Summary:

- AMD achieved its target price of $160 and now focuses on aggressive AI hardware expansion to challenge Nvidia’s dominance.

- The Instinct MI300X GPUs, with up to 16,384 GPUs per supercluster, position AMD as a top contender for AI infrastructure.

- Q2 2024 saw 115% YoY revenue growth in AMD’s data center segment, accounting for nearly half of the company’s total revenue.

- AMD-powered cloud instances grew by 34% YoY, attracting key clients like Microsoft, Netflix, and Adobe and expanding its market footprint.

- AMD projects over $4.5 billion in data center GPU revenue for 2024, showcasing a positive growth trajectory despite margin challenges.

luza studios/E+ via Getty Images

Investment Thesis

Our previous analysis set a target price of $160 for Advanced Micro Devices, Inc. (NASDAQ:AMD), which it has now achieved. We remain bullish due to AMD’s aggressive push into AI hardware with the Instinct MI300X accelerators and EPYC server processors. These products position AMD as a key player in AI infrastructure, challenging Nvidia (NVDA). With 115% YoY revenue growth in the data center segment, AMD’s focus on AI-centric applications could drive substantial top-line growth in 2024, expanding market share and further boosting its valuation.

AMD’s Data Center Surge: Aggressive Expansion in AI Hardware Powers Market Lead

AMD’s upcoming “Advancing AI 2024” event may present Instinct MI300X accelerators and EPYC server processors that point to its aggressive expansion in AI hardware. Specifically, the MI300X GPUs are critical for large-scale AI tasks, featuring up to 16,384 GPUs in a single OCI Supercluster. This infrastructure is optimized for large language models (LLMs) that require massive parallel processing and high memory bandwidth. Each MI300X GPU offers leading memory capacity and bandwidth, positioning AMD as a top contender for enterprises’ AI workloads (like inference and training) demand.

Moreover, the collaboration with Oracle Cloud Infrastructure (OCI) further validates the MI300X’s real-world applicability. OCI’s support for bare metal instances with MI300X GPUs boosts AI workloads by removing virtualization overhead. It is a vital factor in latency-sensitive applications.

This adoption points to AMD’s strengthening ecosystem based on open software solutions like ROCm. The MI300X’s role in high-performance computing signals AMD’s competitive edge in the rapidly growing AI infrastructure market. This expanded ecosystem could significantly accelerate AMD’s top-line growth in 2024 in cloud computing and AI-centric applications.

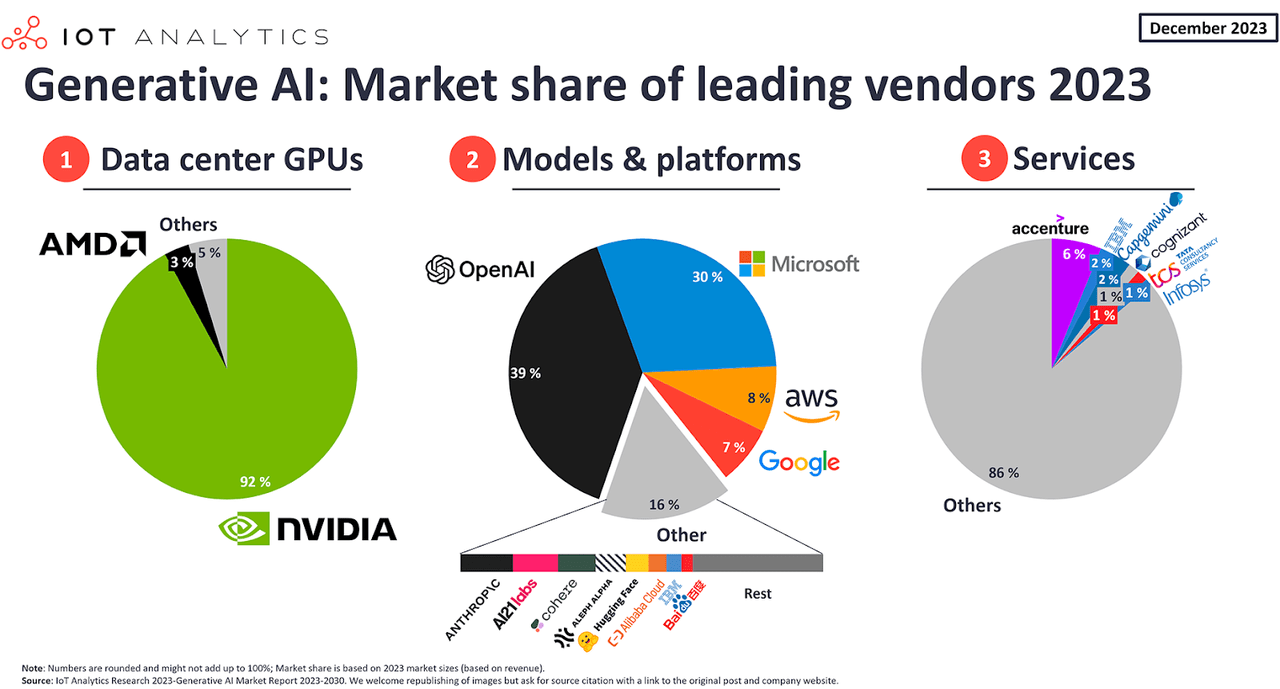

These recent developments mark that AMD is moving ahead to disrupt Nvidia’s market lead in the GPU market. Nvidia’s market share is shifting downwards from 92%-94% in 2023. It may drop to ~75% by 2025-2026, giving AMD a fundamental edge to expand its top-line growth and valuation with competing (price and performance) products.

iot-analytics.com

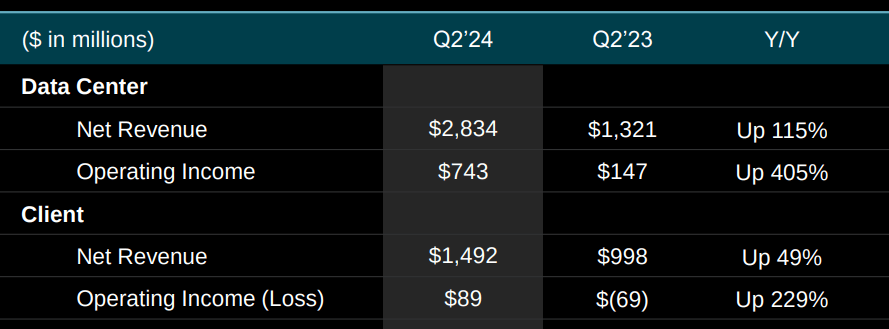

AMD has already demonstrated solid revenue growth in its data center segment. In Q2 2024, AMD’s data center segment derived $2.8 billion in net revenue, which was 115% year-over-year (YoY). On a quarter-over-quarter (QoQ) basis, revenue in this segment increased by 21%. This acceleration in revenue is based on increasing demand for Instinct GPUs and EPYC CPUs that have gained traction in the market based on performance and efficiency advantages. Thus, the data center segment accounts for nearly half of AMD’s revenue.

Additionally, the ramp-up of Instinct MI300 GPU shipments has led to this surge, with AMD securing notable wins in cloud and enterprise workloads. Key clients like Microsoft (MSFT) have expanded the use of the Instinct MI300X accelerators to power advanced AI workloads, including GPT-4 Turbo. Additionally, hyperscalers, like Microsoft Azure, have adopted EPYC CPUs to power a more significant portion of workloads, displacing competitors (in the expanding AI tech market). AMD’s growing influence in the cloud infrastructure as improved performance and energy efficiency are becoming paramount due to cost factors.

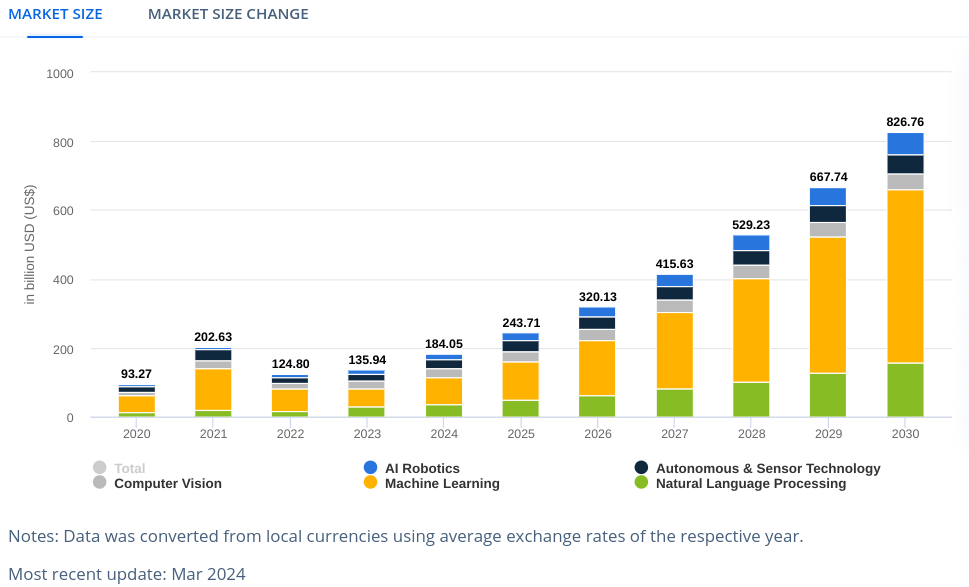

AI Market (statista.com)

Further, AMD’s growing customer base in the data center segment can be observed in a 34% increase in AMD-powered cloud instances. These rise from 670 instances in Q2 2023 to over 900 in Q2 2024, indicating a growing preference for AMD solutions among hyperscalers and cloud service providers.

This is one of the main reasons for the company’s rapid top-line growth. Recent wins from organizations like Netflix (NFLX), Uber (UBER), and Adobe (ADBE) demonstrate its ability to attract new enterprise clients. In particular, during H1 2024, over a third of AMD’s enterprise server wins came from businesses deploying EPYC in data centers for the first time. This could be a good point showing how well the company has expanded its client footprint.

In addition to AMD’s data center segment’s performance, the company’s top-line solid growth was driven by the client segment, primarily due to higher sales of AMD Ryzen processors. This segment generated revenue of $1.49 billion, up 49% YoY from $998 million in Q2 2023. The growth trend continues sequentially, as the segment was up 9% over $1.37 billion in Q1 2024. This depicts solid and consistent demand for AMD’s Ryzen processors, primarily led by consumer and commercial demand.

Q2 2024 Presentation

One of the key drivers behind the client segment’s lead is the continued demand for Ryzen processors, including the AI 300 series. These chips have industry-leading AI processing capabilities with up to 50 TOPs of AI processing power. These processors target the growing market for AI-enhanced PCs, particularly in the Windows Copilot+ ecosystem. For instance, the Ryzen AI 300 series processors may capture a larger share of the AI PC market based on increasing consumer demand for devices with AI functionalities. This segment’s revenue growth points to AMD’s strategic push into AI-powered consumer devices, which may lead to further revenue expansion.

One of the strategic highlights for the client segment is the announcement of the Ryzen 9000 series processors based on Zen 5 architecture. These processors deliver leading performance in gaming, productivity, and content creation. The 9000 series represents a tech advancement with improved instructions per clock (IPC) performance and energy efficiency compared to previous generations, making the Ryzen 9000 series highly competitive in the desktop market. In the mobile and desktop markets, AMD has also introduced the Ryzen PRO 8040 series targeted at enterprises seeking manageability and security features. The demand for enterprise-grade processors with security and performance features may continue to grow based on the increasing need for secure computing environments in businesses.

Looking ahead, AMD’s top-line outlook remains positive, with expectations for continued revenue growth in H2 2024. The company’s data center segment may drive much of this growth, with GPU revenue exceeding $4.5 billion in 2024, up from $4 billion previously guided in April 2024. This projection points to AMD’s product portfolio’s strength and capability to capture more market share in the data center space.

Downside: Margin Meltdown Threatens Growth Ambitions

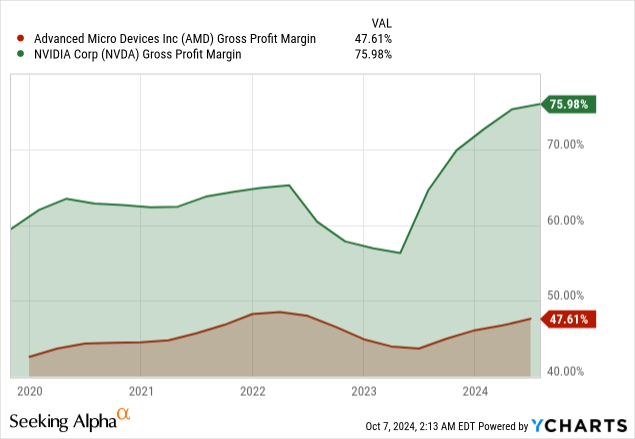

AMD’s quarterly gross profit margins have been unchanged between 49% and 53% in the middle term. While this consistency may seem positive to such an extent, it is a stagnation in margin expansion that the stock needs to see proper market valuation, and even AMD needs to see scaling operations effectively.

A gross margin of around 50% is solid for a semiconductor company. Still, AMD faces intense competition from industry giants like Nvidia and puts continuous upward pressure on costs related to design and research, chip development, supply chain, and fab efficiencies. Comparatively, Nvidia has maintained a 70%-78% gross margin since the July 2023 quarter.

This inability to match gross margin and growth with Nvidia fundamentally suggests AMD’s cost control and pricing power challenges. These are critical factors for maintaining profitability in a highly competitive AI tech and semiconductor space. AMD’s transitions to advanced technologies like 5nm and 3nm chip designs have become capital-intensive (for semiconductor production), which means that any inability to lower production costs may continue to affect the bottom line directly.

With that, AMD’s operating income margin tells a more concerning story. The operating margin was highly volatile from December 2021 to June 2024, falling from a high of 24% in December 2021 to a low of -2.71% in April 2023. For the corresponding period, Nvidia derived its operating margins from 38% in the January 2022 quarter to 62% in the July 2024 quarter. Now, AMD’s operating margin stands at ~4.6%, this steep decline in operating income margin explains the deviation in Nvidia’s and AMD’s stocks’ performance. Lastly, the street discounts how these companies manage cost structure and operational expenses, particularly under heightened macro uncertainty and increased CapEx.

Concluding Thoughts

Heading into AMD’s earnings later this month, the stock remains a buy based on expected solid EPS growth. The next quarter’s earnings are expected at $0.91, which is robust YoY growth. As a result, AMD has emerged as one of the most important contributors in the AI hardware segment because of its performance, driven by data center performance on the back of its Instinct MI300X accelerators. Positive EPS surprises in recent quarters support an upbeat outlook and hint at further upside potential, especially with AMD aggressively expanding in AI and cloud computing markets.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.