Summary:

- Boeing’s Q2 earnings missed analyst estimates on top and bottom line.

- Focus shifts towards improving safety and quality to prevent past issues.

- New CEO appointment and progress on increasing production rates are positive signs for investors.

Jon Tetzlaff/iStock Editorial via Getty Images

Boeing (NYSE:BA) reported second quarter earnings that missed analyst estimates on the top and bottom line. Right now, however, the focus is not so much on earnings. Investors, analysts, and Boeing leadership know that earnings are not going to be pretty, and the focus has shifted towards putting a system in place that will prevent what happened to Boeing over the past 5 to 6 years from ever happening again. Boeing’s earnings calls are always packed with information on the financials as well as the trajectory of the company and in this report, I will discuss both the earnings and progress on improving safety and quality throughout the organization.

Boeing Q2 Earnings And Revenues Fall Short Of Expectations

Boeing booked revenues of $16.87 million, marking a 15% decline driven by lower commercial airplane deliveries. Core earnings per share were a $2.90 loss compared to a $0.82 loss a year earlier, with core operating margins dropping from -2% to -8.3%. Analysts had expected a $17.35 billion revenue, so there was a $480.3 million miss. That seems like a major miss, but it is actually just a 2.8% miss, and we also need to note that Boeing’s least expensive commercial airplane model sells for around $50 million. So, if you deliver 10 units less than anticipated, you already have a $500 million miss. The past five years have not been business as usual for any aerospace and defense company, and most certainly not for Boeing. So, for analysts, it is challenging to get an accurate estimate and that has also been the case when Boeing was operating closer to stable levels. That is something I observed when I published earnings previews for Boeing, and at times we simply saw that analysts estimates were way off from what delivery flows would suggest. I wouldn’t necessarily say that Boeing’s miss was driven by expectations being too high compared to the delivery flow, but I will definitely put that to the test.

Earnings per share or better said the loss per share was $2.90 whereas a $2.01 loss per share was expected. This was driven by continued cost growth in the defense segment.

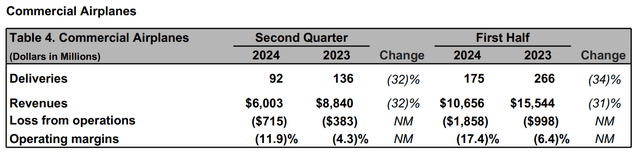

Boeing Commercial Airplanes Loss Deepens In Q2

The accident with the Boeing 737 MAX 9 in January of this year triggered a reduction in the production rate on the Boeing 737 MAX program and due to supply chain issues the Boeing 787 production rate has also been reduced. Consequently, the number of deliveries declined from 136 to 92 airplanes, which is a 32% decrease and revenues also decreased by the same percentage. As said, a Boeing 737 MAX delivery brings Boeing around $50 million in revenues, so a decline in deliveries adds up rather quickly to the top line, and we need to check whether the delivery mix reflects the top line. We do this by modeling the mix against the market values and assess the difference between that estimate and the reported revenues. After modeling the delivery volumes and mix, the revenues should be around $5,990 million. So, the $6,003 million seems about right as pricing differs from customer to customer and each customer, next to obtaining different discounts, also has different wishes when it comes to aircraft interiors and other items which affect prices. So, overall, we see that the revenues came in around $13 million or 0.2% better than expected.

As Boeing is assigning more engineering resources to its certification efforts, I had increased my estimate for R&D by 10% to $550 million and Boeing actually spent $555 million on R&D for commercial airplanes. Selling, and general expenses that are attributable to Boeing are typically estimated at $695 million for Boeing, but from time to time, we see that those period expenses are significantly higher than modeled. That was the case during the second quarter, partially offset by lower-than-expected abnormal production costs on the Dreamliner program. As a result, we anticipated a loss of around $426 million and the actual loss was $715 million. So there was a $289 million shortfall on BCA earnings, or $0.47 per share.

Boeing 737 MAX: Higher Production Rates

The Boeing Company

The Boeing 737 MAX program is definitely where it should have been, but we are seeing some positives. Boeing has reduced traveled work, which should result in cleaner fuselages entering the assembly line with less rework required and improved quality and reliability of the assembled product. At the end of May, Boeing submitted its comprehensive safety and quality plan to the FAA indicating measures used to monitor the health and quality of the production system. That is not going to change things for Boeing overnight, but it is an important milestone as Boeing seeks to increase production.

The company aims to increase its production to 38 airplanes per month by the end of the year. The company has increased production from low single digits to in the first quarter to 25 airplanes in June and July. While that is still far off from 38 airplanes per month, it does show a significant increase in production, which I believe is a good indicator of improving and managing manufacturing quality at higher rates. Previously, it was already known that Boeing would be reducing production rates for 60 days as it stopped accepting traveled work on fuselages coming into the assembly line. In those 60 days, a glut of fuselages had to go through the new acceptance process, and that temporarily reduced deliveries. The increasing rates suggest that the glut has now been worked through, and the new acceptance criteria are in place for a smoother flow from Spirit AeroSystems to Boeing.

The company has also reactivated its third assembly line for the Boeing 737 MAX, which provides Boeing with more production flexibility. Currently, the production is limited by the FAA driven by KPI control limits. Theoretically, when supply chain issues ease and the FAA removes the production cap for the MAX, it would allow for the production of around 60 airplanes per month. On the Boeing 737 MAX 7 and MAX 10, Boeing has found an engineering solution for in-production aircraft that will be implemented and that can also be considered a big step.

The Boeing 737 MAX inventory of airplanes built prior to 2023 further reduced to 90 units from 110 in the prior quarter and while there is still some work in progress units cumulating, we do see a net positive on the Boeing 737 MAX inventory reduction.

Boeing 777X Reaches Key Milestone And Boeing 787 Inventory Reduces

On the Boeing 777X program, Boeing reached a key milestone as it received the Type Inspection Authorization. The company shared that it conducted more than 1,200 flights spanning 3,500 flight hours, which fetches fairly well with our data. Boeing is currently increasing the inventory by around $800 million per quarter as it is preparing to have airplanes ready when the Boeing 777X is certified, allowing for a relatively fast delivery flow of airplanes.

On the Boeing 787 program, the production rate remains below 5 per month, but we are seeing the legacy inventory decreasing, but the work-in-progress tally is likely increasing. That is just the reality of the aerospace supply chain health at this point in time, but Boeing expects to return to higher production rates later this.

Putting everything together for Boeing Commercial Airplanes. We see that revenues were in line with expectations, but period costs were up. On the certification of the Boeing 737 MAX 7/10 and Boeing 777X, the jet maker is marching steadily through the process, which is also good. On the Boeing 737 MAX production quality effort, Boeing has delivered its plan to the FAA and production has increased on a cleaner fuselage flow. So, all of that is going well. The current uncertainty on production ramp up profiles is providing some cash headwinds as less orders are being signed, meaning the signing payment for orders is not coming in. That is not the biggest cash item that is missing for Boeing because the lower delivery volumes also mean less delivery payments are coming in. Furthermore, we see that airlines on a net basis are slowing down advance payments. Advance payments are tied to the number of months prior to delivery and with the timing of deliveries uncertain, advance payments are slowing down and, in some cases, even have to be reversed.

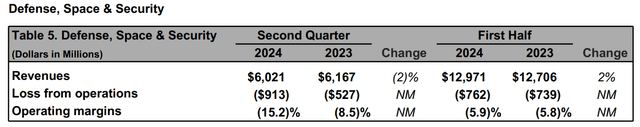

Boeing Defense, Space & Security Costs Continue To Spiral

Boeing Defense, Space & Security is a beaten down segment for quite some time now. This used to be a business that could generate 10% in margins, but due to cost growth on fixed-price development contracts and fixed-price contracts, those margins have been slimming as Boeing is absorbing the inflation component on the contracts to which it is exposed. We have this modelled as a $6.4 billion revenue business, down from our previous assumption of $6.75 billion and with 2% margins after additional charges have been added. Boeing reported revenues of $6.0 billion which was $400 million lower than what I had expected and the loss from operations was $913 million whereas a less aggressive de-risking would have indicated a $128 million profit. So, Boeing missed my estimate here by more than a billion dollars.

On the VC-25B Presidential Aircraft program, cost increased by $250 million due to engineering challenges, while the KC-46A program saw $391 million in cost growth due to supply chain challenges. The T-7A program suffered a $278 million loss to meet specifications and absorb delays. The delayed crewed test flight increased the forward loss on the program by $125 adding $1.044 billion in costs. Adding it back, the company would have reported a $131 million profit or a 2.2% margin. That is not a great margin. As I mentioned, I model this business at 2% including cost growth, and the defense segment now has those margins excluding cost growth. So, the positives I saw in the adjusted profit and revenues last quarter were just a timing element.

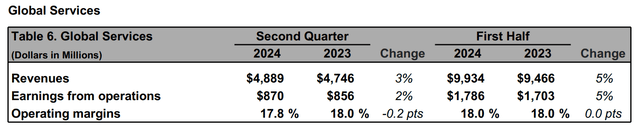

Boeing Global Services Earnings Are Strong But Missed Estimate

Boeing Global Services has been the only bright spot in Boeing’s earnings for quite some time now, and I have this segment modelled at $19.985 billion for the full year, which indicated that revenues for BGS in the second quarter should have been around $4.95 billion. So, revenues came in $58.5 million lower than expected, and the operating margin was 0.2 points lower than modelled.

Boeing Earnings Missed My Estimates

Boeing missed analysts estimates on revenues by $480.3 million, and I would say that is mostly caused by the revenues reported in the defense, space & security segment. Compared to my estimates, Boeing missed expectations on the top line by $447 million.

On earnings per share, Boeing missed analyst estimates by $0.89. I believe that was driven by the higher period expense and the remainder was either driven by the charges for the defense programs being higher than anticipated or the fine that Boeing agreed to pay not being modeled. Compared to my estimates, even after we added in the defense cost growth, Boeing missed estimates by $0.56.

Boeing shares gained 2% after presenting its earnings, but the reason most definitely is not because earnings excluding charges came in stronger than expected because those were actually materially weaker.

Boeing Debt Jumps, Net Debt Positions Increases

For the six months ended, Boeing repaid $4.5 billion in debt out of a total of $5.1 billion in debt repayments scheduled for the year. After the debt repayment, the debt balance stands at $57.9 billion, reflecting borrowings of $10 billion. Cash and marketable securities increased from $7.5 billion to $12.6 billion, bringing the net debt to $45.3 billion from $40.4 billion, largely reflecting the $4.3 billion free cash flow burn for the quarter.

The Reason Why Boeing Stock Jumped: A New CEO

The second quarter results weren’t good and did not provide any reason for Boeing stock to jump the way it did. However, much like Boeing not being overly focused on earnings at this point in time, we see that investors look for bright spots elsewhere and there were various bright spots.

The first one is that Boeing announced a new CEO that will take the lead in a week from now. Boeing named Kelly Ortberg as CEO effective August 8th and with that comes some things that investors likely are liking. The first one is that David Calhoun will depart, and he will do so months earlier, as he was set to step down by year-end. Secondly, Ortberg has a degree in Mechanical Engineering and that means we have an engineer at the top of Boeing, which investors have been looking for in my opinion. For quite a long time, investors have feared that the current CEO of Boeing Commercial Airplanes, Stephanie Pope, would be Boeing’s next leader and I believe Boeing investors are fatigued of people with an accounting background running the business. So, the appointment of Ortberg is a relief.

Furthermore, we see that Boeing is planning on increasing rates, and it has already done so during the quarter and even re-opened the third assembly line for the Boeing 737 MAX. The company has also submitted its comprehensive plan to the FAA, which should eventually allow Boeing to produce at levels beyond the current cap of 38 MAX airplanes per month. That is something that will not drive Boeing’s earnings now, but investors are looking at what actions are creating a sustainable growth path for Boeing, and the steps we are seeing now are in support of that.

On the certification end, we see that Boeing is moving ahead with its solution that paves the way for MAX 7 and MAX 10 certification and Boeing is also in a new phase on the Boeing 777X certification campaign. All of those items are positives and have likely increased the stock prices.

Conclusion: Ugly Earnings With Promising Steps

I believe the best way to describe Boeing’s earnings is that on the financial side they were significantly worse than expected due to continued cost growth on fixed-price contracts and higher period costs at the commercial airplane segment. However, even with earnings being bad and worse than expected, I believe that investors have not been focused on that. In some ways, earnings could only be materially better but not materially worse in the sense that it would drive the stock price.

The focus was on what progress Boeing is making on quality, steps towards high production rates in the future, certification of commercial airplanes and the leadership transformation. On those items, we see strong progress. I am maintaining my buy rating as I believe that Boeing is finally taking steps in the right direction that should provide better support to its financials in the future and drive stock prices up.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.