Summary:

- Ambarella’s Q2 results exceeded expectations in revenue and in earnings per shares, driving an 18% stock price jump today.

- The company’s optimistic outlook, particularly in the automotive and IoT sectors, and strong product positioning in AI and computer vision bolstered investor confidence.

- Ambarella’s unique vision-language model and real-time camera feedback technology provide a competitive edge, potentially justifying a higher share price.

- Despite risks from competitors and China’s EV market downturn, Ambarella’s growth prospects remain strong, with anticipated sales growth and reduced operating expenses in upcoming quarters.

- Related stocks include Samsara, Ouster, and Rivian.

Hiroshi Watanabe

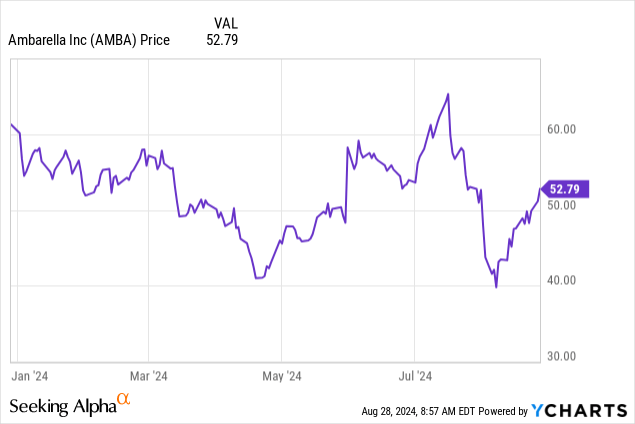

Ahead of posting second quarter results for fiscal 2025, Ambarella, Inc. (NASDAQ:AMBA) traded as low as $40 earlier this month. In hindsight, Japan’s Black Monday moment pulled semiconductor equipment stocks sharply lower. After AMBA stock double-bottomed, the share price gained to close at closer to its moving average.

At the time of writing, AMBA shares added another 18% after posting a quarterly earnings per share loss and a 2.6% Y/Y increase in revenue. What did markets like about the company’s results and outlook?

Ambarella Second Quarter Results

Ambarella reported an EPS loss of $0.13, which beat consensus estimates by $0.06. Its revenue increased by 2.6% to $63.73 million, also exceeding expectations.

In the above earnings chart, the company beat expectations in the last three quarters before the Q2 report. Notice the EPS change Y/Y is on the rise.

Shares jumped by 18.5% in response to Ambarella’s outlook. Below is the stock chart before the open:

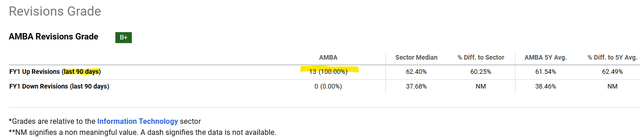

In the third quarter, the revenue forecast of between $77 million to $81 million surpasses the consensus estimate of $69 million. Markets are reacting to the wide difference between actual versus Wall Street’s forecast. 10 analysts already raised their earnings to the upside in the last 90 days.

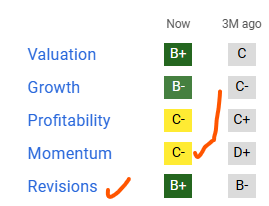

The stock earns a B+ on its revisions grade as a result of the positive revisions.

Seeking Alpha

In the factor grades offered by Seeking Alpha, the post-earnings rally will lift the momentum grade for AMBA stock after markets close today.

Increased Outlook

In the earnings press release, President and Chief Executive Officer Fermi Wang said attributed company-specific drivers more than offsetting the mixed global economic environment. The firm may now recognize initial revenue ramping up as customers in the IoT and automotive fields order Ambarella’s new products.

Markets did not expect the automotive sector to initiate such project spending. The electric vehicle bubble accelerated its pop by November 2023. Tesla (TSLA) bounced back from its stock sell-off. Polestar (PSNY) declined in value and Fisker filed for bankruptcy. Lucid Group (LCID) and Rivian (RIVN), however, formed an uptrend this year.

CEO Wang said that the company is optimistic about the long-term positioning of its new products. The company positioned them:

“to scale our current computer vision business into more advanced AI networks, including vision-language models and GenAI, where rising edge compute needs can drive revenue growth in the years to come.”

In the last quarter, Ambarella posted operating expenses of $56.76 million, up slightly from $54.92 million. For Q3, it expects non-GAAP operating expenses in the range of $49 million to $51 million. Shareholders may infer that expenses will fall as research and development costs trend lower. The firm will pivot from product development toward accelerating initial product sales.

Opportunities in AMBA Stock

The vision language model is an AI-like opportunity. Unlike ChatBots built on large language model training, Ambarella demonstrated LLaVA on an N1 chip at the Computer Electronics Show this year. This attracted many customers. Automotive firms expressed interest in attaching multiple cameras to LLaVA. CEO Wang said on the conference call that machines would have the capability of describing what the camera sees in real-time.

The CEO acknowledged that the company talked about computer vision for three quarters already. This time, realized revenue growth is a strong possibility. CV72 may run on a smaller model. As a result, cameras would provide real-time feedback. No other company offers this functionality. If it is successful, Ambarella would have a strong moat. This would justify a higher share price, even after the post-earnings stock jump.

In the next quarter, the CEO expects normal seasonality patterns (based on the last 10 years). In the next two quarters, results will benefit after the inventory correction is over. The company’s sales growth begins from strong demand for the products in the ramping-up phase.

Ambarella’s positive outlook is notably in contrast to that offered by Ouster (OUST). OUST shares fell from around $11 to close at $7.49 in response to weak Q2 results and cautious Q3 guidance. CEO Angus Pacala reasoned that the headwinds from broader macroeconomic and industry trends are consistent with Ouster seeing “some customer schedules pushed to the right.” As a result, Ouster warned that this would “soften” near-term growth.

Risks

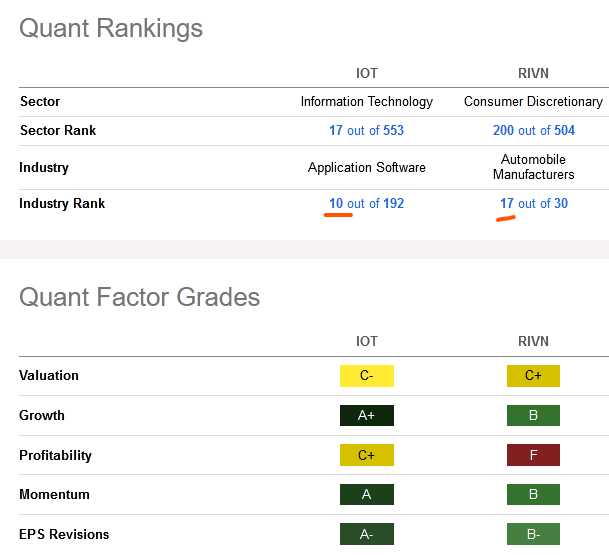

Samsara (IOT) and Rivian are both ramping up with CV5 implementation in their products. Although it raises Ambarella’s quarterly forecast, it may not continue in future quarters. Investors seeking related stock picks in the automotive technology or EV sector may consider those two firms. Samsara is particularly attractive: it ranks 10 out of 192.

Seeking Alpha

Rivian will likely survive the EV downturn since it specializes in the truck sector. However, Tesla only needs to offer affordable mainstream Cyber trucks to take Rivian’s market share.

Risks from China

China’s EV market downturn is another risk for Ambarella. Although it believes Chinese firms will keep driving innovative technology in vehicles, Ambarella is too optimistic. Firms like BYD Company (OTCPK:BYDDF) face punitive tariffs from the U.S., Europe, and Canada.

Your Takeaway

Until recently, markets neglected Ambarella’s growth prospects after losing patience. The strong guidance rewards shareholders who did not panic sell the stock earlier this month. Additionally, hype might lift AI-related stocks, but Ambarella’s implementation of language models in computer vision is unique.

The company will strengthen its moat as product sales accelerate. AMBA stock, even after rising today, does not fully price those growth prospects.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Newly Launched: DIY Value Investing Basic. Get a top stock pick weekly. Readers who want to get urgent, daily commentary may join here.