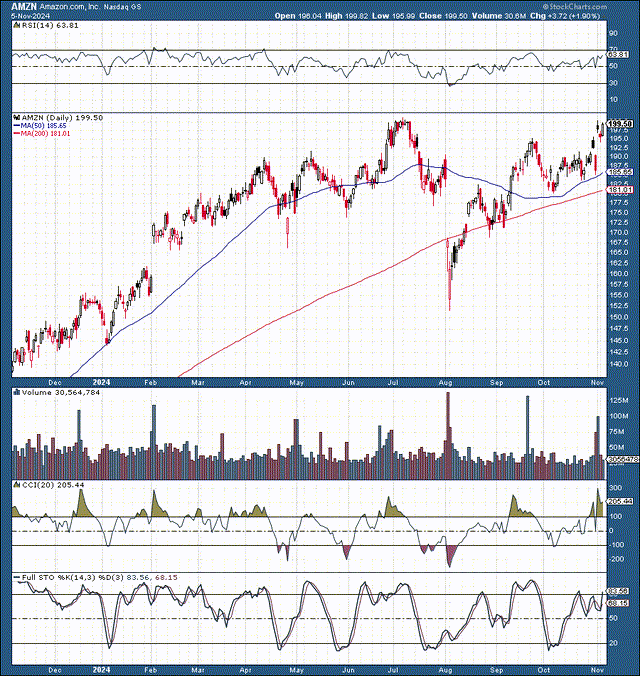

Amazon.com, Inc. (NASDAQ:AMZN) stock surged recently after reporting a better-than-expected quarter. The last time we discussed Amazon in an article, I gave the stock a strong buy rating as it dropped into the $155-150 support zone during the early August flash crash.

Amazon’s stock has had a superb recovery, appreciating by over 30% since bottoming this past summer. Looking back, we see that Amazon is up by approximately 45% over the last year.

Amazon’s momentum and technical image remain highly constructive. Moreover, from a fundamental standpoint, Amazon posted an outstanding quarter, illustrating remarkable performance in its AWS segment.

Furthermore, Amazon continues innovating and may have a competitive edge in AI compared to many competitors. Additionally, Amazon’s stock is relatively inexpensive, and the stock price can move substantially higher as we advance. I remain bullish on Amazon and have a $250-300 price target for year-end 2025.

Amazon’s Bullish Technical Image

Amazon’s stock continues to recover and could break out above $200 soon. While technically, it is not significantly overbought, it may need more time to consolidate before breaking out, and $200-190 is an excellent consolidation zone for the stock. We also see a solid uptrend since the August bottom occurred, with constructive higher lows and higher highs propelling the stock higher. Once the consolidation is over, Amazon could have a considerable breakout to $220 or higher.

Solid Earnings — Amazon’s Increasing Profitability

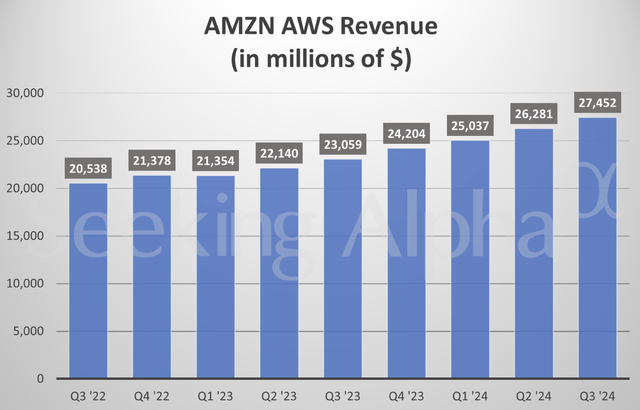

For Q3 2024, Amazon delivered GAAP EPS of $1.43, 29 cents above the consensus estimate, representing a substantial 25% outperformance rate. Revenue came in at $158.88B, an 11% YoY increase, a $1.6B increase over the estimates. Amazon Web Services, or AWS, segment sales surged to $27.5B, increasing 19% YoY.

AWS growth (seekingalpha.com )

AWS continues to shine as the most significant cloud service globally, expanding revenues and reasserting its dominance. Next year, AWS revenues could increase to about $125B, with substantial growth ahead.

We see high-quality companies trading around 10-12 times sales or higher in the cloud, as well as other high growth/high profitability segments. Therefore, AWS could be valued at around $1.25-1.5T.

Operating cash flow increased by 57% YoY to $112.7B. Free cash flow increased to $47.7B on a TTM basis relative to $21.4B a year ago. Guidance-wise, Amazon expects sales growth of 7-11% in Q4, and operating income is expected to be $16-20B, a 20-50% YoY increase.

Amazon’s AI Advantage

Amazon’s AWS enables users to scale the next wave of innovation by leveraging more than 25 years of pioneering AI experience. AWS makes AI accessible to millions, including builders, data scientists, business analysts, and students. AWS provides the most comprehensive set of AI tools, resources, and services to unlock the value of its customers’ data.

In addition, Amazon provides comprehensive generative AI, AI services, machine learning, AI infrastructure, a data foundation for AI, and more. More than 100,000 customers have already chosen AWS for AI to improve customer service, optimize their businesses, create better customer experiences, and more. Amazon’s AI advantage could continue improving, potentially enabling more market share, sales, and profitability gains as Amazon advances.

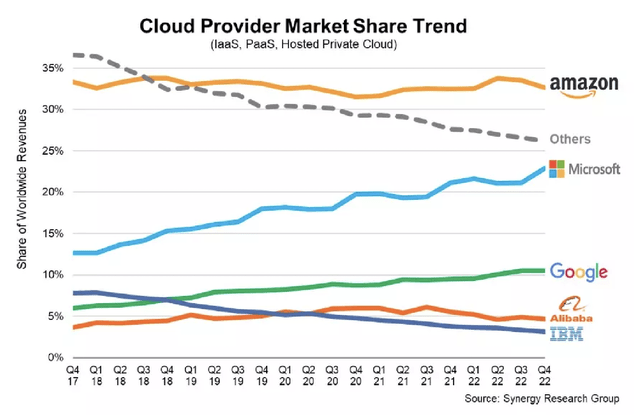

Cloud market share (cloudzero.com )

We see a fascinating market dynamic here. Amazon’s market-leading cloud service has remained around 32-33% market share for years. Furthermore, while Microsoft (MSFT) and Alphabet (GOOG, GOOGL) have gained share, other cloud services have declined, essentially leaving the massive market to “the big three.” Amazon has the top global cloud service, with roughly 33% global share. Moreover, AWS’s market share could increase as it continues making advancements in AI, cementing its spot as the top cloud service globally.

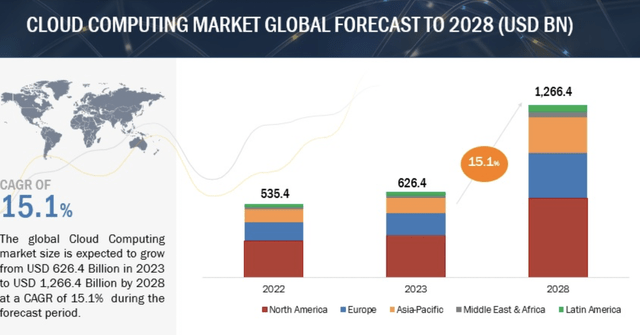

Enormous Cloud Growth Ahead

AWS should continue driving Amazon’s growth and profitability in future years. However, the market may still be underestimating the potential growth in this segment in the coming years.

Cloud growth estimates (marketsandmarkets.com )

The cloud market is expected to expand to about $1.27T by 2028, illustrating a healthy CAGR of approximately 15%. This dynamic implies that AWS could expand even if it maintains its market share at roughly 30-35%. If Amazon can increase its market share, its revenues could expand substantially more than anticipated. Furthermore, Amazon should continue benefiting from AWS’s increasing profitability, recording a remarkably high operating margin of over 38% last quarter (about an 8% YoY increase).

The Valuation Perspective — Amazon Still Inexpensive

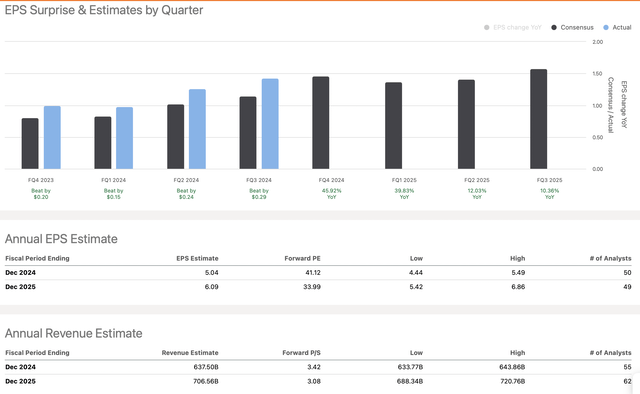

EPS vs. estimates (seekingalpha.com )

Amazon is becoming increasingly more profitable, which is excellent for its share price. The TTM consensus EPS estimate was around $3.79, yet Amazon delivered $4.67 in EPS, demonstrating much better than expected profitability. This dynamic illustrates a healthy 23% EPS outperformance rate.

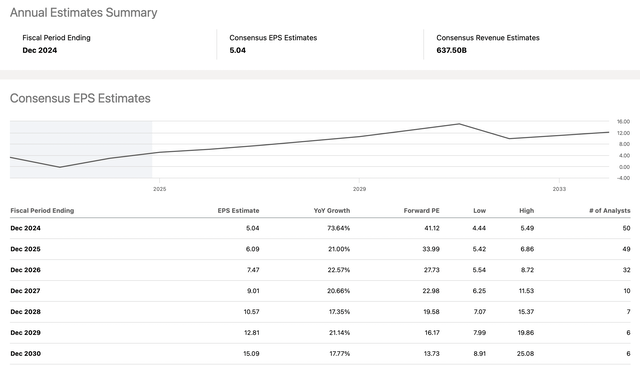

EPS estimates (seekingalpha.com)

The consensus EPS estimate for next year is around $6.10, and for 2026, it is about $7.50. However, due to Amazon’s considerable outperformance and bright financial prospects, Amazon could outperform the consensus estimates.

Applying a modest 15% outperformance rate suggests Amazon could achieve EPS of about $7 next year and potentially EPS of about $8.60 in 2026. This dynamic implies that at approximately $200, Amazon trades around 28 times forward (2025) EPS estimates and about 23 times potential 2026 EPS results.

Even if Amazon achieves my $8 lower-end estimate, it’s trading only around 25 times 2026 EPS estimates, which is relatively inexpensive for a company in Amazon’s dominant market-leading position with a long growth runway and considerable potential ahead.

Where Amazon’s stock could be in future years:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs |

$640 |

$718 | $800 | $896 | $1004 | $1114 | $1225 |

| Revenue growth | 11% | 12% | 11% | 12% | 12% | 11% | 10% |

| EPS | $5 | $6.75 | $8.50 | $10.32 | $12.70 | $15.50 | $18.60 |

| EPS growth | 72% | 35% | 26% | 25% | 23% | 22% | 20% |

| Forward P/E | 33 | 31 | 32 | 33 | 31 | 30 | 28 |

| Price | $220 | $265 | $330 | $419 | $480 | $540 | $600 |

Source: The Financial Prophet.

Amazon could experience 10-15% annual revenue growth in a base-case scenario in future years. Moreover, Amazon’s EPS could increase substantially, appreciating toward the higher end of the estimate range moving forward. Therefore, Amazon’s P/E ratio could remain elevated around the 28-35 range. This bullish long-term growth and increased profitability dynamic could enable Amazon’s stock to move much higher, potentially achieving $500-600 by 2030, or sooner, in a bullish case outcome.

Risks To Amazon

Despite my bullish outlook, Amazon faces risks. Amazon’s AWS could experience slower-than-expected growth and worse-than-anticipated profitability due to advancing competition, general growth issues, and other factors. Furthermore, if rates remain high, Amazon’s profitability growth may be slower than expected. Amazon could also encounter regulatory matters and other concerns that could negatively impact sentiment, reflecting poorly on Amazon’s business. Please consider these and other risks before investing in Amazon.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

QAre You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!