Summary:

- Exxon Mobil has significantly improved its balance sheet strength while maintaining its dividend payouts, reducing its net debt by over $30 billion in just over five years.

- The company’s production growth outlook is supported by fracking technological improvements, oil projects in Guyana, and the possibility of a large LNG export project in Tanzania.

- Exxon Mobil’s large cash position and strong free cash flow generation should allow it to continue rewarding income-seeking investors.

takasuu

Exxon Mobil Corporation (NYSE:XOM) is a stellar income generation opportunity. In a past article, Exxon Mobil Has Ample Upside In Current Environment (link here), I covered my reasoning for why XOM stock could be conservatively worth ~$122 per share (versus ~$105 per share as of this writing). Exxon Mobil is also a great way to generate meaningful income and I will highlight why that’s the case in this article.

Amazing Financial Turnaround

Over the past few years, Exxon Mobil turned what was a bloated balance sheet into one that’s relatively strong for the industry, all while maintaining its large dividend payouts. Unlike some of Exxon Mobil’s peers, the company did not cut its dividend during the oil pricing bust of late 2014 to early 2021, highlighting one of the reasons why I’m a huge fan of the name. Sure, that decision hurt its past financial strength, but it also highlighted how management was willing to do anything and everything to ensure that income seeking investors didn’t get a payout cut.

To get an idea of why the recent improvements to Exxon Mobil’s balance sheet strength are so impressive, let’s take a step back and look at the negative impact the oil pricing bust had on its financial strength. In particular, the period from 2015-2017 was particularly brutal as raw energy resource prices were quite subdued at a while when Exxon Mobil had several major projects under development (such as massive Gorgon LNG export project in Australia) that needed to get completed before it could materially lower its capital investments to conserve cash.

At the end of December 2017, Exxon Mobil had $3.2 billion in cash and cash equivalents on hand versus $17.9 billion in short-term debt and $24.4 billion in long-term debt, good for a net debt load of ~$39.2 billion. Put another way, its balance sheet was incredibly bloated.

While Exxon Mobil generated $24.4 billion in cumulative free cash flows (defined as net operating cash flows less capital expenditures) from 2015-2017, the company spent $38.1 billion covering its total dividend obligations (cash dividends to Exxon Mobil shareholders and noncontrolling interests) during this period. Furthermore, Exxon Mobil spent $5.8 billion cumulatively buying back its stock from 2015-2017. This cash flow outspend resulted in the company’s balance sheet strength significantly deteriorating during the middle of the 2010s decade. For reference, Exxon Mobil’s net debt load stood at $24.5 billion at the end of December 2014.

Fast forward to 2021 and 2022, and things started to look up for Exxon Mobil. Sharp increases in raw energy resource pricing due to myriad factors including supply shortfalls after years of subdued upstream capital investment during the 2010s decade, recovering energy demand as COVID-19 pandemic lockdown measures were eased, and efforts by the OPEC+ oil cartel to limit output all helped drive up energy prices. After generating negative free cash flows in 2020, surging energy prices enabled Exxon Mobil to generate $94.4 billion in cumulative free cash flow in 2021-2022. During the 2021-2022 period, Exxon Mobil spent $30.4 billion covering its total payout obligations along with $15.3 billion buying back its stock, activities that were easily covered by its free cash flows.

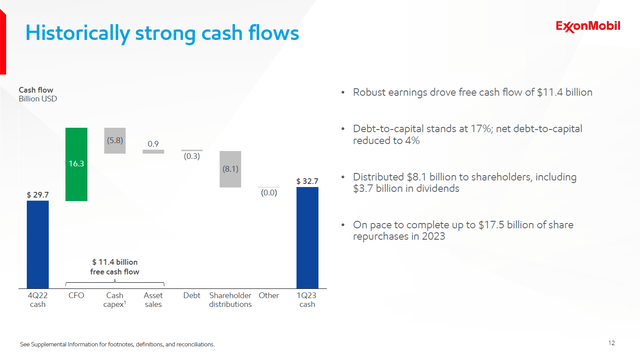

Most of Exxon Mobil’s remaining free cash flow, after covering dividend payouts and share repurchases, went towards repairing its balance sheet. By the end of December 2022, Exxon Mobil had $29.7 billion in cash, cash equivalents, and short-term investments on hand versus $0.6 billion in short-term debt and $40.6 billion in long-term debt. That’s good for a net debt load of ~$11.5 billion.

The good times continued to roll in during the first quarter of 2023. Exxon Mobil generated $10.9 billion in free cash flow last quarter while spending $3.9 billion covering its total payout obligations along with $4.3 billion buying back its common stock. Again, both of these activities were fully covered by its free cash flows with room to spare. It exited March 2023 with $32.7 billion in cash, cash equivalents, and short-term investments on hand versus $2.3 billion in short-term debt and $39.2 billion in long-term debt, equivalent to a net debt load of ~$8.8 billion.

Exxon Mobil’s balance sheet is relatively strong, though a net cash position would be preferred over a net debt load. (Exxon Mobil – First Quarter of 2023 IR Earnings Presentation)

Structural Cost Savings and Favorable Outlook

Here I must stress how impressive it is that Exxon Mobil cut its net debt load by $30+ billion within a little more than five years, all while maintaining its dividend and buying back its stock. That’s stunning, and these efforts should put substantial downward pressure on Exxon Mobil’s annual financing expenses. In 2020, Exxon Mobil spent $1.2 billion on its interest expenses, which fell down to $0.8 billion in 2022 even as interest rates continued to rise on a macro basis. Furthermore, here is an excerpt from my past article on Exxon Mobil (cited in the opening paragraph of this article) covering the company’s operating cost savings initiatives:

Exxon Mobil is well on its way to achieving $9.0 billion in annualized cost reductions this year versus 2019 levels. Reductions in the size of its workforce have been part of this process, alongside corporate consolidation efforts. Last year, Exxon Mobil combined its petrochemicals and downstream operations into one unit known as ExxonMobil Product Solutions.

Productivity improvements are being utilized to enable Exxon Mobil to do more with less. When Exxon Mobil published its first quarter of 2023 earnings update in April, management noted that the firm had achieved $7.2 billion of its cost reduction target so far and that Exxon Mobil remained on track to achieve its remaining cost reduction goals by the end of this year.

Operating expense savings combined with financing cost savings will go a long way towards improving Exxon Mobil’s earnings potential and future cash flow generating abilities in any environment. Furthermore, energy prices should remain favorable going forward as Chinese demand for crude oil is rising at a robust pace. Here is an excerpt from a recent article of mine covering the outlook for global energy prices (link here):

According to the market research service Energy Intelligence, China’s estimated oil demand hit over 16.05 million barrels per day in April 2023 based on refinery throughput volumes (how much crude oil China’s vast downstream industry is processing) and net imports of refined petroleum products. Demand for petroleum products and ultimately crude oil is recovering robustly as COVID-19 lockdowns are eased, as figures from Energy Intelligence indicate that China’s oil demand was up more than 26% year-over-year in April 2023.

Going forward, Exxon Mobil’s free cash flows in the current environment should be able to easily cover its dividend obligations, allowing investors to sleep a bit easier at night.

Concerns Over Proved Reserves

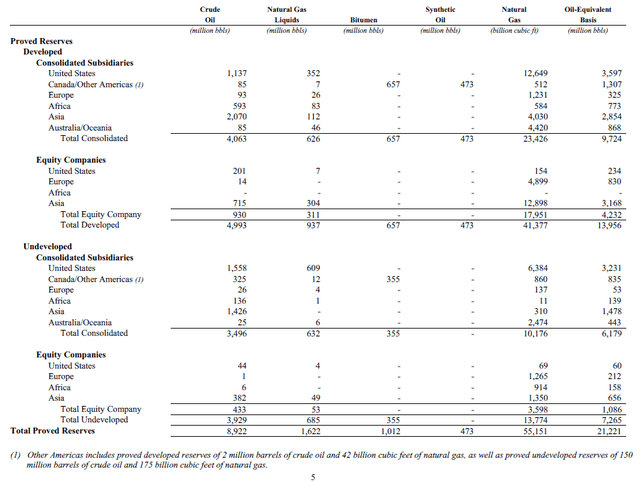

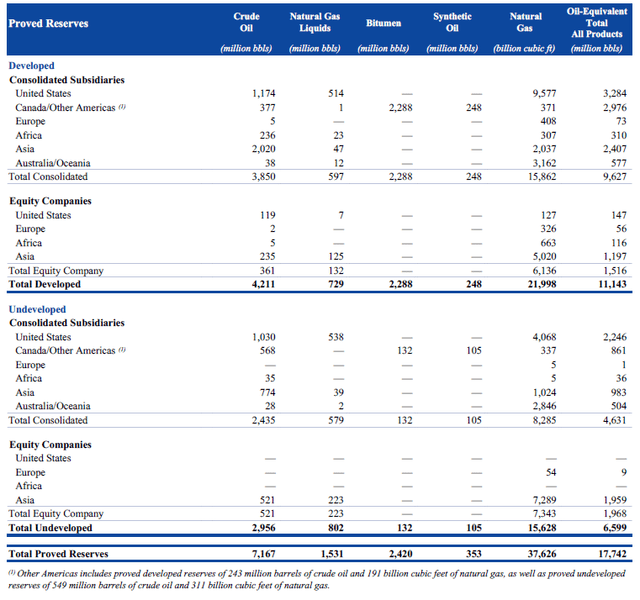

Exxon Mobil is facing hurdles arising from its shrinking proved reserve base. At the end of December 2017, the company had 21.2 billion barrels of oil equivalent [‘BBOE’] in proved reserves. By the end of December 2022, Exxon Mobil’s proved reserves had declined to 17.7 BBOE as large parts of its asset base continued to mature. However, some positive signs are emerging that could help turn this around.

Exxon Mobil’s proved reserve base has been sliding lower in recent years. (Exxon Mobil – 2017 Annual Report)

Exxon Mobil has come up with several ways to reverse the slide in its proved reserve base seen in recent years. (Exxon Mobil – 2022 Annual Report)

During a recent investor conference, Exxon Mobil’s CEO and Chairman Darren Woods noted that the firm was focused on boosting the recovery rate from shale plays across the US (any improvements could also be utilized in shale plays in Canada and Argentina as well). Generally speaking, Exxon Mobil and other upstream companies only recover around 10% of the oil in place from shale fields and other unconventional opportunities that are developed by horizontal drilling and hydraulic fracturing activities (shale, limestone, chalk, sandstone, and other formations are developed via “fracking” activities).

For reference, conventional oil fields generally see recovery rates of ~30% (as a rule of thumb, the geological and engineering complexities vary from field to field) and in places like the North Sea, onshore US assets developed via CO2 injection activities, and the US Gulf of Mexico, recovery rates (as a percentage of oil in place) can rise to ~50% or more.

The company’s CEO aims to “double recoveries” across Exxon Mobil’s US shale assets via new fracking technologies over the coming years, which if achieved could substantially grow the firm’s proved reserve base by boosting the amount of oil in place that’s ultimately recovered. Part of this strategy involves figuring out how to keep the fissures created during the hydraulic fracturing process open for longer. Traditionally, sand is used to keep those fissures open. Exxon Mobil aims to figure out what combination of hydraulic fracturing techniques and proppant (such as sand) strategies could boost oil flows and thus recovery rates at horizontal wells developing shale and other formations. Additionally, Exxon Mobil aims to further optimize its horizontal drilling strategies as it concerns developing shale plays by ensuring its wells are hitting more of the source rock.

Last year, Exxon Mobil’s Permian Basin operations represented over half of its net US oil and natural gas production at ~550,000 barrels of oil equivalent per day [‘BOE/d’], a figure that’s set to rise to 800,000 BOE/d by 2027 according to the firm’s forecasts. Any efforts that enhance its proved reserve base in the US would have a material impact on Exxon Mobil’s long-term cash flow growth outlook and production growth forecasts. So far, things have been progressing favorably, with the firm’s Permian Basin production rising by 20% in 2022 on an annual basis.

Another region Exxon Mobil has had ample successes of late is in Guyana. The company, along with its partners Hess Corporation (HES) and China’s state-run energy firm CNOOC (OTCPK:CEOHF), have made over 25 discoveries off the coast of the South American country since 2015. Here is what I had to say regarding Guyana’s emerging oil industry in an article covering Hess back in May 2023 (link here, moderately edited):

Hess is working with Exxon Mobil and the Chinese state-run firm CNOOC to develop immense crude oil resources in the Stabroek Block, which covers 6.6 million acres off the coast of Guyana. In May 2015, Exxon Mobil stuck liquid gold and since then the consortium has announced a string exploration and appraisal successes. The group estimates that there are more than 11 billion barrels of recoverable crude oil in the region on a gross basis. Exxon Mobil is the operator of the endeavor with a 45% stake alongside Hess’ 30% stake and CNOOC’s 25% stake.

Exxon Mobil has a large stake in these assets, making its position in Guyana needle-moving even for an energy giant of its size. Furthermore, here is what I had to say in my previous article covering Exxon Mobil concerning its position in Guyana (moderately edited):

By 2027, Exxon Mobil aims to have ~1.2 million barrels of gross daily crude production capacity in Guyana, up from just under 0.4 million barrels per day currently. Developing new floating production storage and offloading (‘FPSO’) assets is how Exxon Mobil intends to achieve its goals in Guyana…The next FPSO development expected to come online is the Payara asset, with first-oil targeted by next year.

Guyanese oil production growth and the chance for future discoveries in the Stabroek Block should help improve Exxon Mobil’s resource base and production growth trajectory going forward. For reference, Exxon Mobil produced 3.8 million BOE/d net from its upstream production base during the first quarter of 2023, up 4% year-over-year, aided by the uplift provide by its assets in the Permian Basin and Guyana.

Hidden LNG Growth Opportunity

Farther out, Exxon Mobil’s presence in Tanzania’s emerging natural gas industry provides the energy major without another potential growth driver. Exxon Mobil and its partners, including Equinor ASA (EQNR) and Shell Plc (SHEL) along with other firms, own sizable interests in offshore concessions in Tanzania and working towards a future LNG export project in the region. Here’s what I had to say on the endeavor in a recent note (link here, moderately edited):

Exxon Mobil owns 35% of Tanzania’s Block 2 offshore concession alongside its joint-venture partner Equinor, the state-run Norwegian energy firm. Tanzania Petroleum Development Corporation [‘TPDC’] is the country’s national oil company and according to Equinor, TPDC has the right to acquire a 10% stake in the Block 2 concession…

Part of the reason why this potential LNG export project in Tanzania that, if approved, would be worth tens of billions of dollars is not well known is due to this endeavor getting put on ice several years ago. The JV commenced exploration drilling in the Block 2 concession back in 2011 and after 15 exploration wells were drilled, the venture determined that there were over 20 trillion cubic feet of natural gas in place. Future exploration and appraisal activities could uncover additional resources…

It is important to keep in mind Shell’s role in a potential LNG export project in Tanzania. After Shell acquired BG Group back in 2016, it became the operator of the offshore Block 1 and Block 4 concessions in Tanzania. Shell’s partners in these blocks are… Medco Energi and Pavilion Energy… After 22 exploration and appraisal wells were drilled in Block 1 and Block 4, Shell and its partners determined that these concessions house 16 trillion cubic feet of natural gas in place (these are the resources discovered so far)…

Exxon Mobil, Equinor, Shell, Medco Energi, Pavilion Energy, TPDC, and Tanzania reached an agreement to develop these offshore natural gas resources and to construct an onshore LNG export terminal in Tanzania as part of a combined effort that was announced in May 2023… According to Reuters, Tanzania’s chief negotiator on the development framework expects that the energy firms and government could reach a final investment decision in 2025.

Please note that it’s unlikely that the resource base of these Tanzanian assets are fully booked as part of Exxon Mobil’s proved reserves, given that this project was effectively left for dead several years ago and only very recently was given a second chance. Should the potential Tanzanian LNG endeavor get the green light, that would further improve the outlook for Exxon Mobil’s longer-term production and cash flow growth.

Concluding Thoughts

Exxon Mobil is a stellar company with a bright production growth outlook that’s underpinned by a large resource base. Technological improvements that boost oil recovery rates from US shale plays, future oil discoveries in Guyana, and the chance that a massive LNG export endeavor in Tanzania gets sanctioned should help Exxon Mobil grow its proved reserve base going forward. Putting this together, oil and natural gas production growth should drive cash flow and earnings growth over the long haul, enabling Exxon Mobil to continue rewarding income seeking investors.

Improvements in its balance sheet further strengthen Exxon Mobil’s income generation prospects, as large net debt loads tend to eventually force firms to cut their payout as their cash flow is diverted to cover their financial obligations. Exxon Mobil has ample cash on hand to meet its near-term funding needs and in the current environment, the firm should continue generating enormous amounts of free cash flow.

During the final quarter of 2022, Exxon Mobil raised its quarterly dividend from $0.88 per share previously to $0.91 per share, equal to 3% sequential growth. There is ample room for Exxon Mobil to keep growing its quarterly dividend going forward. Shares of XOM yield ~3.5% as of this writing on a forward-looking basis.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.