Summary:

- The Disney stock has been trading at new lows, as investors mull on the prospects of its linear-to-DTC transition amid an accelerating pace of cord-cutting and intensifying streaming competition.

- Recent news on Disney’s doubled capex commitment to parks amid the already capital-intensive linear-to-DTC transition is also weighing on confidence in the company’s FCF prospects.

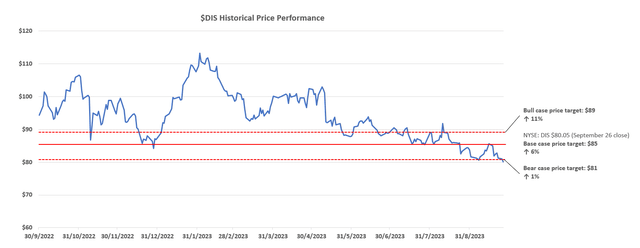

- However, the Disney stock creates a compelling risk-reward opportunity at $80 apiece, which in our opinion already captures company-specific and broader industry and macroeconomic considerations.

Bastiaan Slabbers

The Disney stock (NYSE:DIS) has been consistently closing at new lows over the past six months. Despite breaching a floor that hasn’t been seen for nine years in late August, the downtrend has continued through September. Investors’ confidence in the stock has been blighted by a concoction of adversities in the underlying business, spanning persistent direct-to-consumer (“DTC”) losses amid intensifying competition and record-setting cord-cutters that are putting Disney’s cash-driving linear networks business at risk of a faster-than-expected pace of deterioration. The backdrop also bodes unfavorably with Disney’s recent announcement to double down on its capital outlay for Disney Parks, Experiences and Products.

All of which have cast a darkening shadow over cash flows, which are critical to supporting an urgent transition to streaming, deleveraging, an impending Hulu buyout, and more importantly, the restoration of a capital return program that’s been absent since the onset of the pandemic. We’ve taken the time to go through the numbers across all of Disney’s business revenue streams and determine their prospects based on company-specific factors. Taken comprehensively with industry secular trends, we believe the bottom is in and the Disney stock could find support at $80.

The Love-Hate Relationship with Linear Networks

Disney has long been the industry leader in linear networks, holding an influential market share of more than 30% over media, cable and broadcasting. For years, it has been able to capitalize from a lucrative, high margin linear TV advertising business. But the same success has also harbingered its ultimate demise – the business still critical to funding Disney’s longer-term growth investments is facing a faster-than-expected pace of secular declines. Cord-cutting has been forging new all-time highs in recent quarters, with expectations for total pay-TV subscriptions to fall by more than 8% this year.

This has been adverse to Disney’s ad- and TV distribution / content licensing reliant business model. And the dire outlook is reflective in the modesty of recent linear ad sales – despite observations of a gradual recovery in ad demand from its inherent sensitivity to cyclical headwinds, Disney’s upfront volumes for the upcoming season were relatively flat from the prior year, with sports placements being the sole bright spot. For now, sports seem to be the only tangible force holding linear TV ad demand and its share of TV screen time together – hence Disney’s intentions to further expand ESPN’s potential. The weakening backdrop has effectively put Disney’s cash cow, which has long been the source of funding for significant growth investments such as its transition to streaming, at risk.

With time seemingly running out for Disney to execute its original plan of getting DTC up on its own feet with what’s left of linear networks, the company is looking to sell some of its best TV assets – including ABC, which currently retains NBA broadcasting rights. Current industry forecasts expect a deal of this extent to “fetch around $8 billion”. The figure implies a nominal valuation for the linear TV business relative to Disney’s market cap of almost $150 billion, despite its contributions to nearly a third of the company’s consolidated quarterly sales, highlighting the diminishing appeal of this cash engine. The limited appeal and importance of linear networks is further corroborated by management’s intentions to reshuffle Disney’s segment information starting next quarter; the presentation of its financial information will be recast into the following buckets: “Disney Entertainment”, “ESPN”, and “Parks, Experiences and Products”.

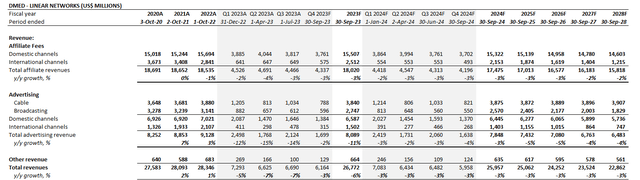

Zeroing into the fundamentals, we believe the rapidly unraveling era of linear TV is likely to drive declines at a -3% five-year CAGR for Disney’s linear networks business. The downtrend will be primarily driven by weakness in international advertising, offset by relative resilience in domestic channels. Specifically, international markets have experienced rapid adoption of streaming in recent years, despite being lower profit regions. This is corroborated by continued growth in international Disney+ core subscriptions (ex-Hotstar), which has been sufficient in offsetting domestic net losses in the U.S.

While the linear networks business has long been operating at scale with a generous profit profile, accelerating declines are likely to weigh adversely on its cost structure and ability to generate operating leverage going forward. We expect linear networks profitability to fluctuate, with segment operating margins likely to stay below the historical 30% range.

Handling DTC With Care

Despite CEO Bob Iger’s return to Disney, and his less aggressive approach to DTC expansion relative to his protégé Bob Chapek’s embrace for “growth over profit”, the emerging growth driver remains a darling and key focus area for the company’s future. Specifically, secular tailwinds persist in the DTC streaming business as consumers crave for flexibility in the connected era, yet intensifying competition has Disney switching roles from a steadfast market leader in media and entertainment to playing an endless catch-up game.

Disney’s trailing progress is captured in the introduction of Disney+ in 2019 at a competitively low price to gain market share from industry leader Netflix (NFLX). Then, in late 2022, Disney+ introduced an ad-supported tier to compete against peers that have hurried to copy the company’s success in ad-supported Hulu streaming. Looking ahead, Disney+ is also hinting at the adoption of paid password sharing to better monetize on currently non-paying viewers, which follows Netflix’s footstep as we had been expecting since last year.

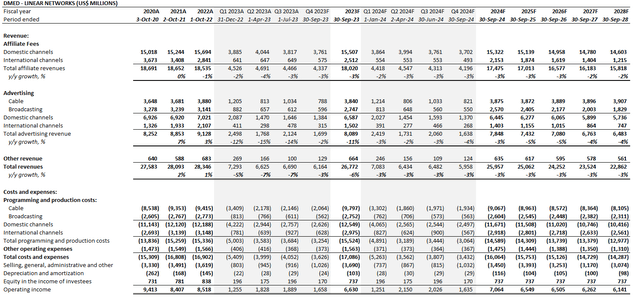

The continuous catch-up game has been costly – the DTC segment has been registering quarterly losses at an average of close to $1 billion over the last 12 months, though at a welcomed, albeit gradual, diminishing rate. While management expects to exit FY 2024 with DTC profitability, our base case forecast estimates it to be nominal. Even under the scenario of perfect execution on increasing paid subscriptions and ARPU by maintaining resilient ad sales growth amid a mixed and competitive cyclical backdrop, the company will still need to work on substantial opex margin improvements at Disney+ (at least a 7-point decrease in Disney+ opex as a percentage of total DTC revenue from F3Q23).

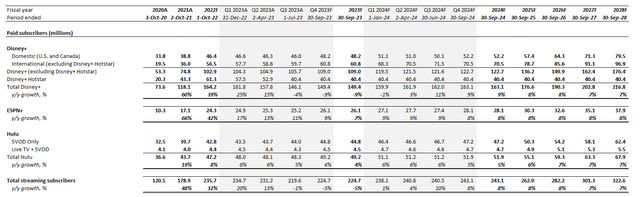

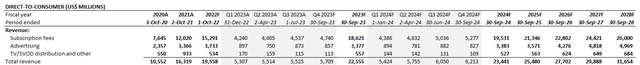

Our base case forecast for DTC expects a 7% five-year CAGR for subscriptions, driven primarily by Disney+ and ESPN+, with continued resilience at Hulu. Disney+ subscriptions will be driven by a 10% five-year CAGR at core to offset conservative expectations for stagnant Hotstar take-rates given uncertainties to how the company plans to compete against emerging local rivals in India after losing IPL streaming rights. Recall from management’s recent commentary that Disney Hotstar contributions to DTC economics are also marginal due to the cohort’s “significantly lower ARPU”.

On the revenue front, we expect quarterly ARPU to benefit in the near-term from recent price increases coupled with softer than expected churn. The ad-supported tier for Disney+ is expected to be a main driver for ARPU, with expectations for resilient DTC ad revenue growth at an 8% five-year CAGR to offset lower subscription pricing on relevant sign-ups.

To achieve profitability exiting FY 2024, Disney will also need to scale its SG&A spend further. We’ve modelled the cost item conservatively, considering expectations for continued allocation of spending towards promotion of Disney+ to international platforms within the foreseeable future, alongside incremental support to relevant ad sales efforts amid the increasingly competitive environment.

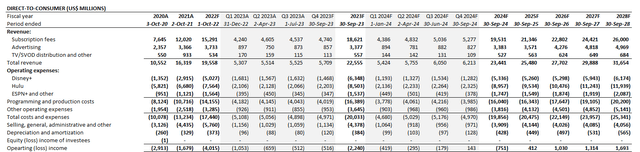

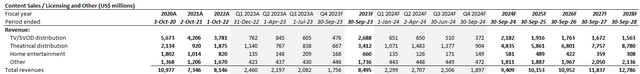

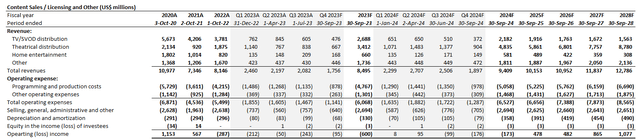

Lumpy Performance in Content Licensing

Content sales/licensing and other represent the smallest revenue contributor to Disney’s consolidated performance, with the business’ bottom line results also fluctuating in line with the lumpy nature of relevant sales. Much of the business’ performance is correlated with the reception of theatrical film and TV production releases, highlighting the revenue stream’s unpredictable nature. This is further corroborated by weak performance in Disney’s summer films as management had highlighted, diverging from the outperformance of “Avatar: The Way of Water” and “Guardians of the Galaxy 3” released earlier in fiscal 2023.

In line with expectations for secular declines in linear TV viewership and other non-internet-based content consumption channels, we expect TV/SVOD distribution and home entertainment revenue performance to be soft. SVOD tailwinds to distribution revenue is likely to be offset by Disney’s incentive to better capitalize on its content competitiveness by retaining the latest and greatest ties for its own streaming platforms. Meanwhile, theatrical distrain will likely remain the core driver of content sales/licensing given Disney’s extensive trove of industry-leading IPs from studios, including Pixar, Marvel and Lucasfilm.

Meanwhile, segment operating margins are expected to stay relatively in line with historical performance, with limited scale from the weaker home entertainment and TV/SVOD distribution businesses, offset by a greater returns profile on theatrical releases. The assumption also takes into consideration management’s intentions to further embrace the traditional windowing strategy to optimize investment returns over the longer-term.

Doubling Down on Disney Parks, Experiences and Products

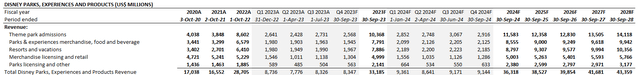

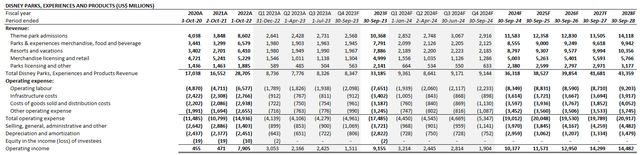

The DPEP segment has been a core earnings and free cash flow growth driver for Disney, representing a key source of funding for DMED segment – particularly DTC – growth initiatives. And the company is doubling down on its investments in this corner to ensure DPEP keeps up with longer-term opportunities. Specifically, Disney has committed $60 billion of capex over the next 10 years for the expansion of its parks and experiences, as well as the Disney Cruise Line that has been met with favorable performance in recent quarters. The amount is close to double the amount Disney is currently spending on the DPEP segment, with the company eyeing for potential TAM expansion with the addition of parks and resorts/vacation venues.

With six global theme parks (including Tokyo Disneyland, which is run by a third-party operator with IP licensing), and a handful of other experiences spanning the Disney Cruise Line and Disney Resorts, Disney captures an average of more than 50 million visitors annually. DPEP currently faces near-term headwinds, including inflationary pressures consumer spending, a tough PY compare due to calendar 2022’s Disneyworld 50th Anniversary celebrations, and limited international visitation due to elevated travel costs. The challenges have been partially offset by stronger-than-expected volumes and spending at the Shanghai Disney Resort and Hong Kong Disneyland Resort, though the outlook remains uncertain given mixed post-pandemic recovery prospects in said regions.

But over the longer-term, Disney’s aggressive investment roadmap for DPEP could imply potential improvements to penetrating previously unreached markets, while also reinforcing international visitation volumes and better capitalizing on tourism dollars. In addition to plans for expanding the global footprint of Disney theme parks and the experiences within them (e.g. Zootopia-themed park at Shanghai Disney Resort and Frozen-themed experiences at Hong Kong Disneyland), the recently announced capex roadmap would include the addition of two more ships to the Cruise Line in fiscal 2025 and fiscal 2025. This is expected to help the company better monetize a “market of more than 700 million people with high Disney affinity it has yet to reach with its Parks”.

The investment thesis for Disney’s $60 billion capex commitment to DPEP also includes reinforcement for its IPs. The company has long credited its Parks for bolstering the connection and engagement between its fan base and the expansive portfolio of Disney IPs. In addition to DPEP segment growth, the longer-term investment roadmap for Parks and vacation experiences is likely to drive adjacent revenues to Disney’s entertainment portfolio.

Taken together, we expect Disney to maintain a five-year CAGR at about 5% at its DPEP segment, driven primary by theme park admissions, parks and experiences merchandise, food and beverage, and resorts and vacations sales – all of which represent key beneficiaries of impending growth investments.

Meanwhile, profit margins are expected to stay elevate towards the high 50% range through the forecast period. The bottom line will be impacted by accelerated depreciation attributable to the early retirement of the Galactic Starcruiser experience in Florida this year. Spending is expected to gradually increase further over the forecast period to support the build-out of new facilities, theme parks and vacations, and the ensuing ramp-up of visitors, before scaling back towards the sub-50% range over the longer-term.

Valuation Considerations

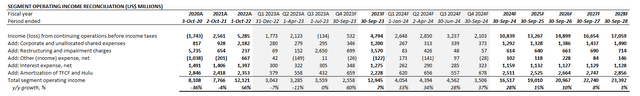

Taking projections from DMED (Disney Media and Entertainment Distribution) and DPEP together, we expect segment operating income to total $13 billion in FY 2023. This represents an increase of 7% y/y, in line with management’s guidance for high-single digit expansion for FY 2023. Total segment operating income is expected to accelerate at 28% to $16.5 billion in FY 2024, driven primarily by expectations for narrowing losses at DTC.

Disney_-_Forecasted_Financial_Information.pdf

Our forecast expects capex to total about $5 billion in FY 2023, which is in line with management’s guide. The amount is expected to increase substantially over the forecast period, given Disney’s $60 billion 10-year spending plan on DPEP. Specifically, the investment roadmap implies a CAGR of more than 7% over the forecast period through fiscal 2027, which outpaces the 3.3% five-year CAGR assumption applied on revenue.

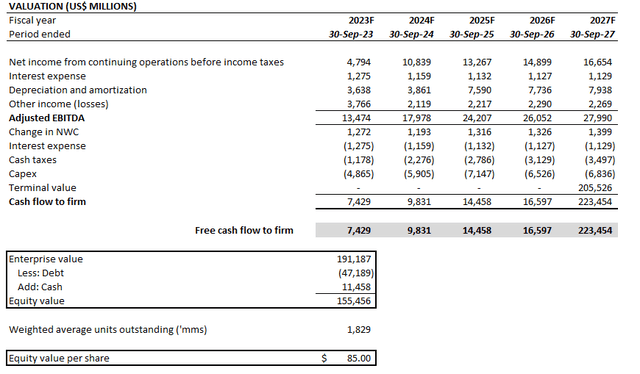

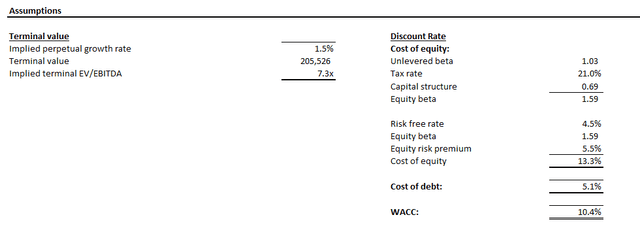

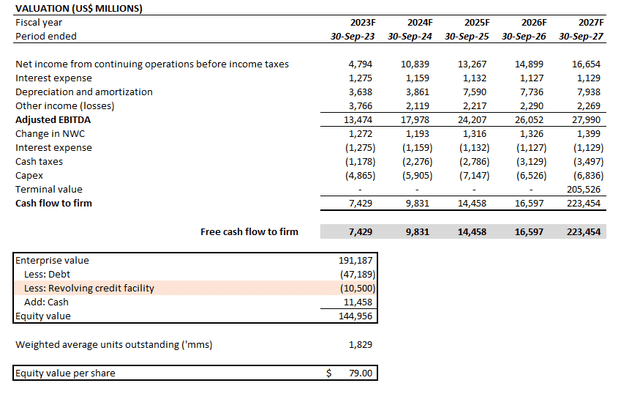

Our base case price target of $85 is computed by discounting the projected cash flows taken in conjunction with the foregoing fundamental analysis. We’ve applied a 10.4% WACC in line with Disney’s capital structure and risk profile. The discount rate also takes into conservative consideration of an elevated rate environment, in line with the Fed’s intentions to keep monetary policy in restrictive territory for longer, which would impact long-end yields and, inadvertently, the valuation of long duration assets. The analysis also applies an implied perpetual growth rate of 1.5%, which assumes that DTC tailwinds will displace linear prospects, instead of being accretive to maturation in DMED and DPEP growth. The computation yields an enterprise value of $191.2 billion, which results in an equity value of $155 billion or $85 apiece with incremental consideration of Disney’s net debt.

Even under the hypothetical scenario that Disney adds another $10.5 billion in debt by drawing on its revolving credit facility to fund the impending Hulu buyout, the stock should find support at ~$80.

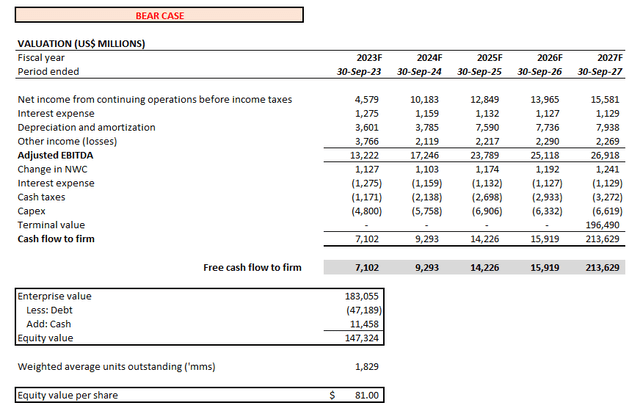

In the downside scenario, we assume lower cash flows due to weaker growth prospects and reduced operating leverage. Applying the same base case valuation assumptions (10.4% WACC; 1.5% perpetual growth), the bear case PT is $81, mirroring the stock’s current levels.

The Bottom Line

Disney faces a rough and capital-intensive turnaround roadmap, given significant investments required in the transition to DTC is expected to be met with growth in replacement of its existing market leadership in media and entertainment, instead of accretive and TAM expansion. The combination of impending cash commitments, including the $9.2 billion Hulu put due fiscal 2024, $60 billion long-term DPEP investments, and ballooning content spend amid intensifying DTC competition, also dials up execution risks. However, we believe anything below or at $80 apiece represents a balanced risk-reward opportunity in Disney.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!