Summary:

- In this article, I express my opinion on why Amazon should follow the example of Alibaba and spin off its business into separate, independent segments.

- This corporate action can unlock the value of its business units by creating more streamlined businesses that are easier for investors to value.

- Based on my new SOTP analysis, the company is 28% undervalued, despite being one of the largest representatives with a strong moat in every industry.

- I believe that the stock will continue to recover in the medium term, even if the spinoff doesn’t happen. So I reiterate my previous Buy recommendation.

David McNew/Getty Images News

Thesis

In this article, I express my opinion on why Amazon (NASDAQ:AMZN) should follow the example of Alibaba Group (BABA) and spin off its business into separate, independent segments, which can provide more flexibility to both the newly formed companies themselves and their investors.

Why Do I Think So?

Spinning off a business can bring many benefits to companies, such as simplifying their operations and allowing them to focus on their core business. This corporate action can also unlock the value of the subsidiary or business unit by creating a more streamlined business that is easier for investors to value, resulting in a higher valuation for both the parent company and the newly created entity. In addition, a spin-off can give both the parent company and the new entity more flexibility to pursue their own strategic initiatives and investments.

That’s likely the reason why Alibaba’s bulls got excited about the news and subsequent official announcement that the Chinese internet company has revealed a new organizational structure – Alibaba’s ADR rose 14% on Tuesday amid the about-flat dynamic of the S&P 500 Index (SPX). The company will now have six business units, each with its own CEO and independent board of directors. These 6 units include cloud intelligence, internet retail, mapping, transactions, logistics, and digital media (including Alibaba Pictures).

In recent reports, it has been stated that Jack Ma, the founder of Alibaba, has returned to China after being absent for a few months – this event has coincided with Alibaba’s recent announcement of a new organizational structure. I believe that the Chinese Communist Party [CCP] has been planning to split up the company for some time, and that would be a condition for Jack Ma’s return.

Such a directive system for managing public companies, which we see in everything that is happening around Alibaba Group, seems to be such an obvious red flag for Western investors that it is not clear to me to this day why anyone other than Chinese citizens would buy stock of this country. Yes, the company is clearly undervalued. Yes, the Chinese economy will continue to recover from the COVID lockdowns. But is the play worth the candle? How well will your interests as an investor be protected? In my opinion, the problem is that the state will not protect you from itself if it is authoritarian. This simple logic should serve as your screener when choosing a long-term investment, just like any other financial screener: sales growth rate, margin, or valuation multiples.

In this article, however, I’d like to highlight a positive development in Alibaba’s management. The decision to spin off a large, complex organization and the subsequent market reaction can serve as a valuable lesson for Amazon, a more established and reliable player in the global e-commerce, cloud, and media markets in terms of geographical reach and jurisdiction.

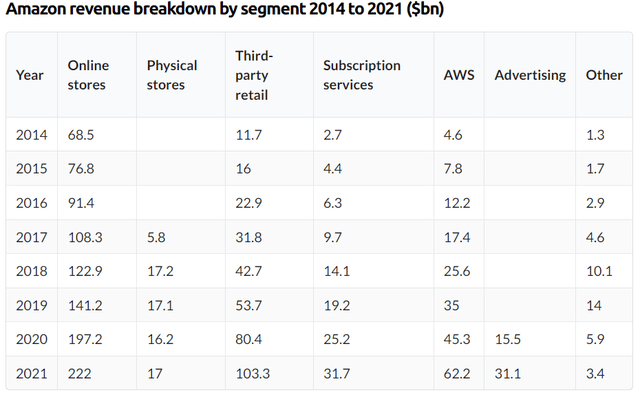

Amazon is the second-largest revenue-generating company in the U.S. and the third-largest in the world [total revenue in FY2022 = $514 billion]. If we look closely at how the company’s revenue dynamics have changed, we find that it has the desire to diversify and is trying to cover the fastest-growing niches at once, which sometimes has nothing to do with what the company originally earned.

Business of Apps, the Company’s data

As I wrote in my last article on the company, the sell-off that the stock has experienced since late 2021 was due to some logical fundamental reasons that have only recently improved. I still believe that the intrinsic fair value per share is much higher compared to the current share price – my earlier findings of $123.2 per share on a consolidated basis still hold.

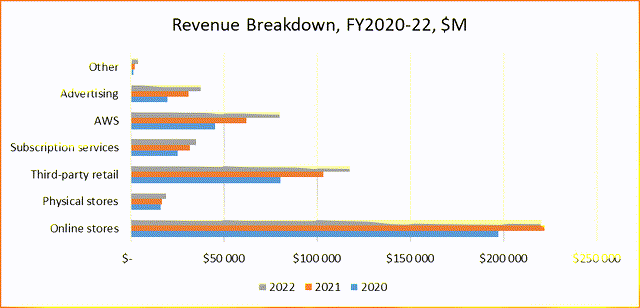

As I see from the latest 10-K filing, in 2022 the company experienced its lowest YoY growth in over 2 decades – however, this slowdown was only due to a slight weakening [-0.9% YoY] in the company’s largest segment [Online stores, 42.8% of total sales]:

Author’s work, based on AMZN’s 10-K

There are multiple reasons for the slower growth in this segment, including the shift of customers back to in-store shopping and the supply chain issues that have restricted sales opportunities for numerous eCommerce companies.

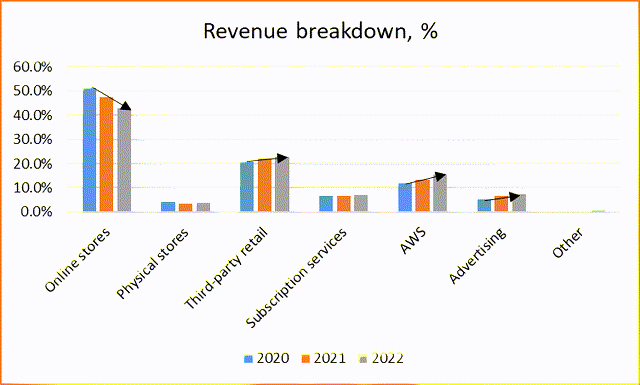

In my opinion, AMZN has experienced a kind of cannibalization of customer traffic – they have flown from one segment [Online stores] to another – Physical stores and Third-party retail. The dynamics of the corresponding shares confirm my conclusions.

Author’s work, based on AMZN’s 10-K

With different growth dynamics, the company’s segments should have different fair values. I suggest looking at the price-to-sales ratio and sales growth in recent years, as well as absolute revenue volumes to derive the final sum.

| AMZN’s segment | Industry | # of companies in the sample | Average P/S | Average FWD sales growth | AMZN’s FY2022 sales | Fair Value |

| Online stores | Broadline retail | 31 | 2.32 | 8.14% | $220004 | $509345 |

| Physical stores | Consumer Staples Merchandise Retail | 11 | 0.87 | 11.58% | $18963 | $16463 |

| Third-party retail | Broadline retail | 31 | 2.32 | 8.14% | $117716 | $272532 |

| Subscription services | Movies and Entertainment | 35 | 2.26 | 24.46% | $35218 | $79613 |

| AWS | Internet Services and Infrastructure | 27 | 4.91 | 17.67% | $80096 | $393301 |

| Advertising | Advertising | 35 | 1.84 | 11.96% | $37739 | $69300 |

| Other | – | – | 3.00 | – | $4247 | $12741 |

| $1353294 |

Source: Author’s work based on Seeking Alpha data

The resulting amount is 28% higher than the company’s current market capitalization [$1.058 trillion, based on YCharts]. That is, based on averages alone, we see that the company is grossly undervalued, despite being one of the largest representatives with a strong moat in every industry in which it is represented!

I believe management needs to follow Alibaba’s led to unlock the intrinsic potential of each segment. Yes, the synergy effect in some areas will be lost – but what’s to stop the potentially disconnected parts of this tech behemoth from continuing to interact with each other on a partnership basis?

Jim Osman from The Edge Research shares my view of Amazon’s potential value in a breakup situation. In his recent interview with Barron’s, he stated that Amazon Web Services, along with the rest of the company, could fetch about $200 within a few years. Currently, Amazon stock is hovering around $100 per share, which is a significant drop from its all-time high of nearly $189 in the summer of 2021. This forecast highlights the tremendous value that could be realized by dividing up Amazon’s various components and positioning them for growth and success.

Concluding Thoughts

Admittedly, there are several notable risks associated with my conclusions and the Buy recommendation. As mentioned in my previous article – “How To Position Your Portfolio For 2023” – we are currently in a turbulent period that is expected to persist throughout the year, and it may culminate in a recession in the mid-year or a bit later.

It should also be noted that the conclusions on undervaluation, which I come to again in today’s article, by no means mean that AMZN should start to grow – a revaluation can take a long time.

However, I still believe that Amazon will eventually decide to do the same thing that the company’s largest Asian competitor has done – decoupling the business units will help shareholders unlock more value. In turn, the companies will get more breathing room and set themselves up for further growth.

But even if the spinoff does not happen, my analysis, which is absolutely different from my earlier DCF-based analysis, has again confirmed the same thing – AMZN is severely undervalued today, perhaps more so than other large tech companies. I think the stock should continue to recover in the medium term. Therefore, I reiterate my previous Buy recommendation.

Thank you for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Struggle to navigate the stock market environment?

Beyond the Wall Investing is about active portfolio positioning and finding investment ideas that are hidden from a broad market of investors. We don’t bury our heads in the sand when the market is down – we try to anticipate this in advance and protect ourselves from unnecessary risks accordingly.

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!