Summary:

- Apple’s upsurge since June is driving a widening divergence from its stalling fundamental growth outlook.

- The AI upgrade supercycle narrative is rapidly losing steam, and the broadening rollout of Apple Intelligence to Europe and China next year is likely too little, too late.

- Despite AAPL being the market’s favorite haven stock with substantial institutional support, its weakening fundamentals will eventually take precedence in driving its valuation outlook.

- The impending catalyst for the stock’s correction will be ironic, but it’ll be an about-face that reveals the extent of which Apple’s lost its lustre over the past year.

ozgurdonmaz

Following its relentless rally since June, Apple (NASDAQ:AAPL) is at increased risk of an about-face. The stock’s upsurge is drawing a widening divergence from the underlying business’ tepid growth outlook, even as Apple prepares for a broadening rollout of its AI software.

And there’s limited respite in sight, as previous market optimism on the impending AI supercycle is rapidly fading. This is not only evident in China but also in the U.S. where Apple Intelligence is already launched with limited consumer interest.

Contrary to the market’s expectations that Apple’s eventual AI strategy for China will help the iPhone regain its footing, we believe it’s likely that the exact undertaking will mark the beginning of the stock’s correction instead. The eventual reality that Apple Intelligence for China isn’t going to be a needle-mover for the company’s single-digit growth outlook will likely settle in by then. And this will leave Apple’s last straw of leverage to no avail.

Apple Intelligence Isn’t The Answer

The Apple stock has been on a blistering rally since the introduction of Apple Intelligence at WWDC in June. Much of the market’s optimism has been driven by expectations for an AI upgrade supercycle—particularly for the iPhone, which represents the anchor product for Apple’s other services and hardware offerings.

More than 300 million iPhone 12s bought during the beginning of the 5G cycle have yet to be upgraded. And the advent of Apple Intelligence could incentivize this cohort of consumers to pull the trigger on a new iPhone.

Yet, this optimistic expectation is increasingly diverging from what reality entails.

At least, it certainly isn’t coming from Apple’s management themselves. The company’s iPhone revenue grew 6% y/y during the September quarter, which coincided with only a little more than a week of all-new AI-enabled iPhone 16 sales. For the current holiday quarter, Apple is only expecting company-wide revenue to grow low- to mid-single digits y/y, alongside double-digit expansion over the same period for the services segment. This implies another quarter of tepid iPhone uptake, with Apple Intelligence features offering limited respite to the segment’s extended sales slump.

This is corroborated by a unanimous agreement across the U.S.’s big three telcos that iPhone 16 upgrades will not be significant. During the latest earnings season, AT&T (T) CEO John Stankey reiterated his expectations that U.S. iPhone 16 upgrades will remain slow, with no substantial deviation from historical holiday season purchase trends. Stankey went so far as to predict that U.S. consumer interest in the AI-enhanced iPhones will be a “graceful ramp-up” rather than a “big bang”, highlighting his reservation on the anticipated upgrade cycle. This was echoed by CEOs at Verizon (VZ) and T-Mobile (TMUS)—both companies saw a drag on September-quarter revenue growth due to persistently weak hardware sales that failed to take off with the iPhone 16. T-Mobile CEO Mike Sievert even stepped out earlier this month to temper investors’ expectations about Q4 results, adding angst to iPhone uptake in the holiday quarter.

This makes sense, given consumers’ evidently lukewarm interest in the AI-enabled iPhone 16. In the U.S., where Apple Intelligence’s available, most touted features are still pending launch in the coming year. Some top gadget reviewers have even gone ahead to turn off the feature altogether. Meanwhile, Europe still has no Apple Intelligence access until at least April, and the timeline for China remains undetermined.

Entrenched China Market Share Loss

As mentioned in the earlier section, about 300 million active iPhone 12s today are ready to be upgraded—and a third of which is in China. CEO Tim Cook has acknowledged this himself—the company needs China.

I value them [China] very highly. We could not do what we do without them.

Source: Tim Cook’s latest remarks on his latest visit to China

Yet, Apple continues to lack an AI strategy for the world’s largest smartphone market. There has been speculation that Apple is already working with Baidu (BIDU) as its local AI partner. However, the developments have been met with repeated snags, including hallucinations and a clash between the two companies on user data rights. This essentially leaves Apple’s efforts in reinvigorating China sales to no avail.

As a result, Apple is facing increasing risks of entrenched market share loss to local rivals. This is evident in the iPhone’s accelerating market share loss to Chinese smartphone makers in the past year.

Huawei has stood out as a key rival to Apple following its quiet release of the Mate 60 last year. Momentum for Huawei’s Mate series has since taken off. This was evident in the launch of the Huawei Mate XT—the world’s first trifold smartphone. Despite it being one of the most (if not the most) expensive smartphones in the world with a starting price of $2,800, the Mate XT garnered more than three million pre-orders prior to launch. It’s still difficult to get a hand on the exclusive device. Customer orders for the Mate XT are still being allocated through a lottery system. Pre-orders that don’t receive confirmed shipment within 30 days will have to resubmit their requests online.

Similar momentum was observed for Huawei’s latest Mate 70—the iPhone’s arch-nemesis in China. Fitted with Huawei’s self-developed HarmonyOS Next operating system and AI features, the Mate 70 reinforces itself as an apt replacement for iPhones. With more than three million pre-orders as well, Huawei’s newest mass market-focused Mate 70 is estimated to reach 10 million deliveries over its lifecycle. Similar to the Mate XT, the Mate 70s is also being allocated under a lottery system at the initial launch due to substantial demand.

Admittedly, the exclusive Mate XT is unlikely to be a needle mover for Huawei. Estimated lifetime shipments of the Mate 70s are still no match for Apple’s iPhone installed base in China. But both of Huawei’s latest innovations are posing a structural challenge to Apple’s China market share.

Assuming 100% conversion on the 6+ million pre-orders on both the Mate XT and Mate 70. That’d represent more than 5% of the population across China’s most affluent tier 1 regions. That’s also more than 5% of prospective iPhone sales lost for Apple.

So, why does this matter?

Well, device upgrade cycles have lengthened significantly in recent years due to technology improvements, changing consumer dynamics, and macroeconomic factors. The average smartphone upgrade cycle is now about 40 months. That means every prospective iPhone sales lost to a local rival today likely won’t be recoverable until the next innovation cycle. Thus, every iPhone sale lost today to Huawei or another local rival is one permanently lost in the “so-called” AI upgrade super cycle.

The Impending Downtrend Catalyst

Ironically, it’s likely when Apple eventually rolls out Apple Intelligence for China that the impending correction will happen.

The jury on whether AI can be Apple’s China saviour might still be out today, but reality will eventually settle in. We expect the rollout of Apple Intelligence in China to be met with tepid uptake due to entrenched market share loss already sustained over the past year.

AI has been a big driver for smartphone upgrades in China this year. The next-generation devices are expected to account for 12% of total China smartphone shipments this year, besting the global average of 9%. But it is not the only thing that is capturing the interest of local consumers. Non-Apple smartphone makers in the region have also been diligent in pushing out proprietary technologies and designs, spanning folded devices and exclusive operating systems.

This suggests that consumer interest in AI features alone is dwindling, and the nascent technology is insufficient on its own to incentivize upgrades if not coupled with other major device advancements. The setup leaves limited respite for Apple, given its marketing continues to tout “Apple Intelligence as the main reason to buy a new iPhone”.

Some might argue that additional upgrades to the upcoming iPhone 17, alongside the Apple Intelligence rollout in China next year, could spur local consumer interest. But this faces imminent regulatory hurdles that shouldn’t be overlooked.

Specifically, it’s speculated that Apple might be working on a thinner iPhone 17 design that solely relies on eSIM technology and eliminates the need for a card slot. This is consistent with Apple’s ongoing efforts in bringing its silicon development efforts in-house, with the latest targeting a move of its current connectivity and modem technology away from third-party chipmakers like Qualcomm (QCOM).

However, China and its SARs (including Hong Kong and Macau) currently run a real name registration requirement for all mobile users—even travellers on prepaid SIM cards will need to validate their identities with a government-issued ID. This effectively requires phones to feature a physical SIM card and card slot in order to work in China, which clashes with Apple’s vision for the iPhone 17.

Taken together, Apple is likely in for a rude awakening when its AI features finally enter the Chinese market. Our expectations for tepid uptake are likely to wield an imminent downward correction to Apple’s growth trajectory and weaken ensuing cash flows underpinning the stock’s valuation outlook.

Valuation Considerations

On a relative basis, Apple is currently trading at about 9x estimated sales and 33x earnings—a 50% premium to its 10-year average. Meanwhile, the anticipated uplift to its fundamental prospects—particularly surrounding the AI upgrade cycle—has been nominal. Other drivers such as Apple’s record $110 billion share repurchase authorization this year are also insufficient for explaining the entirety of the stock’s upsurge.

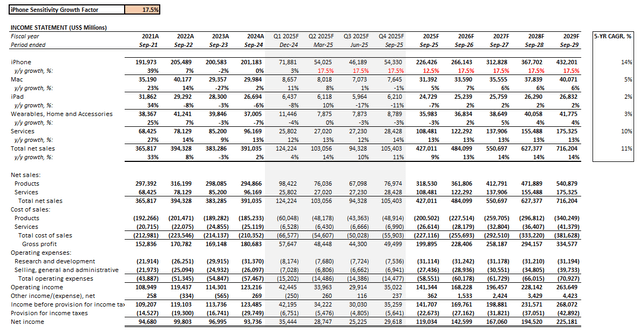

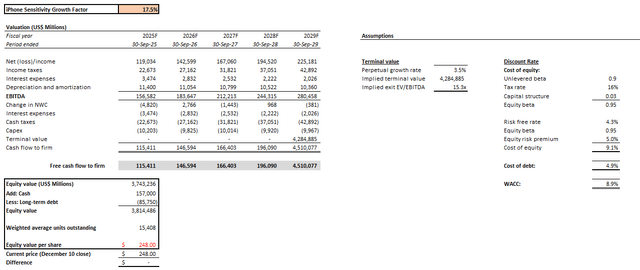

On an intrinsic basis, the stock’s current price also implies multi-year growth at a double-digit CAGR, which is unlikely. Assuming services continue to grow in the high teens, and other product sales growth remains consistent with historical trends, the iPhone segment would have to grow at a five-year CAGR of 14% to make the stock’s current price of $248 apiece make sense.

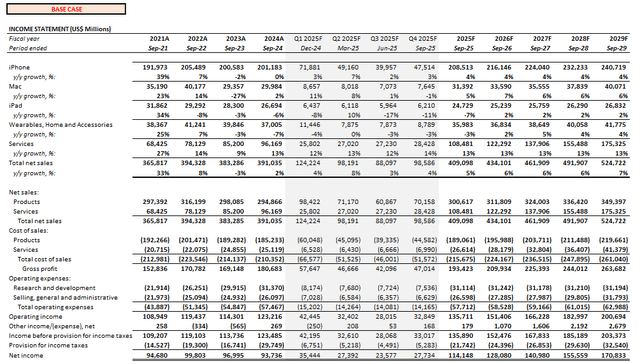

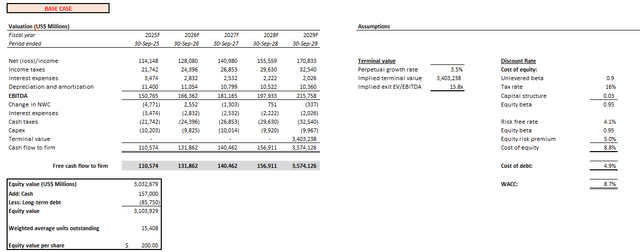

Considering our base case projection expects Apple to expand revenue at a much more reasonable five-year CAGR of 5%—and 3% for iPhone sales, specifically—the anticipated correction will likely take the stock back to $200 apiece.

Conclusion

Admittedly, there are risks to our short thesis on Apple. It’s still one of the market’s favourite haven stocks after all, given Apple’s robust balance sheet. There’s also substantial institutional support, given Apple’s sizable weight in crucial indexes such as the S&P 500. All of these mechanics could serve as downside mitigation factors for the stock.

However, fundamentals have historically taken precedence in driving eventual stock valuations. Apple’s outlook on this front is weakening. Without immediately additive growth drivers in the mix, the Apple stock’s valuation premium at current levels lacks durability and is likely bound for correction.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.