Summary:

- I believe Exxon Mobil stock is a solid long-term investment despite lagging the broader market and high valuation due to its scale and cost-saving initiatives.

- Despite lower earnings in Q3, Exxon is still putting out a great deal of output – 4.58 million barrels a day, the highest in 40 years.

- I think XOM’s plans for production growth and structural cost savings justify its premium valuation.

- XOM now has a huge competitive advantage in the energy world, where production costs are the number one way to keep profits high.

- Exxon is still a great stock today, with tremendous upside opportunities in both traditional energy and low-carbon energy. The stock is a “Buy”

jetcityimage

Intro & Thesis

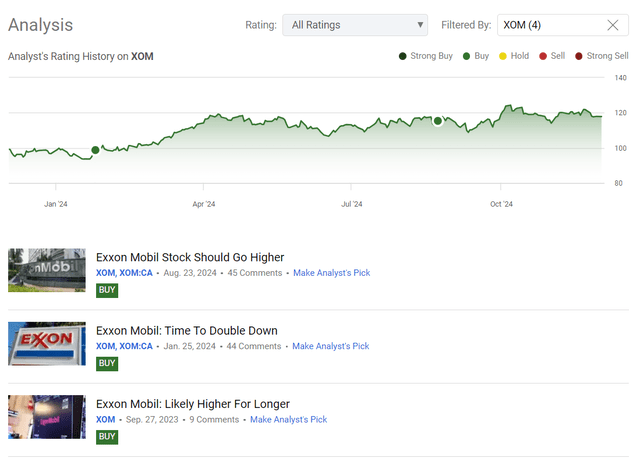

I first initiated coverage of Exxon Mobil Corporation (NYSE:XOM) stock at the end of December 2022. Unfortunately, I had no luck with timing at that time. However, when the stock started to turn around, I wrote my 2nd article at the end of September 2023 and actually caught the local top of the stock. Nevertheless, I believed that Exxon Mobil could recover in the medium term, as the company seemed resilient against a backdrop of global instability and relatively high energy prices, which is why I thought a doubling down on that dip would be reasonable. As it turned out, this decision paid off. On the other hand, my most recent bullish update now lags the broader market by a few hundred basis points, although it’s in the green:

Seeking Alpha, my coverage of XOM

Although XOM lags behind the broader U.S. stock market so far this year, I think the stock is a good long-term investment, even if many don’t believe in the future of oil and fossil fuel-based power generation. While XOM stock is expensive, the company clearly has great scale, and its plans for production growth and progress in implementing structural cost savings only add to its premium valuation. Hence, my “Buy” rating confirmation today.

Why Do I Think So?

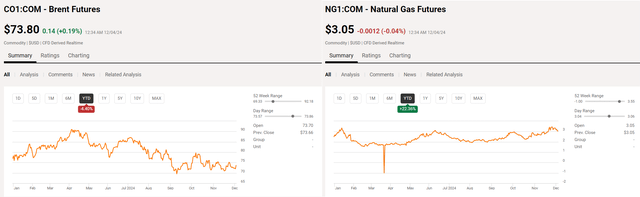

This year has been quite volatile for the O&G industry, although we have seen a common dynamic in the sector’s key energy prices. At the time of writing, Brent oil futures (CO1:COM) are trading at $73.87/barrel, below last year’s levels. At the same time, natural gas futures (NG1:COM) have managed to rise by more than 20% YTD, resulting in a rather mixed picture overall.

Seeking Alpha

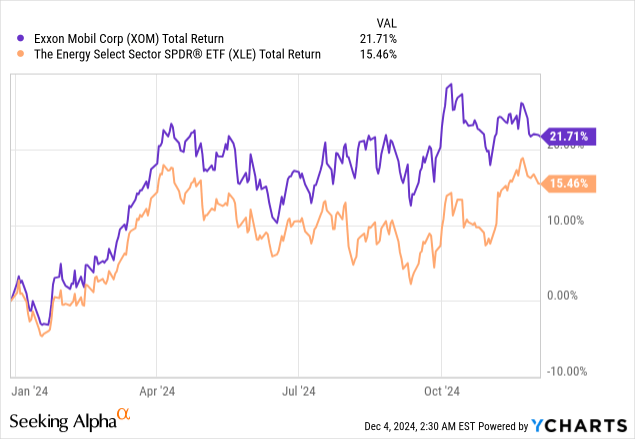

Against this backdrop, the stock price performance of one of the world’s largest companies in the sector seems quite stable – XOM is outperforming the broader energy market (XLE) by 625 bps so far this year:

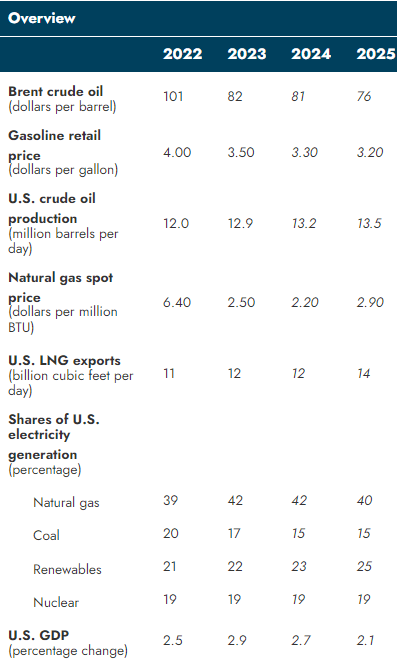

I believe ExxonMobil has the opportunity to remain strong for the next few years, especially given its $59.5 billion purchase of Pioneer Natural Resources on May 3, 2024, which wasn’t just a common M&A deal, in my view. I think it really ramps up Exxon’s size and takes its stockpile in the Permian Basin past 15-20 years with a cost of supply of between $35-40 a barrel – way higher than the average prices forecasted for the next 1-2 years by reputable agencies. At the same time, prices for natural gas will most likely continue to rise higher.

EIA.org

So I believe that XOM now has a huge competitive advantage in the energy world, where production costs are the number one way to keep profits high.

As Morningstar analysts wrote in their November report [proprietary source], Exxon should double its Permian output by FY2027, which would be impressive in the current scenario of possible selling prices. Moreover, estimated cost synergies from this deal will be in the region of ~$2 billion per year on average over the near future. So going forward from here, those synergies should drive margin expansion at the firm and create some kind of buffer for any uncertainty in the market.

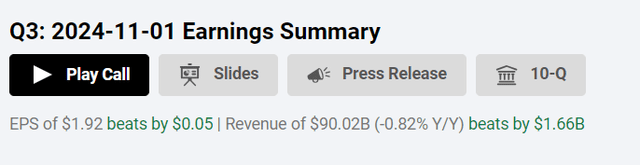

In Q3 FY2024, we saw XOM delivering virtually unchanged revenue of $90 billion, which was enough to beat the consensus expectation by almost 1.9%. Adjusted net income of $8.61 billion or $1.92 per diluted share was lower than last year’s, but it also beat the analysts’ expectations:

Seeking Alpha, XOM’s press release

Some might think of that as a blow because of the shrinking refining margins in the industry and declining selling prices for crude oil (natural gas realizations were also down compared to 2023), but I think it’s important to note that Exxon is still putting out a great deal of output – 4.58 million barrels a day, the highest in 40 years. The production levels compensate for the selling prices’ stagnation. I also like that Exxon’s spreadable operations have at least mitigated some of the pressure from commodity price declines. Their Energy Products group, for example, had higher operating profit than anticipated thanks to timing effects in derivatives and lower maintenance times.

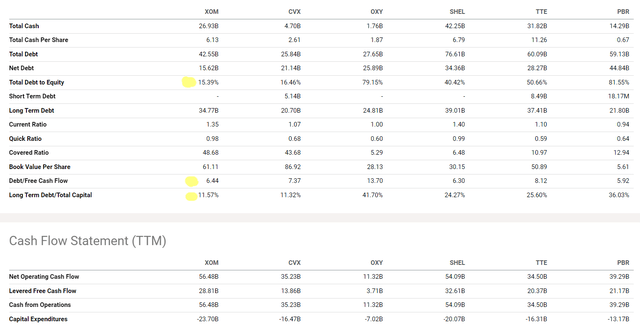

Exxon’s balance sheet is still remarkably healthy, with a debt-to-capital ratio of slightly over 15%, which is relatively low.

SA data, XOM and its peers, notes added

XOM has very tight cash control, yet it still manages to post good cash flow in a cheap environment. For instance, they generated $16 billion in operating cash flow in Q3 2024 through record volumes and savings. To date, ExxonMobil has returned $17.5 billion to shareholders in dividends and share repurchases and has the cash stashed away for high-yield projects like the Permian Basin, Guyana, and low-carbon ones. Such strong cash flows and low leverage mean that ExxonMobil has lots of cash sitting in the bank to pay dividends to shareholders and to build for the future. While market pressures are obvious, management is bullish on growth and forecasting positive earnings and cash flow growth through 2027 from ultra-return investments in “low cost, high advantaged” assets like the Permian Basin, Guyana, and LNG. The company projects oil and gas production rising from 3.8 million barrels of oil equivalent per day in 2024 to 4.2 million barrels in 2027, and capital spending at $22-27 billion a year. This also applies to ExxonMobil’s work on its portfolio of low-carbon solutions: More than $20 billion has been spent on carbon capture, hydrogen, and biofuels to date through 2027 (all with a 15% ROI). Led by a management team focused on disciplined capital, cost savings, and shareholder value – with a relentless share buyback program of $20 billion per year through 2025 – the company’s strategy is to be a leader in the conventional energy and energy transition markets.

As recent political events unfold – the possibility of Chris Wright, CEO of Liberty Energy, being picked to head the U.S. Department of Energy – I think it’s worth asking how all this could play out for Exxon. Although Wright and Donald Trump are vocal advocates of U.S. oil production and opponents of low-carbon energy policy, I think that government policy will be less important than capital control and efficiency improvements in deciding the growth in output for companies such as Exxon and Chevron (CVX). All this only further reassures me that Exxon’s strategy of operational excellence and strategic investment will be the reason why it’s so successful, regardless of politics.

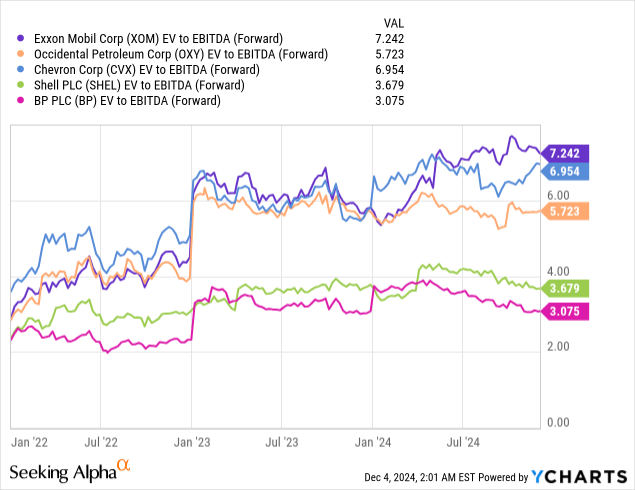

Now let’s talk about valuation because this is probably the point that many XOM shareholders are most concerned about. First off, it’s obvious that XOM is trading at a premium to other market players, which is understandable as the company is one of the largest firms in the industry and has impressive results to show. Following the acquisition of Pioneer last year, XOM has only strengthened its position in the market, and with its low break-even costs, I believe the company is protected from sudden oil price declines for at least several years. Most other companies, even quite large ones, do not have this protection, which justifies the current apparent overvaluation of XOM.

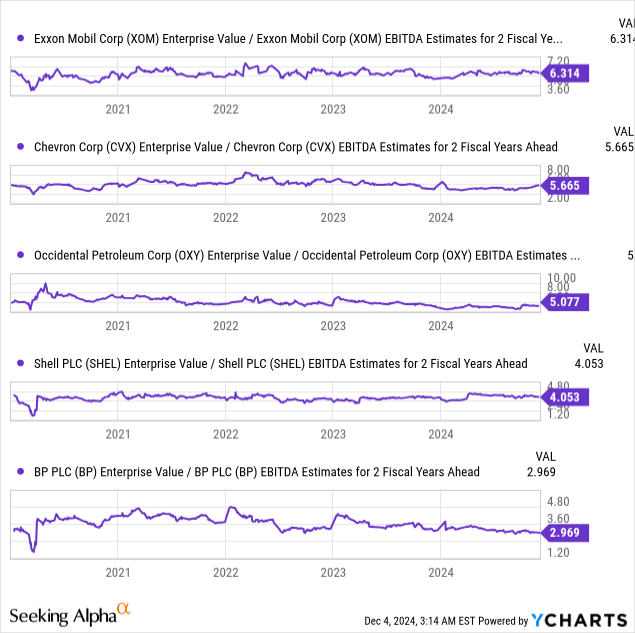

At this point, it should be noted that the overvaluation of XOM is likely to continue in 2025 if current EBITDA expectations by Wall Street analysts are anywhere near accurate:

However, in the context of historical valuation, XOM’s multiples don’t look that expensive. Argus Research analysts [proprietary source] point out that Exxon’s stock looks quite cheap in terms of P/E, P/B, P/S, and other key metrics when we compare the current numbers to historical averages. For this reason, given the financial growth driven by the recent acquisitions, XOM will likely continue to rise unless something extraordinary happens in the world.

The shares trade at 13.1-times our 2024 EPS estimate and at 11.7-times our 2025 estimate, compared to a 13-year historical average range of 12-20. They also trade at a trailing price/book multiple of 1.8, below the midpoint of the historical average range of 1.7-2.3; at a price/sales multiple of 1.4, at the high end of the historical range of 1.0-1.4; and at a price/cash flow multiple of 8.4, below the midpoint of the range of 7.2-11.6. The enterprise value/EBITDA multiple is 7.4, below the midpoint of the historical range of 6.6-10.3.

We believe that Exxon remains favorably valued at current prices, based on both historical averages and peer-group comparisons. We continue to see meaningful upside to the share price in 2024 and beyond and expect the company to benefit from the recent Denbury and Pioneer Natural acquisitions.

So based on all that, I decided to maintain my “Buy” rating for now.

Where Can I Be Wrong?

There are still some risks to my bullish thesis that I have to admit and make sure my readers are aware of them.

First, if commodity price volatility becomes worse than I predict, ExxonMobil may face a harsh time in growing its financials and sustaining its stock price. I do think that the low cost of production and portfolio diversification are good insurance, but if oil and natural gas prices continue to be very low in the future, it would weaken margins and decrease cash flow. So that would put pressure on ExxonMobil’s ability to maintain its savage shareholder dividends (executing on the $20 billion share buyback program, for example) and sustain its bold CAPEX programs.

I also understand execution risks could wreck ExxonMobil’s growth plan. XOM has grand plans to double Permian production, expand Guyana, and plough billions into low-carbon solutions, but delays, cost overruns, or operational failures might diminish the expected return on these projects. For instance, if the synergies of the Pioneer acquisition don’t pan out as expected or production expansion in important regions such as Guyana doesn’t take place as planned, the company’s capacity to meet its targets over the long term may be undermined.

What’s more, while I think ExxonMobil’s relatively richly valued stock price is justified by the firm’s size and position in the market, the market might not keep the premium in place if XOM falls short of Wall Street’s expectations or if the larger energy crowd pivots away from the stock.

The Bottom Line

Despite the above risks, I do think Exxon’s recent acquisitions and efficiency are on the right path to continue to grow and adapt in a dynamic energy environment. Strong fundamentals and proactive sustainability make ExxonMobil a popular choice for investors looking to get exposure to the energy sector, and I think its valuation premium is likely to keep staying where it is now, at least for the next few years.

I’m excited about what ExxonMobil has in store, and it’s still a great stock today, with tremendous upside opportunities in both traditional energy and low-carbon energy.

Thank you for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!