Summary:

- Google’s stock faces pressure due to DOJ’s proposed antitrust remedies, including Chrome divestiture.

- Despite regulatory challenges, Google continues to deliver strong earnings, with Q3 2024 revenue up 15% year-over-year and operating margins at an all-time high.

- The likelihood of a Chrome divestiture is low; softer remedies like restricting exclusive agreements and opening Chrome to third-party search engines are more probable.

- With a P/E ratio of 21.9x and potential for 21% annual returns, I find the risk/reward attractive and continue to add to my position.

ymgerman/iStock Editorial via Getty Images

Google’s stock (NASDAQ:GOOGL) (NASDAQ:GOOG) is once again under pressure following the recent development in the antitrust case, as the DOJ has proposed remedies, such as a forced divestiture of Chrome, potential Android sale, restrictions on default search and imposing restrictions on Google’s AI development, all that could meaningfully influence its future growth, keeping the company underneath a continuous regulatory spotlight with investor sentiment turning sour.

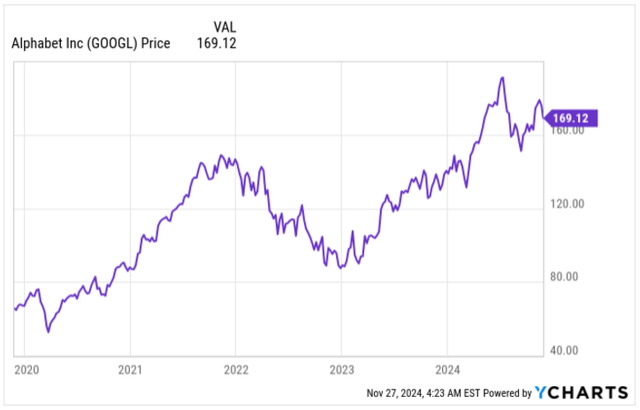

Google’s stock is still down 12% from its all-time high of $192, even as the company is firing on all cylinders and delivering better-than-expected earnings.

Price Development (Seeking Alpha)

Negative sentiment may continue to weigh on the stock price in the near term, but we need to look in-depth underneath the hood to determine the likelihood of a Chrome divestiture, particularly as the new US administration will take power in January 2025, prior to Google’s remedy hearing, and whether buying the shares here opens up an attractive opportunity.

Previous Coverage

The last time I covered Alphabet, Google’s parent company, was back in August 2024 in an article titled “Google: 3 Potential Outcomes Of Antitrust Case And What It Means For Investors.”

In that coverage, I went to great lengths discussing the DOJ antitrust case against Google, which was based on the company’s dominance in the global search market, thanks to a staggering 89% market share across all devices, well ahead of peers such as Microsoft’s (MSFT) Bing with 3.9% and Russian Yandex with 1.4%.

According to the antitrust case, Google’s monopoly-like position has been established thanks to strategic deals similar to the ones with Apple (AAPL), where Google paid as much as $20B annually to secure Safari’s default. In 2023, Google spent $53B in traffic acquisition costs (TAC), with an estimated 40% going to Apple to secure its search dominance, virtually eliminating competition. Likewise, Google’s ownership of Android, an OS with a 70% market share in smartphones globally, significantly helped, but I would argue that Google is the most accurate and reliable search engine, and that’s why many users specifically choose to use it.

At the time of my coverage, the potential remedies were not yet known. Still, Google’s breakup seemed to me to be an unlikely solution due to its complexity and negative impact on consumers. Likewise, imposing financial penalties, I argued that financial penalties may not effectively address the core issue of its monopoly-like position. The most probable solution to me seemed to be to restrict exclusive default search agreements and instead give the users a choice to select their preferred search engine on their device during a setup, a similar measure that is already in place in the European Union.

This would, in turn, result in a loss of market share for Google, but the company would, in the future, retain most of its TAC expenses.

Chrome Divestiture

A few months later, we have more information available, and the DOJ is now demanding Google’s divestiture of its Chrome browser. In a filing last Wednesday, the DOJ presented its plan, arguing that selling Chrome would level the competitive landscape for rival search engines:

Permanently stop Google’s control of this critical search access point and allow rival search engines the ability to access the browser that for many users is a gateway to the internet.”

Chrome alone generates no revenue for Google, at least not directly. Yet, Chrome is a key component for Google to maintain its search market dominance, with around 89% of global search traffic and 50% of the US browser market. If the software was divested, analysts are estimating it could be worth up to $20B.

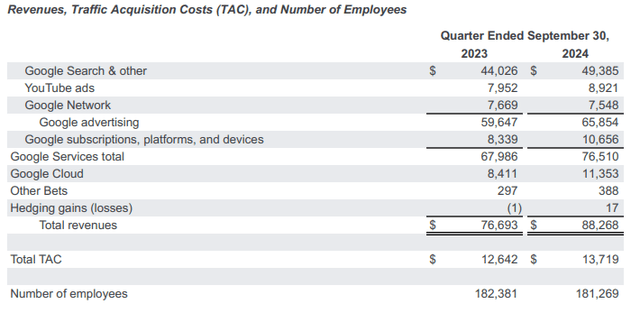

As you would expect, Chrome is the most popular web browser. It is essentially free but indirectly drives Google’s revenue by directing massive traffic to its default Google search engine, which in turn generates revenue for Google via ads. In the Q3 2024 earnings report, Google Search generated as much as $49.4B in revenue for the company, which accounts for roughly 56% of total revenue during the quarter.

Q3 Earnings (GOOGL IR)

But that’s not all. Chrome is one of the reasons why Google is the best search engine, as it allows the company to collect browsing data, improve its search relevance, and enhance Google’s ad-targeting capabilities. This, in turn, attracts more advertisers who are willing to pay premium prices for advertising on the platform.

We could argue that without Chrome, Google’s market share would likely fall, search quality would deteriorate, and the integration into its broader ecosystem would be impacted. Simply put, it is a negative development for users, which should be a consideration for the DOJ.

Beyond search and ads, Chrome serves as a gateway to all its other services, such as Gmail, YouTube, and Google accounts, which help to drive user engagement. In my opinion, given the size and popularity of these services, users would be negatively impacted if the seamless integration is removed.

That said, even as Chrome does not directly generate revenue for Alphabet, it’s a strategic asset, and without Chrome, Alphabet’s core business would be disrupted.

A Chrome divestiture remedy by the DOJ would, in my opinion, be very harmful to Alphabet’s core business, but I still view it as very unlikely. Instead, I see this proposal as a leverage tactic to push Google to agree to other, less severe measures, such as the elimination of exclusive contracts with the device manufacturers like Apple and Samsung (OTCPK:SSNLF) and force Google to open up Chrome to other, third-party search engines, giving users a choice of what search engine to use.

The DOJ also seeks to force Google to sell Android entirely or impose restrictions on the OS to prevent Google from favoring its own search engine. Likewise, Google has perhaps the largest available source of information at its disposal, and the DOJ is trying to prevent Google from manipulating the development of generative AI tools, which would give Google the edge once again.

Worse, this likely means that Google or Alphabet won’t be allowed to make any new acquisitions in the tech arena, with all new search-based and AI tools having to originate from their own R&D pipeline. This is similar, as we see across other mega-cap businesses, where M&A is becoming increasingly rare.

Nonetheless, Alphabet already flagged that the company will challenge this ruling, with a final decision expected in August 2025, prolonging the legal process and likely the negative sentiment around the company as long as we have no resolution in sight.

However, this brings me to the point of the newly appointed US administration.

New US Administration

Here, I need to make it clear that discussing the impact of President-elect Donald Trump and the new US administration on Google’s antitrust case is speculation rather than anything else. However, there are a few essential points that we, investors, should consider, in my opinion.

The first Trump administration initially brought the case against Google. However, in October, Trump made it clear that different penalties could be better alternatives to breaking up any pieces of Google’s business as the US is aiming to maintain its competitiveness against Chinese tech businesses, and breaking up Google’s business could just do the opposite.

From my perspective, a complete withdrawal of the case is unlikely, given that the Trump administration initiated it in the first place, but I am expecting a softer remedy for Google to retain its competitiveness, particularly on a global scale.

One thing we need to consider here is the timing. The ruling is expected to be by August 2025, which is already well into Trump’s second administration. The new president-elect could influence the DOJ’s decision-making; however, states could continue pursuing the case independently, even if the federal tone softens.

In my opinion, Trump’s priority will be to retain US tech competitiveness on the global scale rather than dismantling its crown jewel businesses, so I would expect a softer tone from the government against Google, yet still enforcing measures to increase competitiveness in the search market. This may elevate the negative sentiment, but for now, this is just speculation.

Is Google’s Stock Attractive To Buy Now?

Google’s business continues to fire on all cylinders, bringing in $88.3B in revenue in Q3 2024, a 15% growth compared to the prior year, with all three core segments, Google’s Search, YouTube ads and Google Cloud delivering double-digit growth rates.

The company is also catching up in the AI race, introducing new features and expanding its search capabilities.

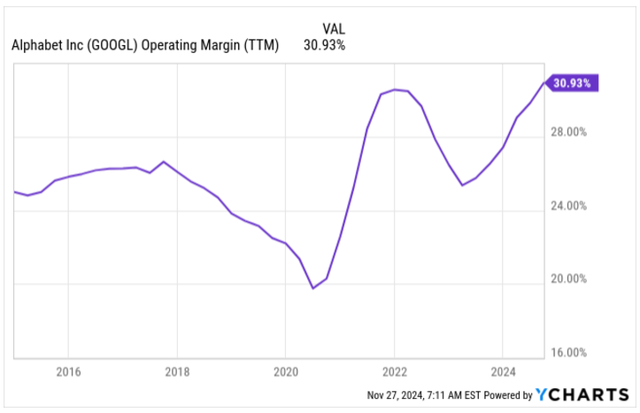

What’s more, management’s focus on efficiency helped to improve the operating margins, which are currently at an all-time high of 31% and likely to expand further, similar to what we are seeing also with another ad-business Meta Platforms (META), whose Operating Margin is around 40%.

Operating Margin (Seeking Alpha)

However, the legal overhang will likely weigh on Google’s stock for the time being, and I do not expect any meaningful rally in the near term, particularly as we will need to see what kind of implications President-elect Donald Trump and the new US administration will have on the DOJ antitrust case.

In my opinion, the proposed number one remedy, forcing Google to divest its browser, Chrome, is unlikely, as Trump will want to retain its global competitiveness, particularly avoiding Chinese companies to capture market share in what could be considered strategic business, thanks to the data collection.

Instead, softer remedies, such as restricting exclusive agreements and perhaps opening Chrome to third-party search engines, are the likely outcome from my perspective. These could improve the competitiveness of the search business but ultimately not harm Google’s business to the extent that Chrome’s divestiture would.

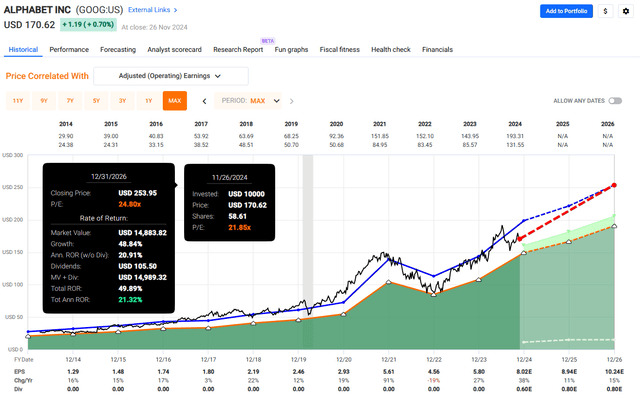

As a result of the negative sentiment, Google’s stock is trading at a relatively depressed Blended P/E of 21.9x, well below its historical average of 24.8x.

Analysts are not expecting any meaningful impact on its earnings over the next few years as the Chrome divestiture is not reflected in the forecast; they expect 11% EPS growth in 2025, followed by 15% in 2026.

This offers the potential for up to 21% total annual returns for investors willing to take the risk that the DOJ won’t successfully implement its proposed remedies, which appear to be exaggerated and are likely to face legal challenges.

I continue to add to my Google’s position, as the risk/reward is attractive.

GOOGL Valuation (Fast Graphs)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.