Summary:

- I rate Apple as a hold due to limited near-term growth, elevated valuation, and potential for a correction, despite its innovative products and strong brand.

- Apple prefers Google’s TPUs and Amazon’s AI chips over Nvidia’s GPUs for AI/ML tasks, aiming for efficiency and cost-effectiveness.

- Apple’s forward P/E ratio remains high, with projected EPS growth not justifying its current valuation; a correction could make it more attractive.

- Despite Apple’s AI advancements, its massive size may limit AI’s impact on its bottom line, making it a hold until a notable pullback.

hapabapa

The last time we discussed Apple (NASDAQ:AAPL) in a public article, I rated it a hold because of its relatively limited near-term growth prospects, elevated valuation, and other uninspiring factors. Still, Apple managed to move higher due to increasing future growth prospects, multiple expansion, and other potentially constructive elements.

Apple is remarkable due to its innovative products, unique business model, and enormous cultural impact. Apple has consistently surprised the market with revolutionary products like the iPod, iPhone, iPad, and much more.

Moreover, Apple has spearheaded the smartphone revolution, impacting other crucial markets in design, functionality, and quality, unlike any company that has ever come before or after the tech giant.

Apple has one of the strongest brands and ecosystems globally, enabling it to generate phenomenal financial results. Its leadership and vision are legendary, and recently, Apple has been making more noise.

Due to Apple’s massive global reach, it is destined to become one of the most critical conduits of AI to its estimated 1.5+ billion consumers (2.2+ billion active devices).

Can Apple’s AI Survive Without Nvidia?

You would think Nvidia (NVDA) would be Apple’s leading partner due to its advanced GPU AI-related technologies. However, Apple prefers to avoid heavy reliance on third parties, so its relationship with Nvidia has evolved into a limited partnership within specific areas rather than widespread hardware integration.

For its AI and machine learning capabilities, Apple appears to have opted out of using Nvidia’s GPUs and has instead used Alphabet’s (GOOG) (GOOGL) tensor processing unit (TPU) technology in several instances. It has also discussed using Amazon’s (AMZN) newest AI accelerator chips to pre-train its Apple Intelligence models.

Why Apple Prefers TPUs Over GPUs

While the technology may seem similar, there are crucial differences between GPU and TPU technology. TPUs provide AI-specific tensor computations rather than general-purpose GPU technology. They are designed specifically for AI/ML training and inference, emphasizing inference more than GPU tech.

While Nvidia’s high-quality GPU tech is considered excellent for AI, TPU tech is superior for tensor-heavy workloads. While offering less flexibility, TPUs are more energy efficient, have lower latency, and have better cost performance in the cloud.

From this perspective, it becomes clearer why Apple uses Google’s and Amazon’s application-specific integrated circuit (ASIC) technology. For starters, Apple likely doesn’t want to depend on Nvidia’s costly and, in some cases, “non-ideal” technology. Apple wants the best, and the best fit for its AI needs is TPU technology, as it can be geared to deliver precisely what Apple needs with more efficiency and lower costs.

Apple has a history of limiting third-party influence to save costs and avoid heavy reliance on outside sources. It also has a well-established record of designing its ASIC chips to enhance the performance and efficiency of its products. The A-series chips for iPhones and iPads and the M-series chips for Mac computers are notable examples. These custom ASICs enable Apple to tailor hardware to its software necessities, resulting in optimized performance and seamless integration across its devices and platforms.

Apple plans to use its own AI server chips to power the AI on its devices. Apple does not have its own TPU-equivalent hardware for large-scale AI training, so it relies on external platforms like Google’s TPUs for such tasks. Yet, Apple continues to innovate in AI processing within its devices, and it could design its TPUs as we advance. Therefore, it’s normal to see little or no reliance on Nvidia and some temporary or even more lengthy dependence on Google and Amazon until Apple can supply itself with TPU/ASIC technology for its in-house operations.

When Apple Becomes A Buy

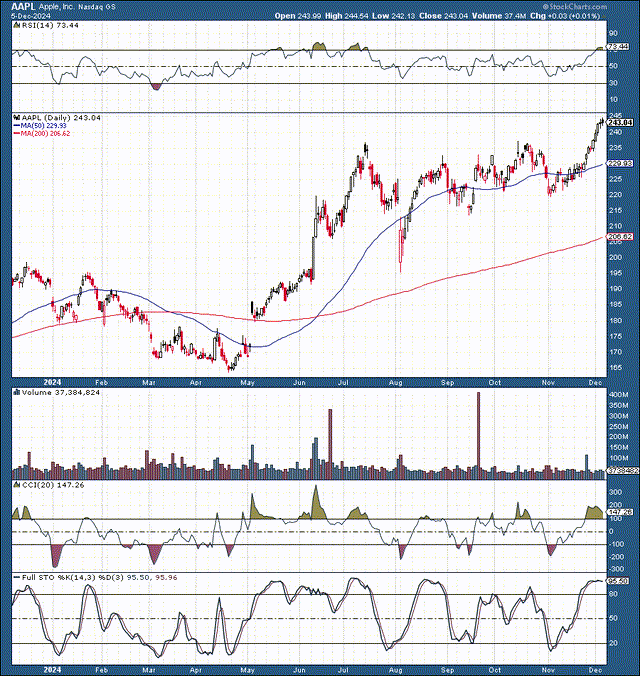

I wouldn’t rush into Apple’s stock, and while I rate Apple as a hold, it’s considerably overbought here. The massive run-up has taken the stock up to nearly $245, sending the RSI to over 70. The stock is also considerably higher than its significant moving averages, floating around high elevated levels, similar to the July top time frame. Therefore, a correction could materialize soon, and the stock looks increasingly attractive around the $220-200 level.

Apple Is “Arguably” Overvalued

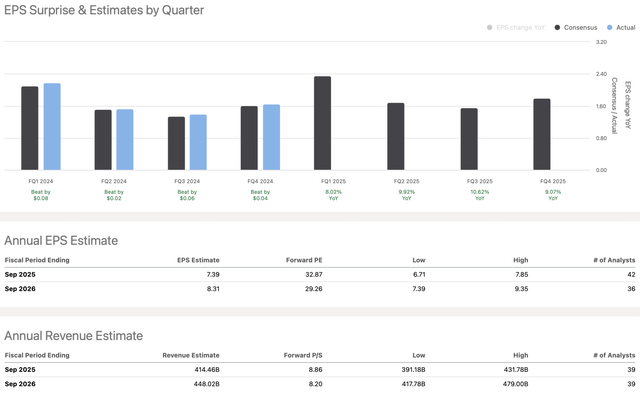

EPS vs. Estimates (Seeking Alpha)

Apple could deliver EPS of about $7.40 in 2025, putting its forward P/E ratio above 32. If we look forward to the following year’s (2026) $8.31 in EPS, Apple still trades at a relatively high 29-30 forward P/E ratio. Even if we factor in a minor outperformance Apple could achieve, its forward P/E ratio is still around 28-29, which is relatively high for a company in Apple’s position.

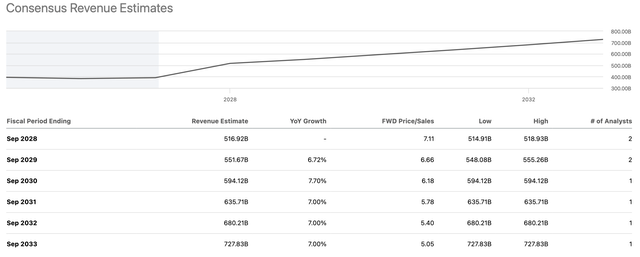

Consensus estimates suggest Apple could have about 7% sales growth in future years. However, given the market dynamics and its massive size, its growth could underwhelm at around 5% or lower in some years. EPS growth could have a similar single-digit or low double-digit growth in future years. These limited growth factors may not justify a higher valuation, and they may not justify Apple’s current valuation.

The Bottom Line

Apple should continue to capitalize on AI. Apple has launched its Apple Intelligence platform. Furthermore, Apple’s products run on in-house AI-supportive hardware, like the A18 Chip. Apple has also gobbled up over 30 AI startups (by 2023), more than any other tech giant. Apple has also made numerous partnerships with top AI players, including integrating ChatGPT, arguably the most advanced AI platform globally.

Next, Apple could develop TPUs to meet the massive demand for AI servers. Despite this favorable AI outlook, Apple’s enormous size could limit the impact AI has on its bottom line in future years, and Apple remains at high risk of a considerable correction. Therefore, Apple remains a hold here but may become a buy after a notable pullback.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMZN, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!