Summary:

- Adobe’s stock has recently been weak on fears of how the benefits of AI can accrue to software businesses in general.

- Many believe AI will change the competitive landscape for the company, but I think otherwise. I share my views in this article.

- Even after accounting for SBC, I believe Adobe is currently trading at an attractive valuation. I go over the numbers.

We Are/DigitalVision via Getty Images

Introduction

I have held Adobe (NASDAQ:ADBE) for more than 2 years in my portfolio and I must admit I have had a love/hate relationship with the company. I bought my first Adobe shares before the company announced its intention to acquire Figma. Unsurprisingly, this acquisition brought understandable doubts around its moat, some of which I discussed in my article ‘Why Adobe Is Buying Figma for $20 Billion.‘ The takeaway for many was that Adobe was making this acquisition on disruption fears. The price tag surely made it seem like there was something more than a financial motive behind the acquisition. Uncertainty is one thing financials markets dislike, so Adobe’s stock fell significantly on this news.

This acquisition was finally turned down by the regulator, with many claiming that Adobe was being denied the ability to eliminate a competitor as it had historically done. While I understood this argument, I also believed that the arrival of AI (Artificial Intelligence) had rendered the acquisition less necessary. AI somewhat changed the competitive landscape in the industry, and Adobe had a “head start” here compared to Figma. Adobe was indeed denied the ability to acquire a competitor, but it also “avoided” spending $20 billion of shareholders’ money on an acquisition that was maybe not as necessary as before. The market, of course, decided to also penalize Adobe on such news.

AI might have made the acquisition less necessary, but it brought another set of “problems” for Adobe. Many saw how powerful tools as Dall-E or Midjourney could become in the creation of content and believed this was a net negative for the company. While investors in general tend to overweight competitive threats over the short term, some might fall prey of underweighing them over the long term. It’s natural to have doubts about a company’s competitive position when an industry shift is underway, and I must admit that I was unsure about the impact an AI-world would have on Adobe’s moat.

Knowing if AI would be a net negative or positive was very hard at the time (and still is), so I decided to trim my position slightly. The main reason for my trim was that I had bought Adobe for a thesis that had shifted, and I needed more time to understand if I was comfortable with the “new” thesis.

I started reading about the company’s strategy around AI and the implications it might have in the creative industry. This helped me grow increasingly comfortable with the idea of AI not being the disruptor to the company’s business model that many feared. I explained this strategy and why my conviction had grown in two relatively recent articles I published on the company: ‘Adobe Is More than AI’ and ‘Adobe: Is OpenAI’s Sora Changing the Game?‘.

In this article, I’ll summarize my views on Adobe and AI, and I’ll explain why I believe the valuation is appealing at these levels.

Without further ado, let’s get on with it.

My views on Adobe and AI

The following bullet points summarize why I have grown increasingly comfortable with Adobe’s competitive position in an AI-world, although I recommend reading the articles I shared above to get the full picture:

- Ideation is just one step, and the models are unlikely to provide exactly what the creative seeks: AI in the creative industry is currently being applied to the ideation phase. The results of this ideation phase are outstanding, but they are unlikely to be exactly what a creative seeks. This means that editing tools remain critical. Adobe has the most comprehensive editing tools suite which, unsurprisingly, works seamlessly with Firefly (Adobe’s AI model).

- Capturing the entire E2E content supply chain: on top of owning the content editing supply chain, Adobe also owns the distribution and measurement in the creative industry thanks to its Experience Cloud. This is unlikely to be relevant for small customers, but it’s likely critical for enterprise customers. It’s not just about creation but also about distribution, follow-up and iteration. The Experience Cloud has significant switching costs and obviously works better when integrated with Adobe’s creative tools.

- Every technology requires distribution: many correctly predict that AI will lower development costs but fail to account for the fact that distribution is also an important factor in the equation. It’s not just the technology in itself that matters, but also the ability a company has to distribute it. Note also that the transition to the Cloud was once believed to be a net negative for these companies due to lower entry barriers, but it ended up being a net benefit in terms of growth (Adobe is a great example here).

- Non-monetizable vs monetizable users: many have grown increasingly worried with the viralization of tools such as Dall-E and MidJourney, but I believe we should make a distinction between monetizable and non-monetizable users to understand how these might impact Adobe’s business. While many have used Dall-E and Midjourney to have fun, the proportion of these “hobby” users who would be willing to pay for such services is probably limited. Adobe should care about both types of users (in order to build its funnel) but it’s much more important to have a strong proposition for the monetizable users.

The takeaway from this section should be that Adobe is much more than AI and that “simply” solving the ideation phase (where most competitors are currently present) is unlikely to pose a threat to the company’s business; monetizable users require much more than just ideation. In some cases, they require editing post the ideation phase and in others they require distribution and measurement. Adobe has both covered, and an argument can also be made around lower entry barriers to content creation filling up the company’s funnels more than being a net negative. More content created requires more editing and distribution.

A glance at Adobe’s valuation

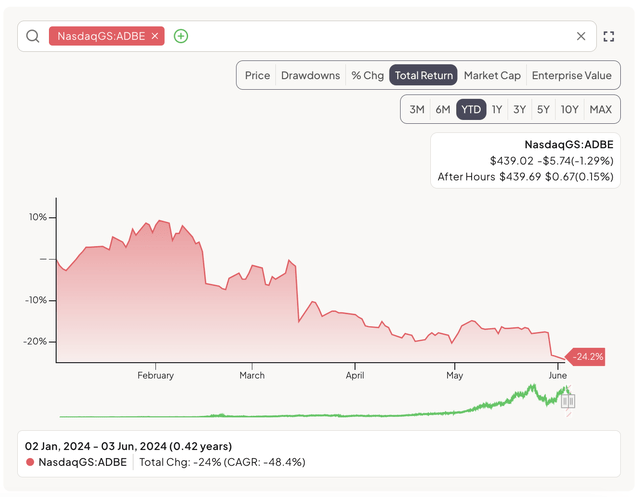

Adobe’s stock has been pretty weak lately and has returned to much more acceptable territory. The stock is down 24% year to date and more than 35% off highs:

Finchat

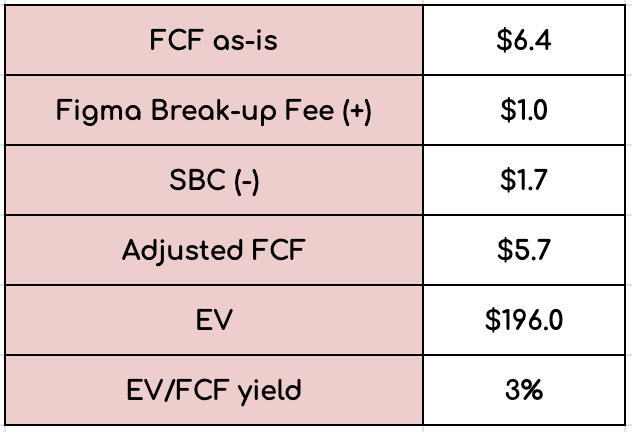

I don’t think the stock’s performance is relevant to judge whether it’s cheap or expensive, so let’s look at its valuation. Many people will use the Free Cash Flow number as it is, but we must make several adjustments to really grasp the company’s normalized valuation. For example, Adobe has significant SBC (share-based compensation), a real but non-cash expense that bypasses the cash flow statement. Not adjusting cash flow for this expense is misleading because Adobe spends significant sums of its Free Cash Flow on buybacks that are not really a return to shareholders, as they are being used to sterilize the dilution created by SBC. So, let’s get on with the numbers.

Adobe has generated Free Cash Flow of $6.4 billion over the last twelve months, but this Free Cash Flow is in itself misleading because it includes the non-recurring break-up fee the company had to pay to Figma after the regulator turned down the deal. This break-up fee was $1 billion. If we adjust for this, we reach a Free Cash Flow figure of around $7.4 billion. We can then look at the cash flow statement to see stock-based compensation of $1.7 billion over the last twelve months. This leads us to a FCF figure adjusted for SBC and the Figma break-up fee of $5.7 billion. The company currently has an EV of $196 billion, so its EV/FCF yield adjusted for SBC, and the Figma payment is around 3%. Here are the calculations:

Made by Best Anchor Stocks

Now, this seems pretty acceptable, considering the growth that’s left here and the company’s quality. We should also not forget that Adobe has recently approved a $25 billion buyback program that it might start using aggressively at these prices. Note that management has also claimed that they believe the company has the ability to run with a more “leveraged” balance sheet, signaling that returns to shareholders might be strong in the coming years.

Conclusion

For the reasons I discussed in the article and the company’s return to a much more appealing valuation, I have added to my position this week. I believe Adobe is a great company currently trading at a reasonable valuation. Software in general has not had the best start of the year on fears of how the benefit of AI can accrue to these companies, but the best time to buy companies tends to be when they are out of favor.

In the meantime, keep growing!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Anchor Stocks helps you find the best quality stocks to outperform the market with the lowest volatility/growth ratio. We look for top-notch quality compounders, with solid growth and lower volatility than you would expect.

Best Anchor Stocks picks have a track record of revenue growth combined with below-average volatility. Since the inception in January 2022, our portfolio has generated a MWR (Money Weighted Return) of 54%, or what’s the same: a +20% MWR CAGR. This compares against a MWR of around 8% for the S&P 500.

There’s a 2-week free trial, so don’t hesitate to join Best Anchor Stocks now!