Summary:

- AT&T is showing signs of improvement in financial health by paying off debt and reducing net debt-to-adjusted EBITDA to 2.5x.

- EBITDA margin was the highest in Q2-2023 from Q1-2021 due to the lower cost of domestic wireless equipment and its associated selling costs from lower wireless sales volumes.

- Furthermore, the management expects FCF of $16+ billion for FY-2023, indicating an additional FCF of $11 billion in the remaining two quarters of FY-2023.

Justin Sullivan

Background

Shares of AT&T (NYSE:T) have remained under pressure, hovering around record low levels of $14.16 a piece on the NYSE on concerns over exposure to toxic lead cables, which remained under pressure since a July 24 report by The Wall Street Journal. In this report, the WSJ accused telecom companies of misrepresenting details about risks the lead cables posed to human and the environmental pollution. The US Senator Ed Markey demands to fix the responsibility of telecom companies to act responsibly for mitigating any environmental and public health effects. Furthermore, he termed this situation as “corporate irresponsibility of the worst kind.” According to a Wall Street Analyst, an estimated liability for removing the leftover lead cables could cost the telecom companies $60 billion. Moreover, AT&T has the biggest network of legacy telephone cables and could thus have the highest financial exposure.

US Telecom Industry Overview

The US Telecom Industry is projected to increase from $427 billion in 2023 to $511 billion by 2028, at a CAGR of 3.67% during the same forecast period. The change in consumer inclination toward next-generation advanced technologies and smartphone devices is one of the key catalysts driving this industry. Furthermore, the ever rising number of mobile subscribers, consumer expectations for high-speed data connectivity, and the growing requirement for value-added managed services are the other factors increasing the market growth.

In the US, the prominent market players are spending heavily on acquiring the required spectrum for offering next-generation technologies. Some key competitors in the US telecom services market include Verizon Communications (VZ), T-Mobile US (TMUS), Charter Communications (CHTR) and Comcast Corporation (CMCSA). In general, the telecom industry is facing a challenging phase, with a mix of declining growth in revenue and increasing investment costs. The industry has underperformed compared to the market index over the past few years. Furthermore, it is among the industry which spends heavily on capital expenditure due to network and infrastructure expenditure, specifically relating to deploying 5G, the further advancement of 5G architecture and the prospect of 6G.

“Contrarian” Case Investment Thesis

The investor should ask the question “How low is low” for an AT&T stock trading at a price to book ratio of 0.99x with a dividend yield of 7.84%. I do not think AT&T justifies trading below 1.00x and lower than peers.

Do you think a company which has increasing subscribers and ARPU should trade below a P/B ratio, below 1.00x?

Do you think a company which has EBITDA margin expansion and cost management should trade below a P/B ratio below 1.00x?

Do you think a company which has increased free cash flow and reducing net debt should trade below a P/B ratio below 1.00x?

If your answers are “NO” to these questions, then AT&T is a buy at current levels.

3 Things Contrarian Investors Should Watch

1. Growing Durable 5G and Fiber Relationships

AT&T is a leading player for providing connectivity services through 5G and fiber. AT&T expects that demand will increase for broadband, and it will capitalize on its fiber and 5G deployments, driven by streaming, augmented reality, and mobile user-generated content. The wireless industry in the U.S. has matured, and future wireless growth will be generated from innovative services supported by the AT&T 5G wireless network. I believe through 5G networks, AT&T can offer services required by advanced technologies like sensors, devices and the Internet of Things (IoT).

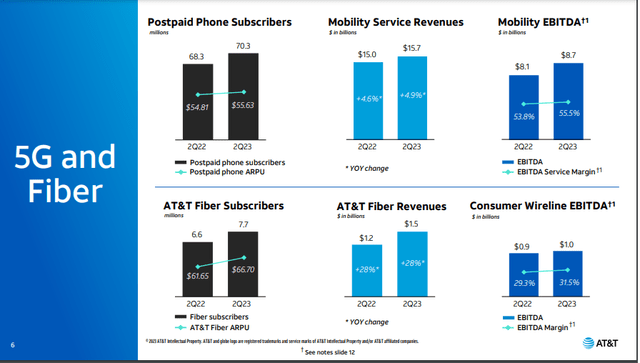

Mobility Service Revenue and AT&T Fiber Revenue:

In the above chart, we can see the total revenue for Mobility Service Revenue increased by 4.9% in Q2-2023 compared to 2Q-2022, driven by increase in subscriber gains and postpaid average revenue per subscriber growth. The postpaid phone subscribers increased by 2 million, ARPU increased by $0.82 in Q2-2023 YoY basis. AT&T increased wireless service revenues by $2B+ since 2Q20 on a quarterly basis, and also achieved industry-leading churn. Furthermore, EBITDA margin increased to 55.5% in 2Q-2023, an increase of 170bps compared to Q2-2022. Similar increasing trend, we can see for Fiber revenues and its EBITDA margin as well (in the above chart).

In summary, AT&T is growing its subscriber base and ARPU, and most importantly, providing 5G and fiber services required by the most important technologies needed by humans. For e.g. Since 2Q20, AT&T included more than 8 million postpaid phones and increased AT&T Fiber subscribers by 3.4 million. However, growth will be muted for the next few years but once AI and IOT, fully deployed then will see the exponential growth for 5G and fiber services. Therefore, we cannot rule out company like AT&T from investment radar. This is supported by Bridgewater Associates buying 1.98 million shares of AT&T at an average price of $15.9.

2. Cost Transformation and Margin Expansion

| Q121 | Q221 | Q321 | Q421 | Q122 | Q222 | Q322 | Q422 | Q123 | Q223 |

| 32.5% | 33.4% | 34.5% | 30.5% | 34.3% | 34.8% | 35.7% | 32.6% | 35.1% | 36.9% |

Source: Company Fillings Q2-2023

EBITDA margin was the highest in Q2-2023 from Q1-2021 due to lower cost of domestic wireless equipment and its associated selling costs from lower wireless sales volumes along with lower personnel costs. In Q2-2023, margin increased by 180bps, which is a significant cost improvement. While evaluating AT&T, investors should consider improving trend in EBITDA margin. Furthermore, the company is on track to achieve full-year Adjusted EBITDA growth of more than 3%. Also, it accomplished its $6 billion cost-cutting goal ahead of schedule and is now planning an additional $2 billion-plus over the next three year. The company achieved cost-cutting goal with AI; associated with Microsoft to launch custom-built generative AI tool, Ask AT&T.

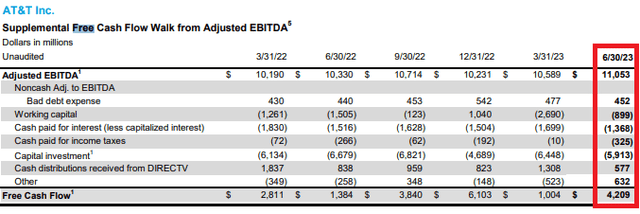

3. Increasing Free Cash Flow

Free cash flow increased to $4.2 billion in Q2-2023 compared to $1.0 billion in Q1-2023 due to cost-cutting program. Furthermore, the management expect FCF of $16+ billion for FY-2023, indicating additional FCF of $11 billion in the remaining two quarters of FY-2023. One of the strong catalysts is a consistent dividend payout ratio. In fact, the stock looks sustainable at this level due to the dividend yield. To maintain the continuous payment of dividends, it’s very crucial for AT&T to generate sufficient free cash flow for dividend payout. I believe the company is carefully crafting a cost-cutting program due to the estimated $11 billion free cash flow for the remaining quarters of this year.

Furthermore, with the adoption of technology for operations, AT&T will be able to expand its cost-cutting program beyond three years and keep on generating strong free cash flow. An indicator which is important for investors to gauge the financial health of the company.

Strong free cash flow helps the company to manage net debt efficiently.

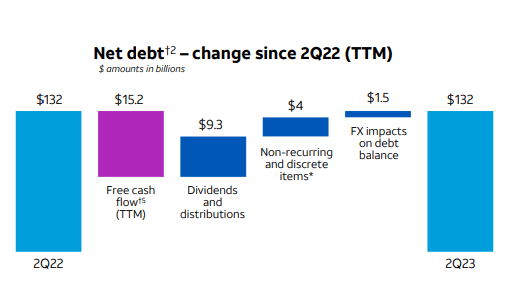

Q2-2023 Net Debt Bridge:

Company Report Q2-2023

In Q2-2023, AT&T had $132 billion net debt, which is equal to Q2-2022. However, AT&T expects to reduce net debt by around $4 billion by the end of FY-2023, with net debt-to-adjusted EBITDA of 3.0x. Going forward, management expect most of the cash (after dividends) to go for reducing debt. Furthermore, the company expects it is on track to reach the 2.5x range in the first half of 2025.

In summary, AT&T is showing signs of improvement in financial health by paying off the debt and reducing net debt-to-adjusted EBITDA to 2.5x. Investors should consider this as a positive catalyst because this will reduce the interest burden and increase net income. An improvement in EPS will increase valuation as well. Hence, this shows that the company has upside potential from its current level. However, AT&T is a gigantic ship and will take time to turnaround.

Valuation Analysis

| Peers | Price | Forward EPS | P/E Multiple |

| AT&T (T) | $14.15 | $2.43 | 5.83x |

| Verizon (VZ) | $33.38 | $4.72 | 7.03x |

| T-Mobile US (TMUS) | $133.32 | $7.77 | 17.54x |

| Comcast (CMCSA) | $45.24 | $3.79 | 12.4 x |

| Deutsche Telekom (OTCQX:DTEGY) | $20.63 | $1.83 | 11.44x |

| Swisscom (OTCPK:SCMWY) | $59.93 | $3.83 | 15.79x |

| BCE Inc (BCE) | $41.37 | $2.36 | 17.18X |

| Implied Price | |||

| Maximum | $42.62 | 17.5x | |

| 75th Percentile | $40.90 | 16.8x | |

| Median | $34.25 | 14.1x | |

| 25th Percentile | $28.38 | 11.7x | |

| Minimum | $17.08 | 7.0x |

Based on the above comparative analysis, we can conclude that AT&T is trading at a discount compared to its peers. Even if we consider the 25th percentile of the peer’s multiple (P/E multiple – 11.7x), it is still trading at a discount of 100% and 142% compared to the median multiple of 14.1x.

In the long-term, I believe AT&T will catch up with the industry median based on the implementation of technology and its impact through cost-cutting. Also, with the wider deployment of IoT and AI, the requirement for 5G and fiber will increase. AT&T is also aiming to reduce its debt, and that will impact the valuation as well in the future.

My Recommendation: Buy Rating (Medium – Long Term)

I recommend a Buy rating for AT&T based on the following factors:

1. AT&T expects that demand will increase for broadband, and it will capitalize on its fiber and 5G deployments, driven by streaming, augmented reality, and mobile user-generated content

2. Improvement in EBITDA margin may continue for a few years, driven by cost-cutting

3. Strong growth in free cash flow helps companies to reduce debt and interest expense

4. Furthermore, it is on track to reach the 2.5x range in the first half of 2025

5. Based on the above comparative analysis, we can conclude that AT&T is trading at a discount compared to its peers.

Cautious Note: Investors should be careful due to toxic lead cable matter.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.