Summary:

- Microsoft’s investment in OpenAI’s generative AI technology has so far paid off, leading to a perception that it is a leader in this field.

- The stock price reached a 52-week high in July but has since stalled, potentially due to concerns about the hype surrounding generative AI.

- Despite possible short-term volatility in the stock, Microsoft has long-term growth potential in generative AI, and existing investors should continue to hold onto their shares.

jewhyte

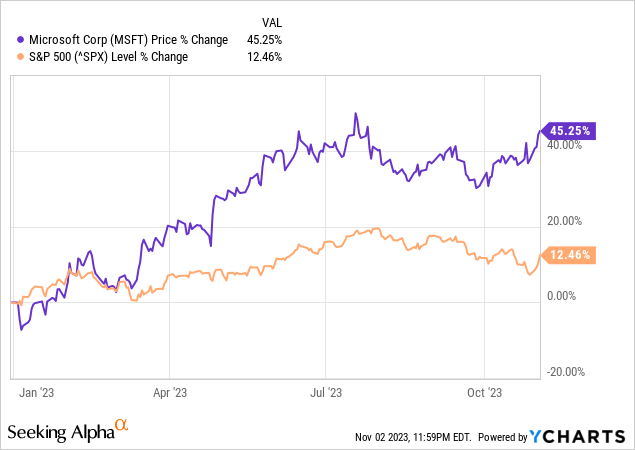

I believe one of the most genius moves Microsoft’s (NASDAQ:MSFT) management has made over the past several years was purchasing a $1 billion stake and cementing a partnership with Artificial Intelligence (“AI”) research company OpenAI in 2019. That bet began paying off after OpenAI shocked the world with the generative AI chatbot ChatGPT in late November 2022, and that app turned into the fastest-growing app of all time. In February 2023, Microsoft started incorporating OpenAI’s generative AI technology GPT-4 into Bing and later added the technology to other products like Microsoft 365 and Azure. As a result, there is a perception that it beat Alphabet (GOOG) (GOOGL) to the punch in generative AI and is firmly in the lead with this new technology. The stock took off in March and is now up 45% for the year compared to 12.5% for the S&P 500 over the same period.

Microsoft hit a 52-week high of $366.78 on July 18, and since then, the stock price has been in a holding pattern. The company’s recent earnings have done little to change things. Microsoft reported an outstanding quarter on October 24 after the bell; it beat analysts’ revenue and earnings expectations. More importantly, the management talked glowingly about the future, and guidance exceeded analysts’ expectations. The stock rose from its closing price of $330.53 on October 24 to open on October 25, the day after earnings, at $345.02. Since then, however, the stock price has stalled, dropping to a low of $326.94 on October 26, below where it was before it reported earnings.

One of the reasons for the stock’s fall was the overall market selling off. However, Microsoft’s current valuation could have played a part. Seeking Alpha’s quant gives the company a valuation rating of F. Additionally, some investors may worry that the hype surrounding generative AI could be fading. Gartner’s (IT) hype cycle, released on August 16, 2023, has placed generative AI at the “Peak of Inflated Expectations,” ready to dive into the “Trough of Disillusionment.” Other analysts predict the bubble will burst on AI hype in 2024. Suppose the generative AI balloon does deflate in 2024; the company’s stock price is ripe to potentially fall off a cliff in my opinion.

Microsoft has excellent long-term growth potential because of its first-mover position in generative AI. However, the stock price could be like riding a rollercoaster in the short term. For these reasons, most investors would be better off avoiding buying this stock at these prices. However, existing investors should consider holding.

The company is all-in on OpenAI

Microsoft pushed all of its chips into the center of the table when investing in OpenAI’s generative AI technology. Management made an informed and high-quality bet, as OpenAI may be the most innovative AI company in the world. Fast Company rated OpenAI the number one innovative company in artificial intelligence in 2023, and it also topped the CNBC Disruptor 50 Companies list this year.

In early January 2023, Microsoft announced an additional $10 billion investment in OpenAI. Additionally, it formed a partnership where it could build and optimize its entire AI platform, from the hardware to the operating system to all its consumer and enterprise products, to use AI models based on OpenAI research. By optimizing its technology stack on a single model for all its AI workloads, Microsoft can achieve economies of scale. In other words, the cost of AI development and deployment lowers as a percentage of revenue as the company reaches a larger output volume. On the first quarter fiscal 2024 earnings call, Microsoft Chief Executive Officer (“CEO”) Satya Nadella said:

The approach we have taken is a full stack approach all the way from whether it’s ChatGPT or Bing Chat or all our Copilots, all share the same model. So in some sense, one of the things that we do have is very, very high leverage of the one model that we used — which we trained, and then the one model that we are doing inferencing at scale. And that advantage sort of trickles down all the way to both utilization internally, utilization of third parties, and also over time, you can see the sort of stack optimization all the way to the silicon because the abstraction layer to which the developers are riding is much higher up than low-level kernels, if you will.

Source: First quarter fiscal 2024 earnings call

Simplifying from tech-speak to plain English that an investor can understand, the above passage means that having a consistent AI infrastructure based on OpenAI’s models from the hardware all the way up to the top technology layer will allow Microsoft to save money in its AI investments. Since developing, training, deploying, and using an AI model can be expensive, some investors have wondered whether Microsoft could rapidly grow its AI business while maintaining or even growing its margins. Mizuho analyst Gregg Moskowitz brought this concern up on the first quarter 2024 conference call when he asked whether the company’s gross margins could continue to improve, given the company’s increased AI investments. Chief Financial Officer (“CFO”) Amy Hood answered by saying that she believed Microsoft could increase margins in the medium term and reiterated what the CEO said:

In addition, what Satya mentioned earlier in a question, and I just want to take every chance to reiterate it, if you have a consistent infrastructure from the platform all the way up through its layers, then every capital dollar we spend, if we optimize revenue against it, we will have great leverage, because wherever demand shows up in the layers, whether it’s at the SaaS layer, whether it’s at the infrastructure layer, whether it’s for training workloads, we’re able to quickly put our infrastructure to work generating revenue, or on our Bing workloads. I mean, I should have mentioned all the consumer workloads use the same frame.

Source: First quarter fiscal 2024 earnings call

The above comment was music to investors’ ears, indicating management believes it can grow the AI business profitably. In addition, Microsoft expects the payoff from this bet on OpenAI and its AI models to come quickly and be massive. During the Goldman Sachs 2023 Communacopia + Technology Conference, CFO Amy Hood said about its AI business, “It [next-generation AI business] absolutely should be the fastest $10 billion business we’ve ever built.” The potential of AI becoming Microsoft’s most rapidly growing business is why some remain bullish on the stock despite what could be a high valuation.

It has a premier cloud business

Microsoft’s crown jewel is Azure, a popular hybrid cloud product with over 200 services. As of the end of 2022, Microsoft had the second largest cloud business globally with a 23% market share, and first quarter fiscal 2024 results show it is still capturing share. CEO Nadella said during the earnings call, “Azure again took share as organizations bring their workloads to our cloud.”

Part of the reason that the stock rose the day after earnings is CEO Satya Nadella gave investors three reasons Azure should continue to outperform moving forward. First, cloud migrations boosted by the expanded partnership between Microsoft and Oracle (ORCL) should provide robust growth tailwinds. Satya Nadella said about the partnership:

Once we announced that the Oracle databases are going to be available on Azure, we saw a bunch of unlock from new customers who have significant Oracle estates that have not yet moved to the cloud because they needed to rendezvous with the rest of the app estate in one single cloud. And so we’re excited about that. So in some sense, even the financial services sector, for example, is a good place where there’s a lot of Oracle that still needs to move to the cloud.

Source: First quarter fiscal 2024 earnings call

The second Azure growth driver is that the cloud business is cyclical, and Microsoft should move into a more favorable part of the cycle by the first half of fiscal 2025. Satya Nadella describes the cloud cycle as “the workloads start, then workloads get optimized, and then new workloads start, and that cycle continues.” Right now, Azure is in the “optimization phase.” The optimization phase can be a good thing. In some cases, cloud companies in the optimization phase can generate more revenue as customers may use optimized apps even more.

However, in the high inflation, rising interest rate, and slowing economy of 2022 into 2023, some investors associate “optimization” with customers spending less money on the cloud and revenue of cloud companies falling off a cliff. Satya Nadella calls this current optimization cycle “extreme” and believes the company will begin putting this “extreme” cycle in the rearview mirror in the second half of fiscal 2024, which starts at the beginning of January 2024. Suppose what Nadella says is true; the company could see a tailwind to revenue growth from companies starting new workloads on Azure by the beginning of June 2024. What’s really impressive about this company is that even though the cloud industry is still in the optimization phase, Azure revenue grew 29% in the quarter, above the 26% analyst consensus estimates. In comparison, Alphabet’s Google Cloud missed analysts’ estimates, and some investors wonder if Google Cloud is losing ground to Azure.

The last Azure growth driver that Nadella highlighted was new workloads starting around AI. CFO Amy Hood attributes around three basis points of Azure growth in the first quarter of fiscal 2024 to contributions from AI Services and expects AI workloads to continue to increase in the future. If generative AI turns out to be as significant for Microsoft as management believes, the cloud business should thrive in the long term.

First Quarter Fiscal 2024 results

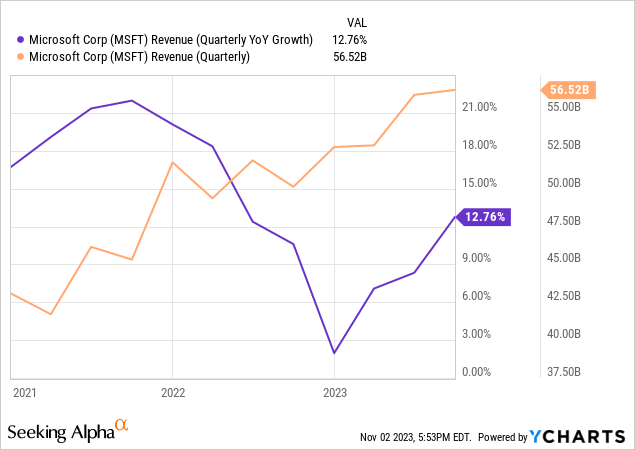

The market liked seeing cloud and AI growth help Microsoft finally return to double-digit year-over-year revenue growth in the first quarter of fiscal 2024 — a partial reason the stock rose immediately after the earnings release. Quarterly revenue reached $56.52 billion.

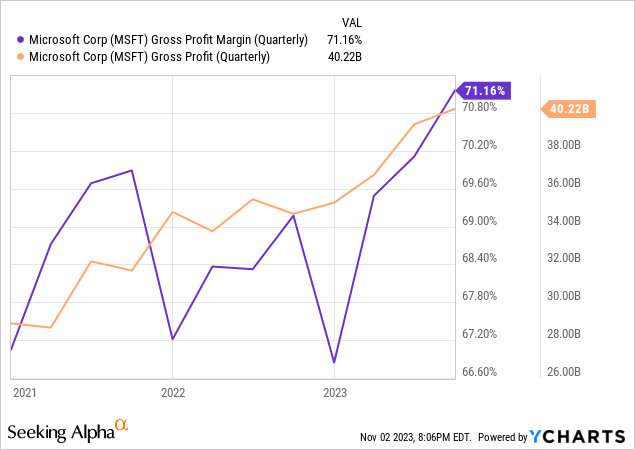

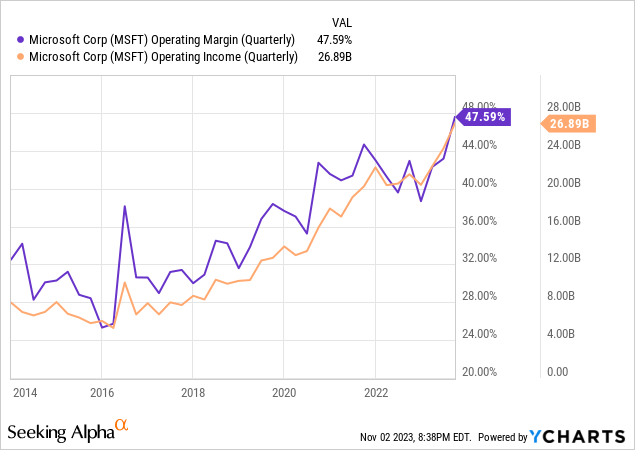

After a terrible 2022 for gross margins, Microsoft increased its gross margin by two basis points from the previous year’s comparable quarter to reach 71.16% — suitable for a software company. The CFO attributes the margin expansion to the “[Gross margin] improvement in Azure and Office 365 as well as sales mix shift to higher margin businesses,” in the first quarter earnings call. Gross profits rose 16% year-over-year to $40.22 billion.

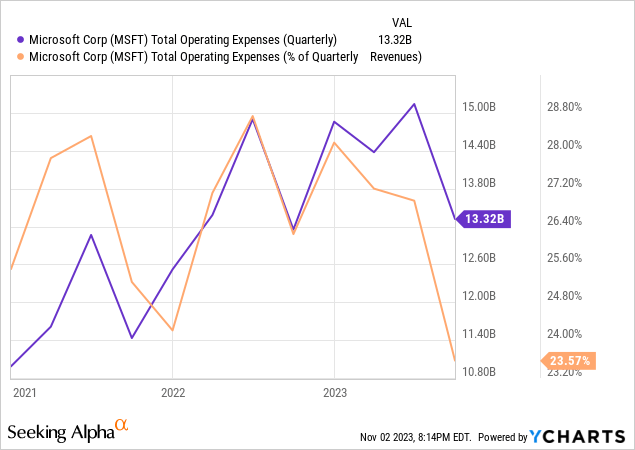

CFO Amy Hood said on the earnings call that operating expenses rose less than expected “due to cost-efficiency focus as well as investments that shifted to future quarters.” During the quarter, operating expenses as a percentage of revenue dropped to 23.57% — a good thing. In this economy, investors favor companies that focus on keeping costs low.

As a result of Microsoft growing its top-line double digits, increasing gross margins, and decreasing operating costs as a percentage of revenue, operating margins rose sharply in the first quarter, up around five basis points over the previous year’s comparable quarter to 47.59% — the highest operating margin in ten years.

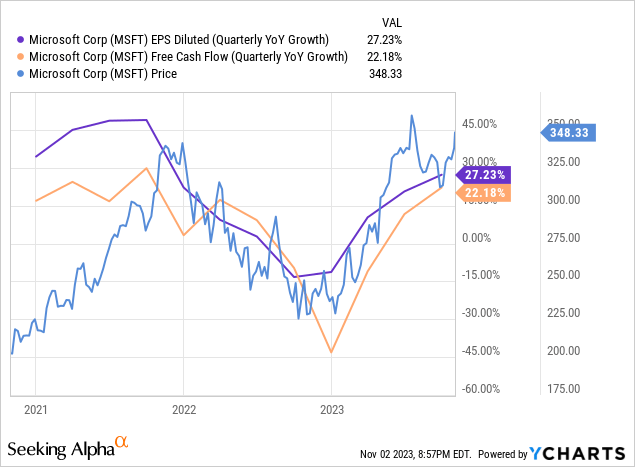

The company grew diluted earnings-per-share (“EPS”) by 27.66% year-over-year to $2.99. Free Cash Flow (“FCF”) rose 22.18% over the previous year’s comparable quarter to $63.23 billion. The chart below shows that as the year-over-year growth rates for EPS and FCF rebounded from a terrible 2022, the stock price has recovered.

Microsoft also has an excellent balance sheet with $143.94 billion of cash and short-term investments against $71.5 billion in long-term debt. It has a debt-to-equity (D/E) of 0.324. A D/E below one means a company’s balance sheet is relatively safe in my view.

Risks

Since at least 60% of website traffic occurred on mobile phones in 2022 and only 39% on desktops, according to Allconnect, one thing that could dent Microsoft’s long-term AI ambitions is that it lacks a meaningful mobile presence. Microsoft’s mobile dreams ended when its Windows Phone franchise ended in January 2020. In contrast, Android is the most popular operating system in the world and has over three billion monthly active devices. Apple (AAPL) is also a significant force with over two billion active mobile devices. Alphabet presents a substantial threat to Microsoft in cloud, search, and AI applications, and its robust presence in the mobile market could potentially give it a considerable advantage. While Apple presents an insignificant threat to Microsoft in the cloud, it could present a significant long-term threat to Bing in search and the consumer-facing Software as a Service market by adding generative AI to its products like Siri and Apple Music.

Another significant risk for Microsoft is a potential conflict with its AI partner, OpenAI. First, these two companies are not only partners but also directly compete for many of the same customers — a potential conflict of interest. Additionally, there are rumors that the two partners had argued over Microsoft using an unreleased version of its AI model in Bing. Investors should monitor the situation for any signs of strife between the partners. Microsoft openly having beef potentially with OpenAI instead of presenting a united front in opposition to its primary adversaries, Google and Amazon (AMZN), would probably not end well for Microsoft.

Valuation

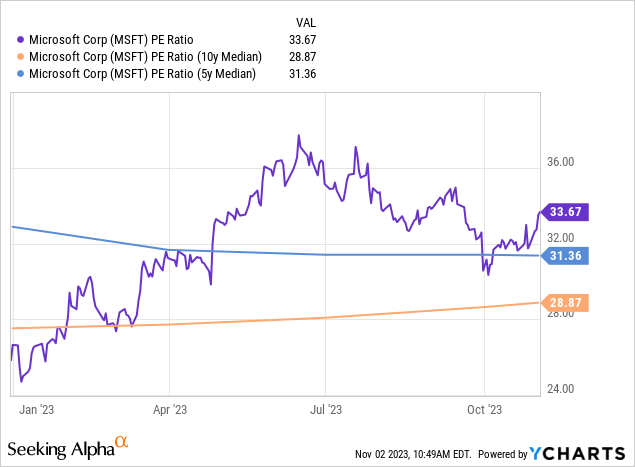

Microsoft’s price-to-earnings (P/E) ratio today is 33.67, slightly below the software industry’s P/E ratio of 34.41. However, it is above the technology sector’s P/E ratio of 32.22 and well above the S&P 500 P/E ratio of 24.54. Additionally, the chart below shows that its P/E ratio is above its five- and ten-year median P/E ratio. Based on these numbers, some might call the stock modestly overvalued or at fair value.

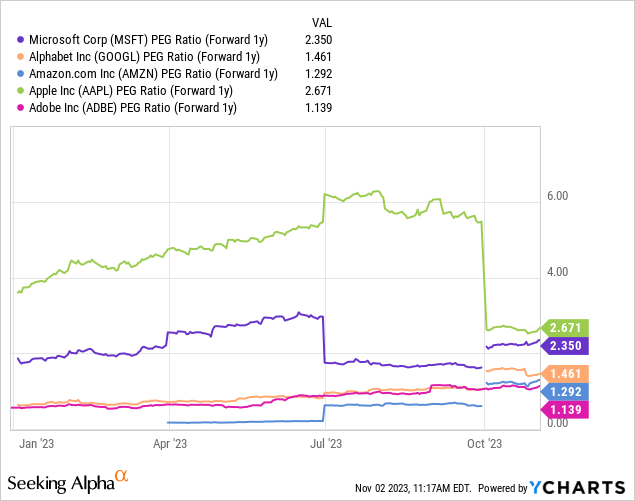

The chart below shows the company’s one-year forward Price/Earnings-to-Growth (“PEG”) ratio compared to other major tech companies. Microsoft’s PEG (forward 1yr) is 2.36, with only Apple exceeding it at 2.67. The standard rule is that a PEG ratio of one is fairly valued, and a sign of overvaluation is when a PEG ratio exceeds one. In practice, however, growth investors may be willing to hold a high-growth stock with a PEG ratio exceeding one but grow cautious as the number approaches two. As CNBC’s Jim Cramer once said, “My rule of thumb, a guideline that I’ve arrived at based on more than three decades of trading and investing, is that I don’t like to pay more than two times a company’s growth rate for a given stock, meaning any stock with a PEG ratio of more than two is too pricey for me.” According to Cramer’s rule, the market is overpricing Microsoft at the current valuation.

Despite the perceived overvaluation of the stock, Wall Street analysts currently rate it at a Strong Buy with an average consensus price target of $403.27, according to data from Seeking Alpha.

In my opinion, the valuation is too high to jump into the stock now for only a potential one-year return of approximately 16%.

It is a great long-term hold

Microsoft should be an excellent company to own in the long term. However, the near-term ride on this stock may be turbulent. Suppose you have yet to buy the company; its current valuation makes caution warranted, and you should remain patient, as the opportunity to buy may arise over the coming months. However, if you already own shares, the upside potential may make it worth continuing to hold onto your stake in the company. I recommend Microsoft as a solid Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.