Summary:

- Amazon.com, Inc.’s strong focus on third-party merchants and advertising, to compete with Shopify, Google, and Meta, has stalled in growth.

- Revenue expectations were missed in the first half of the year, with shoppers shifting to cheaper goods and a fragmented marketplace making competition complex.

- Despite solid attention grabbed by groundbreaking content releases this year, there has been no substantial increase in online sales on the platform.

- AWS remains a key Amazon revenue driver with stable growth. However, solid EPS growth being promised this year currently seems unlikely to be repeated in future years.

JHVEPhoto/iStock Editorial via Getty Images

It has been a while since Amazon.com, Inc. (NASDAQ:AMZN) went from being an “e-commerce company with a quirky cloud computing effort” to a “cloud computing company with a costly e-commerce gig and a content business thrown in.” In 2023, the company advanced on its plans to shake the status quo by:

- building outreach to independent third-party merchants by and their customers by offering additional services such as “Fulfillment by Amazon” (FBA) in a bid to stymie the likes of Shopify Inc. (SHOP);

- capturing market share away from Google (GOOG; GOOGL) and Meta Platforms (META) in the business of online advertising (after all, Amazon is a sellers’ platform);

- continuing to make their content business the means of converting shoppers to subscribers and vice versa.

At the halfway mark for this current year, revenue expectations were deemed to have been missed, with the forward outlook decidedly mixed.

Trend Drilldown

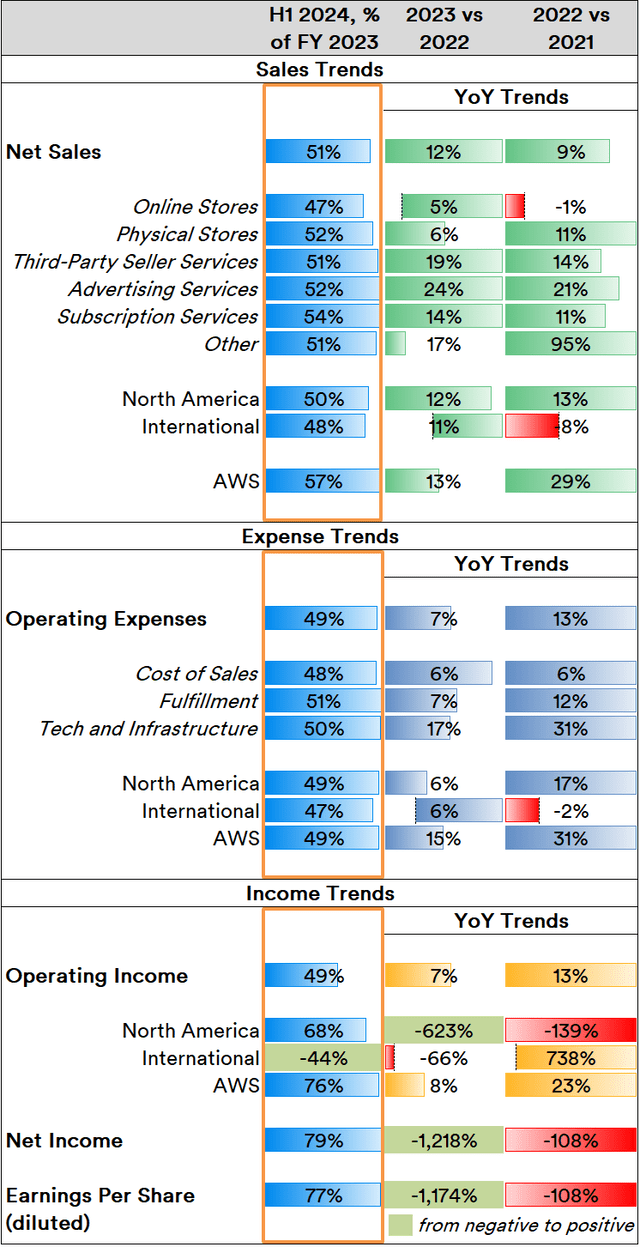

In terms of net sales across all segments as of the first half (H1) of the current year, the company is trending at barely breaking par with the previous year:

Source: Created by Sandeep G. Rao using data from Amazon’s Financial Statements

- The online stores segment (40% of net sales in 2023), which grew at 5% Year-on-Year (YoY) last Fiscal Year (FY), is currently trending to cede these gains by the end of the current year.

- Third-party seller services (24%), which grew a massive 19% YoY last FY, is trending to gain only 2% this year.

- Advertising services (8%), which grew at a solid 24% YoY last FY, is trending to grow 4% this year.

- Subscription services (7%), which grew 14% YoY last FY, is trending to grow 8% this year.

- Physical stores (3%), which grew 6% YoY last FY, is trending at 4% growth for the year.

In comparison to the business of “buying and selling,” Amazon Web Services (or “AWS”) only accounted for 18% of net sales last FY. However, it delivered a whopping 66.8% of total operating income — thus making Amazon “primarily” a cloud computing business, which continues to gain prominence as AI spends continue apace. At the halfway mark, the segment-wise sales contribution metrics remain largely unchanged except for online stores which ceded 2% to AWS.

However, not everything is doom and gloom in the business of “buying and selling.” The company’s “International” division has gone from a drag of (i.e., “a negative”) 7.2% on total operating income last FY to a positive contribution of 3.9% as of H1. However, the “North America” division, which had recovered strongly last FY relative to the massive 23% drag in 2022, declined from delivering 40% of income last FY to 34%. All told, both divisions together have improved in income contribution from 33.2% last FY to 37.4% in H1 2024.

Massive investments were made to drive this level of operational improvements by richly drawing upon the vein of gold described by AWS’ continued YoY success over the course of several years. While no division is running negative in income performance, the fact remains that a strong payoff from all the successive years of investment — as evidenced by the massive growth in segments outside of AWS last FY — might be a blip. In the business of “buying and selling”, competition is plentiful and unconsolidated, i.e., there’s no single giant to slay.

The company’s content business is a particularly interesting ball to unravel. As a “tech” company, the company’s debt is financed at a lower rate of interest than a “media” company is, since the latter is considered to be in a “riskier” field of business. This means that the company can ostensibly produce “original content” more cheaply. In the area of “original content”, two original series stood out: “Fallout,” based on a popular award-winning series of video games, and “Mr. and Mrs. Smith,” a reboot/retooling of a popular movie released in 2005. “Fallout” attracted a staggering 2.9 billion minutes of views within five days on Prime Video, while “Mr. and Mrs. Smith” accrued 964 million minutes in the first three days of the pilot episode’s availability. Both series contributed 33 of the 62 Emmy nominations the company earned in the current year.

The classical argument that the company could have made about bundling content with the business of “buying and selling” is that those who come for the drama stick around to buy goods. This argument might have found some (but not strong) support in the YoY trends in Subscription Services vis-à-vis other businesses related to “buying and selling”. However, what weakens the argument is that both these massive shows were released in H1 2024 and there is no evidence that those who came onboard stuck around and ordered substantially more wares from the company’s platforms than before.

The greater the number of unique customers, the more sophisticated the aggregate behavior. Both customers and merchants (both “brick-and-mortar” and online) have numerous avenues to interact with each other; Amazon currently finds itself hitting a ceiling on “inviting” more sales for simply that reason.

In June, the company had noted the challenge posed by Chinese platforms Shein and Temu. These have been making steady inroads in the company’s addressable markets across the Western Hemisphere, and often at a cost to the company’s network of merchants in place. Even company CFO Brian Olsavsky noted during the earnings call that the company missed revenue expectations due to consumers on average choosing to buy cheaper products, leading to lower average selling price (ASP).

Towards that end, the company is working on plans nearly two months ago that would launch a “discount store” in the vein of Dollar General Corporation (DG) and Dollar Tree, Inc. (DLTR) wherein unbranded apparel, home goods and other products mostly priced below $20 would be available. At least in terms of setup with a roadmap towards addressing a sizeable market, this would likely be quite a costly endeavor. Fortunately, AWS continues to deliver: after a 13% YoY growth last FY, it is trending to grow by approximately the same rate this year and will continue to deliver valuable dollars to fund these “dollar store” analogues.

With numerous learning models such as Anthropic Claude 3.5 Sonnet, Meta Llama 3.1, and Mistral Large 2 launched on Amazon’s Bedrock AI computing platform along with the likes of DoorDash, Nasdaq and Workday building applications within Bedrock, Arm Holdings plc (ARM) Graviton4 instances delivering better cost performance on AWS and a host of new agreements with Discover, ServiceNow and GE Healthcare — among many others — the company’s AWS division will likely continue to prosper and deliver. Given an almost-exclusively “corporate” clientele with specific expectations and a higher likelihood of “repeat business”, AWS has the opportunity that AMD has just begun to realize (and which was covered in a recent article).

And, finally, in what would likely need substantial availability of computing as well as financial resources if brought to completion, Amazon-owned Zoox has announced that its prototype robotaxis are expanding their testing grounds from San Francisco, California and Las Vegas, Nevada to include Austin, Texas and Miami, Florida.

In Conclusion

The key factor that drew the company’s stock into the ranks of the “Magnificent Seven” was the explosive growth across segments through FY 2023. If revenues continue to pile in, the costs associated with building — which led to such massive instability in the “passthrough” Earnings Per Share (EPS) in YoY terms, gain justifications. If all else stays the same, EPS will likely close 54% higher than last year, but stagnation in business segments’ growth implies that sustained EPS growth of a similar magnitude in the years to come will likely be questionable.

This is the rubric employed by growth seekers that have been driving away institutional growth investors from continuing to hold or buy into the stock. With the loss of sustained passthrough value generation comes the fall in traded volumes and a fall in valuation. It is to be expected and is arguably valid. Choppiness can be expected around future earnings dates and index rebalance dates, since ETF issuers are among the largest blocks of investors holding the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.