Summary:

- Nike is currently priced for perfection amid a challenging macro backdrop.

- Days sales outstanding have grown at a rate that raises concerns.

- We believe the stock presents an asymmetric risk for investors.

Robert Way

Bulls, Rejoice

When Nike (NYSE:NKE) reported its second quarter earnings on December 20th, the market erupted. Prior to the announcement of earnings, shared had closed trading at $103. The following morning, shares began trading at $116 and closed at $115. The market, it seemed, was primed for good news from the apparel giant. After all, it had been a long time since investors in Nike had reason to be excited.

Nike has dealt with body blow after body blow – from being a poster child for logistics issues throughout COVID due to a heavily off-shored supply chain to a continual victim of China’s lockdown policies, Nike shareholders have desperately been looking for a win.

The company’s second quarter results delivered just that. Top line revenue for the quarter was $13.3 billion versus estimates of $12.5 billion. The earnings per share beat was even stronger; the company booked $0.85 cents per share profit against estimates of $0.64.

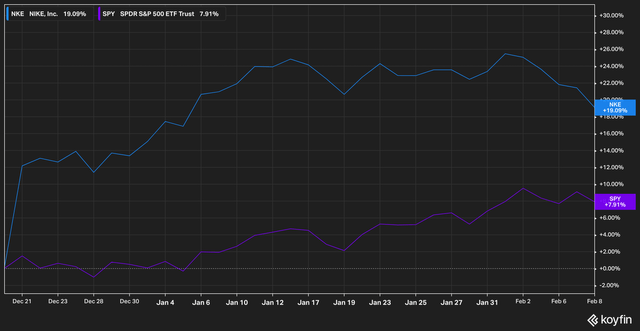

Nike vs. SPY Since Earnings (Koyfin)

Since earnings, Nike has outperformed the S&P 500 (SPY) by a wide margin, delivering 19% price appreciation against 7%, respectively.

While Nike bulls can’t be faulted for taking a much-wanted victory lap, we must, unfortunately, say that several things stood out to us that warrant further scrutiny. We outline our case here for why we believe Nike shares will eventually re-rate to their pre-earnings valuations.

Just Ship It

While retail investors (especially those on this site) will typically express a healthy degree of skepticism about a company’s pronouncements regarding its future earnings potential, one unfortunate truth keeps still keeps us up at night: most investors continue to accept top-line revenue numbers as gospel.

Revenue recognition remains, in our opinion, one of the biggest blind spots for investors. And here, we take issue with Nike’s method of accounting for revenue.

Much has been made about the company’s efforts to reduce levels of inventory, which is all well and good. After all, inventory is recorded as an asset on the balance sheet until it is sold, at which time the asset converts to an expense on the income statement as a cost of goods sold. So, anytime inventory reduces at a reasonable rate is a cause for celebration – it indicates that management is thoughtfully working through its current asses without incurring impairment charges.

The real flexibility of reporting, however, lies elsewhere. We believe that accounts receivable is an often neglected number among investors, so that is what we want to focus on here.

Accrual accounting and accounting principles dictate that a company can record revenue (the top line of earnings) before the cash is actually received (by recording the sale as a receivable). Companies can dictate in sales contracts when revenue is recorded. This flexibility is good – it allows companies to do business on terms that are not so rigid that it impairs their ability to make sales.

But a rise in accounts receivable can be a cause for concern, since it could signal that a company has loosened its payment terms or has extended credit to customers.

A method that investors can use to assess how accounts receivable have grown or shrunk relative to revenue is by utilizing a metric called Days Sales Outstanding (DSO). By calculating payments the company has yet to receive divided by recorded revenue (the top line number) and multiplied by the number of average days in a quarter (91.25, generally), investors can smooth out the picture of a company’s credit terms or payment expectations from customers.

In Nike’s case, DSO has been on the rise.

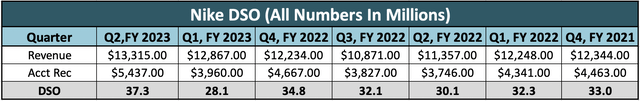

Nike DSO (Koyfin, Author’s Presentation)

Nike’s Days Sales Outstanding has risen from 30.1 to 37.3 year-over-year. This is, in our view, a not-insignificant increase.

Consider, also, Nike’s customers. A lot of headlines have been generated around Nike’s direct to consumer business, but Sales to Wholesale Customers remain the lion’s share of its business. This business-to-business (B2B) channel gives rise to payment terms (businesses often negotiate to buy now and pay later, versus business-to-consumer transactions where revenue and cash are generally recorded at the time of sale).

Further, consider that Nike records revenue for wholesale clients based upon either shipment or receipt. This is a bigger deal than it might sound. The bar for recording revenue by shipping merchandise versus by confirming a customer has received merchandise is quite different (full disclosure, Nike utilizes both terms of recognition and negotiates contracts with both terms, though it does not delineate what percentage of contracts utilize which type of recognition).

At any rate, one fact is clear – Nike has reported an increase in accounts receivable. This has resulted in an increase in DSO, which indicates that the company has likely booked proportionally more revenue on terms than it has actual cash from those sales.

This raises, for us, a question about how revenue in the quarter was accounted for on credit terms, especially considering reports that Nike leaned heavily on discounts and promotions in the quarter.

The Re-Shoring Movement

One thing not often considered by investors is the right-place-right-time factor of Nike’s success. For several decades, Nike has reaped the rewards of globalization – where offshore supply chains and lower input costs have driven down prices for consumers.

As the winds shift, however, Nike appears to be one of the front-runners to feel the pain of the re-shoring movement. As much as globalization was a disinflationary force on the planet, deglobalization will push prices in the opposite direction.

While this particular line of thought is in its early stages, we believe that certain companies that have benefitted tremendously from the impact of globalization will feel the pinch in margins over the coming years as supply chains are re-configured to reduce geopolitical risk.

Valuation

On the whole, we believe that Nike remains expensive against its historical valuation.

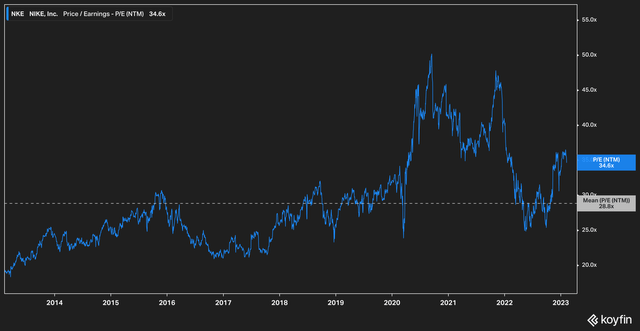

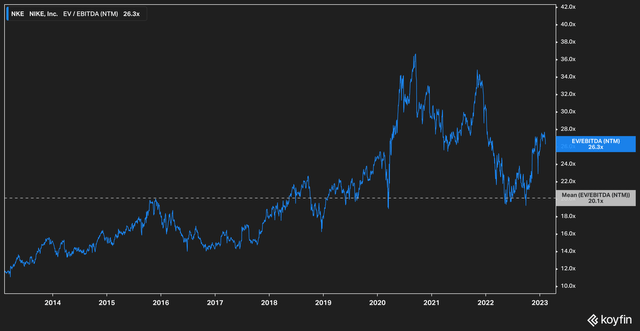

Nike’s stock currently trades at 34x forward earnings against a 10-year average of 28x. The company’s EV/EBITDA valuation is even more rich, trading at 26x versus a 10-year average of 20x.

These valuations seem high to us, but more importantly, they seem to paint a picture of expected perfection. The market seems to not be factoring in any possible drop in earnings for the company in the short to medium-term future. Based on everything that we’ve outlined above, we believe this presents a risk that investors ignore at their own peril.

Thank you for reading our article.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.