Summary:

- Broadcom targets a $150 billion AI semiconductor market with 30-40% annual growth, driving significant revenue potential.

- Fiscal 2024 AI revenues projected at $12 billion, growing 33% YoY, with $16 billion expected in 2025.

- Key AI customers include Google, Meta, and ByteDance, with potential collaboration from OpenAI further strengthening the market position.

- VMware acquisition boosted infrastructure software revenue by 200% year-over-year, contributing $3.8 billion in Q3 alone.

- Broadcom faces high debt obligations of $72.3 billion, with floating-rate debt posing risks in the midterm.

G0d4ather

Investment Thesis

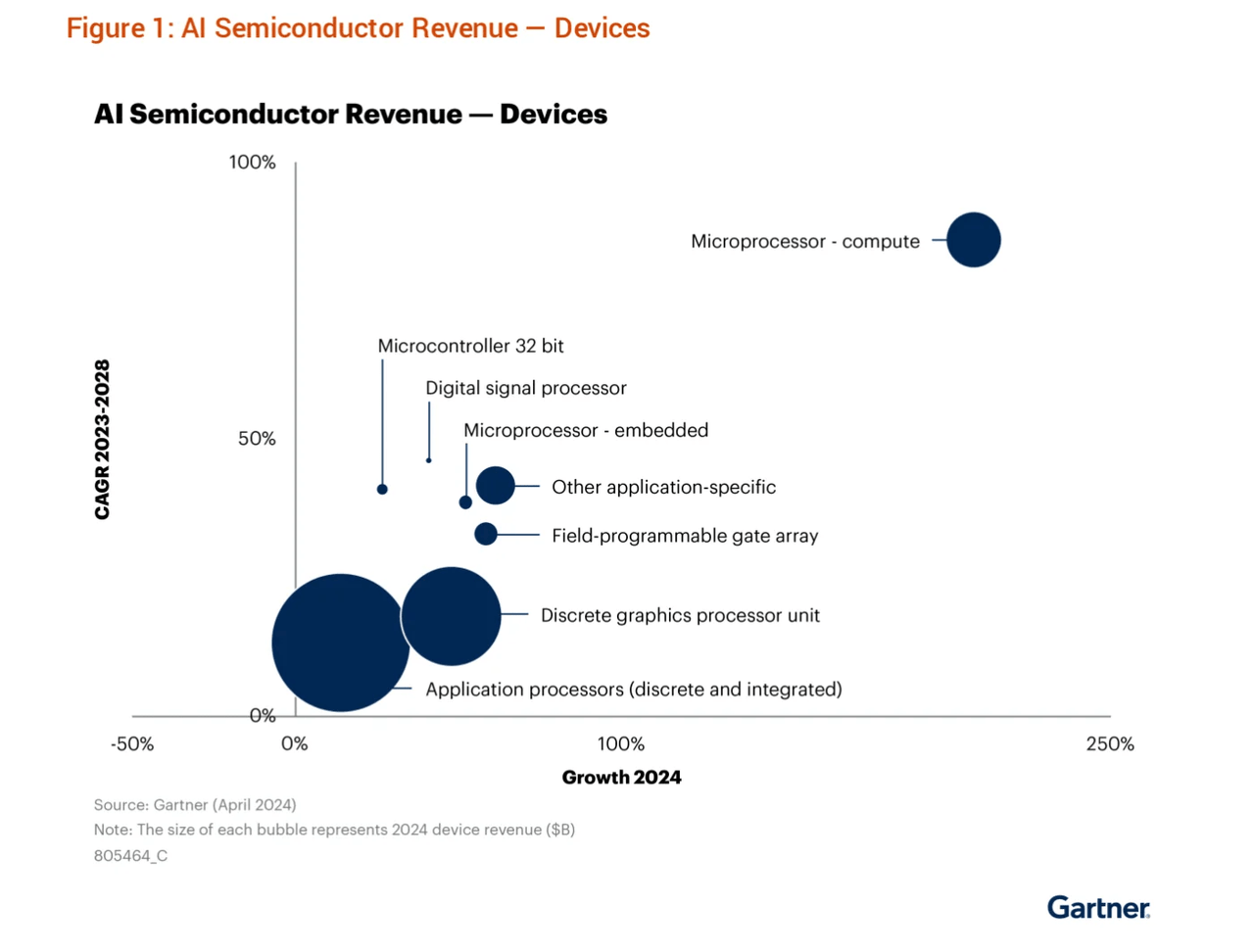

Broadcom Inc. (NASDAQ:AVGO) is poised for capture with rising AI semiconductor demand, making for a compelling investment opportunity. Assuming the market for AI semiconductors reaches up to $150 billion in the next five years, Broadcom has designed AI-specific chips that could generate upwards of 30-40% annual growth.

Broadcom’s fiscal 2024 AI revenues are estimated at $12 billion, with a 33% year-on-year (YoY) growth trajectory, signaling strong demand for its custom chips. The VMware acquisition strengthened its infrastructure software segment, contributing to a 200% YoY revenue increase. Therefore, Broadcom’s expanding AI footprint, solid revenue streams, and strategic acquisitions support a strong buy case, even as it navigates challenges like its high debt load.

Nevertheless, Broadcom carries a substantial debt burden, including exposure to fluctuating interest rates, which could impact profitability. Hence, market concerns are reflected in some of its debt trading below face value.

Broadcom’s AI Revolution: Capitalizing on a $150+ Billion Semiconductor Opportunity

JPMorgan (JPM) reported that Broadcom leads in the AI sector and has potential collaborations with OpenAI and other leading companies. A data point supporting this trend is the company’s estimation of a $150 billion opportunity in AI semiconductors over the next five years that represents a 30-40% annual growth rate in AI revenues based on AI-specific chip designs (in line with Gartner’s market growth projection).

The company has already secured three major AI application-specific integrated circuit (ASIC) customers, namely Google (GOOGL) (GOOG), Meta (META), and ByteDance, with Microsoft’s (MSFT) OpenAI poised to be the fourth. Each company represents leaders in AI development, deep learning, and data center expansions. If Broadcom successfully adds a fifth major customer, as J.P. Morgan speculated, its foothold in the AI chip market will be further reinforced.

Moreover, Broadcom’s AI-related revenues are on a steep growth trajectory. For instance, in fiscal 2024, the company can generate $12 billion in AI revenues and $16 billion in fiscal 2025, indicating a 33% YoY growth rate. These figures are notable because of the revenue size and how they scale about the broader AI semiconductor market. Fundamentally, Broadcom’s capability to tailor its chips for customized workload demands means it can cater to the exact specifications required by hyperscale cloud providers. This trend is observable in custom AI accelerators’ 3.5 times YoY growth.

Financially, Broadcom’s Q3 fiscal derived consolidated net revenue grew 47% YoY. Here, Broadcom’s acquisition of VMware is yielding significant returns. Q3 revenue from the infrastructure software segment hit a 200% YoY increase based on VMware’s contribution of $3.8 billion. The integration into Broadcom’s business led to a 32% quarter-on-quarter increase in annualized booking value (ABV) for VMware Cloud Foundation (VCF), which indicates solid demand growth for private cloud infrastructure.

In the same direction, Broadcom’s non-AI semiconductor revenue is stabilizing, with Q3 non-AI networking revenue up 17% sequentially despite being -41% YoY. This indicates a bottoming out in non-AI semiconductor demand, and the company expects this segment to stabilize further in Q4. Broadcom’s networking segment revenue grew by 43% YoY, accounting for 55% of total semiconductor revenue in Q3. This growth is primarily led by hyperscalers (large cloud service providers) scaling up their AI clusters and the intense demand for specialized chips that can handle AI workloads efficiently.

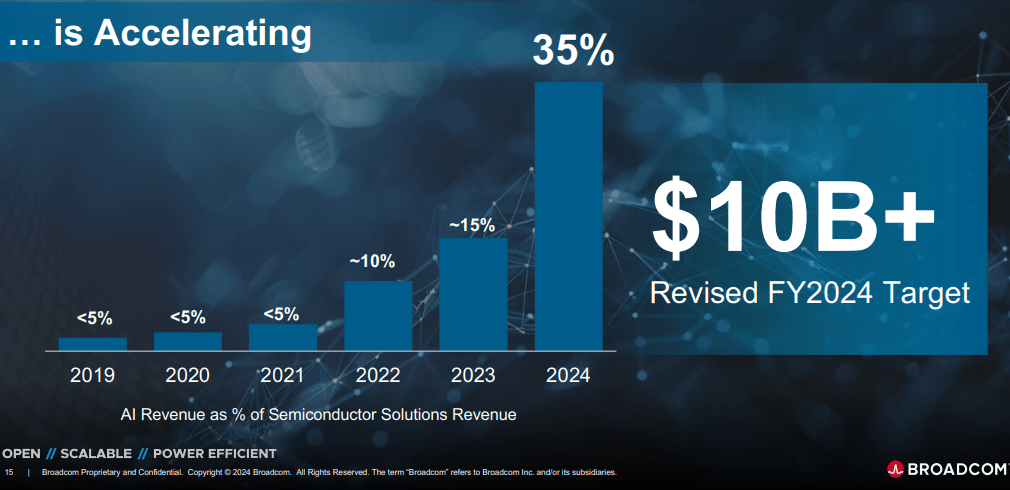

Finally, AI’s increasing contribution to Broadcom’s overall semiconductor revenue clearly indicates its shifting business focus. In fiscal 2019-2021, AI revenues represented less than 5% of semiconductor solution revenues. In fiscal 2022, AI accounted for approximately 10% of the semiconductor solution segment. In fiscal 2023, the AI revenue reached 15% of all semiconductor revenues. By comparison, the initial target for AI’s contribution in fiscal 2024 was 25%. However, due to the surge in demand and Broadcom’s progress in winning AI contracts, this target has been revised to 35%. This dramatic midterm shift from AI being a minor revenue contributor to becoming a central pillar of Broadcom’s business in pivoting toward high-growth markets.

Broadcom Presentation

Debt Dilemma: High Obligations Amidst Growth Aspirations

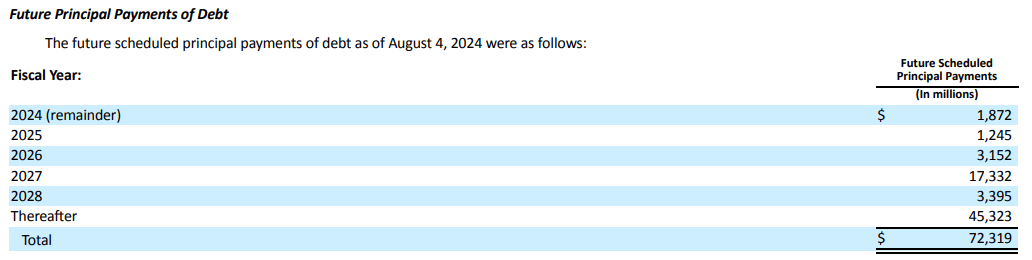

Broadcom’s current debt load presents a significant issue in its fundamental structure that may hinder its growth potential. In the context of its ongoing VMware acquisition, as of August 4, 2024, the company holds a substantial gross principal debt of $72.3 billion, including a mixture of fixed and floating-rate debts.

Specifically, Broadcom’s financial statements reveal that the weighted average coupon rate on $53 billion of its fixed-rate debt is 3.6%, with an average maturity of 7.7 years. On the floating-rate side, the company is exposed to a higher risk of rate cuts and quantitative easing. A $19 billion outstanding balance carries a weighted average coupon rate of 6.7% and a shorter average maturity of 3.1 years.

In the midterm, this debt burden (particularly the floating-rate portion) creates vulnerabilities. Given the reducing-interest rate environment and the company’s high reliance on floating-rate instruments, it may lead to a short-term boost in interest expenses that will erode profitability. For instance, the $5 billion replacement of floating-rate notes with new fixed senior notes marks management’s attempt to mitigate some risk.

Yet the higher coupon rate on the floating debt remains a concern based on the pace of the rate cut cycle. Moreover, the $4.2 billion debt reduction attained through selling VMware’s End-User Computing business to KKR and cash on hand led to some relief. However, the company is still left with substantial obligations, which makes immediate refinancing necessary. Particularly for the $19 billion floating rate debt that matures sooner.

Further, at the end of August 2024, the fair value of Broadcom’s debt is $68.4 billion. The difference between the gross principal debt of $72.3 billion and the $68.4 billion fair value would indicate that some group company debt is trading below its face value. The premium here signals concerns about Broadcom’s relative ability to manage its obligations in the short term. The breakdown of Broadcom’s future principal payments points to the company’s growing obligations, with $1.9 billion due by the end of fiscal 2024 and another $1.2 billion due in fiscal 2025.

However, the most substantial burden comes in fiscal 2027. In 2027, a significant $17.3 billion payment is due. This lump-sum obligation or its replacement could strain the company’s cash flows if revenue growth falters (as revenue growth estimates are normalizing in the midterm) or if the capital markets become less favorable again for refinancing options. Furthermore, beyond 2027, Broadcom faces $45.3 billion in debt repayment obligations that may require long-term strategic capital management to prevent liquidity crises and preserve the progressiveness of the bottom-line.

Broadcom 10Q

From a cash flow perspective, Broadcom generated $4.8 billion in free cash flow during the most recent quarter, representing 37% of revenues. Free cash flow as a percentage of revenue declined from last year, partly due to higher cash interest expenses resulting from its increased debt load post-VMware acquisition. Although adjusted free cash flow, excluding $529 million for restructuring and integration, came in at $5.3 billion (41% of revenue), the increased interest payments are a fundamental bottom-line issue (negative normalized income). This led to a significant overvaluation of the AVGO stock against the historical average.

Finally, US tax laws, particularly the delayed reenactment of Section 174, further pressure Broadcom’s cash flow. The section allows for immediate expensing of R&D costs. The company is now facing higher cash taxes due to a larger mix of US income that leaves it with less room to maneuver. These compounding factors make Broadcom’s debt levels a potential hindrance to its ability to scale rapidly.

Takeaway

Broadcom is AI’s big winner due to its leadership in AI-specific semiconductors, securing big tech clients. With a projected $150 billion AI market opportunity and rapidly growing AI revenues, Broadcom is poised to dominate the space. Its custom chip designs tailored for hyperscale cloud providers and a strong foothold in the AI ecosystem solidify its position as a key player in the industry, driving long-term growth and market leadership.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.