Summary:

- Alphabet Inc./Google’s stock price drop after Q4 earnings indicated positive revenue and income trends have a lot to do with its “Magnificent” status.

- While it shows stable trends in all regions, Google remains dependent on ad spends at a time when macro factors indicate headwinds ahead for overall consumption.

- Google’s burning cash to catch up in the AI arms race being fought between tech giants. It will be a while before the company can display a worthy edge.

Supatman

“Magnificent Seven” colossus Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) aka Google announced its Q4 earnings for 2023 on the 30th of January. Despite an uptick in overall revenues and income, the stock immediately took a tumble due to the stock missing expectations. Said expectations are rather nuanced and gain importance in the current macroeconomic/market outlook.

A Deep Trend Drilldown

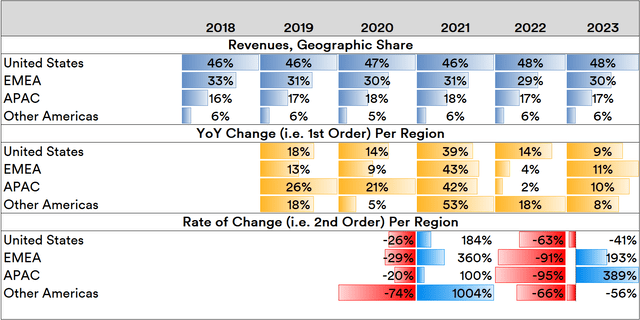

Given how keenly this stock features in investor sentiment (and its massive size in most broad market indices/ETFs), the fact pattern presented in its trends merits a highly nuanced look. First off, the company’s net revenues are analyzed on a regional basis under both first- and second-order terms.

Source: Created by Sandeep G. Rao using data from Alphabet’s Financial Statements

Region-wise, YoY trends in regional revenues show now single-digit growth, with EMEA and APAC at around 11-10%. The U.S. is the breadwinner for the company and alone accounts for as much as EMEA and APAC combined. Overall, the company’s geographical revenue streams have become fairly stable contributors.

Now, APAC historically registered growth far in excess of all other regions, as seen in the 1st-order estimates. The fact that this segment’s growth is now nearly on par with all other regions is noteworthy, since an “explosive growth” outlook is a key consideration for “Magnificent” status. In 1st-order terms, it can be seen that strong double-digit growth patterns have been slipping since 2022.

The 2nd-order changes (which estimate the rate of change) show no strong and sustained trends in either direction. One year’s fall is more-or-less made up in the next, with no significant impact on geographical share. This buttresses the outlook that massive growth in its present mode of business cannot be reliably expected.

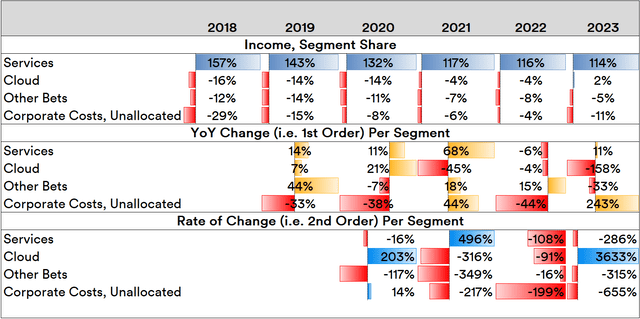

A similar framework applied on the company’s Net Income reveal a somewhat similar story, albeit with additional nuance.

Source: Created by Sandeep G. Rao using data from Alphabet’s Financial Statements

Overall, it can be seen that “Services” has witnessed progressive growth, thus making the burden of the other income-negative segments progressively easier to bear. It bears noting that the company’s long-in-the-making “Cloud” business is beginning to bear fruit in 2023 by finally turning weakly income-positive. Overall, its “Other Bets” (i.e., the likes of Waymo, Wing, et al) continue to consume cash. The 1st-order matrix reaffirms the dominant position occupied by “Services,” while the wild swings in the 2nd-order matrix without really changing the segment share largely mirrors the “wax-and-wane” dynamic seen in the geographical estimates.

Outside of the numbers, however, the company’s growing “corporate costs,” which includes the costs borne by layoffs, litigation, et cetera, continue to grow on an absolute basis. In 2023, the costs associated with downsizing office space in the wake of the company’s many layoffs is a dominant feature. At the same time, it also highlights a somewhat tacit admission that growth is longer a matter of personnel. What the company needs, instead, are new markets.

Alphabet remains dependent on ad spends. Advertisers are driven to spend to fulfil an outreach towards customers. However, in the region of greatest revenue contribution, i.e., the United States, overall consumer purchases are in decline. One interesting “proxy” for consumer behavior could be represented by recent events at United Parcel Service (UPS): after months of negotiations with the unions, the company announced the cutting of 12,000 jobs, followed by a warning that parcel volume is likely to decline in the first half of the year (like most of 2023) followed by an expectation of some recovery in the second half of the year. Given its dependence on ad spends in America, this is a key factor in the deflation of forward-looking sentiment.

To maintain the company’s “Magnificent” status, an “explosive growth” rationale is needed. The AI theme has been a key driver for many a stock over the past year. On the front, the company finds itself on the backfoot (at least presently).

The AI Edge

For Alphabet, any imputation of AI driving revenue will be integrated into the performance of its segments. AI’s contribution to “Services” would likely be most visible as some estimation of greater search and ad matching efficiency as well as increased buy-ins into the cloud business by enterprises. In the former, this isn’t apparent yet.

In the latter, however, Alphabet is at least one or two beats behind the likes of Microsoft (MSFT), which stated in its earnings call that Azure AI, by virtue of offering top performance for AI training and inference as well as the most diverse selection of AI accelerators – including the latest from AMD (AMD) and Nvidia (NVDA) – has again made market share advancements in this past quarter. Microsoft CEO Satya Nadella stated that Microsoft is now infusing AI across every layer of its products and services, as a result of which it is winning new customers who can unlock new benefits and productivity gains.

To combat this, Alphabet is increasingly committing more and more resources to building its own place in this burgeoning market, as evidenced by its commitment to continue to spend in larger quantities to do so; greater capex is to be expected for success against the incumbent. Alphabet’s executives, for their part, seem to be asserting that the company’s upcoming model Gemini will be more powerful than Microsoft/OpenAI-affiliated ChatGPT 4 while holding forth that delivering the “world’s most advanced, safe, and responsible AI” is now the company’s number one priority.

Whether the service offering can be deemed substantively better than that by the likes of Microsoft, of course, remains to be seen.

In Conclusion

In its present business model, Google has hit peak growth and is now entirely stable. Given the preponderance of ad spends, it can also be assumed that Alphabet Inc. has now gone from “growth champion” in investor expectations to a “bellwether” of the macroeconomic outlook.

The AI edge could be a game-changer but there’s a lot of ground to cover, especially given that other giants (and possibly some other small-yet-mighty upstarts) are deep in the fray. While it’s likely that Microsoft will be recognizing substantial revenue upticks as a result of its mostly-matured and effective AI-integrated offering from 2024 onwards, Alphabet still has a ways to go. Market share capture (if any) in this key battleground would likely be visible from 2025 onwards.

Until the dust settles, Alphabet Inc. stock can be expected to shed some of its more ambitious pricing levels: such is the plight of a “bellwether” in this economy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.