Summary:

- Dell is poised to benefit from AI-driven data center growth, with significant partnerships with industry titans.

- Dell’s fiscal Q2 results show impressive growth and free cash flow supports dividends and share buybacks, enhancing shareholder value.

- Trading at a reasonable valuation, Dell remains a strong long-term buy, with analysts bullish on its potential to exceed earnings estimates.

Gerville/iStock via Getty Images

The race to corner the artificial intelligence (AI) market is on. Hyperscalers like Alphabet (GOOG)(GOOGL), Meta (META), Amazon (AMZN), Microsoft (MSFT), and Elon Musk’s xAI are spending billions, while companies across the globe are leveraging generative AI, robotic process automation, and machine learning to improve efficiency in a super-competitive business world.

Musk believes AI will make the gigantic leap from generative (creating content or accomplishing tasks using massive data pools) to artificial general intelligence (AGI) within two years, while others predict it will take longer. Whether you think Musk is right or wildly optimistic, cheer him or cringe (or anything in between) is beside the point.

The point for investors is to find companies that benefit from the enormous spending. Here’s why I recently initiated a position in Dell Technologies (NYSE:DELL).

Demand tailwinds

Statista predicts global data center revenue will increase 50% in five years, from $416 billion this year to $624 billion in 2029, with servers and storage sales alone rising from $176 billion to $308 billion. This is a massive opportunity for Dell.

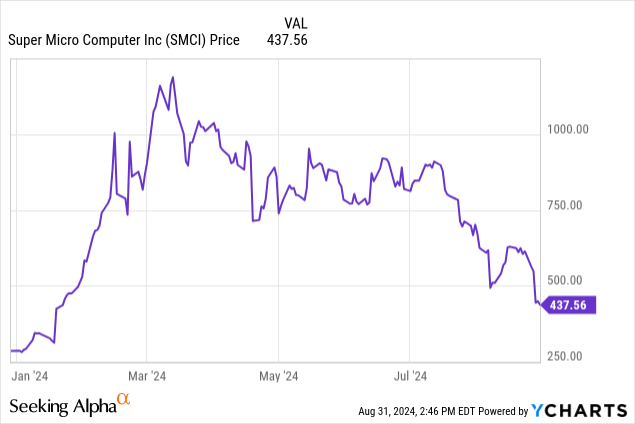

Much of this will come from the centers constructed by “Hyperscalers” like those mentioned above. Dell is a major vendor for xAI’s initiative that seeks to build the “world’s largest supercomputer” and will provide server racks. You can read more about this here. A key competitor, Super Micro Computer (SMCI), is also involved in this build, and its troubles could launch Dell into the driver’s seat. Success here will translate into future contracts.

Super Micro Computer’s troubles are positive for Dell. Super Micro’s stock plunged as it delayed its annual 10-K filing, and its reputation suffered after a scorching short report from Hindenburg Research.

It doesn’t matter whether the report is eye-opening or a hatchet job. After these events, would you rather be a salesperson for Dell or SMCI?

NVIDIA (NVDA) and Dell are also well integrated with the Dell AI Factory and Project Helix, aimed at accelerating the adoption of AI tech.

These powerful partners will allow Dell to expand its market share rapidly.

Impressive results

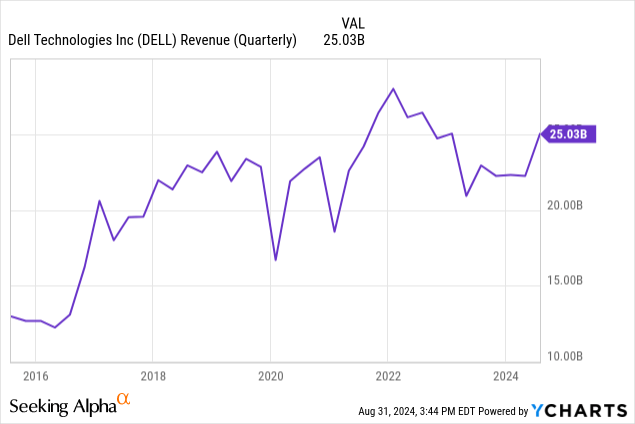

Dell’s fiscal Q2 results are encouraging. Revenue increased 9% year over year (YOY) and 13% sequentially, as shown below.

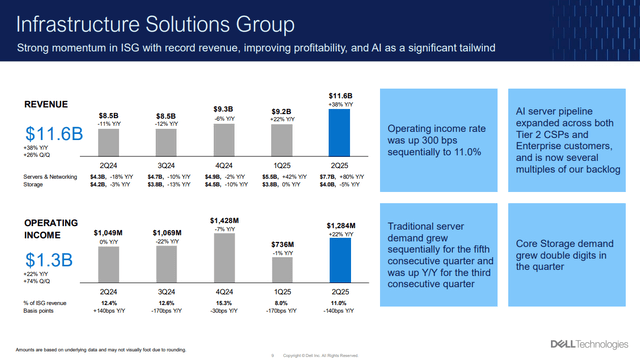

Operating income and free cash flow were also strong, at $1.3 billion each. But the best news is in the details.

Sales in the Infrastructure Solutions Group (ISG) (which serves its data center customers) hit $11.6 billion, with 33% YOY growth, powered by an 80% increase in servers and networking revenue, as shown below.

The increases are a direct result of the increasing market demand. Here is a selection of CEO Jeffrey Clarke’s comments, emphasis mine:

In ISG, our AI server orders and shipments increased again sequentially. Our unique capability to deliver leading-edge air and liquid-cooled AI servers, networking, and storage…continues to resonate with customers. Orders demand was $3.2 billion, primarily driven by tier 2 cloud service providers. Encouragingly, we continue to see an increase in the number of enterprise customers buying AI solutions each quarter.

Enterprise remains a significant opportunity for us as many are still in the early stages of AI adoption…We shipped $3.1 billion of AI servers in Q2…AI server backlog remains healthy at $3.8 billion.

Most exciting, our AI server pipeline expanded across both tier 2 CSPs and Enterprise customers again in Q2 and now has grown to several multiples of our backlog.

The robust market, its industry expertise, and competitors’ struggles are an excellent setup for Dell. But there are also other considerations.

What could go wrong?

All stocks have risks, and Dell is no exception. The industry is competitive, and the highly cyclical PC market is its largest business. Some predict a new upgrade cycle driven by operating system and AI-related performance updates, but this is speculative at the moment. Consumers are clearly feeling the pinch of high interest rates; however, rate cuts are expected soon.

Is Dell stock a buy?

In addition to the massive potential of its ISG group, Dell’s shareholders have other perks. The dividend yields 1.5% after the healthy 20% increase this year, and management’s goal is to grow it by at least 10% annually through fiscal 2028. This will give today’s investors at least a 2% yield on cost, regardless of increases in the stock price.

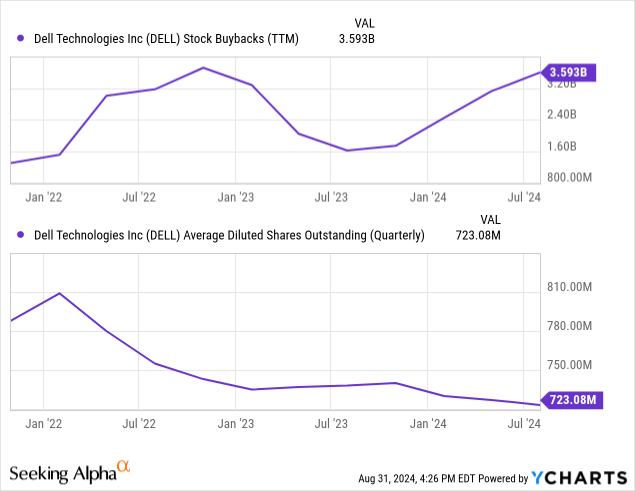

The company is more prolific in share buybacks, with $700 million last quarter and $3.6 billion, or 4.5% of the current market cap over the last twelve months. As shown below, the outstanding share count is shrinking rapidly as buybacks increase.

Dell can do this because of its prolific free cash flow, which was $24 billion over the previous five years and $1.3 billion last quarter – a $5.2 billion run rate.

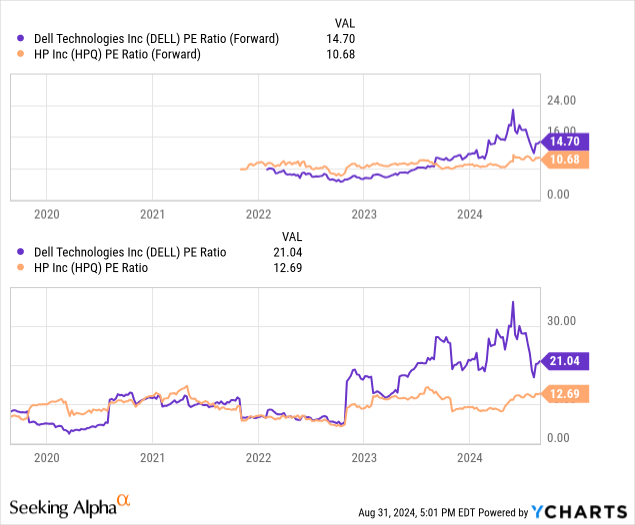

The stock trades at a higher price-to-earnings (P/E) than its recent averages and competitors like HP (HPQ), as shown below.

However, Dell’s recent results have been more impressive, and analysts are bullish, with an average price target just North of $150 per share, or 32% above the current price. In addition, Dell could beat analysts’ earnings-per-share (EPS) estimates if it increases its market share due to problems at Super Micro or if demand is even higher than anticipated.

Many stocks have already caught the AI hype train out of the station, but Dell still trades at a reasonable valuation and 36% off its recent high. This is why I initiated a position when the stock fell to $100 per share, and still consider the stock a strong long-term buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.