Summary:

- Broadcom’s Q2 FY2024 results showed a 43% YoY sales increase and strong profitability, driven by AI-related revenue and VMware contributions. Let’s preview Q3 results now.

- Management’s revised FY2024 outlook projects over 40% top-line growth, with significant contributions from generative AI and software, indicating potential margin expansion.

- The current Wall Street forecasts and recent news seem to provide a favorable environment for another earnings beat, in my view.

- Taking into account the recent decline in the stock price, AVGO’s fundamental upside potential may now surpass 40%.

- I reiterate my “Buy” rating on Broadcom and eagerly await the release of the report on September 5 after the market closes, which should provide further clarity.

G0d4ather

Intro & Thesis

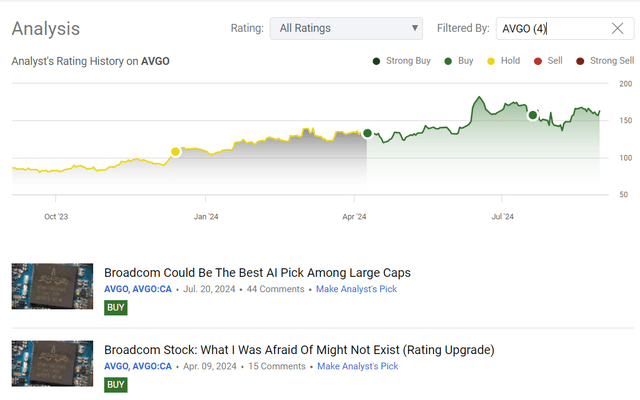

I initiated coverage of Broadcom Inc. (NASDAQ:AVGO) stock on July 20, 2023, with a “Hold” rating, which I upgraded to “Buy” in April 2024, admitting my mistake and assuming that the risks I was afraid of initially might not exist. Since my upgrade, the stock has continued to rise, gaining nearly 13% to date so far and outperforming the S&P 500 Index (SP500) (SPY) by a factor of 2.

However, since my last update, the stock has entered its volatile phase, becoming an underperformer.

Seeking Alpha, my coverage of AVGO

As AVGO is scheduled to release its Q3 FY2024 results on September 5 (after market close), I would like to update my coverage in advance and check how high the company’s chances are of beating the current consensus again this time.

Quick Recap Of Recent Results (Q2 FY2024)

In this part, let’s just briefly mention the most crucial parts from the Q2 report – for a more detailed analysis, please take a look at my previous article, as the data analyzed here and there doesn’t differ.

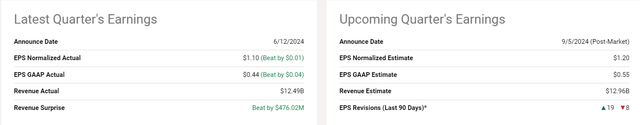

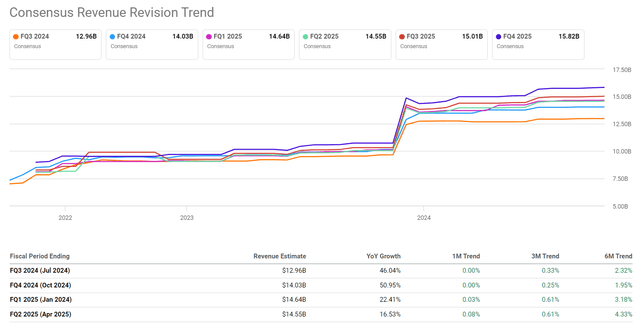

AVGO’s sales of $12.49 billion in Q2 showed a whopping 43% increase on the same period last year, beating Wall Street estimates by nearly $500 million, which was a lot. Also, the company’s actual earnings per share for the quarter climbed 6% YoY to $10.96 (or $1.1 after adjusting for the stock split), also exceeding consensus expectations. All that led to Q3 estimates revisions to the upside – 19 out of 27 analysts increased their projections for the next quarter:

Broadcom’s AI-related revenue skyrocketed by 280% YoY to ~$3.1 billion, so it looks like the acquisition of VMware was well-timed, and it is already proving its worth; VMware contributing ~$2.7 billion to infrastructure software sales, which now account for about 42% of total sales, potentially leading to higher margins for the business overall.

In the Semiconductor Solutions segment, Broadcom achieved a 6% YoY revenue increase, reaching ~$7.20 billion. As I can see, the networking business within this segment showed particularly strong growth, with revenue rising 44% annually to ~$3.8 billion. Broadcom’s focus on Ethernet solutions for AI clusters appears to be yielding positive results, as evidenced by the doubling of switch and router sales year-over-year.

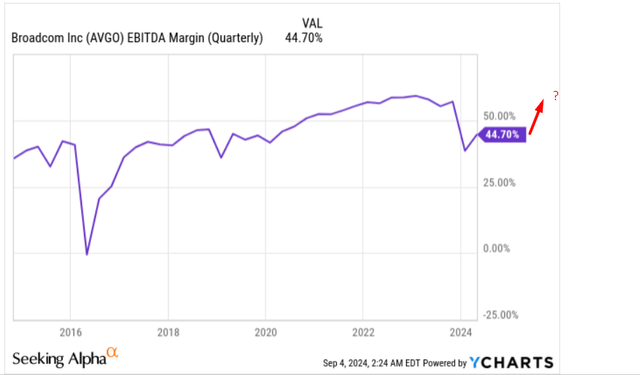

With adjusted EBITDA reaching nearly $7.5 billion and representing a robust 59% margin relative to sales, Broadcom demonstrated strong profitability in Q2. Also, important to note here is that approximately 72% of that EBITDA figure translated into net income, so it’s not just an “inflated non-GAAP metric.” Despite a significant increase in the number of outstanding shares, which grew by over 12% compared to the same quarter last year, Broadcom still managed to deliver non-GAAP EPS growth of ~6% YoY. Although it was slightly lower than the previous quarter, I believe this performance was more than sufficient to please investors, taking into account the acquisition integration efforts it possibly took for AVGO to come where it is today.

I also think Broadcom has demonstrated a disciplined approach to debt management. Despite taking on substantial debt for acquisitions, including $28 billion for the VMware deal, the company has maintained a debt-to-EBITDA ratio of 2.1x, which is comfortably below its target of 2.5x.

From Q2 results, I think we could expect Broadcom to maintain strong profitability in the foreseeable future even as it expands its operations.

Why Broadcom Should Beat Q3 FY2024?

Following the great performance in Q2, AVGO’s management has revised its outlook for FY2024 upward, projecting annual revenue to exceed $51 billion, an increase from the previous guidance of $50 billion. So this new forecast represents over 40% top-line growth, which is quite impressive. The company also anticipates that at least 37% of its semiconductor revenue will be derived from generative AI applications, an increase from earlier projections. With software expected to contribute up to 40% of total revenue, I believe Broadcom should be positioned for continued margin expansion – the management’s statements that “VMware margins should improve towards the “classic Broadcom” software margin by FY2025″ supports this assumption of mine.

YCharts, the author’s notes added

The Q2 results revealed that certain segments of the company were still experiencing a cyclical decline. However, during the last earnings call, management suggested that Q2 might represent the bottom of this cycle’s downturn. As Michael del Monte, another SA analyst, recently noted in his brilliant article, server storage connectivity could be poised for a rebound in the second half of FY2024, driven by the increasing demand for data storage in AI/ML applications. So, perhaps we can expect some positive surprises on this front, who knows?

Now let’s examine how market expectations have evolved regarding the company’s anticipated Q3 results, due to be released tomorrow.

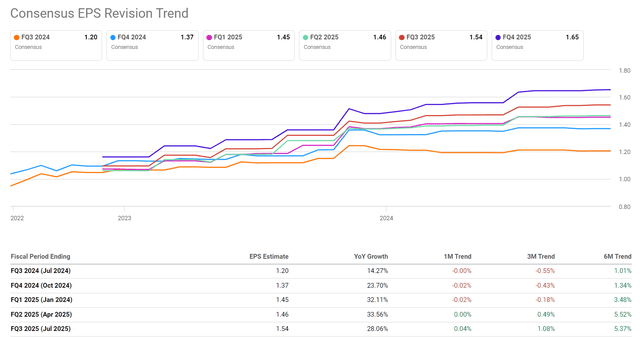

Looking at the projections for the next few years, an interesting picture emerges. Following management’s comments from Q2, the market only slightly adjusted its estimates for AVGO’s full-year revenue (their modest increase aligns with management’s own upward revision). For the full year 2024, Wall Street now expects the company to exceed the forecast by half a billion dollars. On the other hand, regarding earnings per share, it appears to me the market is less optimistic. Analysts seem to have been concerned about the marginality trends observed earlier in the year; consequently, they’ve slightly lowered their EPS forecasts through Q2 2025:

Seeking Alpha, AVGO Seeking Alpha, AVGO

Overall, I see no compelling reason to share the slight pessimism that we may witness based on the analysts’ forecast adjustments for the earnings over the past three months. The management’s decision to raise the sales forecast, combined with the initiatives to reduce debt and maintain profit margins, suggests a positive outlook for Q3. Given the market’s current reduced forecasts for Q3 and Q4, all the factors I mentioned above suggest that the company is well-positioned to exceed consensus expectations. In fact, my base case assumption is that Broadcom is likely to outperform current conservative market projections.

In late August 2024, Broadcom unveiled 3 new tools related to its recent VMware acquisition: “enhanced network appliances combining fixed Wireless Access and satellite connections, a new cybersecurity solution, and improvements to their edge computing stack”. It’s all part of Broadcom’s grand plan to grab a bigger slice of the edge computing pie, which is expected to be worth a whopping $232 billion this year, according to Seeking Alpha News. I believe that providing a more detailed description of the prospects offered by these new tools, along with a more comprehensive commentary on the recovery of segments currently experiencing a cyclical decline, should serve as an essential bullish catalyst for Broadcom’s stock following the Q3 results.

Consequently, in light of likely positive comments from management and the potential for exceeding consensus forecasts, the company’s stock should in theory continue its upward trajectory in the medium term.

Valuation Update Before Q3 Release

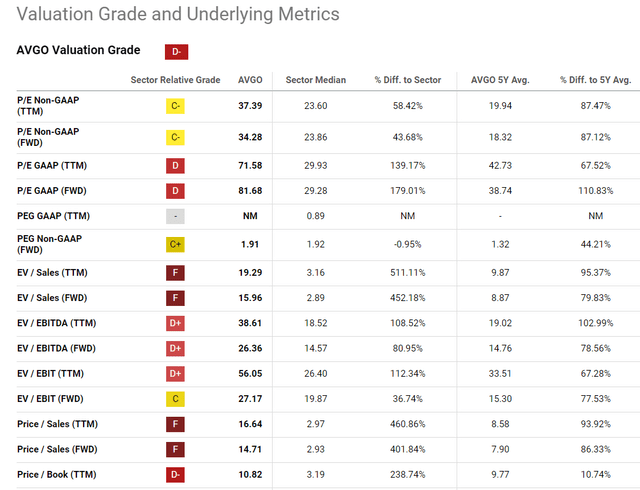

According to Seeking Alpha’s Quant system, Broadcom’s stock is currently rated as ‘D-‘ for Valuation, which suggests a potential overvaluation compared to the sector’s norms.

Seeking Alpha, AVGO’s Valuation grade

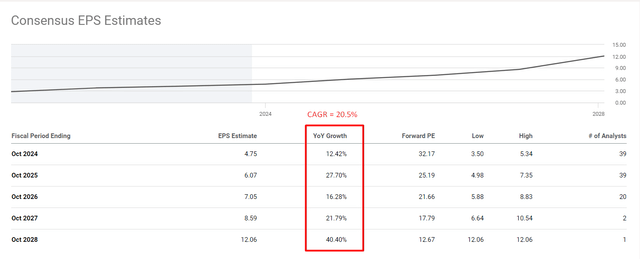

However, we must understand that the expansion of multiples we have seen in recent years is mainly justified by Broadcom’s relatively wide moat, so the premium the stock holds today is primarily explained by the size factor. Moreover, as the annual EPS consensus estimates show, the general trend is upward: As the company acquires new assets year after year, expands its product line, and maintains its position as a major chip supplier in its niche markets, its earnings continue to grow at a rapid pace. While the market may appear pessimistic in the short term (in my view), the long-term outlook remains robust as Wall Street analysts expect the EPS CAGR for the next 5 years to exceed 20%. In my opinion, this projected growth more than justifies the current high multiples.

Seeking Alpha, AVGO, notes added

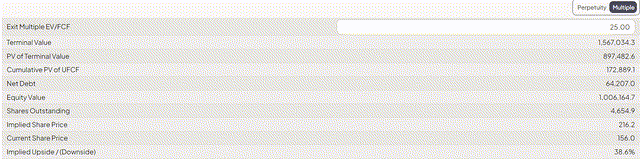

Since the publication of my last article, the financials have remained unchanged, so my DCF model’s output should stay the same. So again, even when considering the significantly pessimistic input data I used previously, such as a conservative EV/FCF exit multiple relative to where it stands today, the fundamental undervaluation of the company still exceeds 35%.

FinChat, from my previous article on AVGO

Moreover, taking into account the recent decline in the stock price, the upside potential may now surpass 40%. So I have no choice but to reiterate my “Buy” rating on AVGO right before its Q3 report release.

Where Can I Be Wrong?

As I noted in my previous article, all prospective buyers of AVGO stock should keep in mind that investing in Broadcom, like anything else on the stock market, comes with risks. So again, it’s essential for investors to consider the company’s recent acquisition spree, which has significantly increased the company’s debt load. However, I’d like to immediately note here that thanks to the strong FCF that the company generates, its debt-to-equity is still well below 1, and it keeps falling lower. Anyway, although AVGO’s debt seems to be manageable, if the company fails to sustain its growth momentum over an extended period, the burden of debt could negatively impact its financial performance and, subsequently, its stock price.

Another significant risk to my bullish outlook is the potential overvaluation of the company. Despite my attempts to justify the premium on current multiples, they remain notably high, even by historical standards. Trading at a forward non-GAAP P/E ratio of ~34x, Broadcom’s stock may indeed be overvalued. This assessment is corroborated by some external sources. For instance, Morningstar’s valuation model [proprietary source] suggests a fair value of $155 per share, which isn’t far from current prices – this proximity to the estimated fair value indicates potentially limited growth in the foreseeable future.

Morningstar, AVGO [proprietary source]![Morningstar, AVGO [proprietary source]](https://static.seekingalpha.com/uploads/2024/9/4/49513514-17254332328335464.png)

The Verdict

Despite the risks mentioned above and the recent volatility in the semiconductor industry as a whole, I maintain a positive outlook for Broadcom. I believe it’s very likely that the company will exceed the current Q3 2024 consensus. Furthermore, in my base case scenario, I expect management to make optimistic comments that could usher in a new round of growth for the stock in the medium term. The current Wall Street forecasts and recent news seem to provide a favorable environment for these expectations.

Given these factors, I reiterate my “Buy” rating on Broadcom. I eagerly await the release of the report on September 5 after the market closes, which should provide further clarity.

Thank you for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!