Summary:

- AT&T, one of the world’s telecommunications leaders, has continued to come under pressure from short sellers over the past few quarters.

- Currently, the company’s Non-GAAP P/E [TTM] stands at 5.96x, which is 52.04% lower than the sector average and 26.44% lower than the average over the past five years.

- AT&T, alongside Verizon Communications, has been at the forefront of advancing 5G technology and holds a significant position in the ongoing expansion of the fiber optic network across the USA.

- We initiate our coverage of AT&T stock with an “outperform” rating for the next 12 months.

urbazon/E+ via Getty Images

AT&T (NYSE:T) is one of the global telecommunications leaders headquartered in Dallas, which, after selling Warner Media to Discovery for more than forty billion dollars, has focused its business on providing wireless communications, broadband, and digital television entertainment services, serving tens of millions of customers.

AT&T, alongside Verizon Communications, has been at the forefront of advancing 5G technology and holds a significant position in the ongoing expansion of the fiber optic network across the United States. The growth of this network is motivated by the rising necessity for faster data transmission and the imperative to facilitate the transfer of substantial data volumes among businesses.

At the end of 2022, AT&T’s network in North America reached more than 441 million individuals with 4G LTE and more than 285 million people with the fifth generation of cellular technology, up 7 million and 35 million year-over-year, respectively. As the telemedicine, gaming, and autonomous vehicle industries rapidly develop, the telecommunications sector will be one of the primary beneficiaries, helping to maintain demand for the company’s services and devices.

Despite the prevailing optimism in the financial markets due to increased investment in the technology and energy sectors, AT&T is a defensive stock with a low beta of 0.75. In our assessment, this factor is an essential point since the price of its shares is expected to be less sensitive to market movements in the event of negative news from the Fed about the need for another interest rate hike. Furthermore, due to its stable cash flow, AT&T offers an exceptionally high dividend yield of 7.39%, making it a compelling choice for conservative investors.

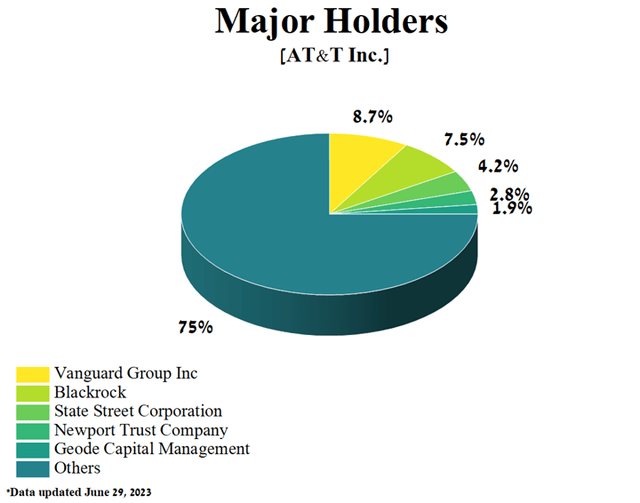

Even with the growth of total debt in recent years, the top five largest stakeholders in AT&T, collectively holding a 25.04% ownership stake in the company, have consistently included Wall Street titans such as Newport Trust Company, Vanguard Group, Blackrock, State Street, and Geode Capital Management.

Author’s elaboration, based on Yahoo Finance

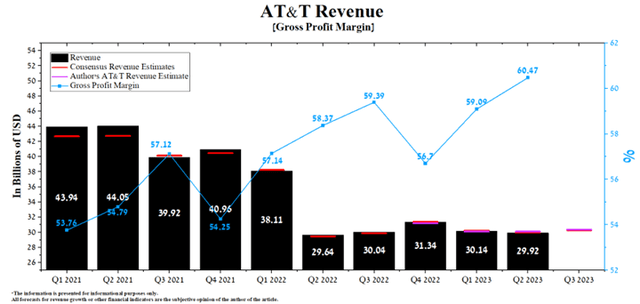

The second quarter of 2023 showed mixed results. On the one hand, AT&T’s revenue was able to exceed analysts’ expectations, but at the same time, in recent years, the downward trend in its EPS has continued. As a result, investors are becoming increasingly worried about the company’s management’s ability to sustain its profit margins at a sufficient level to avoid reducing dividend payouts in the future.

On October 19, 2023, AT&T will publish its financial report for the third quarter of 2023, which, according to our estimates, should please investors with continued double-digit revenue growth in the Latin America segment and increased demand for mobile consumer broadband services.

According to Seeking Alpha, AT&T’s third-quarter 2023 revenue is expected to be from $30.08 billion to $30.42 billion, up slightly year-over-year and 1.1% higher than analysts’ expectations for the previous quarter. At the same time, under our model, the company’s total revenue will be within this range, amounting to $30.35 billion. AT&T’s revenue growth in the quarter will be primarily driven by increased demand for services from its Mobility business unit and increased device sales and customer growth in Latin America. These factors, in particular, will mitigate the negative impact of our anticipated decline in revenue from the Business Wireline business unit in the post-COVID-19 era.

Author’s elaboration, based on Seeking Alpha

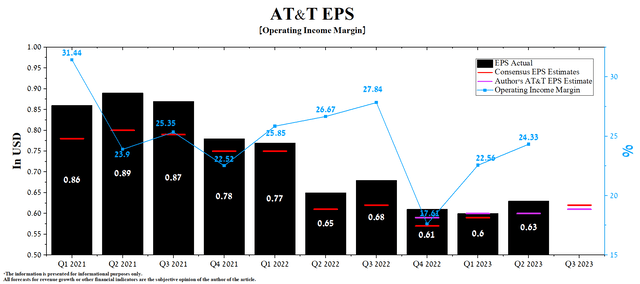

At the same time, we predict that the company’s operating income margin will reach 25.1% by 2023, and by 2024, it will increase to 26.4%, thanks to a reduction in the cost of components for the production of equipment necessary for the deployment of 5G, optimization of labor costs and an increase in the number of fiber customers.

According to Seeking Alpha, AT&T’s third-quarter EPS is expected to be $0.59-$0.67, up 3.3% from the 2Q23 consensus estimate. At the same time, according to our model, AT&T’s EPS will be $0.61, slightly less than the previous quarter.

Currently, the company’s Non-GAAP P/E [TTM] stands at 5.96x, which is 52.04% lower than the sector average and 26.44% lower than the average over the past five years. Furthermore, AT&T’s Non-GAAP P/E [FWD] stands at 6.18x, indicating that the company is noticeably undervalued even after being excluded from the prestigious S&P Dividend Aristocrat index.

Author’s elaboration, based on Seeking Alpha

Conclusion

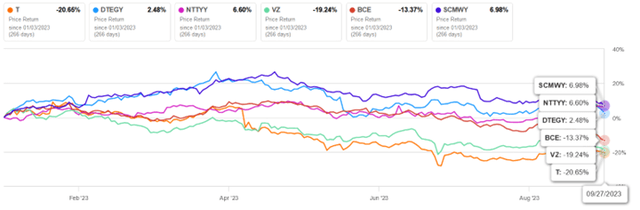

AT&T, one of the world’s telecommunications leaders, has continued to come under pressure from short sellers over the past few quarters. Market sharks not only have doubts about AT&T’s prospects but also fear that an investigation by The Wall Street Journal, which led to the discovery of a vast network of cables covered in toxic lead and left behind by the telecom giant, could affect its financial stability.

As a result, AT&T’s share price has fallen by more than 20% since the beginning of 2023, underperforming Verizon Communications (VZ), which is its key competitor in the communication services sector.

Author’s elaboration, based on Seeking Alpha

Despite all the challenges the company has faced in recent years, we believe its growing gross margin, extremely high dividend yield, and growing demand for mobile consumer broadband services will continue to attract investors.

We initiate our coverage of AT&T with an “outperform” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.