Summary:

- Comcast is trading at a deep discount with a forward PE of 9.6, significantly below its historical average, presenting a strong long-term buy opportunity.

- Despite recent revenue declines in theme parks and theaters, Comcast’s broadband and wireless segments show robust growth, driven by ARPU improvements and rising wireless revenues.

- The company maintains a strong A- rated balance sheet and returns significant capital to shareholders through buybacks and dividends, supported by strong cash generation.

- Catalysts like the bundling opportunities, the recent Olympics, NBA rights, and the upcoming Epic Universe theme park offer potential for market-beating returns from Comcast’s current discounted valuation.

MarsBars

Stocks can trade at unreasonably high valuations for extended periods of time and, in the same vein, can be too cheap for both known and unknown reasons that defy logic.

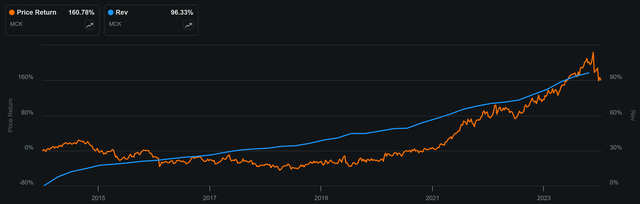

One example is McKesson (MCK), which traded at a bargain valuation in the 2018 to 2020 timeframe, despite steadily growing its revenues. As shown below, it only finally caught a bid starting in 2021, trading as high as $630 in August before settling at $508 at a more reasonable forward PE of 15.8.

(Note: The following graph shows price return and revenue percentage growth on two different scales on the left and right).

This brings me to Comcast (NASDAQ:CMCSA), which remains unmistakably cheap with a sub-10x PE. I last covered CMCSA in January, highlighting its pricing power, bottom-line growth, and strong cash generation.

It still hasn’t caught a bid as the stock has declined by 7% since my last piece (-5.4% total return including dividends) while the S&P 500 (SPY) has marched higher by 21%.

In this article, I revisit CMCSA, including recent business developments, and discuss why the stock remains a great long-term buy at the current bargain valuation before it catches a bid, so let’s get started!

Why CMCSA?

Comcast remains a great choice for bargain seekers who want to have automatic diversification into the media, broadband, and wireless space. It can also be thought of as a real estate company through its Theme Parks segment. On a combined basis, CMCSA is highly cash-generative, enabling sizable returns of capital to shareholders, including both share buybacks and dividends.

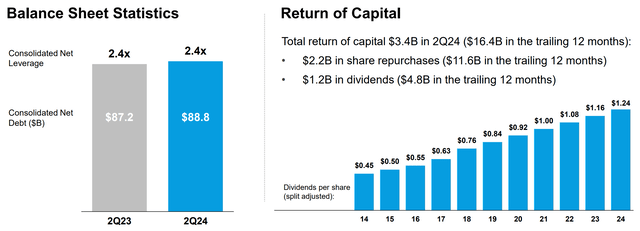

CMCSA has consistently raised its dividend for the past 10 years and over the trailing 12 months, returned $16.4 billion to shareholders (11.6 billion in share buybacks and $4.8 billion through dividends). As shown below, it was able to achieve these robust capital returns without sacrificing balance sheet quality, with the leverage ratio being unchanged at 2.4x compared to the prior year.

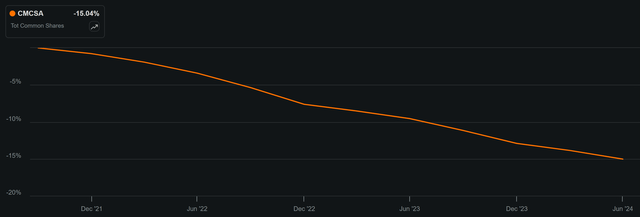

As shown below, CMCSA has retired 15% of its outstanding shares since share repurchases began 3 years ago, when the stock began trading at lower valuations. This equates to an impressive 5% reduction per year!

CMCSA Shares Outstanding (Seeking Alpha)

One of the reasons why CMCSA has underperformed this year may be due to underwhelming top-line performance, with total revenue declining by 2.7% YoY to $29.7 billion during Q2 2024. This was due to growth challenges at the theme parks and the theater segment. It’s worth noting that CMCSA had tough comps, given the blockbuster success of The Super Mario Bros. Movie and Fast X last year.

Free cash flow of $1.3 billion during Q2 was down from $3.4 billion. However, that was due to a $2 billion increase in cash taxes due to the gain on sale of the Hulu streaming service to Disney (DIS), and as such, I would expect for FCF to normalize this quarter.

Meanwhile, CMCSA continues to see broadband revenue grow at 3% YoY during Q2, driven by a 3.6% increase in ARPU (average revenue per user). The growth in ARPU largely offset a decline in subscribers due to competition from AT&T’s (T) fiber offering, and 5G Broadband from Verizon (VZ) and T-Mobile (TMUS), and by the end of the Affordable Connectivity Program.

Moreover, CMCSA continues to see strong wireless growth (from which it buys wholesale from Verizon), with a robust 17% YoY revenue growth and 322K new line additions during the second quarter. This was driven by bundling between broadband and wireless options. Also encouraging, CMCSA’s streaming service, saw 28% YoY revenue growth and now has 33 million subscribers, contributing to a $300 million YoY improvement in EBITDA. This outweighed the pressure on its TV networks.

Looking ahead to Q3 results and beyond, I believe the market isn’t giving CMCSA enough credit for a very strong Olympics showing in August, which pushed NBC to a 52-week network ratings win for the 2023-24 TV season. NBC was also able to leverage the Olympics to promote its other shows, such as ‘The Voice’ featuring new judge Snoop Dogg, who had a heavy presence in TV broadcasts from Paris.

Moreover, CMCSA won an 11-year NBA rights deal and is also heavily investing in its theme parks, with the 2025 opening of Epic Universe in Orlando expected to be a significant growth driver. Management also expects bundling to drive ARPU with the NOW suite, which offers internet, mobile, and streaming in one package, and continues to guide for 3-4% annual ARPU growth.

Importantly, CMCSA carries a strong A- credit rating from S&P with the support of a strong balance sheet with a net debt to adjusted EBITDA ratio of 2.4x, sitting well below the 3.0x level generally considered to be safe by ratings agencies. This lends support to the 3.1% dividend yield. The dividend is well-covered by a 29% payout ratio and comes with a 5-year CAGR of 8.5%.

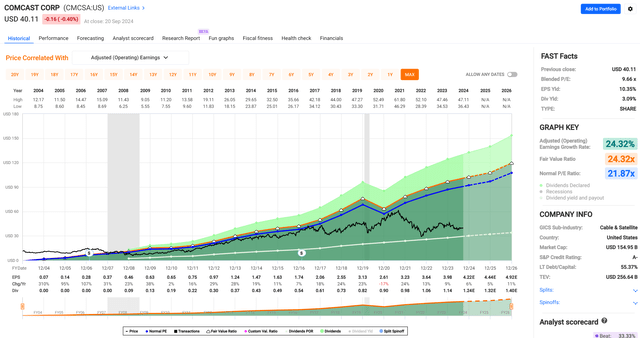

Lastly, CMCSA remains a deep bargain at the current price of $40.11 with a forward PE of 9.6, sitting at less than half its historical PE of 21.9, as shown below.

With a 3.1% dividend yield, earnings accretion from aggressive share buybacks, earnings growth from the aforementioned catalysts, and potential for even a slight reversion toward its mean valuation, CMCSA offers potentially strong market-beating returns from its current price.

Risks to the thesis include intense competition in the broadband segment as fiber and 5G broadband providers seek to take market share. Also, cord-cutting pressure on CMCSA’s TV networks could eat into growth if the Peacock streaming service isn’t able to pick up the slack, and future strikes in Hollywood could impact content creation. Lastly, theme parks are generally sensitive to economic recessions and therefore could provide lumpy results from time to time.

Investor Takeaway

Comcast presents an attractive investment opportunity for long-term investors, trading at a discounted valuation with a forward PE of 9.6, far below its historical average. Despite a modest revenue decline in the most recent reported quarter due to challenges in theme parks and theaters, CMCSA’s broadband and wireless segments continue to show strong growth, with robust ARPU improvements and rising wireless revenues.

The company remains highly cash-generative, returning significant capital to shareholders through buybacks and dividends while maintaining a strong A- rated balance sheet. With catalysts like the Olympics, NBA rights, and the upcoming Epic Universe theme park, CMCSA offers strong potential for market-beating returns from its current discounted valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Read The Full Report on iREIT+Hoya

iREIT+HOYA Capital is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.