Summary:

- Despite the slight Q2 revenue miss, markets have rewarded AT&T’s stock with further gains. This differs from the selloff at Verizon earlier this week on similar earnings headline figures.

- The stock’s post-earnings upsurge continues to reflect the market’s optimism for AT&T’s sustained market share gains, especially given the rising mix shift towards its higher-margin postpaid phone and fiber businesses.

- Looking ahead, the continued ramp of Internet Air, alongside incremental upgrade cycle and cyclical tailwinds will be additive to AT&T’s growth outlook.

- We believe AT&T may be positioned for a potential upside surprise this year, supporting a sustained long-term FCF growth trajectory critical to its ongoing deleveraging efforts and dividend program critical to its income-focused investor base.

jetcityimage

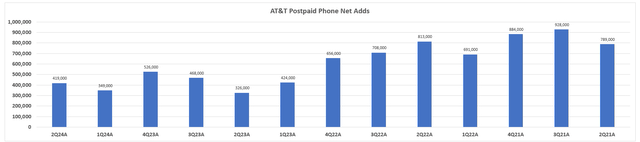

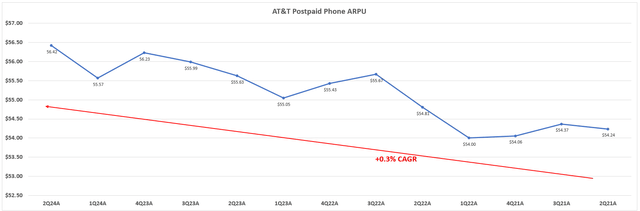

AT&T’s stock (NYSE:T) has been on a consistent uptrend this year, albeit trailing the broader S&P 500 (SP500) index. And the company’s latest earnings results, which highlight resilient service revenue growth – particularly postpaid phone and fiber uptake – continues to provide tangible fundamental support to its persistent valuation upsurge. Despite its slight revenue miss, AT&T has continued to deliver substantial net adds across its core postpaid phone and fiber businesses, while benefitting from ARPU expansion and record low churn. This differs from the comparatively modest set-up at key rival Verizon (VZ), which reported similarly mixed results earlier this week but met with a stock pullback as its share gains within the increasingly competitive wireless mobility business remain a challenge.

As discussed in a previous coverage on the stock, AT&T has also continued to maintain its positive correlation to Treasuries with a consistent yield differential of about three points. This has turned to AT&T’s favour in recent months, given rising Treasuries amid speculation of impending rate cuts as inflation cools.

Looking ahead, we view the continued ramp for AT&T Internet Air, upcoming cyclical events, and end-of-year device upgrades as key drivers of the company’s fundamental performance. This will also inadvertently contribute to free cash flow generation critical to AT&T’s impending capital allocation priorities, which include ongoing deleveraging efforts and a recovering dividend program following cuts in 2022.

With AT&T’s net debt to leverage ratio improving further from 2.9x in Q1 given the additional $2.2 billion debt paydown and sequential EBITDA growth in Q2, the company continues to make favourable progress towards its 2.5x target by the first half of 2025. The company has also generated $7.7 billion of FCF already in 1H24, which represents 45% of AT&T full year 2024 target of $17 billion to $18 billion, besting management’s previous estimate of 40%. Paired with consistent EBITDA expansion, AT&T continues to exhibit self-sufficiency in meeting its imminent capital allocation priorities – namely, deleveraging efforts and dividend growth – critical to its income-focused investor base.

Internet Air is Additive to AT&T’s Wireless Strength

AT&T has long reiterated its priority over fiber investments in its broadband strategy, differing from rivals like Verizon and T-Mobile (TMUS) which have continued to double-down on 5G fixed wireless deployments. Yet the company’s deepening foray in the adjacent opportunity through its aggressive promotion of AT&T Internet Air to both business and consumer end-markets remains a complementary growth driver for its broadband business, nonetheless. The introduction of AT&T Internet Air effectively expands AT&T’s broadband TAM, while also improving its return profile on previously hefty 5G investments. It also provides an incremental offset to “continued legacy copper declines” that have weighed on the broadband segment’s performance in recent years.

Recall that management had rolled out Internet Air first for businesses, then for consumer end-markets – both at competitive prices. Specifically, AT&T Internet Air for Business was initially rolled out at $30 per month for enterprise subscribers that are also eligible wireless customers – representing a 50% discount to the regular rate of $60 per month. Meanwhile, AT&T Internet Air for consumers was introduced at $35 per month when bundled with an eligible unlimited wireless mobility plan, versus the regular rate of $60 per month.

As discussed in our previous coverage, the intro price to Internet Air has been competitive when compared to rival offerings like Verizon FWA and T-Mobile FWA. And when paired with a 14-day free trial, AT&T’s competitive initial go-to-market strategy for Internet Air has likely played a key role in relevant share gains. The company reported 139,000 AT&T Internet Air net adds in Q2, adding to the product’s 200,000 subscriber base in Q1, and under 100,000 at launch in 4Q23. This continues to underscore incremental penetration into opportunities that its core fiber business could not reach, while also offering additional contributions to AT&T’s 5G investment returns portfolio.

In the latest development, AT&T has raised its Internet Air offering price for consumer end-markets to $47 per month when bundled with an eligible wireless service. The bundled subscription rate for Internet Air for Business remains unchanged at $30 per month. This continues to highlight AT&T’s efforts in maintaining Internet Air as a complementary service to its core fiber offering to the broader consumer end-market, while prioritizing incremental adjacent sales in business end-markets where diversified connectivity is required to mitigate outage risks.

Taken together, we believe the latest pricing action and differentiated strategies for consumer and business end-markets will be accretive to AT&T’s broadband ARPU by complementing the $70+ intake rate from fiber subscriptions observed in recent quarters. In addition to contributing favourably to AT&T’s growth guidance of 3% this year, the go-to-market strategy for Internet Air is also additive to the broadband segment’s forward performance by further offsetting secular declines in legacy copper connections.

AT&T’s continued leverage of bundled discounts is also expected to bolster adjacent attach rates from existing Unlimited plan subscribers. This continues to highlight the benefit of AT&T’s differentiated converged broadband offering with both 5G and fiber. Not only will the continued ramp of Internet Air help optimize AT&T’s 5G returns by encouraging both wireless mobility and broadband adoption, but it is also expected to also complement continued momentum in its core fiber business.

Roaming for the Holidays

Despite reduced airtime for roaming contributions in recent quarters as they normalize from COVID era disruptions, the revenue stream should not be overlooked. Roaming charges have long been a key growth driver for telco carriers, including AT&T. This was evident during the COVID-era downturn when travelling was halted, upending the roaming revenue stream.

Q3 has historically been a key beneficiary of seasonality tailwinds due to incremental roaming charges generated from summer holiday travels. But this time around, AT&T is also expected to benefit from cyclical events like the upcoming Paris Summer Olympics. This is likely to give AT&T an incremental boost to 2H24 revenues, which remains underappreciated in current street estimates, in our opinion.

This is consistent with AT&T’s historical performance during global events like the 2016 Rio Olympics, which have incentivized additional traveling volumes and, inadvertently, roaming charges on top of the usual business-related ones. Specifically, AT&T’s wireless service EBITDA margins reached a record 50.1% in 3Q16 during the Rio Summer Olympics, despite aggressive promotions at the time. Meanwhile, this incremental tailwind was largely absent during the Tokyo and Beijing Olympics in 2021 and 2022, respectively, due to lingering COVID travel restrictions.

And this time around, more than 15 million additional tourists are expected to be attending the Summer Olympics in Paris next month, with close to a quarter of which from the U.S., including more than 500 American athletes. This is likely to drive additive growth to AT&T’s mobility revenue stream in the current quarter due to the anticipated boost in incremental roaming volumes, which will accordingly benefit its ongoing margin expansion efforts as well. This is further corroborated by an increasing mix shift towards premium postpaid phone plan subscriptions, which is evident in the combination of AT&T’s recent ARPU expansion, robust postpaid phone net adds, and stable churn rates.

Author, with data from investors.att.com

Author, with data from investors.att.com

Gearing Up for an Upgrade Supercycle

In addition to TAM expansion tailwinds with the roll-out of Internet Air, and incremental cyclical tailwinds from the upcoming Olympics, AT&T is also gearing up for an impending smartphone upgrade supercycle. The advent of generative AI solutions have given consumers a reason to potentially consider device upgrades despite ongoing macroeconomic uncertainties that have heightened their inherent price sensitivity.

Specifically, Apple’s (AAPL) recent introduction of “Apple Intelligence”, as well as the exclusivity of relevant features and processing power to the upcoming iPhone 16 family is expected to be a key incentive for upgrades. Considering the modest smartphone recovery observed earlier this year, which is consistent with ongoing declines in mobility equipment revenue at AT&T during 1H24, management’s original guidance has likely remained conservative about upcoming upgrade cycle tailwinds.

It has recently been reported that Apple is looking to increase its initial round of iPhone 16 shipments by 10%, as the implementation of AI features are expected to reverse its sales slump in recent quarters. This is likely to become an incremental tailwind for AT&T’s mobility business in the latter half of the year, as device upgrades have traditionally been a key driver of new premium subscription sign-ups and renewals on higher-priced plans.

And AT&T is ready to take advantage of these impending tailwinds, as it pre-emptively puts upgrade-related plan features in place. The company has recently introduced “Next Up Anytime”, a $10 per month add-on feature that allows Unlimited plan members to partake in early device upgrades for up to three times per year, as long as they have paid off one-third of the existing device’s cost. There is also a less expensive “Next Up” alternative for an add-on price of $6 per month, which allows Unlimited plan members to upgrade their devices for up to two times per year, as long as 50% of the existing device’s cost have been paid off. In addition to upgrade-related plan perks, AT&T has also offered device subsidies of up to $1,100 on eligible trade-ins.

The combination represents a competitive slate of upgrade-related promotions compared to those offered by rivals like Verizon and T-Mobile. Yet AT&T management remains committed to driving sustainable subscriber and related service revenue growth. By charging a monthly add-on fee for Unlimited plan members, alongside a 33% device cost paydown, AT&T effectively requires its customers to shoulder some of the heavy equipment costs. This essentially mitigates AT&T’s exposure to substantial upgrade-related promotions that have historically been margin dilutive, while also maintaining market share gains ahead of the upcoming device buying cycle.

The recently introduced Next Up Anytime feature also offers better economics for AT&T than outright device subsidies of up to $1,100, which typically covers 100% of phone upgrade costs. Meanwhile, a portion of Next Up Anytime revenues will likely come at zero marginal cost for AT&T, as some Unlimited plan members that have added the feature are not expected to exercise their device upgrade rights. Taken together, Next Up Anytime represents a cash flow accretive approach to the upcoming device upgrade cycle for AT&T.

Final Thoughts

With $7.7 billion FCF already generated in 1H24, AT&T presents a favourable set-up for the back half of the year. Its full year 2024 FCF guidance likely remaining conservative, in our opinion, given upcoming growth tailwinds that leave potential for an upside surprise. We believe the anticipated boost in roaming volumes stemming from upcoming Olympics-related travel on top of summer seasonality remains underappreciated at the stock’s market valuation at current levels. Meanwhile, Apple’s shocker AI reveal last month, with exclusivity to the iPhone 16, is also likely to drive stronger-than-expected smartphone upgrades later this year, which will be additive to AT&T’s full year guidance.

Taken together with the expanded broadband TAM through AT&T Internet Air, which benefits from an upcoming pricing tailwind and robust demand trends observed at early ramp-up, the company remains well-positioned for further valuation gains from current levels. This will be critical to enabling further cash flow growth underpinning AT&T’s dividend payout as well. Specifically, AT&T’s current quarterly dividend of $0.2775 represents a 6.1% yield at the stock’s price of about $18 apiece at current levels. This has already reduced from AT&T’s dividend yield of as high as 6.9% earlier this year, which is consistent with our expectations given continued fundamental-driven upside and the stock’s positive correlation to rising Treasuries.

Meanwhile, the dividend yields on AT&T’s preferred shares have been relatively stable in recent months, which potentially offers less volatility exposure to income-focused investors:

- 5.000% Perpetual Preferred Stock, Series A (NYSE:T.PR.A): $312.50 per preferred share or $0.3125 per depositary share, which represents a 5.9% yield

- 4.750% Preferred Stock, Series C (NYSE:T.PR.C): $296.875 per preferred share or $0.296875 per depositary share, which represents 5.9% yield

As a result, a sustained long-term FCF growth outlook would be critical to supporting AT&T’s ongoing deleveraging efforts and potential for further expansion of its dividend program, which remains a priority for its income-focused investor base.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.