Summary:

- Google’s stock has outperformed the S&P 500 in 2023.

- The company has been buying back its own shares, reducing the overall floats of its Class C and Class A stock by 3.5% since April 2022.

- Despite negative press and regulatory risks, analysts predict double-digit revenue growth for Google.

400tmax/iStock Unreleased via Getty Images

Background

We have been bullish on Google (NASDAQ:GOOG) (NASDAQ:GOOGL) for a while. We first wrote about the company at the start of the year (which you can read here), and the stock is up about 18% since then. While 2023 has had no shortage of headlines for the search engine giant – ChatGPT, DOJ lawsuits, etc. – the market hasn’t punished the company for much of anything this year.

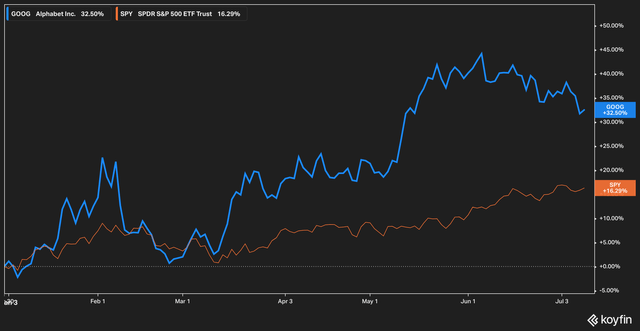

So far Google has outperformed the broader S&P 500 (SPY) handily this year, returning 32% against SPY’s total return of 16% for the year.

And yet, concerns about Google are likely to linger in investor’s minds, because while it has outperformed the S&P, the stock has failed to reach the same highs this year that its other mega-tech brethren have. Apple (AAPL), Amazon (AMZN), and Facebook parent company Meta (META) have all beat out Google on a total return basis in 2023.

In this article we’ll discuss why we think that shares of Google still have room to run, and why we think concerns about the company’s future prospects are overblown. Let’s dive in.

Buyback Pressure

In the market, they say, memories are short. Headlines from the financial press change day to day, week to week. This is why we bring up the ancient date of April 2022, which is the month that Google’s board authorized the company to repurchase up to $70 billion of the company’s stock.

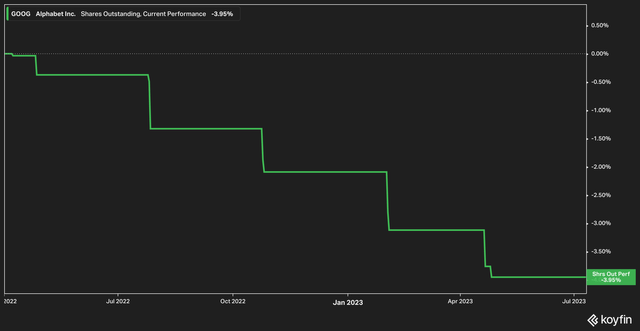

Since that time, the overall floats of the Class C and Class A stock have been reduced by 3.5%. The effect of this reduction of float provides two benefits for shareholders: it first creates a natural buyer in the market to absorb a portion of sales, as the continual, stair-stepping action of the buybacks suggest. It also, more obviously, has an anti-dilutive effect on the equity shareholders own in the company.

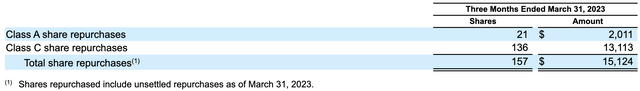

In the first quarter 2023, Google bought back a total of $15.1 billion in its own shares which were comprised of 21 million Class A shares and 136 million Class C shares. According to the company’s quarterly filing, at the end of Q1 the remaining authorization on the original $70 billion stood at $13.1 billion.

This last point, of course, begs the question: will the buybacks continue? While we cannot enter the minds of management, we believe it is more likely that the board will announce a new repurchase authorization than not. We think this for a few reasons.

First, Google is sitting upon a large, large, pile of cash. Its total cash and marketable securities balance at the end of the first quarter 2023 stood at $115 billion. For context, its cash and marketable securities on hand when the board authorized the April 2022 $70 billion repurchase was only slightly higher at $133 billion.

It also seems eminently unlikely that the board will reverse its long standing position of not paying a dividend as a use for the cash. As recently as the end of 2022 the company made this statement in its annal 10K:

We have never declared or paid any cash dividend on our common or capital stock. The primary use of capital continues to be to invest for the long-term growth of the business. We regularly evaluate our cash and capital structure, including the size, pace, and form of capital return to stockholders.

While the above statement does not necessarily rule out the possibility of a dividend, it certainly doesn’t crack open the door. Given that the company’s primary means of returning capital to shareholders thus far has consistently been through share buybacks, we think it more likely than not that the company will continue this practice.

Analyst Estimates

While the financial headlines surrounding Google relate to anti-trust lawsuits or the threat posed to its main search property by Microsoft’s (MSFT) ChatGPT-infused Bing, we point out that the projected analyst growth rates for the company have yet to reflect a doomsday scenario.

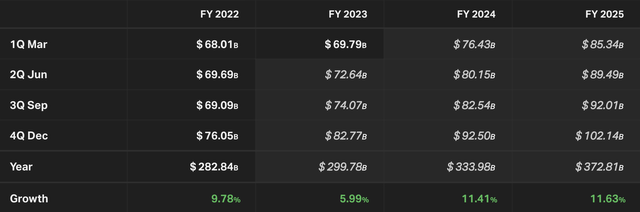

Looking out beyond 2023, analyst consensus is that top line revenue growth will resume the double-digit pace that most investors traditionally associate with Google. The main drivers behind these assumptions, we speculate, are growing adoption of the company’s Bard search product (which we wrote about here), and the growth of its Google Cloud offering which accelerated 28% year over year from $5.8 billion in revenue in Q1 2022 to $7.4 billion in revenue for the first quarter 2023.

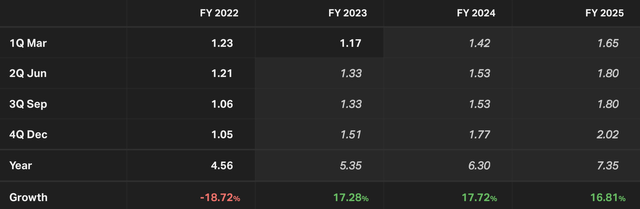

Analysts have even higher expectations for non-GAAP EPS growth, pictured above, with gains in the mid to high teens for FY 2023 to 2025. The primary driver for these expectations is likely Google’s renewed focus on delivering to the bottom line through headcount and cost rationalization.

The Bottom Line

2022 was a tough year for Google and the rest of the tech sector generally. Rising interest rates and a re-rating of many tech stocks turned many an investor bearish against companies which were previously loved. However, we believe that the slew of negative press against Google likely masks the positive news and expectations around the stock. In the near term, we’ll be on the lookout for continued cost cutting, performance of the Cloud offering, and for an additional share repurchase authorization from the board given the similar amount of cash the company currently has compared with the time that the board gave its previous authorization. Risks to our thesis are primarily regulatory, which Google is quite familiar with. However, we think the potential benefits outweigh the risks going forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.